In this article, we wanted to take a moment to answer some of the most common questions we get from people applying for life insurance after being diagnosed with Charcot-Marie-Tooth Disease.

- Can I qualify for life insurance if diagnosed with Charcot Marie-Tooth Disease?

- Why do life insurance companies care if I have suffered from Charcot Marie-Tooth Disease?

- What kind of information will the insurance companies ask me or be interested in?

- What “rate” can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have suffered from Charcot Marie-Tooth Disease?

Yes, individuals who have been diagnosed with Charcot Marie-Tooth Disease can and often will be able to qualify for a traditional term or whole life insurance policy. The problem is that because Charcot-Marie-Tooth Disease is a chronic and progressive disease without a cure, most (if not all) of the top-rated life insurance companies that most folks are going to be familiar with are going to want to know how “serious” your condition is before making any decisions about your life insurance application.

For this reason, it’s usually best to avoid applying for any term life insurance policy without a medical exam, as these “types” of life insurance policies tend to be more challenging to qualify for.

Why do life insurance companies care if I have suffered from Charcot Marie-Tooth Disease?

The main reason why most life insurance companies are going to “care” if an individual has been diagnosed with Charcot Marie-Tooth Disease is that it is a chronic and progressive disease that will slowly attack one’s peripheral nervous system, causing progressive loss of muscle tissue and touch sensation across various parts of the body.

Symptoms may include:

- Muscle weakness in one’s legs, ankles, and feet.

- High foot arches,

- Curled toes, commonly referred to as “hammertoes,”

- Difficulty lifting your foot at the ankle is commonly called “foot drop.”

- Difficulty running,

- Abnormal gait when walking,

In rare cases, Charcot Marie-Tooth Disease can also affect one’s diaphragm, causing one to suffer from breathing difficulties.

Fortunately…

Most cases of Charcot Marie-Tooth Disease will not affect one’s respiratory system. While there may not be any current cure for this disease, physical therapy, occupational therapy, braces, and other orthopedic devices, as well as some orthopedic surgical procedures, will often minimize the effect that this disease will have on one daily life.

Which is why, most (if not all) life insurance companies will still consider an individual eligible for a traditional life insurance policy, assuming that this is the “only” pre-existing medical condition that they are suffering from and that their condition hasn’t progressed into a debilitating medical condition preventing them from being able to live a “normal” life.

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll likely be asked may include:

- When were you first diagnosed with Charcot Marie-Tooth Disease?

- Who diagnosed your Charcot Marie-Tooth Disease? A general practitioner or a specialist?

- What symptoms (if any) led to your diagnosis?

- What treatment options are you currently pursuing to treat your Charcot Marie-Tooth Disease?

- Has your doctor recommended future surgical procedures to treat your Charcot Marie-Tooth Disease?

- Have you been diagnosed with any other pre-existing medical conditions?

- Over the past 12 months, has your condition improved, worsened, or remained the same?

- In the past two years, have you been hospitalized for any reason?

- In the past 12 months, have you used any tobacco or nicotine products?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

Now, at this point…

We usually like to take a moment and remind folks that nobody here at IBUSA has any medical training, and we’re certainly not doctors. All we are is a bunch of life insurance agents who are good at helping folks with pre-existing medical conditions like Charcot Marie-Tooth Disease find and qualify for the life insurance coverage they are looking for.

So, without further ado, let’s look at what kind of rates an individual diagnosed with Charcot Marie-Tooth Disease might be able to qualify for!

What “rate” can I qualify for?

As one can see after reviewing the questions above, many factors can come into play when trying to determine what kind of “rate” an individual might qualify for after having been diagnosed with Charcot-Marie-Tooth Disease. This is why, knowing what kind of “rate” an individual might qualify for is almost impossible without first speaking with you briefly.

That said, however…

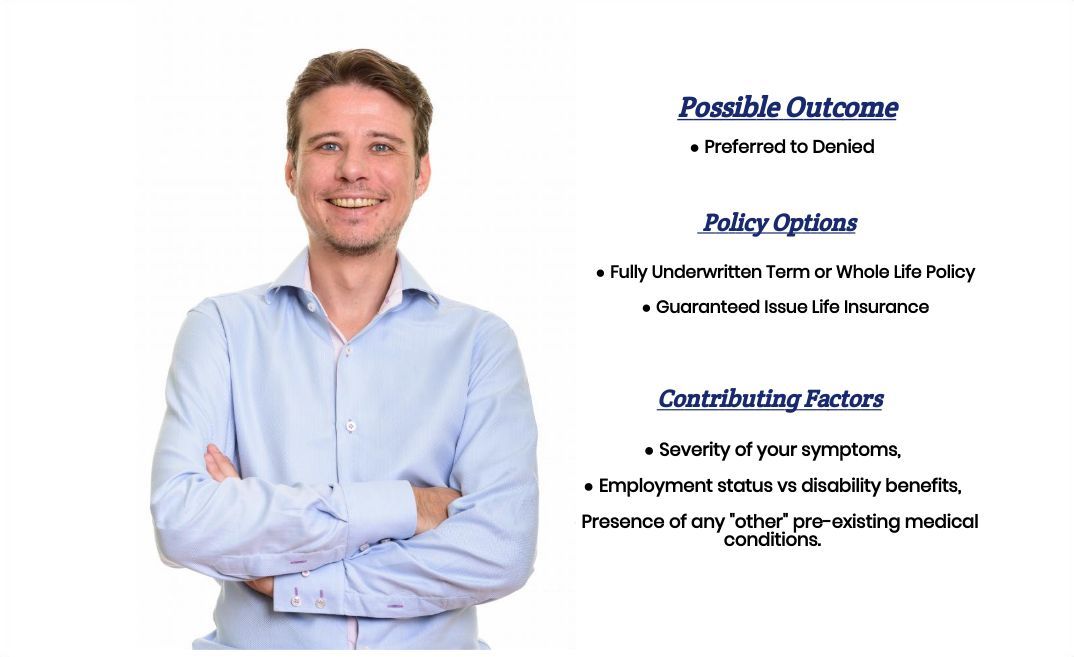

One can make a few “assumptions” that will generally hold when working with an individual diagnosed with Charcot Marie-Tooth Disease. For example, suppose you’ve been diagnosed with Charcot Marie-Tooth Disease, and you’re not suffering from any respiratory issues. You’re currently working and living what one might consider a “normal” life with some physical challenges that may make things more difficult but not impossible. In that case, chances are you may be able to qualify for a Standard or “better” rate.

Where we run into…

Trouble is when an individual suffers from some “type” of respiratory issues related to their Charcot Marie-Tooth Disease, has been diagnosed with some other “kind” of a pre-existing medical condition, or has symptoms directly associated with their Charcot Marie-Tooth Disease, which has led them to qualify for some disability benefit.

In cases like these, what you’re going to find is that either they’re NOT going to be able to qualify for a traditional term or whole life insurance policy, in which case they would need to seek out an “alternative” product such as a guaranteed issue life insurance policy or accidental death policy, or they will be able to qualify for coverage only now they will only be able to qualify for a “high-risk” classification.

The good news is…

Regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy they can qualify for.

This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to see the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

Seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is precisely what you’ll find here at IBUSA!