In this article, we aim to answer some of the most common questions individuals have when applying for life insurance after being diagnosed with an arrhythmia.

It’s important to note that there are approximately 16 different types of arrhythmias an individual may be diagnosed with. Thus, we’ll keep our discussion vague to focus on the essential facts that most top life insurance companies care about.

While this approach may not answer everyone’s questions, we believe it’s an excellent starting point. For those who need more information, we encourage them to visit our pre-existing medical conditions page or contact us directly.

The questions that we’ll address in this article include:

- Can I qualify for life insurance if I have been diagnosed with an arrhythmia?

- Why do life insurance companies care if I have been diagnosed with an arrhythmia?

- What kind of information will the insurance companies ask me or be interested in?

- What “rate” can I qualify for?

- What can I do to help ensure I get the best life insurance policy?

Without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Arrhythmia?

Yes, it may be possible to qualify for life insurance if you have been diagnosed with Arrhythmia. In fact, many individuals may even be able to qualify for a No Medical Exam Term Life Insurance Policy at a Preferred Plus rate!

That said…

Not all Arrhythmias will be considered the same, causing some applicants to be classified as “high-risk”, which can lead to higher premiums. Life insurance companies will likely ask for detailed information about your medical history, current condition, and any medications or treatments you are undergoing (if any).

Why do life insurance companies care if I have been diagnosed with Arrhythmia?

Any time an individual is diagnosed with some “type” of a pre-existing medical condition related to one’s heart, you can bet that a life insurance company will be “somewhat” interested in knowing exactly what that condition is. And in the case of being diagnosed with Arrhythmia, this is precisely what we find!

Fortunately or unfortunately…

Depending on one’s point of view, being diagnosed with Arrhythmia is a very common thing, which is why most life insurance underwriters are going to be very familiar with these “types” of pre-existing medical conditions.

They’re also going to know precisely what they are looking for to “spot” those who may be “seriously” ill for those who should be able to qualify for a traditional life insurance policy without any significant “complications.”

To get a better understanding…

Of what a typical life insurance underwriter will be looking for, it makes sense to get a better idea of precisely what an Arrhythmia is, as well as understand some of the more severe complications of these “types” of conditions that can cause someone in “extreme” cases.

Arrhythmia Defined.

The term arrhythmia defines various conditions that cause the heart’s improper beating. This irregular heartbeat can either be too fast (tachycardia) or too slow (bradycardia) or could be due to some “irregularity” whereby someone may experience an “extra-beat” such as in cases like Bigeminy or premature ventricular contraction (PVC).

Common symptoms one might experience may include:

- Chest pain,

- Fainting or feeling lightheaded,

- Shortness of breath,

- A “fluttering” of the chest,

- Sweating,

- Etc, etc…

While most of these symptoms may not appear too serious at first glance, it’s essential to understand that some serious consequences can arise with individuals who leave their condition untreated. Consequences such as an increased risk of a heart attack and/or stroke, which can lead to death.

What kind of information will the insurance companies ask me or be interested in?

If you’ve been diagnosed with arrhythmia, a condition characterized by abnormal heart rhythms, the life insurance company may ask you a range of questions better to understand your health status and any potential risks. Some of the information they may ask about includes:

- Date of diagnosis: The life insurance company may ask when you were diagnosed with an arrhythmia and how severe your symptoms were at the time.

- Type of arrhythmia: The life insurance company may ask about the specific type of arrhythmia you have, as different types can impact your health differently.

- Treatment: The life insurance company may ask about any treatments you have received for your arrhythmia, such as medication or a pacemaker. They may also ask about the effectiveness of these treatments and whether you have experienced any side effects or complications resulting from the condition.

- Current health status: The life insurance company may ask about your current health status, including any ongoing medical conditions, medications, and other health issues you have experienced.

- Lifestyle: The life insurance company may ask about your lifestyle habits, such as your diet, exercise routine, and use of tobacco or alcohol, as these can all potentially impact your health.

It’s important to be as honest and accurate as possible when answering these questions, as any discrepancies or omissions could affect the coverage provided by the policy.

Now, at this point…

We usually like to take a moment and remind folks that nobody here at IBUSA has any “official” medical training, and we’re certainly not doctors. All we are is a bunch of life insurance agents who are really good at helping folks with pre-existing medical conditions like this one find and qualify for the life insurance coverage they are looking for.

But…

It’s not so great if you’re seeking answers to specific medical questions. In such cases, we recommend contacting an actual medical professional with the training to help. For everyone else, you’re in luck because now we’re going to get into some of the “nitty-gritty” about what you may or may not be able to qualify for.

What “rate” can I qualify for?

As you can see from above, many factors can “potentially” affect one’s life insurance application once it becomes apparent that the applicant has been diagnosed with some “kind” of Arrhythmia. This is why, it’s pretty much impossible to know for sure what kind of “rate” you might be able to qualify for without actually speaking with you, particularly because there are many “kinds” of Arrhythmias one might be diagnosed with, each with their only potential health risks.

That said, however…

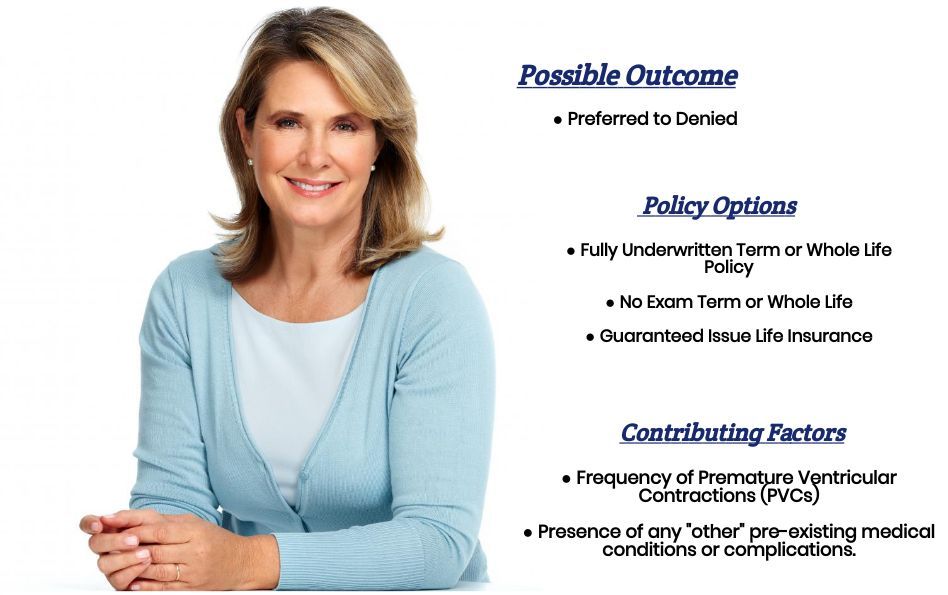

We can tell you that most individuals diagnosed with Arrhythmia will usually qualify for a traditional term or whole life insurance policy, whether at a Standard or better rate or a “high-risk” rating.

And that…

For those who have been diagnosed with an arrhythmia but aren’t suffering from any symptoms directly related to it, there is a good chance that the fact that you have been diagnosed with an arrhythmia isn’t going to play any role in the outcome of your life insurance application.

Or, in other words…

Whatever “rate” you would have been able to qualify for before being diagnosed with arrhythmia should be the same “rate” you would qualify for AFTER being diagnosed with an arrhythmia.

This brings us to the last topic we wanted to discuss in this article…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance professional who will work as an advocate for you. Such an agent who will be able to guide through the application process and be perfectly “frank” with you about what options may or may not be possible?

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because, after all, it really doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly, before applying for coverage, you’ll want to ensure you’re completely honest with your life insurance agent. By doing so, you will be helping them narrow down what options might be the “best.”

Now, can we help out everyone previously diagnosed with Arrhythmia?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Top 10 Best Final Expense Insurance Companies as well so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available, call us!