In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after having been diagnosed with Bronchitis.

- Can I qualify for life insurance if I have been diagnosed with Bronchitis?

- Why do life insurance companies care if I have been diagnosed with Bronchitis?

- What kind of information will the insurance companies ask me or be interested in?

- What “rate” can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Bronchitis?

Yes, individuals who have been diagnosed with Bronchitis can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, they may even be able to qualify some of the best no medical exam life insurance policies in the nation!

The only problem is…

That because there are generally two “types” of Bronchitis that an individual might be diagnosed with. Most of the top-rated life insurance companies we’re all familiar with will want to know what “type” you have been diagnosed with before they’re going to be willing to approve your life insurance application.

For example…

There will be those who suffer from the “occasional” bought of Bronchitis during cold season which most life insurance companies aren’t going to be all that worried about, and there are those who seem to suffer from a “chronic” bout of Bronchitis which will cause alarm during a traditional term or whole life insurance application.

Why do life insurance companies care if I have been diagnosed with Bronchitis?

Probably the best and easiest way to understand why a life insurance company is likely to “care” if an individual has been diagnosed with Chronic Bronchitis is to take a moment and briefly examine exactly what “chronic bronchitis” is and discuss some of the complications that can arise due to this pre-existing medical condition.

Chronic Bronchitis Defined:

Chronic Bronchitis is just one of many different respiratory conditions that can fall under the heading of COPD or Chronic Obstructive Pulmonary Disease, and in this case, it involves the inflammation of the bronchial tubes within the lungs, which causes an overproduction of mucus.

As a result…

The affected patient will suffer from a chronic cough, which may either be dry or wet with phlegm. Additional symptoms may also include:

- Shortness of breath,

- Chest pain,

- Production of mucus (sputum) can vary in color including white, yellow/gray or green,

- Etc…

Causes of “chronic” Bronchitis…

Unlike acute Bronchitis, which will typically be referred to as a “chest cold”, Chronic Bronchitis is usually caused by some “long-term” exposure to air pollution, dust and or fumes form the environment, and most commonly caused by smoking.

Fortunately…

Unlike many other respiratory medical conditions, one’s exposure to the harmful effects of Chronic Bronchitis can often times be reduced significantly once an individual removes him or herself from the harmful environmental factor, which is causing the inflammation to occur within their lungs.

This is why…

Even those who may suffer from a “severe” case of Chronic Bronchitis may still be able to qualify for a traditional term or whole life insurance policy provide that they are no longer being exposed to the agent causing their inflammation and have no history of tobacco or nicotine use within the past 12 months.

Which is why…

One of the first things that a life insurance underwriter is going to want to do once he or she learns that an applicant has been diagnosed with Chronic Bronchitis or Chronic Obstructive Pulmonary Disease (COPD) is first determine “why” an individual has contracted this disease and second try and determine just how “severe” their condition is.

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked may include:

- When were you first diagnosed with Chronic Bronchitis?

- Who diagnosed your Chronic Bronchitis? A general practitioner or a specialist?

- What symptoms (if any) led to your Chronic Bronchitis diagnosis?

- Do you know what may be causing you to suffer from Chronic Bronchitis?

- Have you ever used any kind of tobacco or nicotine products regularly?

- In the past 12 months, have you used any tobacco or nicotine products?

- What treatment options has your doctor recommended for you to treat your Bronchitis?

- Are you currently taking any prescription medications right now?

- In the past two years, have you been hospitalized for any reason?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

Now at this point…

We usually like to take a moment and remind folks that nobody here at IBUSA has any medical training, and we’re certainly not doctors. All we are is a bunch of life insurance agents who just happen to be really good at helping folks with pre-existing medical conditions like Chronic Bronchitis, find and qualify for the life insurance coverage that they are looking for.

So, without further ado, let’s take a look at what kind of rates an individual who has been diagnosed with Chronic Bronchitis might be able to qualify for!

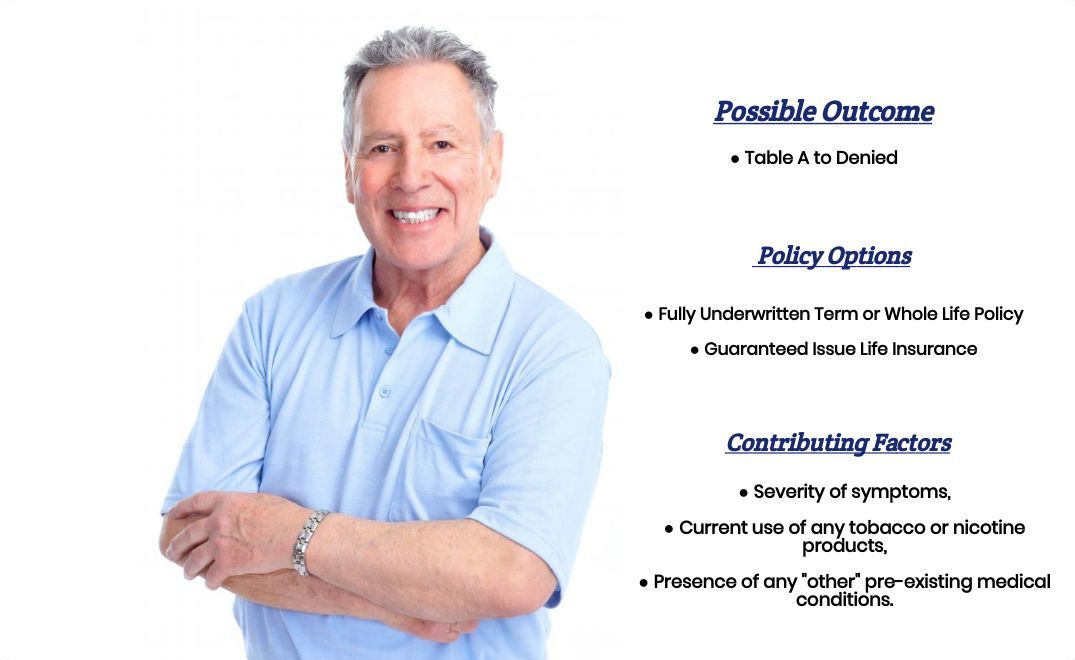

What “rate” can I qualify for?

Now, as one can see, there are a lot of factors that can come into play when determining what kind of “rate” that an individual might be able to qualify for.

For this reason, it’s almost impossible to know what kind of “rate” you might qualify for without first speaking with you directly to get a few basic facts determined.

That said however…

There are a few “assumptions” that one can make that will generally hold true when working with an individual who has been diagnosed with Chronic Bronchitis, which may be helpful to you as you being researching what your options may be.

For example, regardless of how “severe” your Chronic Bronchitis is, what you’ll generally find is that most (if not all) life insurance companies will typically regard anyone who has been diagnosed with Chronic Bronchitis as a “high-risk” applicant meaning that they will generally not be eligible for a Standard or Better rate.

Second…

In most cases, any time an individual has been diagnosed with a “chronic” pre-existing medical condition which has to do with one’s respiratory system, it’s almost a sure bet that if the applicant is also currently using any form of tobacco or nicotine, he or she will “automatically’ be denied a traditional term or whole life insurance policy.

Which is why…

In cases like these, the applicant will either need to postpone his or her life insurance application until which point they are no longer considered “tobacco users” or they will need to pursue some other kind of “alternative” product such as a guaranteed issue life insurance policy or an accidental death policy.

The good news is…

That regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy that they can qualify for. Which brings us to the last topic that we wanted to take a moment and discuss which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to helping a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is exactly what you’re going to find here at IBUSA!