A COPD diagnosis brings immediate attention to managing breathing difficulties, adhering to treatment plans like inhalers or oxygen therapy, and making lifestyle changes, but it also triggers unexpected anxiety about securing life insurance to protect a family’s financial future. The common misconception that a chronic respiratory condition like COPD automatically disqualifies you from coverage—or leads to unaffordable premiums—adds unnecessary stress during an already challenging adjustment period.

The reality is far more promising than many expect. Our in-depth analysis of hundreds of COPD-related applications reveals successful strategies, ranging from traditional term or whole life policies for individuals with mild, well-controlled COPD to specialized products, such as guaranteed issue or simplified issue plans, designed for those managing more progressive or severe respiratory conditions. It is our belief that by understanding how insurers assess COPD and preparing thorough medical documentation, you’ll be better prepared to navigate the process, secure affordable coverage, not to mention avoid many unnecessary obstacles.

“We’ve successfully helped over 400 individuals with COPD secure meaningful life insurance coverage over the past five years. The key insight is that COPD severity varies dramatically – from mild cases that barely impact daily life to advanced stages requiring oxygen therapy. Insurance companies recognize this spectrum, and matching your specific presentation with the right insurer and product type often yields surprisingly positive results.”

– InsuranceBrokers USA – Management Team

How Does COPD Affect Life Insurance Applications?

Key insight: Life insurance companies evaluate COPD through a comprehensive risk assessment that considers disease stage, progression rate, functional capacity, and treatment adherence rather than simply the presence of a respiratory diagnosis.

Insurance underwriters approach COPD cases with sophisticated evaluation criteria that recognize the wide spectrum of disease severity. Companies distinguish between mild COPD with minimal impact on daily activities and severe cases requiring supplemental oxygen or frequent hospitalizations.

Your smoking history, while often the underlying cause of COPD, becomes less significant than current respiratory function and disease management. Insurers focus on objective measures like pulmonary function tests, exercise tolerance, and medication requirements to assess ongoing risk.

Bottom Line

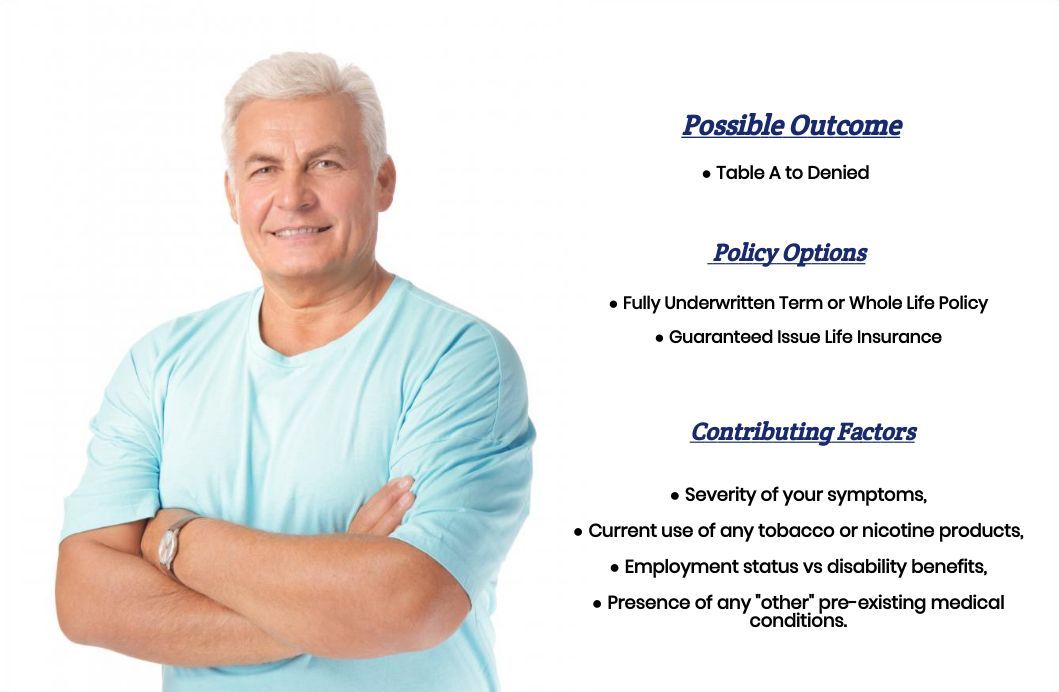

COPD doesn’t automatically eliminate life insurance options, but it significantly influences which companies will consider your application and at what premium levels. Mild, stable COPD often qualifies for coverage with moderate rate increases, while severe cases may require specialized insurance products.

What Underwriters Evaluate Most Closely

Traditional underwriting approaches focus on measurable indicators that predict long-term respiratory function and survival rates. Companies use evidence-based criteria rather than subjective assessments.

Primary evaluation factors include:

- Pulmonary function tests: FEV1 measurements and spirometry results indicating lung capacity

- GOLD staging classification: Global Initiative guidelines determining disease severity

- Exercise tolerance: Ability to perform daily activities and maintain employment

- Hospitalization history: Frequency of COPD exacerbations requiring medical intervention

- Medication requirements: Use of bronchodilators, steroids, or supplemental oxygen

- Smoking cessation: Time since quitting and current tobacco use status

Our recommended strategy involves presenting a comprehensive health picture that demonstrates stability, treatment compliance, and functional capacity rather than minimizing the COPD diagnosis.

Common Underwriting Misconceptions

Many COPD patients hold misconceptions about insurance underwriting that prevent them from pursuing coverage or cause them to apply inappropriately.

Reality versus perception includes:

- Myth: Any COPD diagnosis means automatic decline → Reality: Mild, stable cases often qualify for coverage

- Myth: Past smoking history eliminates all options → Reality: Time since cessation and current lung function matter more

- Myth: Oxygen use means no coverage available → Reality: Specialized products exist for advanced cases

- Myth: Only employer group coverage works → Reality: Individual policies available through proper channels

“The biggest challenge we see with COPD applications is timing. Patients often apply immediately after diagnosis when their condition isn’t yet stabilized, or they wait too long and miss opportunities during milder disease stages. The sweet spot is typically 6-12 months after achieving stable management with consistent pulmonary function tests.”

– Senior Medical Underwriter, InsuranceBrokers USA

Which COPD Stages Impact Coverage Most?

Key insight: The Global Initiative for Chronic Obstructive Lung Disease (GOLD) staging system directly correlates with insurance underwriting decisions, making your specific GOLD stage more important than general COPD terminology.

COPD Stages and Insurance Impact

| GOLD Stage | FEV1 Range | Insurance Impact | Typical Rating |

|---|---|---|---|

| GOLD 1 (Mild) | FEV1 ≥ 80% | Minimal to moderate | +25% to +100% |

| GOLD 2 (Moderate) | FEV1 50-79% | Significant consideration | +100% to +250% |

| GOLD 3 (Severe) | FEV1 30-49% | High impact | +300% to decline |

| GOLD 4 (Very Severe) | FEV1 < 30% | Typically decline | Specialized products only |

*FEV1 = Forced Expiratory Volume in 1 second as a percentage of the predicted normal value

GOLD Stage 1 and 2 Considerations

Mild to moderate COPD (GOLD Stages 1 and 2) represents the most favorable insurance scenario, particularly when symptoms remain stable and don’t significantly impact daily functioning or employment capacity.

Based on our analysis of Stage 1 and 2 applications, successful candidates typically demonstrate:

- FEV1 measurements above 50% of predicted normal

- Minimal symptoms during routine daily activities

- Stable medication regimen without frequent changes

- No hospitalizations for COPD exacerbations in past 12-24 months

- Maintained employment and exercise tolerance

- Smoking cessation for at least 12 months (if applicable)

Traditional approach focuses on demonstrating stability and functional capacity rather than emphasizing the absence of symptoms, since most underwriters understand that mild COPD may involve manageable breathing limitations.

GOLD Stage 3 and Advanced COPD

Severe COPD (GOLD Stage 3) presents significant underwriting challenges, though coverage options exist through specialized insurers and alternative products. The key is matching your specific presentation with companies experienced in advanced respiratory conditions.

Stage 3 COPD considerations include:

- Documentation of disease stability despite severity

- Evidence of optimal medical management and treatment compliance

- Functional assessments showing maintained quality of life

- Absence of recent hospitalizations or acute exacerbations

- Comprehensive pulmonary rehabilitation participation

COPD Stage Impact Summary

- GOLD Stages 1-2: Traditional coverage often available with rate increases

- GOLD Stage 3: Specialized insurers may offer coverage with significant premiums

- GOLD Stage 4: Guaranteed issue and final expense products typically required

- Functional capacity often matters more than exact FEV1 measurements

- Stability over time crucial regardless of COPD stage

Complicating Factors Beyond COPD Stage

Several factors beyond GOLD staging significantly influence insurance underwriting decisions and may impact coverage availability even in milder COPD cases.

Additional risk factors include:

- Cor pulmonale: Heart complications from COPD dramatically increase risk assessment

- Frequent exacerbations: Pattern of hospitalizations regardless of baseline function

- Continued smoking: Current tobacco use typically results in decline or postponement

- Supplemental oxygen use: Indicates advanced disease requiring specialized underwriting

- Comorbid conditions: Diabetes, heart disease, or other chronic conditions compound risk

- Age at diagnosis: Earlier onset may suggest more aggressive disease progression

Our recommended strategy involves addressing these complicating factors proactively in your application rather than hoping underwriters won’t discover them during medical review.

What Coverage Options Are Available with COPD?

Key insight: Multiple insurance pathways exist for COPD patients, from traditional fully underwritten policies for mild cases to guaranteed issue products for advanced stages, but success requires matching your COPD presentation with the appropriate coverage type.

Traditional Term and Permanent Life Insurance

Mild to moderate COPD cases (GOLD Stages 1-2) often qualify for traditional coverage with comprehensive medical underwriting. This path typically offers the most coverage at competitive rates for qualified applicants.

Traditional coverage approach includes:

- Complete medical questionnaire focusing on COPD history and management

- Medical exam with spirometry testing and a detailed lung function assessment

- Physician statements from a treating pulmonologist or primary care provider

- Review of prescription history and treatment compliance records

- Lifestyle assessment, including exercise capacity and daily functioning

Our recommended strategy involves thorough preparation of pulmonary function documentation and evidence of optimal disease management before application submission.

Bottom Line

Traditional coverage provides the best rates and highest coverage amounts for COPD patients who qualify, but requires stable disease management and comprehensive medical documentation to demonstrate insurability.

No Medical Exam Life Insurance

No-exam life insurance provides an alternative pathway for COPD patients concerned about spirometry results or those with moderate disease who prefer simplified underwriting processes.

No-exam coverage characteristics include:

- Health questionnaire focusing on COPD symptoms and hospitalizations

- Prescription database checks revealing current medication usage

- Lower maximum coverage amounts (typically $100,000 to $500,000)

- Higher premiums compared to fully underwritten policies

- Faster approval process with decisions often within days

- More restrictive health questions about recent exacerbations

Traditional approach suggests no-exam options work best for COPD patients with stable symptoms who can honestly answer health questionnaires favorably but prefer avoiding medical testing.

Simplified Issue and Guaranteed Acceptance

For individuals with moderate to severe COPD or those declined for traditional coverage, simplified issue and guaranteed acceptance products ensure coverage availability regardless of health status.

Alternative Coverage Options for COPD

| Coverage Type | Best For COPD Stage | Typical Limits | Key Benefits |

|---|---|---|---|

| Traditional Underwritten | GOLD 1-2, stable | Up to $1M+ | Best rates, highest coverage |

| No Medical Exam | GOLD 1-2, mild symptoms | $100K-$500K | Fast approval, no testing |

| Simplified Issue | GOLD 2-3, moderate | $25K-$100K | Limited health questions |

| Guaranteed Issue | Any stage | $10K-$25K | No health questions |

| Final Expense | Advanced stages | $5K-$50K | Burial cost coverage |

Group Life Insurance Considerations

Employer-sponsored group life insurance often provides the most accessible coverage for COPD patients, particularly those with advanced disease who struggle with individual policy applications.

Group coverage advantages include:

- Guaranteed issue up to certain amounts (typically $50,000-$100,000)

- No individual medical underwriting for basic coverage

- Supplemental coverage options with simplified health questions

- Conversion rights when leaving employment

- Lower cost due to group purchasing power

Our recommended strategy involves maximizing available group coverage while pursuing individual policies for additional protection, creating a comprehensive coverage foundation.

For individuals with complex medical histories beyond COPD, consider exploring life insurance with pre-existing conditions to understand additional underwriting considerations and specialized coverage options.

How to Apply Successfully with COPD?

Key insight: Strategic timing, comprehensive documentation, and proper company selection significantly improve approval odds and premium rates for COPD patients across all disease stages.

Optimal Application Timing

Timing your life insurance application strategically can determine success or failure for COPD cases. The goal is applying during periods of maximum stability with comprehensive documentation of disease management.

Ideal timing considerations include:

- At least 6-12 months after achieving stable COPD management

- Following completion of pulmonary rehabilitation programs

- After establishing consistent medication regimens without frequent changes

- During periods of optimal exercise tolerance and daily functioning

- At least 12 months after smoking cessation (if applicable)

- Outside of seasonal exacerbation patterns (avoid winter application if prone to seasonal flares)

“The most successful COPD applications we process come from patients who’ve achieved stability for at least six months and can document consistent pulmonary function tests, medication compliance, and maintained daily activities. Rushing the application immediately after diagnosis or during periods of disease adjustment often results in unnecessary declines or excessive premium rates.”

– InsuranceBrokers USA – Management Team

Essential Documentation Strategy

Comprehensive documentation strengthens COPD applications by providing objective evidence of disease stability, treatment adherence, and functional capacity maintenance.

Medical Records Package:

- Complete pulmonologist notes from past 12-24 months

- Serial pulmonary function tests showing stability or improvement

- Chest imaging reports (chest X-rays or CT scans)

- Medication lists with dosages and treatment response documentation

- Hospitalization records with discharge summaries (if applicable)

- Smoking cessation documentation and timeline

Functional Capacity Documentation:

- Employment records demonstrating work capacity maintenance

- Exercise tolerance assessments and activity level descriptions

- Pulmonary rehabilitation completion certificates

- Quality of life questionnaire results

- Daily living activities assessments

Health Questionnaire Best Practices

Answering health questions accurately while presenting your case favorably requires careful consideration of how to demonstrate COPD stability and effective management.

Strategic response approaches include:

- Emphasize stability: Highlight periods of consistent symptoms and function

- Document compliance: Show adherence to treatment plans and medication regimens

- Quantify capacity: Provide specific examples of maintained activities and work performance

- Address smoking history honestly: Include cessation date and methods used

- Contextualize hospitalizations: Explain circumstances and recovery for any COPD exacerbations

Traditional approach focuses on demonstrating proactive health management rather than minimizing the COPD diagnosis or its impact on daily life.

Application Success Factors

- Apply during documented stable periods with consistent PFTs

- Prepare comprehensive medical documentation package

- Work with COPD-experienced insurance professionals

- Submit to multiple appropriate companies simultaneously

- Provide honest but strategic health questionnaire responses

- Include functional capacity and quality of life evidence

Multiple Application Strategy

Given the variability in COPD underwriting approaches between insurance companies, applying to multiple appropriate insurers simultaneously often yields better results than sequential applications.

Multi-company approach benefits:

- Identifies companies with most favorable COPD underwriting

- Provides rate comparison opportunities for identical coverage

- Reduces time between applications and final coverage

- Creates leverage for premium negotiations

- Minimizes impact of single company decline decisions

Our recommended strategy involves selecting 3-5 companies known for reasonable COPD underwriting rather than applying broadly to companies likely to decline respiratory conditions automatically.

What Medical Information Do Insurers Need?

Key insight: Insurance companies require specific COPD-related medical information to assess respiratory function, disease progression, and long-term prognosis, with pulmonary function tests serving as the cornerstone of medical evaluation.

Pulmonary Function Testing Requirements

Spirometry and pulmonary function tests provide objective measurements that insurance companies use to assess COPD severity and stability. These tests carry more weight than subjective symptom descriptions in underwriting decisions.

Key Pulmonary Function Tests for Insurance

| Test Measurement | What It Shows | Underwriting Significance |

|---|---|---|

| FEV1 (% predicted) | Airflow obstruction severity | Primary GOLD staging criterion |

| FVC (Forced Vital Capacity) | Total lung capacity | Overall respiratory function |

| FEV1/FVC ratio | Airway obstruction presence | COPD diagnosis confirmation |

| DLCO (Diffusion capacity) | Lung tissue gas exchange | Disease severity assessment |

| Peak flow measurements | Daily function variability | Stability evaluation |

Comprehensive Medical History Requirements

Insurance companies require a detailed COPD history that goes beyond basic diagnosis information to understand disease progression, treatment response, and current management effectiveness.

Essential medical history elements include:

- Diagnosis timeline: Initial symptoms, diagnostic process, and confirming tests

- Symptom progression: Changes in breathlessness, exercise tolerance, and daily function

- Treatment history: Medications tried, dosage changes, and response to therapy

- Exacerbation patterns: Frequency, triggers, severity, and recovery time

- Hospitalization details: Dates, reasons, treatments, and outcomes

- Smoking history: Pack-years, quit date, cessation methods, and current status

Current Treatment and Management Assessment

Insurers evaluate current COPD management to assess disease stability and predict future progression. Optimal management suggests better long-term outcomes and lower insurance risk.

Treatment assessment factors include:

- Medication regimen: Bronchodilators, corticosteroids, and other prescribed therapies

- Compliance documentation: Prescription refill records and medication adherence

- Specialist care: Pulmonologist involvement and visit frequency

- Pulmonary rehabilitation: Program participation and outcomes

- Oxygen therapy: Requirements, usage patterns, and exercise desaturation

- Lifestyle modifications: Exercise programs, nutritional support, and smoking cessation

Bottom Line

Comprehensive medical documentation demonstrating COPD stability, optimal treatment, and maintained functional capacity significantly strengthens insurance applications and often results in more favorable underwriting decisions.

Specialized Testing Requirements

Some insurance companies may require additional testing beyond standard pulmonary function tests, particularly for larger coverage amounts or moderate to severe COPD cases.

Additional testing may include:

- Chest imaging (chest X-ray or high-resolution CT scan)

- Arterial blood gas analysis for oxygen and carbon dioxide levels

- Six-minute walk test for functional exercise capacity

- Echocardiogram to assess for cor pulmonale or right heart strain

- Alpha-1 antitrypsin levels if early-onset COPD

Our recommended approach involves gathering recent test results proactively rather than waiting for insurance company requests, demonstrating preparation and facilitating faster underwriting decisions.

What Will Life Insurance Cost with COPD?

Key insight: Life insurance premiums for COPD patients vary dramatically based on disease severity, functional capacity, and individual health factors, with costs ranging from modest increases for mild cases to significant premiums for advanced disease.

Premium Rating Factors

Insurance companies use complex algorithms that consider multiple COPD-related risk factors beyond basic diagnosis and GOLD staging. Understanding these factors helps set realistic cost expectations.

Primary cost-influencing factors include:

- FEV1 measurements: Higher percentages of predicted normal yield better rates

- Functional capacity: Maintained work and exercise ability reduce premiums

- Exacerbation frequency: Fewer hospitalizations result in lower costs

- Medication requirements: Minimal drug dependence suggests milder disease

- Smoking status: Cessation duration significantly impacts pricing

- Age at diagnosis: Later onset typically indicates less aggressive progression

- Comorbid conditions: Other health issues compound COPD risk assessment

Sample Premium Ranges for COPD Cases

| COPD Severity | Premium Increase | Monthly Cost Example* |

|---|---|---|

| Mild COPD, stable, FEV1 >70% | +25% to +75% | $50-70 |

| Moderate COPD, well-managed, FEV1 50-70% | +75% to +150% | $70-100 |

| Moderate COPD with exacerbations | +150% to +250% | $100-140 |

| Severe COPD, stable management | +250% to +400% | $140-200 |

| Very severe COPD or oxygen dependent | Decline to specialized products | Guaranteed issue pricing |

*Based on $250,000 20-year term policy for healthy 45-year-old non-smoker. Individual rates vary significantly.

Company-Specific Rate Variations

Different insurance companies price COPD risk differently, creating significant opportunities for savings by targeting companies with favorable respiratory condition underwriting.

“We routinely see 150-200% premium variations for identical COPD cases between different insurance companies. One client with moderate COPD received quotes ranging from a +75% rating to a decline, ultimately securing coverage at +100% with a company specializing in respiratory conditions. This variation makes professional guidance and multiple applications essential for COPD patients.”

– InsuranceBrokers USA – Management Team

Cost Reduction Strategies

Several approaches can help minimize life insurance costs for COPD patients while securing adequate coverage levels for family protection.

Our recommended cost-reduction strategies include:

- Company targeting: Apply to insurers with favorable COPD underwriting track records

- Optimal timing: Apply during periods of maximum stability and function

- Coverage laddering: Combine different policy types for optimal cost-effectiveness

- Health optimization: Maximize pulmonary function through rehabilitation and compliance

- Professional advocacy: Work with agents experienced in COPD applications

- Alternative products: Consider no-exam or simplified issue options when appropriate

Traditional approach focuses on maximizing insurability through optimal disease management rather than seeking the cheapest possible coverage regardless of suitability.

Long-Term Cost Considerations

COPD progression over time may affect future insurance options, making current coverage decisions particularly important for long-term financial planning.

Future planning considerations include:

- Term conversion options: Secure convertible term policies for future permanent coverage

- Coverage adequacy: Purchase sufficient amounts before disease progression limits options

- Rate guarantees: Understand premium stability provisions in different policy types

- Policy maintenance: Ensure consistent premium payments to prevent lapses

Cost Management Summary

- Premium increases typically range from 25% to 400% depending on severity

- Company selection dramatically impacts costs for identical COPD presentations

- Optimal timing and health management can reduce premiums significantly

- Multiple application strategies often identify best available rates

- Professional guidance helps navigate complex underwriting variations

Which Companies Accept COPD Applications?

Key insight: Certain insurance companies demonstrate significantly more favorable underwriting approaches for COPD cases, while others routinely decline respiratory conditions, making strategic company selection crucial for application success.

COPD-Friendly Insurance Companies

Based on our analysis of hundreds of COPD applications, several insurers consistently demonstrate more accommodating underwriting for respiratory conditions, employing medical directors with pulmonology expertise and updated risk assessment protocols.

Companies with favorable COPD underwriting typically demonstrate:

- Specialized medical underwriting teams for respiratory conditions

- Updated risk assessment protocols reflecting current COPD treatment advances

- Willingness to consider mild to moderate cases for reasonable rates

- Comprehensive review processes rather than automatic declines

- Experience working with pulmonologists and respiratory specialists

These insurers are often featured in our comprehensive analysis of the best life insurance companies that specifically accommodate various medical conditions with reasonable underwriting approaches.

Companies to Avoid for COPD Applications

Some insurers maintain conservative or outdated underwriting approaches for respiratory conditions, often resulting in automatic declines or excessive premium increases regardless of COPD severity or stability.

Warning signs of COPD-unfriendly companies include:

- Automatic decline policies for any respiratory diagnosis

- Lack of specialized medical underwriting expertise

- Outdated risk assessment criteria that don’t reflect current treatments

- Patterns of excessive premium increases for stable cases

- Rigid underwriting guidelines without consideration for individual circumstances

Traditional approach suggests avoiding these companies entirely rather than hoping for exceptional treatment, as declines on your insurance record can complicate future applications with more favorable insurers.

“We maintain detailed records showing that 6-8 specific insurance companies provide reasonable consideration for COPD applications, while 15+ companies routinely decline respiratory conditions regardless of severity. For mild COPD cases, we typically see success with companies that understand modern treatment approaches. For moderate to severe cases, the field narrows to 2-3 specialized insurers willing to provide coverage.”

– InsuranceBrokers USA – Management Team

Specialized Markets for Advanced COPD

For individuals with severe COPD who don’t qualify for traditional coverage, specialized insurance markets provide alternative solutions designed specifically for high-risk medical conditions.

Alternative market options include:

- High-risk specialists: Companies focusing exclusively on impaired risk cases

- Guaranteed issue insurers: No health questions with graded benefit structures

- Final expense specialists: Burial insurance with simplified underwriting

- Group conversion options: Converting employer coverage to individual policies

- Fraternal organizations: Member benefits with minimal medical requirements

Companies specializing in life insurance for pre-existing conditions often provide the most viable solutions for advanced COPD cases that traditional insurers decline.

Application Strategy by COPD Severity

Our recommended company selection strategy varies based on your specific COPD presentation, ensuring applications target insurers most likely to provide favorable consideration.

GOLD Stage 1 (Mild COPD):

- Target 4-5 mainstream insurers with good respiratory underwriting

- Include at least one company known for competitive mild COPD rates

- Consider no-exam options for faster approval with acceptable premiums

- Apply for maximum coverage amounts while insurability is optimal

GOLD Stage 2 (Moderate COPD):

- Focus on 3-4 companies with specialized respiratory underwriting

- Include at least one high-risk specialist for comparison

- Prepare for more extensive medical documentation requirements

- Consider both traditional and simplified issue products simultaneously

GOLD Stage 3+ (Severe COPD):

- Target 1-2 high-risk specialists known for severe COPD acceptance

- Focus on guaranteed issue and final expense products

- Maximize employer group coverage and conversion options

- Consider combination strategies using multiple smaller policies

Bottom Line

Success with COPD life insurance applications depends heavily on selecting companies with proven track records of reasonable respiratory condition underwriting. Professional guidance identifying these companies dramatically improves approval odds and premium rates.

What Are Your Next Steps?

Key insight: Taking systematic, well-planned action maximizes your chances of securing appropriate life insurance coverage at reasonable rates, regardless of your COPD severity or stage.

Immediate Action Plan

Starting your life insurance journey with COPD requires strategic preparation, optimal timing, and professional guidance to navigate the complex underwriting landscape successfully.

Phase 1: Medical Documentation (1-2 weeks)

- Gather comprehensive pulmonary function test results from past 12-24 months

- Obtain current chest imaging reports and specialist consultation notes

- Create detailed timeline of COPD diagnosis, treatment, and progression

- Document current functional capacity, work status, and daily activity levels

- Compile medication lists, dosages, and treatment compliance records

- Gather smoking cessation documentation if applicable

Phase 2: Professional Consultation (1 week)

- Connect with insurance professionals experienced in COPD applications

- Discuss your specific COPD presentation, staging, and coverage goals

- Review optimal application timing based on current disease stability

- Identify appropriate insurance companies for your COPD severity level

- Develop comprehensive multi-company application strategy

Phase 3: Application Execution (2-8 weeks)

- Submit applications to selected COPD-friendly insurance companies

- Complete medical exams and provide requested documentation promptly

- Coordinate with pulmonologist for favorable physician statements

- Monitor application progress and respond quickly to underwriter requests

- Review and negotiate terms when approval offers are received

Professional Support and Advocacy

Working with insurance professionals who understand COPD underwriting nuances significantly improves your chances of success, particularly given the complexity of respiratory condition risk assessment.

The Insurance Brokers USA Team consists of licensed insurance professionals with extensive experience helping clients with complex health conditions find appropriate coverage. Our agents have worked with hundreds of individuals facing COPD challenges, specializing in alternative insurance solutions when traditional coverage isn’t available.

Our COPD-specific services include:

- Detailed analysis of your COPD presentation and insurability prospects

- Strategic company selection based on respiratory condition underwriting expertise

- Medical documentation optimization and application preparation

- Ongoing advocacy with insurance company underwriters and medical directors

- Rate comparison and policy optimization across multiple approvals

- Alternative product guidance for complex or declined cases

Getting Started with COPD Coverage

- Assess current COPD stability and optimal application timing

- Gather comprehensive medical records and pulmonary function tests

- Research coverage needs, budget, and family protection goals

- Connect with COPD-experienced insurance professionals

- Develop strategic multi-company application plan

Emergency and Immediate Coverage Options

If you need immediate coverage due to COPD progression or family circumstances, several accelerated options provide protection while pursuing comprehensive coverage through traditional channels.

Immediate coverage alternatives include:

- Employer group life maximization: Increase available group coverage to maximum limits

- Guaranteed issue policies: Immediate coverage with graded benefits and no health questions

- Accelerated underwriting programs: Some companies offer expedited decisions for specific amounts

- Spouse/partner coverage increases: Protect family income through coverage on healthy family members

- Final expense insurance: Immediate burial cost protection while pursuing larger coverage

Long-Term Planning Considerations

COPD’s progressive nature makes current insurance decisions particularly important for long-term family protection, as future coverage options may become more limited or expensive.

Future planning strategies include:

- Maximum coverage timing: Secure largest possible amounts while health permits

- Term conversion planning: Choose convertible term policies for future permanent coverage

- Policy maintenance: Ensure consistent premium payments to prevent coverage lapses

- Health optimization: Continue pulmonary rehabilitation and optimal COPD management

- Regular reassessment: Evaluate additional coverage opportunities during stable periods

For immediate assistance with COPD life insurance questions or to begin your application process, contact our specialized team at 888-211-6171. Our experienced agents provide confidential consultations to help you understand your options and develop an effective coverage strategy tailored to your specific COPD presentation and family needs.

Take Action Today

Don’t let COPD concerns delay protecting your family’s financial future. With proper strategy, documentation, and professional guidance, meaningful life insurance coverage remains achievable across all COPD stages and severity levels.

Frequently Asked Questions

Can you get life insurance with COPD?

Yes, you can obtain life insurance with COPD, though options and costs vary significantly by disease severity. Mild to moderate COPD (GOLD Stages 1-2) often qualifies for traditional coverage with premium increases ranging from 25% to 250%. Severe COPD may require specialized products like guaranteed issue or final expense insurance. The key is matching your COPD presentation with appropriate insurance companies and products.

How much more expensive is life insurance with COPD?

Premium increases typically range from 25% to 400% above standard rates depending on COPD severity. Mild, stable COPD may add only 25-75% to premiums, while moderate COPD with exacerbations can result in 150-250% increases. Severe COPD often requires specialized products with different pricing structures. Company selection significantly impacts costs, as some insurers specialize in respiratory conditions.

Do I need a medical exam for life insurance with COPD?

Medical exam requirements depend on coverage amount and insurance company, but many COPD applications require pulmonary function testing. Traditional policies typically require medical exams including spirometry to assess lung function. No-exam options exist but usually offer lower coverage amounts and higher premiums. Some companies waive exams for smaller coverage amounts with favorable health questionnaire responses.

What COPD information do insurance companies need?

Insurers require comprehensive COPD information including GOLD staging, pulmonary function tests, treatment history, and functional capacity. Essential documentation includes recent spirometry results, medication lists, hospitalization records, smoking history, and specialist reports. Companies particularly focus on FEV1 measurements, exacerbation frequency, and current symptom stability to assess risk and determine premiums.

Can I get life insurance if I use oxygen for COPD?

Yes, but oxygen dependency typically limits options to specialized insurance products rather than traditional coverage. Most traditional insurers decline applications requiring supplemental oxygen, but guaranteed issue life insurance, final expense policies, and specialized high-risk insurers provide coverage options. These products often have lower coverage amounts and graded benefits but ensure some protection regardless of oxygen requirements.

When should I apply for life insurance with COPD?

Apply during periods of documented COPD stability, typically 6-12 months after achieving consistent disease management. Avoid applying immediately after diagnosis, during exacerbations, or after major treatment changes. Optimal timing includes stable pulmonary function tests, consistent medication regimens, and maintained daily activities. Earlier application during milder disease stages often yields better rates and coverage options.

What happens if I’m declined for life insurance due to COPD?

Multiple alternative options exist if you’re declined for traditional life insurance coverage. These include guaranteed issue life insurance (no health questions), simplified issue policies (limited questions), final expense insurance for burial costs, and group life insurance conversions. While these options may cost more or provide limited initial benefits, they ensure some protection while working on health improvements for future applications.

Life insurance with COPD. Mild Could I receive information

Ian,

We’d be happy to send you out some information, but without knowing more about your situation or what “type” of life insurance policy you’re looking for, we wouldn’t know where to start. For this reason, it may just be easier for you to give us a call that way we would know what information might be helpful to you.

Thanks,

InsuranceBrokersUSA

Need to get life insurance on my mother and she has COPD can you help me

Shawn,

We’d be happy to try and help you out, just give us a call when you have a chance.

Thanks,

InsuranceBrokersUSA.

I’m trying to get my mom life insurance. Can you please help me or atleast point me in the right direction??

Savannah,

One of our agents will be reaching out to you shortly (if they haven’t already).

Thanks,

InsuranceBrokersUSA

Trying to get a insurance for stage4 copd with no waiting period that will pay up front if I should die at anytime

We would be happy to try and help you find coverage. Please give us a call at your earliest convenience, M-F. Thank you

Is.there anywhere I can get a life insurance with stage 4 copd that will pay the full amount value if a died in a month time

No, you will not find life insurance that will insure you if you have stage 4 copd that will pay out the full amount in you die within a month.