In this article, we aim to address some of the most common questions we receive from individuals who are applying for life insurance after being diagnosed with Emphysema. We will cover the following questions:

- Can I still qualify for life insurance if I have been diagnosed with Emphysema?

- Why do life insurance companies consider Emphysema as a factor?

- What information will the insurance companies ask for or be interested in?

- What kind of rates or prices can I qualify for?

- How can I ensure that I get the best life insurance for my needs?

Without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Emphysema?

Yes, it is possible to qualify for life insurance if you have been diagnosed with Emphysema. However, it may depend on the severity of your condition and other factors such as your age, overall health, and lifestyle habits. The only problem is that because Emphysema is considered a long-term progressive disease, most (if not all) of the best life insurance companies will consider anyone who has been “officially” diagnosed with Emphysema as a “high-risk” applicant.

Why do life insurance companies care if I’ve been diagnosed with Emphysema?

Any time an individual has been diagnosed with a chronic and progressive disease that can have some pretty significant consequences to one’s health, it’s a safe bet that most (if not all) life insurance companies are going to be interested in it.

And this is…

This is precisely what we encounter when working with individuals who have been diagnosed with Emphysema. That’s why we want to take a moment to review what Emphysema is and explore some of the most common symptoms associated with this disease. By doing so, we can gain a better understanding of what individual life insurance underwriters will consider when making their decision about your life insurance application.

Emphysema Defined:

Emphysema is a pre-existing medical condition that will often fall under the “umbrella” diagnosis of Chronic Obstructive Pulmonary Disease or COPD. More specifically, though, it is a pre-existing medical condition that causes the alveoli (air sacs) within the lungs to become damaged. It is a condition that is usually caused by smoking or being exposed to air pollution, dust, or chemical fumes for a prolonged period of time.

Symptoms may include:

- Excessive mucus accumulation within the lungs,

- Increased risk of respiratory infections,

- Difficulty breathing,

- Wheezing,

- Fatigue,

- Cyanosis,

- Sleep problems,

- Etc…

Unfortunately, there isn’t a cure for emphysema. However, individuals may find relief to their symptoms by utilizing a variety of different medications, including aerosol sprays, bronchodilators, steroids, and or antibiotics to fight off any infections.

And here is where…

We might run into trouble because, like many other pre-existing medical conditions, the “severity” of one’s condition can vary significantly from one life insurance applicant to another. This is why, prior to making any kind of decision about your life insurance application, most life insurance companies are going to want to learn more about your specific situation and just how “serious” your emphysema might be.

What kind of information will the insurance companies ask me or be interested in?

Insurance companies will typically ask for a range of information about your Emphysema and overall health when you apply for life insurance. This is because Emphysema is a chronic respiratory disease that can have a significant impact on your overall health and life expectancy. The more severe your condition, the higher the risk you may pose to the insurer and the more you may need to pay for your policy.

Some of the specific information…

That insurance companies may request includes the date of your Emphysema diagnosis, the type and severity of your Emphysema, and any related health issues or complications. For instance, if you have a history of lung infections or heart disease related to your Emphysema, the insurer will likely want to know more about these conditions.

Insurance companies will also be interested in your treatment plan and medications prescribed for your Emphysema. This information can give the insurer a better idea of how well-managed your condition is and whether you are taking steps to control it. If you are taking medications, the insurer may ask for more information about the dosages and frequency of use.

The insurance company may also require pulmonary function tests (PFTs). These tests help to measure how well your lungs are working and can provide insight into the severity of your Emphysema. Other medical tests or exams may be required depending on the severity of your condition and overall health status.

Finally…

Insurance companies may also ask for lifestyle information such as smoking history, alcohol consumption, and physical activity levels. These factors can all have an impact on your overall health and risk level to the insurer.

It’s crucial to provide accurate and detailed information about your health when applying for life insurance. This can help ensure that you receive the most accurate quote and coverage that meets your needs. Working with an experienced agent who understands the underwriting process for Emphysema can be beneficial in helping you navigate the application process and find the best policy for your unique situation.

What rate (or price) can I qualify for?

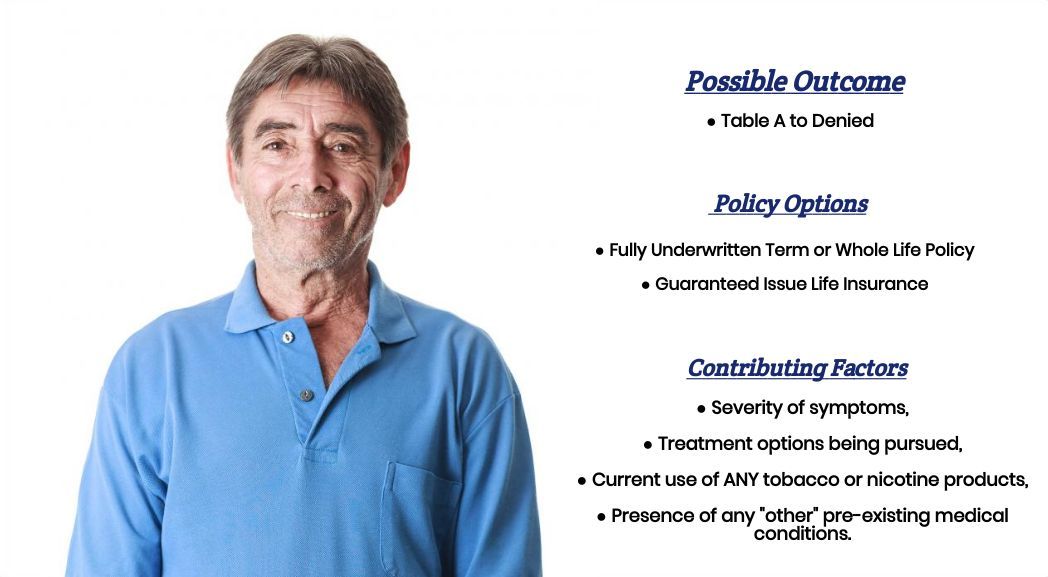

The rate or price you can qualify for after being diagnosed with Emphysema will depend on several factors, including the severity of your condition, any related health issues or complications, and your overall health status.

If you have mild Emphysema and have not experienced any significant health issues related to your condition, you may still be able to qualify for a standard or preferred rate. However, if your Emphysema is more severe, and you have experienced related health issues such as lung infections or heart disease, you may be considered a higher risk and could be offered a substandard or rated policy.

In general, the premiums for life insurance policies are based on the level of risk posed by the insured individual. The higher the risk, the higher the premiums. Insurers may also take into account your age, gender, and lifestyle factors, such as smoking or alcohol use, which can also impact the cost of your policy.

That said, however…

There are a few “assumptions” that we can make that will generally hold true, especially if you have been diagnosed with Emphysema and you currently smoke any form of tobacco (think cigarettes, e-cigs, cigars, etc…). This is because if you have been diagnosed with Emphysema and you do smoke, it’s pretty much a given that you will not be able to qualify for a traditional term or whole life insurance policy.

The good news is…

That if you have been diagnosed with Emphysema and you have been “smoke-free” for at least 12 months, there is a chance that you may be able to qualify for coverage, only now it’s pretty safe to say that you will be considered a “high-risk” applicant which will mean that we’ll definitely want to be more “selective” with which life insurance companies we do choose to recommend.

What can I do to help ensure that I get the “best life insurance” for me?

If you have been diagnosed with Emphysema and are looking to secure the best possible life insurance policy, there are several steps you can take to improve your chances:

- Work with an experienced agent: A knowledgeable agent can help you navigate the underwriting process and find the best policy for your unique situation. They can help you understand the requirements of the insurer and provide guidance on what information you should provide.

- Be honest and accurate: Providing accurate and detailed information about your Emphysema and overall health is crucial to getting the best possible policy. Be upfront about your diagnosis and any related health issues, as this can help the insurer provide you with a more accurate quote.

- Maintain good health habits: While Emphysema is a chronic condition, you can take steps to manage your health and reduce the risk of complications. Quitting smoking, maintaining a healthy diet, and engaging in regular exercise can all help you manage your condition and improve your overall health status.

- Follow your treatment plan: Consistently following your treatment plan and taking your prescribed medications can help improve your health status and demonstrate to the insurer that you are taking steps to manage your condition.

- Shop around: Don’t be afraid to compare policies and quotes from multiple insurers. Rates and coverage options can vary significantly, and shopping around can help you find the best policy for your needs and budget.

By taking these steps, you can help ensure that you get the best possible life insurance policy after being diagnosed with Emphysema. Remember that each individual’s situation is unique, and working with an experienced agent can be beneficial in helping you navigate the application process and find the best policy for your specific n

Now, will we be able to help out everyone who has been previously diagnosed with Emphysema?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Burial Life Insurance Companies as well so that in the event that someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.