Here at IBUSA, we’ll often have clients ask us…

“Which life insurance company is the best?”

While this may seem like an easy question to answer, there are many great life insurance companies out there, but few are actually the “best” for everyone.

You see…

Every life insurance company will have its own unique underwriting guidelines when determining who they will. In addition to determining what PRICE someone might have to pay for such coverage, it won’t insure. So, while one insurance company may be ideal for someone in their early 30s who’s in great shape, that same insurance company may be a terrible option for another person in their late 40s who was just recently diagnosed with type 2 diabetes.

For this reason…

We wanted to provide our readers with our Top 23 Best Life Insurance Companies list and some valuable information about each so that you may begin narrowing down which company might be right for you.

Our online quoter will also provide you with instant quotes for you to review.

This way, you can get a basic idea about how much your insurance would cost if you could qualify at the rate you selected.

Lastly, we should note that we have purposely chosen to list these companies in alphabetical order since we believe each would make a fine choice for the right applicant.

Compare over 50 top life insurance companies instantly.

|

Table of Contents

The Top 23 Best Life Insurance Companies

[Covering Both Term Life and Permanent Life Insurance]

- AIG

- ANICO

- Banner

- Brighthouse Financial

- Equitable

- Guardian Life

- John Hancock

- Lincoln Financial

- MassMutual

- Mutual of Omaha

- New York Life

- Northwestern Mutual

- Pacific Life

- Penn Mutual

- Principal Financial

- Protective Life

- Prudential

- Sagicor

- Securian

- State Farm

- Thrivent

- TIAA

- Transamerica

AIG, less known as American International Group, has been in business since 1919.

AIG, less known as American International Group, has been in business since 1919.

Select-a-Term: AIG term life insurance allows you to choose term lengths of 10 years or any term from 15 to 35 years. The policy is fully convertible with no proof of insurability (i.e. no exam of health questions). Available riders include child riders, waiver of premium, and terminal illness riders.

Guaranteed Issue Whole Life Insurance: AIG also offers one of the best final expense insurance policies. Face amounts range from $5,000 – $25,000. The policy is guaranteed acceptance for ages 50-85.

AIG also offers Universal Life, including:

- Secure Lifetime GUL

- Value Protector IUL

- Max Accumulator IUL

- Platinum Choice VUL

AIG ratings:

- A.M. Best rating: A

- S&P rating: A+

- Moody’s rating: A2

- Fitch rating: A+

- Comdex ranking: 82

For more, please visit our AIG Life Insurance Review.

American National, AKA ANICO, was founded in 1905.

American National, AKA ANICO, was founded in 1905.

Term Life: ANICO offers one of the best Annual Renewable Term (ART) policies, as well as 5, 10, 15, 20, and 30-year term.

Permanent life insurance including:

- Universal life

- Indexed universal life

- Guaranteed universal life

- Dividend Paying Whole life

American National ratings:

- A.M. Best rating: A

- S&P rating: A

- Moody’s rating: n/a

- Fitch rating: n/a

- Comdex ranking: 78

For more, please visit our ANICO Life Insurance Review.

Banner Life is a subsidiary of Legal & General, which has been doing business since 1949. Legal & General does business in NY as William Penn Life Insurance Company of New York.

Banner Life is a subsidiary of Legal & General, which has been doing business since 1949. Legal & General does business in NY as William Penn Life Insurance Company of New York.

Banner has some of the more lenient underwriting regarding various health conditions, such as diabetes.

Term Life: Banner Life is known in the industry as one of the low-price leaders when it comes to term life insurance.

Final Expense Insurance: Banner Life offers up to $15,000 of guaranteed issue whole life insurance.

Banner Life also offers competitively priced universal life insurance.

Banner Life ratings:

- A.M. Best rating: A+

- S&P rating: AA-

- Moody’s rating:

- Fitch rating: AA-

- Comdex ranking: 94

For more, please visit our Banner Life Insurance Review.

Established in 2016, Brighthouse Financial is part of the MetLife family of companies. MetLife has been doing business since 1868.

Established in 2016, Brighthouse Financial is part of the MetLife family of companies. MetLife has been doing business since 1868.

Term Life: Brighthouse Financial offers a one-year term life insurance policy, as well as longer-term periods.

A conversion option lets you convert your term life into Brighthouse Conversion Whole Life.

SmartCare Long Term Care: Brighthouse Financial offers an indexed universal life policy with long-term care benefits. The policy is a hybrid life insurance/long-term care insurance policy.

Brighthouse Life Insurance Company ratings:

- A.M. Best rating: A

- S&P rating: A+

- Moody’s rating: A

- Fitch rating: A3

- Comdex ranking: 78

For more, please visit our Brighthouse Life Insurance Review.

Equitable, also known as AXA Equitable Life Insurance Company was founded in 1859.

Equitable, also known as AXA Equitable Life Insurance Company was founded in 1859.

Term Series: level term life offering term periods of 1, 10, 15, or 20 years.

Equitable’s term life insurance includes the ability to convert the term life to permanent life insurance.

A living benefit rider and disability waiver of premium rider are available.

Permanent Life Insurance:

- Indexed Universal Life

- Variable Universal Life

- Survivorship Life Insurance

- Long-Term Care Coverage

AXA Equitable ratings:

- A.M. Best rating: A

- S&P rating: A+

- Moody’s rating: A2

- Fitch rating: n/a

- Comdex ranking: 82

For more, please visit our Equitable Life Insurance Review.

Guardian Life has been in business since 1860. Guardian is one of the largest mutual companies in the U.S.

Guardian Life has been in business since 1860. Guardian is one of the largest mutual companies in the U.S.

Term Life: term periods of 5 to 30 years are available.

Permanent Life Options:

- Universal Life Insurance

- Participating Whole Life Insurance

Guardian Life ratings:

- A.M. Best rating: A++

- S&P rating: AA+

- Moody’s rating: AA2

- Fitch rating: AA+

- Comdex ranking: 99

For more, please see our Guardian Life Insurance review.

John Hancock was founded in 1862. John Hancock’s Vitality program allows users to get health bonuses based on lifestyle.

John Hancock was founded in 1862. John Hancock’s Vitality program allows users to get health bonuses based on lifestyle.

Life Insurance offered:

- Term Life Insurance

- Universal Life

- Indexed Universal Life

- Variable Universal Life

- Final Expense with Guaranteed Acceptance

John Hancock ratings:

- A.M. Best rating: A+

- S&P rating: AA-

- Moody’s rating: A1

- Fitch rating: AA-

- Comdex ranking: 93

For more, please read our John Hancock Life Insurance review.

Lincoln Financial Group has been doing business since 1905.

Lincoln Financial Group has been doing business since 1905.

Lincoln Financial offers MoneyGuard, a universal life insurance policy with a long-term care rider. The company’s LTC product has no elimination period, so benefits can be paid immediately when an eligible claim is filed.

Term Life: Lincoln Financial offers two different term life products, LifeElements and TermAccel. Both products allow qualifying applicants to get covered without having to take a medical exam.

Permanent Life Insurance includes:

- Universal Life

- Indexed Universal Life

- Variable Universal Life

Lincoln Financial ratings:

- A.M. Best rating: A+

- S&P rating: AA-

- Moody’s rating: A1

- Fitch rating: A+

- Comdex ranking: 91

For more, please visit our Lincoln Financial Review

MassMutual is one of the older life insurance companies founded in 1851. The company offers one of the country’s best dividend-paying whole-life insurance policies.

MassMutual is one of the older life insurance companies founded in 1851. The company offers one of the country’s best dividend-paying whole-life insurance policies.

MassMutual owns Haven Life, an online agency offering Haven Term, an online term life insurance policy.

MassMutual offers different types of life insurance policies, including:

- Convertible Term Life

- Universal Life

- Variable Life

- Participating Whole Life

MassMutual Life Insurance Company ratings:

- A.M. Best rating: A++

- S&P rating: AA+

- Moody’s rating: Aa3

- Fitch rating: AA+

- Comdex ranking: 98

For more, please visit our MassMutual Life Insurance Review.

Mutual of Omaha, aka United of Omaha, aka MOO, was founded in 1909.

Mutual of Omaha, aka United of Omaha, aka MOO, was founded in 1909.

Mutual of Omaha is one of the few companies that offers a long-term care insurance policy.

Term Life: 10, 15, 20, and 30-year terms available

Guaranteed Plus Whole Life: Available for ages 45-85, MOO provides guaranteed issue whole life insurance for burial and final expenses in face amounts ranging from $2,000 – $25,000.

Universal Life products, including:

- Life Protection Advantage

- Income Advantage

- AccumUL Answers

United of Omaha ratings:

- A.M. Best rating: A+

- S&P rating: A+

- Moody’s rating: A1

- Fitch rating: n/a

- Comdex ranking: 90

For more, please visit our Mutual of Omaha Life Insurance Review.

New York Life is the largest mutual company in the U.S. and has been around since 1845.

New York Life is the largest mutual company in the U.S. and has been around since 1845.

New York Life offers some of the best whole life insurance and a hybrid and pure long-term care insurance policy.

New York Life offers different types of life insurance policies, including:

- Convertible Term Life

- Universal Life

- Variable Life

- Participating Whole Life

New York Life’s Custom Whole Life Insurance allows you to structure your policy as a lifetime pay or limited pay policy, with 5 Pay policies available.

New York Life ratings:

- A.M. Best rating: A++

- S&P rating: AA+

- Moody’s rating: Aaa

- Fitch rating: AAA

- Comdex ranking: 100

Northwestern Mutual is the highest-rated life insurance company and has been doing business since 1857.

Northwestern Mutual is the highest-rated life insurance company and has been doing business since 1857.

Northwestern Mutual is a captive agent company, which means only Northwestern Mutual agents can offer the company’s products.

Long-term care insurance is available, as well as a full suite of life insurance products, including:

- Term Life Insurance

- Universal Life Insurance

- Dividend Paying Whole Life Insurance

Northwestern Mutual ratings:

- A.M. Best rating: A++

- S&P rating: AA+

- Moody’s rating: Aaa

- Fitch rating: AAA

- Comdex ranking: 100

For more, please visit our Northwestern Mutual review.

Pacific Life was founded in 1868.

Pacific Life was founded in 1868.

Pacific Life has all the usual life insurance products. The company also boasts one of the most comprehensive indexed universal life insurance products suites.

Pacific Life Insurance products include:

Pacific Life ratings:

- A.M. Best rating: A+

- S&P rating: AA-

- Moody’s rating: A1

- Fitch rating: AA-

- Comdex ranking: 93

For more, please visit our Pacific Life Insurance Review.

Penn Mutual Life Insurance Company has been doing business since 1847.

Penn Mutual Life Insurance Company has been doing business since 1847.

As its name implies, it is a mutual company offering one of the country’s best high-cash-value dividend-paying whole life insurance policies.

Penn Mutual is also an innovator, offering up to $2.5 million in no-exam whole life insurance coverage for qualifying applicants through its accelerated underwriting program.

Penn Mutual Life Insurance Policies include:

- Term Life Insurance

- 5 – 30-year term periods available

- Guaranteed Whole Life

- It can be designed to maximize death benefit or cash value accumulation

Penn Mutual ratings:

- A.M. Best rating: A+

- S&P rating: A+

- Moody’s rating: Aa3

- Fitch rating: n/a

- Comdex ranking: 93

For more, please visit our Penn Mutual review.

Principal Financial Group was founded in 1879.

Principal Financial Group was founded in 1879.

Principal Accelerated Underwriting is available on most life insurance products for qualifying applicants ages 18-60, allowing approval of up to $1,000,000 in coverage without the need for lab testing and exams.

Term Life: Principal Financial offers level term life insurance with a conversion option. 10, 15, 20, and 30 year term lengths are available.

Permanent Life Insurance Policies, including:

- Universal Life

- Indexed Universal Life

- Variable Universal Life

- Survivorship Insurance

Principal Financial Group ratings:

- A.M. Best rating: A+

- S&P rating: A+

- Moody’s rating: A1

- Fitch rating: AA-

- Comdex ranking: 91

For more, please visit our Principal Financial Life Insurance Review.

Protective Life Insurance Company has been in business since 1907. The company is the low-priced leader for term life insurance. You can also find their term life policies sold as Costco Life Insurance.

Protective Life Insurance Company has been in business since 1907. The company is the low-priced leader for term life insurance. You can also find their term life policies sold as Costco Life Insurance.

Protective Life has strong financial ratings, so anyone looking for the most affordable term life insurance quotes will do well with the company.

However, one drawback to being the low-priced leader in the company’s underwriting will be more stringent, so those who are not in perfect health might find that another company with more lenient underwriting may offer more competitive term life insurance rates.

Custom Choice UL

Protective Life offers Custom Choice UL, an innovative universal life policy that acts in many ways like traditional term life insurance.

The policy is convertible in the first 20 years or up to age 70 without lab tests or medical exams.

And unlike term life, your coverage does not end at the end of the Custom Choice UL term period. Instead, the premium stays the same after the term ends while the coverage amount adjusts yearly.

Protective Life ratings:

- A.M. Best rating: A+

- S&P rating: AA-

- Moody’s rating: A1

- Fitch rating: A+

- Comdex ranking: 91

For more, please visit our Protective Life Insurance Review.

Prudential Financial was founded in 1875.

Prudential Financial was founded in 1875.

Prudential’s permanent life insurance offers a BenefitsAccess Rider that allows you to access up to the full death benefit in advance if you are diagnosed with a qualifying chronic or terminal illness.

The Living Needs Benefit, which covers qualifying terminal and chronic illnesses, is available on its term life and permanent life insurance policies.

Prudential Life Insurance Policies Include:

- Term Essential

- Term Elite

- PruLife Universal Protector

- PruLife Essential UL

- PruLife Index Advantage UL

- PruLife Founders Plus UL

- PruLife Custom Premier II

- VUL Protector

Prudential Financial ratings:

- A.M. Best rating: A+

- S&P rating: AA-

- Moody’s rating: n/a

- Fitch rating: AA-

- Comdex ranking: 94

For more, please visit our Prudential Life Insurance Review.

Sagicor Life Insurance Company has been around since 1840. The company excels at no-exam life insurance options via its Accelwriting Process.

Sagicor Life Insurance Company has been around since 1840. The company excels at no-exam life insurance options via its Accelwriting Process.

Sage Term Life: 10, 15, and 20-year no medical exam term life insurance up to $1,000,000 in coverage for ages 18 to 45, up to $750,000 for ages 46-55, and up to $500,000 for ages 56-65.

An Accelerated Benefit Insurance Rider is included at no additional cost, which allows you access to a portion of the death benefit if you are diagnosed with a qualifying terminal illness or confined to a nursing home facility.

A waiver of premium, child rider, and accidental death benefit rider is also available for an additional cost.

Sagicor ratings:

- A.M. Best rating: A-

- S&P rating: n/a

- Moody’s rating: n/a

- Fitch rating: n/a

- Comdex ranking: n/a

For more, please visit our Sagicor Life Insurance Review.

Securian Financial, also known as Securian Life Insurance Company and Minnesota Life Insurance Company, was founded in 1880.

Securian Financial, also known as Securian Life Insurance Company and Minnesota Life Insurance Company, was founded in 1880.

Securian offers Write-Fit Underwriting, which is the company’s accelerated underwriting process. The process allows life insurance with no medical exam for eligible applicants, with some approvals within 24 hours.

Write-Fit Underwriting is available for ages 18-60, for face amounts up to $2,000,000, based on age.

Term Life: Level term life insurance is available for 10-30 years. The term policy comes with the option to convert to permanent life insurance coverage.

Permanent life insurance including:

- Universal Life

- Indexed Universal Life

- Variable Universal Life

Securian Financial ratings:

- A.M. Best rating: A+

- S&P rating: AA-

- Moody’s rating: Aa3

- Fitch rating: AA

- Comdex ranking: 96

For more, please visit our Securian Life Insurance Review.

![]() State Farm has been doing business since 1922.

State Farm has been doing business since 1922.

State Farm Life Insurance Company has captured agents, which means only State Farm agents can offer the company’s life insurance products.

State Farm Life Insurance Policies include:

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Final Expense Insurance

State Farm’s final expense insurance is whole life insurance that builds cash value. It is available for ages 50-80 (75 in NY). The policy provides a $10,000 death benefit for burial and final expenses.

State Farm ratings:

- A.M. Best rating: A++

- S&P rating: AA

- Moody’s rating: Aa1

- Fitch rating: n/a

- Comdex ranking: 98

For more, please visit our State Farm Life Insurance review.

Thrivent Financial for Lutherans was founded in 1902.

Thrivent Financial for Lutherans was founded in 1902.

Thrivent Financial uses captive agents to sell its life insurance policies.

Thrivent Financial offers both term and permanent life insurance, including whole life insurance, universal life, and variable life insurance.

Thrivent Financial ratings:

- A.M. Best rating: A++

- S&P rating: n/a

- Moody’s rating: n/a

- Fitch rating: AA+

- Comdex ranking: 99

For more, please visit our Thrivent Life Insurance review.

TIAA, aka TIAA-CREF, aka Teachers Insurance and Annuity Association, has been in business since 1918.

TIAA, aka TIAA-CREF, aka Teachers Insurance and Annuity Association, has been in business since 1918.

Note: As of December 2019, TIAA has exited the life insurance market and now focuses exclusively on annuities.

TIAA is also a captive insurance company, using only its own captive agents to sell its policies.

Some of the permanent life policies it offers include variable universal life, universal life, and survivorship universal life.

TIAA ratings:

- A.M. Best rating: A++

- S&P rating: AA+

- Moody’s rating: Aa1

- Fitch rating: AAA

- Comdex ranking: 99

Transamerica Life Insurance Company, under its parent Transamerica Corporation, has been in operation since 1928.

Transamerica Life Insurance Company, under its parent Transamerica Corporation, has been in operation since 1928.

The company excels in various life insurance underwriting niches, providing some of the best life insurance underwriting in the industry.

In addition, Transamerica offers a full suite of life insurance products.

Transamerica life insurance policies include:

- Term Life

- Universal Life

- Indexed Universal Life

- Final Expense life insurance

Transamerica also offers TransCare III, a stand-alone long-term care insurance policy.

Transamerica ratings:

- A.M. Best rating: A

- S&P rating: A+

- Moody’s rating: A1

- Fitch rating: A+

- Comdex ranking: 84

For more, please visit our Transamerica Life Insurance Review.

So there you have our top 23 picks for the best life insurance companies listed alphabetically.

Next, let’s look at how to choose the best life insurance company and policy tailored to you based on your specific needs and objectives.

How to Choose the Best Life Insurance Company

When selecting a life insurance policy, in addition to the policy details – cost, coverage, etc. – it can pay dividends to look into customer reviews.

These can provide valuable information about things like customer service and claims payment experiences.

It’s also worthwhile to get multiple life insurance quotes from each company you are looking into to help find the best fit for your requirements.

Deciding Between Term or Whole Life Insurance

Term Life

There are various types of term life insurance.

There are different term lengths, such as annually renewable term (ART), 5, 10, 15, 20, 25, 30, 35, and 40-year term life insurance.

Your term policy can be a level term life or a decreasing term life.

Level-term life offers a fixed premium for the term.

Decreasing term life has a decreasing face amount as the policy ages.

Convertible Term

Convertible term life insurance is a type of life insurance policy that allows the policyholder to convert the policy to a permanent life insurance policy without going through the underwriting process again.

Convertible term life insurance is a good option for people who want the flexibility and affordability of a term life insurance policy but are concerned about the possibility of being declined for a permanent policy in the future due to changes in their health or other circumstances.

Term life insurance is a type of life insurance that provides coverage for a specific period, or “term,” such as 10, 20, or 30 years, with some companies offering up to 40-year term life insurance.

It is generally less expensive than permanent life insurance but does not provide coverage beyond the specified term. If the policyholder outlived the term, they would need to reapply for coverage, potentially at a higher premium rate due to their age or changes in their health.

Convertible term life insurance allows the policyholder to convert their term life insurance policy to a permanent one, such as whole life or universal life insurance, without going through the underwriting process again.

This means that the policyholder can lock in their current health status and premiums and continue to be covered for the rest of their life, even if their health changes.

Convertible term life insurance policies typically have a conversion option built into the policy, allowing the policyholder to exercise the conversion option at any time during the policy term.

Some policies may restrict when the conversion option can be exercised, such as a minimum age requirement or a maximum number of years that have passed since the policy was issued.

It is important to carefully review the terms and conditions of a convertible term life insurance policy before purchasing one to understand the conversion options and any restrictions that may apply.

Term Life vs Whole Life

The term is generally the cheapest.

When choosing the type of insurance to purchase, term life is the least expensive type of life insurance you can buy.

Term Has An End Date

Unlike whole life, a form of permanent insurance, term only lasts for a specified period. Once that period (typically between 10 to 30 years) ends, the insurance will usually lapse, i.e., come to an end.

Term insurance is not meant to last a lifetime, and, as a result, the cost is lower.

Permanent life is for your entire lifetime.

Suppose you would like to maintain life insurance coverage for your life. In that case, permanent life insurance can be less expensive than continually renewing term life insurance because term life becomes increasingly costly as you age due to decreasing life expectancy.

Purchase permanent life insurance such as whole or universal life when you are younger. You can take advantage of lower premiums and the growth of the policy cash account over time, making such a policy less costly than just renewing the term.

As long as the policy remains continuously in force, you will not have to requalify for it later in life by passing a health exam, which is generally not true when term life insurance renewing.

Whole Life

Whole life insurance lasts your whole life. It is the only permanent coverage that offers three primary guarantees.

Whole life guarantees include:

- Guaranteed Death Benefit

- Guaranteed Level Premium

- Guaranteed Cash Value Growth

Dividends

There is also participating life insurance, i.e., dividend-paying whole life insurance, which offers an annual dividend payment.

Life insurance dividends are not guaranteed, but many of the top whole life insurance companies have paid a dividend for over 100 years straight.

The dividend is considered a return of premium, so no taxes are due. The dividend can be taken as cash or reinvested into the policy’s cash account via paid-up additions to increase the cash value and death benefit.

Universal Life

Universal life insurance is a type of permanent life insurance that covers the policyholder’s entire lifetime. It combines the protection of a traditional life insurance policy with the flexibility and potential cash value accumulation of a savings or investment component.

Universal life insurance policies typically have a premium payment structure that is flexible and adjustable, allowing the policyholder to adjust the premium payments or coverage amount within certain limits.

The policy’s cash value component earns a tax-deferred interest rate, which is credited to the policy’s cash value account. The policyholder can use the cash value for various purposes, such as paying premiums, borrowing against the policy, or taking withdrawals.

Universal life insurance policies generally have a guaranteed death benefit, which means that the policy’s beneficiaries will receive the full death benefit amount specified in the policy, regardless of any changes in the policy’s cash value or the policyholder’s health.

However, the policy’s cash value and death benefit may be reduced if the policyholder fails to pay premiums or makes withdrawals that exceed the policy’s cash value.

Universal life insurance is a good option for people who want permanent life insurance coverage and the flexibility to adjust their premiums and coverage amount over time. It can also be a good option for people who want to accumulate cash value for various purposes, such as funding retirement or paying for education expenses.

It is important to carefully review the terms and conditions of a universal life insurance policy before purchasing one, as the specifics of the policy, including the cash value accumulation and death benefit, can vary.

It is also good to consult with a financial advisor or insurance agent to help you understand your options and choose a policy that meets your needs.

Variable Life

Variable life insurance is a type of permanent life insurance that combines the protection of a traditional life insurance policy with the potential for cash value accumulation through investment in various subaccounts, similar to mutual funds.

The policy’s cash value is tied to the performance of the subaccounts, which means that the policy’s cash value and death benefit can fluctuate based on the investment performance of the subaccounts.

Variable life insurance policies generally offer a wide range of subaccount options for the policyholder to choose from, such as stocks, bonds, and money market funds. The policyholder can allocate their premiums and cash value among the subaccounts as they see fit and make changes to their allocations at any time.

Variable life insurance policies generally have a minimum guaranteed death benefit, which means that the policy’s beneficiaries will receive at least the minimum death benefit amount specified in the policy, regardless of any changes in the policy’s cash value or the investment performance of the subaccounts.

However, the policy’s cash value and death benefit may be reduced if the policyholder fails to pay premiums or makes withdrawals that exceed the policy’s cash value.

Variable life insurance is a good option for people wanting permanent life insurance coverage and the opportunity to grow their cash value through investments. It is important to carefully review the terms and conditions of a variable life insurance policy before purchasing one, as the specifics of the policy, including the investment options and fees, can vary.

It is also good to consult with a financial advisor or insurance agent to help you understand your options and choose a policy that meets your needs. It is important to be aware that variable life insurance involves investment risks, and the policy’s cash value and death benefit may fluctuate based on the performance of the subaccounts.

Term Life Most Cost Effective in the Short Term

In most cases, term life insurance is the most cost-effective insurance solution. If you are paying off a mortgage or raising children, after these obligations are fulfilled, the need to carry insurance to pay down debt or replace income often evaporates at that point.

As a result, there is generally no need to purchase more expensive whole life or universal life insurance unless you plan on using your cash value life insurance policy as a savings vehicle.

Term life covers your dependents when they are vulnerable if something should happen to them.

Once they reach adulthood and no longer rely on you for financial support, the term life policy typically expires, and you no longer have to pay for insurance.

There are some cases in which permanent life insurance is appropriate.

For instance, life insurance passes to your beneficiaries without going through probate, so it is an effective way to leave a legacy to family members or other loved ones you wish to provide with resources after your death.

For those with large estates, life insurance can also help provide your heirs with immediate liquidity to pay estate taxes. This can be especially valuable if most of your estate is in non-liquid assets, such as private company shares or real estate.

There are also financial benefits to using life insurance as a savings vehicle, such as taking tax-free policy loans and benefitting from dividend-paying whole life insurance.

While the returns in the cash account of such policies are typically not comparable to those of investments such as equity mutual funds, they can provide solid returns for a conservative investor in the long run and a stable financial foundation from which to build.

Getting Life Insurance Quotes and Policy Reviews

To get the most accurate life insurance quotes, it is important to decide how much coverage you require and the length of time for which you will need it.

Once you have done this, you can get multiple life insurance quotes from the top life insurance companies to ensure that you are on track to finding the best policy for your budget.

After you have purchased life insurance, be sure to review your policy and how it meets your needs regularly. Annually or more frequently is recommended.

A life insurance policy review enables you to make changes if your coverage amount needs to change or if you need to make changes regarding beneficiaries or other aspects of the policy.

Here are some sample best-term life insurance rates to give you an idea of what someone qualifying at the top rate class will pay for a 10, 15, 20, 25, or 30-year term life insurance policy.

Best Life Insurance Rates for Ages 30-39

Best Life Insurance Rates for Ages 40-49

Best Life Insurance Rates for Ages 50-59

Determining Life Insurance Premium Rates

Mortality and Interest Rates

The two most important factors in determining insurance premium rates are mortality and interest rates.

Mortality focuses on an insured’s life expectancy – essentially, the lower the life expectancy, the higher the insurance premium.

The interest rate earned by the insurance company on the premiums it receives also plays into the rate-making process.

Another factor to consider is the expense of running the insurance company, including administrative costs, office rent, etc.

Insurance companies consider these factors to estimate how much they are likely to pay in claims in any given year and how much they should charge in the form of life insurance premiums to those purchasing policies.

Your Health and Lifestyle

Insurance companies also consider your physical condition and lifestyle when pricing a policy.

It will help you get the lowest possible life insurance premium rates if you are in good shape.

Your health rate will fall into one of these categories:

- Preferred Plus

- Preferred

- Standard Plus

- Standard

- Substandard/Table Rated

Your lifestyle

Lifestyle choices, such as tobacco use or engaging in a dangerous hobby, also affect your life insurance rates.

Oddly enough, motorcycle riding does not typically affect your rate class unless you engage in motocross racing.

Your Age

Along with your health at the start of the policy, your age is the other major determinant of your life insurance cost.

Remember that your health is only measured once – at the start of the policy. If you suffer health issues after that, they do not impact your premiums unless your policy expires and you want to purchase a new one or upgrade your policy.

For this reason, some policies offer automatic upgrade options, which enable you to add coverage without having to requalify via a health exam.

An insurance company will consider your age, health, and lifestyle and then project how likely you are to die within a certain period to determine your health rate class and policy premiums.

Accordingly, the younger and healthier you are when buying insurance, the lower your rates will be.

Other factors insurers consider include your driving record and credit score. Bad credit, such as a recent bankruptcy, traffic violations, or accidents for which you are at fault, can all negatively impact your rate class.

How Much Life Insurance Do You Need?

When calculating your insurance needs, one rule of thumb is multiplying your annual income by 10 to arrive at a coverage figure.

However, this approach is very general and may be wrong for your situation.

Human Life Value Approach

A more detailed analysis would be your human life value, where you would look at figures such as your debts (mortgage, credit cards, student loans, etc.), then add in costs for education, anticipated living expenses for your loved ones in the event of your death and any legacies or bequests you would like to leave behind.

This method can provide a more realistic figure of how much coverage would suit your situation.

After you have a total figure, you can determine how much would be left after paying off your debts to support your loved ones at a reasonable rate of return.

Don’t forget to figure inflation into your calculations.

Today’s dollar will likely not have the same purchasing power 20 or 30 years from now. Some insurance policies include cost of living riders when determining death benefit payout.

A Broker Can Help

Given all the complexities involved in selecting the life insurance policy that best fits your situation, working with an insurance broker, such as us here at IBUSA, can be a big help.

Insurance companies include the cost of compensating a broker in their policy rates, so getting help from a broker won’t raise your premiums.

Brokers have the advantage of closely following the market and its companies, so they can be a valuable resource when researching and selecting an insurance policy.

Selecting The Best Life Insurance Company

There are a variety of sources for life insurance company ratings. A.M. Best is one of the most prominent sources of ratings.

This credit agency rates insurers on their financial health, with an A++ or “superior” rating as the highest possible. Generally, any rating above A- indicates that a life insurer is in good financial health.

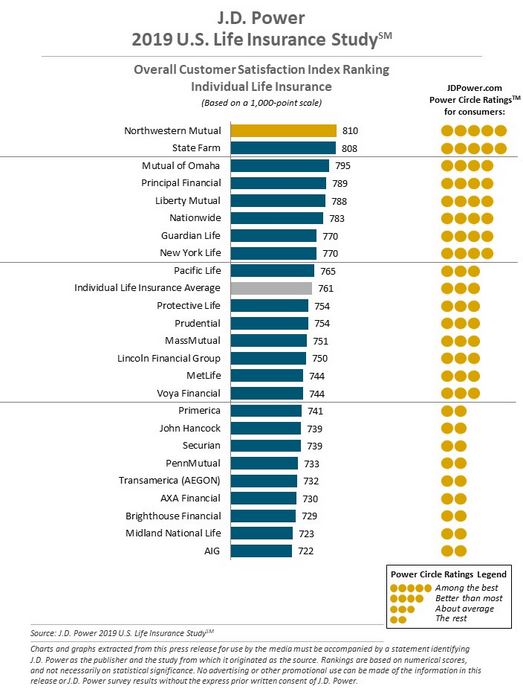

J.D. Power provides ratings that focus on life insurance company customer satisfaction. It rates insurers by giving them a number between 0 and 1,000 based on inputs such as policy offerings, customer service and satisfaction, and policy price.

J.D. Power Rankings

According to J.D. Power, here are the highest-rated life insurance companies based on customer satisfaction.

The NAIC index is another helpful resource that tracks customer complaints, with 1.00 being the median score for this rating.

The NAIC index is another helpful resource that tracks customer complaints, with 1.00 being the median score for this rating.

When researching insurance companies, we looked at several factors in addition to third-party ratings.

For term life insurers, these include offering guaranteed level premiums, which is typically standard and stipulates that your policy will stay the same from year to year for the duration it is in effect.

Additionally, major life insurance companies will generally offer you a choice from various term lengths when purchasing a policy.

conversion option

Another factor we considered was restrictions on conversion.

In some cases, insurers prohibit you from converting a term to a permanent policy in the latter half of the term, meaning you would have to requalify by taking a health exam if you wanted to do so.

waiver of premium

Another attractive feature some policies feature is disability protection via a Waiver of Premium rider that allows you to skip paying premiums while keeping your insurance in force if you become disabled, ensuring that your policy doesn’t lapse.

terminal illness and chronic illness riders

An Accelerated Death Benefit rider is a further helpful rider that enables you to pull funds from your policy to help pay for end-of-life expenses. Such costs can include hospice care or medical treatment designed to treat severe conditions to extend your life.

It should be noted that any funds paid out via such a rider serve to lower your death benefit amount.

Best Life Insurance Companies By Category

Best Overall Life Insurance Company

Most of these types of articles are going to list Northwestern Mutual or New York Life here. But although those two companies are fantastic, what defines “best”?

The best overall company for you is the one that offers the right product at the right price based on what you actually need.

So, we refrain from listing the best life insurance company overall and will point out some unique niches that certain companies fill below.

Best Life Insurance Policies for Diabetics

Finding life insurance with diabetes can be difficult due to the potential health issues associated with type 1 and type 2 diabetes.

A handful of companies specialize in term life insurance for people with diabetes.

The current list of best companies for diabetes includes:

- AIG

- Banner Life

- Lincoln Financial

- Protective Life

Out of all these companies, Banner Life and Protective Life stand out as providing the lowest life insurance premiums for applicants who have diabetes.

Now, it is not always the case. There are other factors that underwriters will weigh, but if we had to pick our top companies, these would be the standard choices without knowing any other factors.

Best Life Insurance for Tobacco Users

Tobacco rates are determined by several factors, including frequency of use and whether or not you smoke cigarettes, cigars, pipes, or chew tobacco.

The current companies that offer the best rates for tobacco users are:

- Americo

- Lincoln Financial

- Prudential

Best Life Insurance for Marijuana Use

It used to be difficult to get life insurance for marijuana use, but many companies have relaxed their underwriting criteria as more and more states legalize marijuana use.

Companies will want to know how often you use it, whether you smoke it or eat it, and why you use it, i.e., is it for recreational purposes or medicinal purposes? If medicinal, what is the underlying condition the marijuana is treating?

The current crop of marijuana-friendly life insurance companies includes:

- Equitable

- Lincoln Financial

- Principal Financial

- Prudential

Best for Final Expense Whole Life Insurance Policies

Final expense whole life insurance policies are policies for funeral and burial expenses focused on smaller death benefits ranging from $2,000 to $25,000.

Some of the top final expense insurance companies currently include:

- AIG

- Foresters

- Gerber

- Mutual of Omaha

Mutual of Omaha has been in business for over a century. It offers whole life, universal life, term life, and accidental death policies. Mutual of Omaha provides small whole-life policies that do not require you to take a medical exam to qualify for them.

A downside to such policies is that they have smaller death benefits than fully underwritten policies.

Mutual of Omaha policies are for under $25,000, most often used to provide funds to pay final expenses.

Best Online Life Insurance Company

Online life insurance companies enable you to complete the whole process of applying for and purchasing life insurance online, often with immediate approval or rejection of an application.

When choosing a company to work with, consider a life insurance broker that offers many companies as options rather than captive agents who can only provide one or two companies.

At IBUSA, we work with many of the top life insurance companies in the U.S. A. We can help you shop around for the best company, the best policy, and the best price for YOU based on your specific needs.