In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after having been diagnosed with either Hepatitis A, Hepatitis B, or Hepatitis C.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Hepatitis?

- Why do life insurance companies care if I have been diagnosed with Hepatitis?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Hepatitis?

Yes, individuals who have been diagnosed with Hepatitis can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, some may even be able to qualify for a term life insurance policy without a medical exam!

The only problem is…

After being diagnosed with Hepatitis, there are going to be a lot of additional factors that are going to come into play when determining the “type” of life insurance that you will be able to qualify for. This is why, before being approved for a traditional term or whole life insurance policy, most (if not all) of the best life insurance companies will want to ask you a series of questions designed to learn more about what “kind” of Hepatitis you were diagnosed with and how “serious” your condition may or may not be.

Why do life insurance companies care if I have been diagnosed with Hepatitis?

The main reason why a life insurance company is going to “care” if you have been diagnosed with Hepatitis is that at the end of the day, no matter how “treatable” this condition continues to become, it still has the potential to become a “life-threatening” medical condition which is why most life insurance underwriters will want to know exactly how you are treating your condition prior to making any definitive decisions about the outcome of your life insurance application.

It’s also why we wanted to take a moment to describe what Hepatitis is, how certain “types” will vary from one another, and highlight some of the most common symptoms of Hepatitis, which are sure to play a role in the outcome of your traditional life insurance application.

Hepatitis Defined:

Hepatitis is a medical condition that is defined as an infection or inflammation of the liver. In total, there are five “types” of Hepatitis that one can suffer from (A-E); however, within the United States, one will typically only encounter types A, B, and C.

Hepatitis A:

Hepatitis A is a viral infection that affects the liver. It is caused by the hepatitis A virus (HAV) and is primarily spread through contact with fecal matter, even in microscopic amounts, from an infected person. This can occur through consuming contaminated food or water or through close contact with an infected person. Hepatitis A is one of the reasons why you’ll usually see an…

“All employees must wash their hands”.

Symptoms may include:

Symptoms of hepatitis A include fever, fatigue, loss of appetite, nausea, vomiting, abdominal pain, dark urine, clay-colored bowel movements, joint pain, and jaundice (yellowing of the skin or eyes). These symptoms can appear anywhere from 2 to 6 weeks after exposure to the virus and can last for several weeks to several months.

Treatment options:

Hepatitis A is usually a self-limiting disease, meaning it will go away on its own without treatment. However, it can cause serious liver damage and, in rare cases, can be fatal.

The best way to prevent hepatitis A is through vaccination. The vaccine is highly effective and provides long-term protection against the virus. Good hygiene practices, such as washing your hands frequently and thoroughly, can also help to prevent the spread of the virus.

Hepatitis B:

Hepatitis B is a viral infection that affects the liver and is caused by the hepatitis B virus (HBV). It is primarily spread through contact with blood or other bodily fluids of an infected person, such as through sexual contact, sharing needles or other equipment used to inject drugs, or from an infected mother to her baby during childbirth.

Hepatitis B can also differ from Hepatitis A in that while some individuals may only suffer from a short-term or acute infection, others may have their Hepatitis B become a chronic infection capable of causing some pretty significant health complications and possibly causing cirrhosis of the liver and or liver cancer.

Symptoms of hepatitis B

Symptoms of hepatitis B can range from mild to severe and may not appear for several weeks or even months after exposure to the virus. Common symptoms include fatigue, nausea, vomiting, loss of appetite, abdominal pain, jaundice (yellowing of the skin or eyes), dark urine, and clay-colored bowel movements. Some people may not have any symptoms at all.

Hepatitis B can cause serious liver damage, including cirrhosis and liver cancer. It can also be chronic, meaning that it can last for a long period of time, even a lifetime.

The best way to prevent hepatitis B is through vaccination. The vaccine is highly effective and provides long-term protection against the virus. If a person is already infected with hepatitis B, antiviral medications can help to control the virus and prevent liver damage.

Hepatitis C:

Hepatitis C is a viral infection that affects the liver and is caused by the hepatitis C virus (HCV). It is primarily spread through contact with the blood of an infected person, such as through sharing needles or other equipment used to inject drugs, or from an infected mother to her baby during childbirth. It can also be acquired through other means of exposure to infected blood such as during medical procedures, tattooing, and piercing.

Symptoms of hepatitis C

Symptoms of hepatitis C can range from mild to severe and may not appear for several weeks or even months after exposure to the virus. Common symptoms include fatigue, nausea, vomiting, loss of appetite, abdominal pain, jaundice (yellowing of the skin or eyes), dark urine, and clay-colored bowel movements. Some people may not have any symptoms at all. Hepatitis C can cause serious liver damage, including cirrhosis and liver cancer. It can also be chronic, meaning that it can last for a long period of time, even a lifetime.

Unfortunately, there is no vaccine for hepatitis C. However, antiviral medications can cure the majority of cases of hepatitis C. These medications are highly effective and can eradicate the virus from the body, preventing liver damage and reducing the risk of liver cancer.

Now…

Before anyone gets too upset or begins complaining about the simplicity of the definitions that we’re using here, it’s important to understand that we here at IBUSA aren’t medical experts or doctors. All we are is a bunch of life insurance agents who just happen to be really good at helping folks with pre-existing medical conditions like the ones described above find and qualify for coverage.

Which means that…

Because we’re not going to be the ones “diagnosing” your condition and certainly not going to be the ones helping you treat your condition, all we need to do is understand that there are differences between these different “types” of Hepatitis and that those differences are going to affect how a life insurance underwriter is going to consider you as a potential “risk.” The good news is that despite how simple our definitions of these different types of Hepatitis are, this is something that we actually have down pat!

This is why, when we are approached by an individual who has been diagnosed with any of these “kinds” of conditions, we’re going to know right away what questions a life insurance underwriter is going to want to know the answers to before he or she will be willing to make any decision about the outcome of your life insurance application.

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked may include:

- When were you first diagnosed with Hepatitis?

- Who diagnosed your Hepatitis? A general practitioner or a specialist?

- What “kind” of Hepatitis have you been diagnosed with?

- Have you been given a definitive “diagnosis”?

- Do you know “how” you contracted Hepatitis?

- What symptoms (if any) led to your diagnosis?

- What treatment options did you pursue (if any)?

- Are you still receiving treatment for your Hepatitis?

- When was the last time you had a liver enzyme test?

- Are you currently taking any prescription medications?

- Do you currently drink any alcohol?

- Do you have a history of drug or alcohol abuse?

- Have you ever been convicted of a felony or misdemeanor?

- Do you have any issues with your driving record? Issues such as multiple moving violations, a DUI, or a suspended license?

- In the past two years, have you been admitted to a hospital for any reason?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

As you can see, many factors can come into play when trying to determine what kind of “rate” you might be able to qualify for after being diagnosed with Hepatitis. This is why it’s pretty much impossible to know what kind of “rate” you might be able to qualify for without first speaking with you directly for a few moments.

That said, however…

There are a few “assumptions” that we can make about individuals applying for a traditional term or whole life insurance policy after having been diagnosed with Hepatitis.

For example, if you have been diagnosed with either Hepatitis A or Hepatitis B and have completely recovered from your infection don’t seem to be suffering from any lingering effects of your infection, and are completely “viral” free in your blood draw, it’s reasonable to assume that you may be able to qualify for a Preferred rate assuming that you would otherwise be eligible.

Now, as for those…

Who have been diagnosed with Hepatitis C and undergone a “viral cure” treatment, it is possible to also be able to qualify for a Preferred rate if, after six months from your treatment, you are able to demonstrate that you are “cured” and the “cause” of your infection isn’t something that might cause you from being considered eligible for coverage (think intravenous drug use).

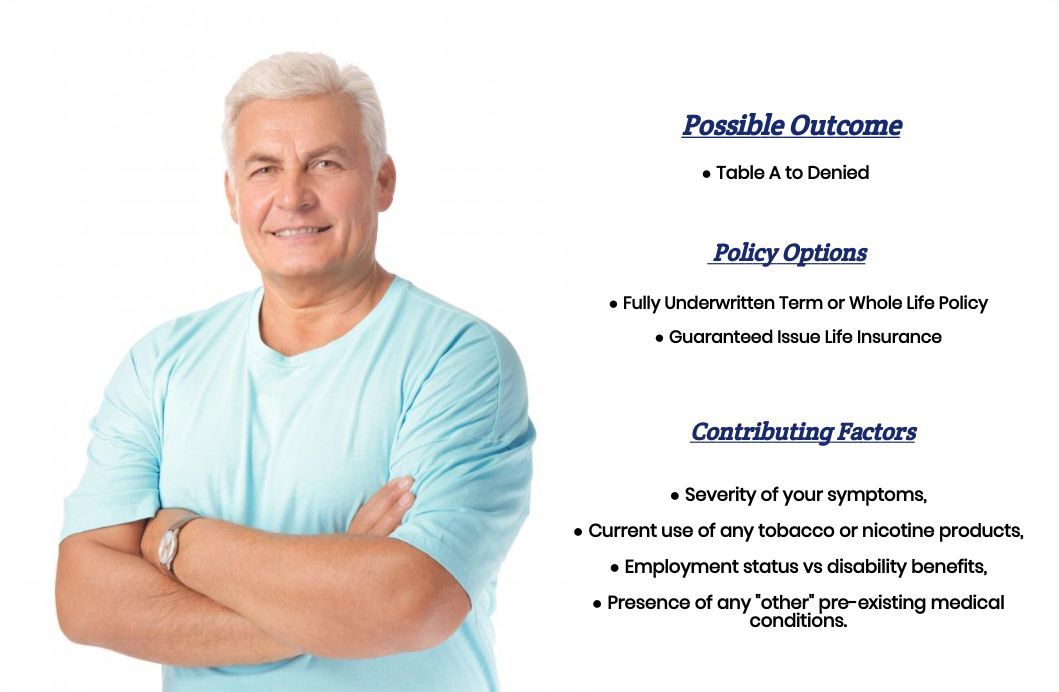

As for everyone else…

Who may still remain positive for Hepatitis B or C, it’s possible that you too may be able to qualify for a traditional term or whole life insurance policy only now you will most likely be considered a “higher-risk” candidate, which will mean that you will want to be much more selective with “which” life insurance companies you choose to apply with.

The good news is…

That regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy that they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is exactly what you’re going to find here at IBUSA!

Now, will we be able to help out everyone who has been previously diagnosed with Hepatitis?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well so that in the event that someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.