In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with Myocarditis.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Myocarditis?

- Why do life insurance companies care if I have been diagnosed with Myocarditis?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Myocarditis?

Yes, individuals who have been diagnosed with Myocarditis can and often will be able to qualify for a traditional term or whole life insurance policy. That said, however, it’s safe to say that if you have been diagnosed with Myocarditis in the past, most of the best-term life insurance companies (in our opinion) will want to learn all about this previous diagnosis before they will be willing to make any definitive decisions about the outcome of your life insurance application.

It’s also why…

You may want to consider avoiding applying for a no medical exam term life insurance policy as well, seeing how these policies tend to be more challenging to qualify for after someone has been diagnosed with a pre-existing medical condition like Myocarditis.

Why do life insurance companies care if I have been diagnosed with Myocarditis?

It’s pretty safe to say that anytime an individual has been diagnosed with a pre-existing medical condition related to their heart, most (if not all) life insurance companies will “care” about it! For this reason, it shouldn’t come as a surprise that if you have been diagnosed with Myocarditis in the past, chances are you’re probably going to have to answer some additional questions and maybe even submit your medical records to the life insurance companies before being approved for coverage.

This is why we wanted to take a moment and discuss what Myocarditis is as well as highlight some of the most common symptoms of this disease so that we can better understand what a life insurance underwriter will be looking for when making their decision about your application.

Myocarditis Defined:

Myocarditis is defined as inflammation of the heart muscle or myocardium. As a result of “inflammation, ” patients can experience changes to the heart’s electrical system, which can interfere with the heart’s ability to function correctly, causing rapid or abnormal heart rhythms (arrhythmias).

Common symptoms may include:

- Chest pain,

- Rapid and abnormal heart rhythms (arrhythmias),

- Edema,

- Shortness of breath,

- Fatigue,

- Flu-like symptoms,

- Etc…

Serious Complications may include:

- Increased risk of heart attack and/or strokes,

- Heart failure,

- Death.

Common causes of Myocarditis may include:

- Epstein-Barr virus (EBV),

- Hepatitis C,

- Herpes,

- HIV,

- Chlamydia,

- Coxsackie B viruses,

- Etc…

Fortunately, Myocarditis is a disease that can be treated using medications that can directly combat the “cause” of one’s Myocarditis and help manage some of the symptoms that may result from this infection. Surgical procedures may also be available for those suffering from “severe” cases of Myocarditis.

Now, at this point…

We usually like to take a moment and remind folks that nobody here at IBUSA has any “official” medical training, and we’re certainly not doctors. We are a bunch of life insurance agents who are really good at helping folks with pre-existing medical conditions like this one find and qualify for the life insurance coverage they are looking for.

But…

It’s it’s not so great if you’re seeking answers to specific medical questions. In such cases, we recommend contacting an actual medical professional with the training to help. For everyone else, you’re in luck because now we’re going to get into some of the “nitty-gritty” about what you may or may not be able to qualify for.

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll likely be asked may include:

- When were you first diagnosed with Myocarditis?

- Who diagnosed your Myocarditis? A general practitioner or a cardiologist?

- What symptoms (if any) led to your diagnosis?

- Do you know what has caused you to develop Myocarditis?

- How have you treated your Myocarditis?

- Are you still treating your Myocarditis?

- Do you have any future medical procedures planned?

- Have you been diagnosed with any other pre-existing medical conditions?

- Have you ever suffered from a heart attack or stroke?

- Are you currently taking any prescription medications?

- In the past 12 months, have you used any tobacco or nicotine products?

- In the past two years, have you been hospitalized for any reason?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

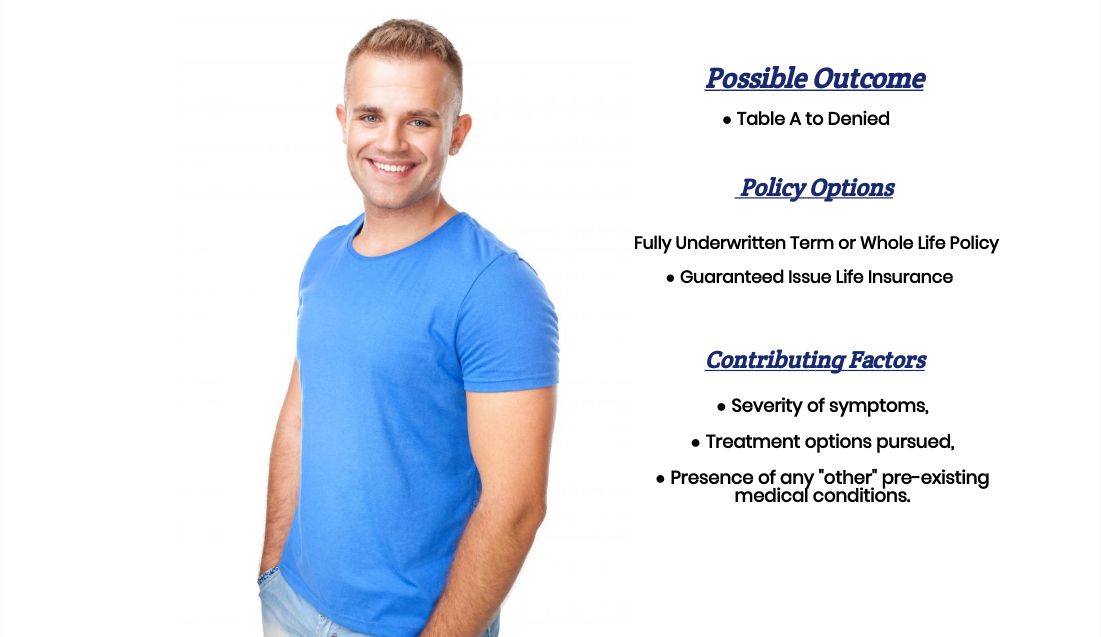

What rate (or price) can I qualify for?

As one can see, many factors can come into play when determining what kind of “rate” an individual might qualify for after having been diagnosed with Myocarditis. This is why knowing what kind of “rate” you might qualify for is almost impossible without first speaking with you directly. That said, however what you’re usually going to find is that most folks who have been diagnosed with Myocarditis are going to fall into one of three different categories.

Category #1.

Those who are currently suffering from Myocarditis, in which case most (if not all) life insurance companies will want to “postpone” their application until they have made a full recovery.

Category #2.

Those who have been diagnosed with Myocarditis and have made a full recovery, but their Myocarditis is considered a “symptom” of some other pre-existing medical condition, will most likely play a more significant role in determining what kind of “rate” they will be able to qualify for.

For folks in this situation…

We would encourage you to look at our Pre-existing Medical Conditions page to see if we don’t have another article that focuses on the particular condition that contributed to your Myocarditis infection.

Category #3.

In this last category, we’ll have those who have been diagnosed with Myocarditis, made a full recovery, and aren’t considered to be “at-risk” for developing this condition again. These individuals will usually be able to qualify for a traditional term or whole life insurance policy. Still, they typically have to settle for a “sub-standard” or “high-risk” classification.

The good news is that regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

Seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is precisely what you’ll find here at IBUSA!

Now, can we help out everyone previously diagnosed with Myocarditis?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that they CAN qualify for.

So, if you’re ready to explore your options, call us!