Because Chronic Obstructive Pulmonary Disease (COPD) is a term used to describe a wide range of symptoms that a variety of respiratory conditions can cause, it’s safe to say that being diagnosed with COPD will undoubtedly complicate one’s life insurance application.

As a result, life insurance underwriters will spend a significant amount of time trying to understand the cause of your COPD and its severity so that they can better understand the potential risk you might pose as an insured.

For this reason…

We wanted to take a moment and answer some of the most common questions we receive from applicants applying for life insurance with COPD and provide some insight into what the application process may be like for you.

Questions that will be directly answered will include:

- Can I qualify for life insurance if I have been diagnosed with Chronic Pulmonary Disease (COPD)?

- Why do life insurance companies care if I have been diagnosed with Chronic Pulmonary Disease (COPD)?

- What kind of information will the insurance companies ask me or be interested in?

- What “rate” can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Chronic Obstructive Pulmonary Disease (COPD)?

Yes, it is possible to qualify for life insurance if you have been diagnosed with Chronic Obstructive Pulmonary Disease (COPD). However, your diagnosis may affect the terms of your policy and the premiums you will pay.

COPD is a chronic lung disease that includes conditions such as chronic bronchitis and emphysema. It is characterized by a decrease in airflow and difficulty breathing and is typically caused by long-term exposure to irritants such as tobacco smoke. COPD can be a progressive disease and may require ongoing medical treatment and management.

The only problem is that COPD is an “umbrella” term often used to describe a wide variety of different progressive lung diseases, which is why most of the best life insurance companies (in our humble opinion) won’t be able to use a “COPD diagnosis” as enough information to make their underwriting decisions.

It’s also why…

You may want to consider avoiding applying for a no medical exam term life insurance policy as well, seeing how these policies tend to be more challenging to qualify for after someone has been diagnosed with a pre-existing medical condition like COPD.

Why do life insurance companies care if I have been diagnosed with Chronic Pulmonary Disease (COPD)?

Life insurance companies care if you have been diagnosed with Chronic Obstructive Pulmonary Disease (COPD) because it is a chronic and potentially progressive medical condition that can affect your life expectancy.

COPD can cause the airways to narrow, making breathing difficult and leading to symptoms such as shortness of breath, coughing, and wheezing. It can also increase the risk of respiratory infections, heart disease, and other health problems. Statistics also show that the five-year life expectancy rate for an individual who has been diagnosed with COPD can range from 40 to 70%!

So, from the insurance company’s perspective, this will classify you as a “high-risk” applicant, which will likely translate into having to pay higher premiums (if approved) or even a denial of coverage (depending on the severity of your condition).

Ultimately, the insurance company’s goal is to determine the level of risk you pose as an insurance customer and to set premiums that reflect that risk if you have been diagnosed with COPD.

Chronic Obstructive Pulmonary Disease (COPD) Defined:

COPD is a medical term used to describe a variety of different progressive lung diseases, which will include the following:

- Emphysema,

- Chronic bronchitis,

- and (non-reversible) Asthma.

Each of these is characterized by breathing difficulties and will often “share” similar symptoms, which may include:

- Shortness of breath,

- Wheezing,

- “Tight” chest,

- Chronic mucus development,

- Difficulty breathing during exercise,

- Discolored mucus development,

- Etc…

Unfortunately…

COPD is not considered a “curable” disease, which means that all current “treatment” options will usually center around minimizing the symptoms of these individual pre-existing medical conditions and trying to improve the overall health of an individual.

Treatment options may include:

- Medications, including bronchodilators and/or steroid use.

- Oxygen therapy,

- Diet and exercise,

- Quitting smoking,

- Avoiding certain environmental “triggers”

- Etc…

The good news is…

Individuals can significantly improve their condition by adopting some of these treatment options, thus potentially qualifying for a traditional term or whole life insurance policy. This is why most (if not all) of the best life insurance companies will take a moment to inquire about how “serious” your COPD is before deciding whether you may have coverage.

What kind of information will the insurance companies ask me or be interested in?

When applying for life insurance, you will typically be required to complete an application with questions about your personal and medical history. If you have been diagnosed with Chronic Obstructive Pulmonary Disease (COPD), the insurance company may ask for more information about your condition and how it is being managed. Some of the information they may request includes:

- Details about your diagnosis, including when you were diagnosed, the severity of your COPD, and the underlying cause of your condition (e.g., tobacco smoke exposure).

- Information about your treatment, including any medications you are taking, lifestyle changes you have made to manage your condition, and any surgical procedures you have undergone.

- Any additional medical conditions you have and your family medical history.

- Your current and past occupation and any hazardous activities you engage in as part of your work or leisure activities.

- Your lifestyle habits, including your diet, exercise routine, and use of tobacco or alcohol.

It is important to be honest and accurate when answering these questions, as this information will be used to determine your eligibility for a life insurance policy and the premiums you will pay. If you do not disclose your COPD diagnosis and it is discovered later, it could affect your coverage or the payout of your policy.

It is also a good idea to have a copy of your medical records and a list of medications you take when applying for life insurance. This can help the insurance company better understand your condition and its management.

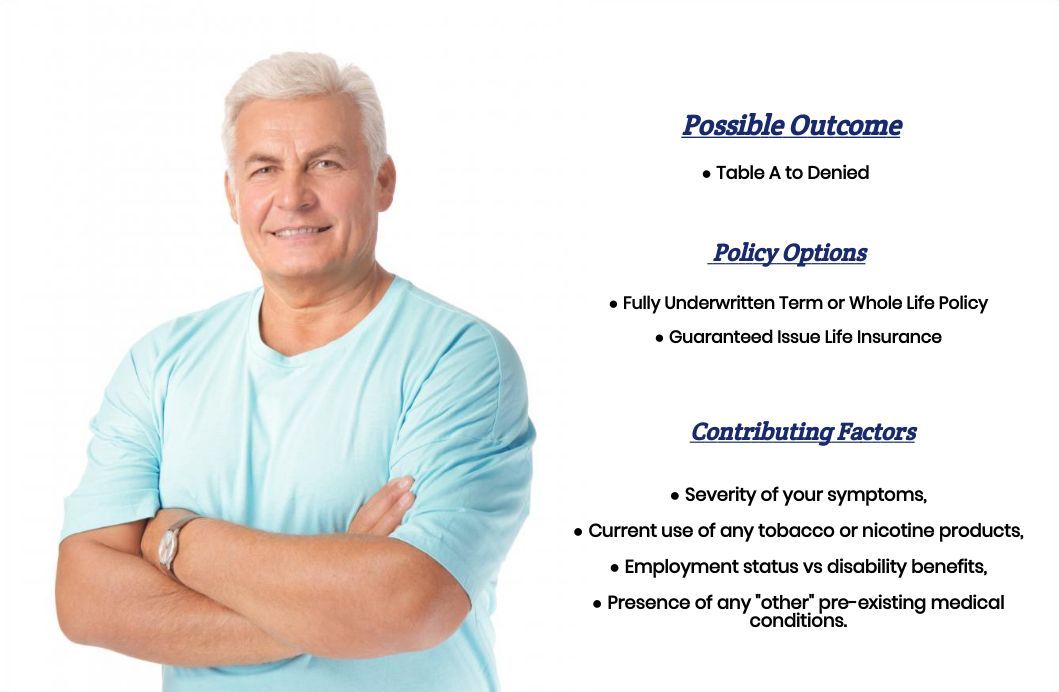

What “rate” can I qualify for?

As you can see from the questions we listed above, quite a few factors can come into play when trying to determine what kind of “rate” an individual might qualify for after being diagnosed with Chronic Obstructive Pulmonary Disease. For this reason, it’s almost impossible to know what kind of “rate” you might qualify for without first speaking with you briefly.

That said, however…

There are a few “assumptions” that we can make that will generally hold true, especially if you have been diagnosed with COPD and you continue to smoke. This is because if you have been diagnosed with COPD and you do smoke, it’s pretty much a given that you will not be able to qualify for a traditional term or whole life insurance policy.

The good news is…

If you have been diagnosed with COPD, and you have been “smoke-free for at least 12 months, there is a chance that you may be able to qualify for coverage, only now it’s pretty safe to say that you will be considered a “high-risk” applicant which will mean that we’ll want to be more “selective” with which life insurance companies we do choose to recommend. This brings us to the last topic that we wanted to take a moment and discuss with you, which is…

How can I help ensure I get the “best life insurance” for me?

If you have been diagnosed with Chronic Obstructive Pulmonary Disease (COPD), there are several steps you can take to help ensure that you get the best life insurance policy for you:

- Work with an experienced agent or broker: A licensed insurance agent or broker with experience working with clients with COPD can help you navigate the application process and find the best policy to fit your needs and budget.

- Be honest and accurate on your application: Provide complete and accurate information, including details about your COPD diagnosis, treatment plan, and any other relevant health conditions. This will help the insurance company assess your risk level and determine the appropriate premium for your policy.

- Get your COPD under control: If possible, take steps to manage your COPD, such as quitting smoking, following your treatment plan, and exercising regularly. This may help you qualify for lower premiums or better policy options.

- Consider a guaranteed issue policy: If you have been denied coverage or are having difficulty getting approved for a traditional life insurance policy, you may want to consider a guaranteed issue policy. These policies do not require a medical exam or health questions and are designed for people with difficulty getting coverage due to health issues.

Ultimately, the key to getting the best life insurance policy for you after being diagnosed with COPD is to work with a knowledgeable agent or broker, provide accurate information, and take steps to manage your condition to the best of your ability.

Now, can we help out everyone previously diagnosed with COPD?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that they CAN qualify for.

So, if you’re ready to explore your options, call us!

Life insurance with COPD. Mild Could I receive information

Ian,

We’d be happy to send you out some information, but without knowing more about your situation or what “type” of life insurance policy you’re looking for, we wouldn’t know where to start. For this reason, it may just be easier for you to give us a call that way we would know what information might be helpful to you.

Thanks,

InsuranceBrokersUSA

Need to get life insurance on my mother and she has COPD can you help me

Shawn,

We’d be happy to try and help you out, just give us a call when you have a chance.

Thanks,

InsuranceBrokersUSA.

I’m trying to get my mom life insurance. Can you please help me or atleast point me in the right direction??

Savannah,

One of our agents will be reaching out to you shortly (if they haven’t already).

Thanks,

InsuranceBrokersUSA

Trying to get a insurance for stage4 copd with no waiting period that will pay up front if I should die at anytime

We would be happy to try and help you find coverage. Please give us a call at your earliest convenience, M-F. Thank you

Is.there anywhere I can get a life insurance with stage 4 copd that will pay the full amount value if a died in a month time

No, you will not find life insurance that will insure you if you have stage 4 copd that will pay out the full amount in you die within a month.