In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after having suffered from a Stroke or a Cerebrovascular Accident.

- Can I qualify for life insurance if I have suffered from a Stroke or Cerebrovascular Accident?

- Why do life insurance companies care if I have suffered from a Stroke or Cerebrovascular Accident?

- What kind of information will the insurance companies ask me or be interested in?

- What “rate” can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have suffered from a Stroke or Cerebrovascular Accident?

Whether or not you can qualify for life insurance after suffering from a stroke or cerebrovascular accident (CVA) will depend on several factors, including the severity of the stroke, your age, and your overall health.

Now…

Most insurance companies will consider applicants who have had a stroke or CVA, but the premiums and coverage options may be limited. Generally, the more severe the stroke or CVA, the higher the premiums will be. But, if you’ve had a stroke or CVA, it is important to disclose this information to the insurance company during the application process. Failing to disclose a stroke or CVA can result in the denial of your claim later on.

The insurance company may also require you to undergo a medical exam or provide medical records to determine the severity of the stroke and assess your overall health.

Why do life insurance companies care if I have suffered from a Stroke or a Cerebrovascular Accident?

Life insurance companies use actuarial tables to determine risk levels, and individuals who have had a stroke or CVA may be considered at higher risk due to the potential for ongoing health issues or complications. This can result in higher premiums or limitations on coverage.

By disclosing any history of stroke or CVA during the application process, the insurance company can accurately assess the risk and determine appropriate coverage and premiums. It’s important to be honest and upfront about any pre-existing medical conditions or health issues, as failure to disclose this information can result in denial of a claim later on.

Cerebrovascular Accident (CVA) Defined:

A cerebrovascular accident (CVA), also known as a stroke, is a medical condition that occurs when the blood supply to a part of the brain is disrupted. This can be caused by a number of factors, including a blocked artery (ischemic stroke) or the bursting of a blood vessel (hemorrhagic stroke). When the brain does not receive enough blood, brain cells can die, leading to serious complications and potentially permanent damage.

Symptoms of a CVA may include:

- Weakness or numbness on one side of the body,

- difficulty speaking or understanding others,

- problems with vision,

- dizziness or difficulty walking,

- and possibly severe headaches.

CVA is a medical emergency that requires immediate treatment to minimize brain damage and improve the chances of a full recovery.

Potential Causes of a Stroke

There are several potential causes of a stroke, also known as a cerebrovascular accident (CVA). Some of the most common causes include:

- Ischemic stroke: This type of stroke occurs when an artery that supplies blood to the brain becomes blocked, usually by a blood clot.

- Hemorrhagic stroke: This type of stroke occurs when a blood vessel in the brain ruptures and bleeds into the brain.

- Transient ischemic attack (TIA): Also known as a “mini-stroke,” a TIA is caused by a temporary disruption in blood flow to the brain. TIAs do not cause permanent damage, but they can be a warning sign of an impending stroke.

- Embolic stroke: This type of stroke is caused by an embolus, which is a clot or other foreign substance that travels to the brain and blocks an artery.

Other potential causes of stroke include high blood pressure, diabetes, high cholesterol, heart disease, and certain medications or medical conditions. Some lifestyle factors, such as smoking and a sedentary lifestyle, can also increase the risk of stroke.

The important takeaway at this point is that Regardless of what may cause someone to suffer from a stroke, the resulting blockage can cause brain cells to suffer and even die, leading to a variety of different symptoms for the patient. And this is what really concerns life insurance companies.

Possible treatment options:

The treatment for a stroke depends on the type of stroke and the severity of the damage. In general, the goals of stroke treatment are to restore blood flow to the brain, prevent further brain damage, and manage symptoms. Some common treatments for stroke include:

- Medications: Several medications can be used to treat stroke, including thrombolytics (medications to dissolve blood clots) and blood thinners to prevent new clots from forming.

- Surgery: In some cases, surgery may be necessary to remove a blood clot or repair a damaged blood vessel.

- Rehabilitation: Rehabilitation is an important part of stroke recovery and may include physical therapy, occupational therapy, and speech therapy to help the individual regain function and independence.

- Lifestyle changes: Making healthy lifestyle changes, such as eating a healthy diet, exercising regularly, and not smoking, can help prevent future strokes.

It’s important to note that treatment for stroke must be started as soon as possible in order to be effective. If you suspect that you or someone you know is experiencing a stroke, it’s important to call 911 or seek emergency medical attention immediately.

What kind of information will the insurance companies ask me or be interested in?

If you have had a stroke and are applying for life insurance, the insurance company will likely ask you for some detailed information about your stroke. This may include:

- The date of the stroke: The insurance company will want to know when the stroke occurred, as this will help them assess the severity of the stroke and determine the likelihood of future strokes.

- The type of stroke you experienced.

- The symptoms you experienced: The insurance company will want to know what symptoms you experienced during the stroke, such as weakness or numbness on one side of the body, difficulty speaking or understanding others, problems with vision, dizziness or difficulty walking, and severe headaches.

- The treatment you received: The insurance company will want to know what treatment you received for your stroke, such as medications, surgery, or rehabilitation.

- The long-term effects of the stroke: The insurance company will want to know if you have experienced any long-term effects as a result of the stroke, such as difficulty with mobility or cognitive function.

- Your current health status: The insurance company will also want to know about your current health status, including any ongoing medical conditions or treatments, as well as your lifestyle habits (such as smoking or exercise).

It’s important to be as honest and forthcoming as possible when answering these questions, as this will help the insurance company accurately assess the risk associated with insuring you and determine the appropriate premium for your policy.

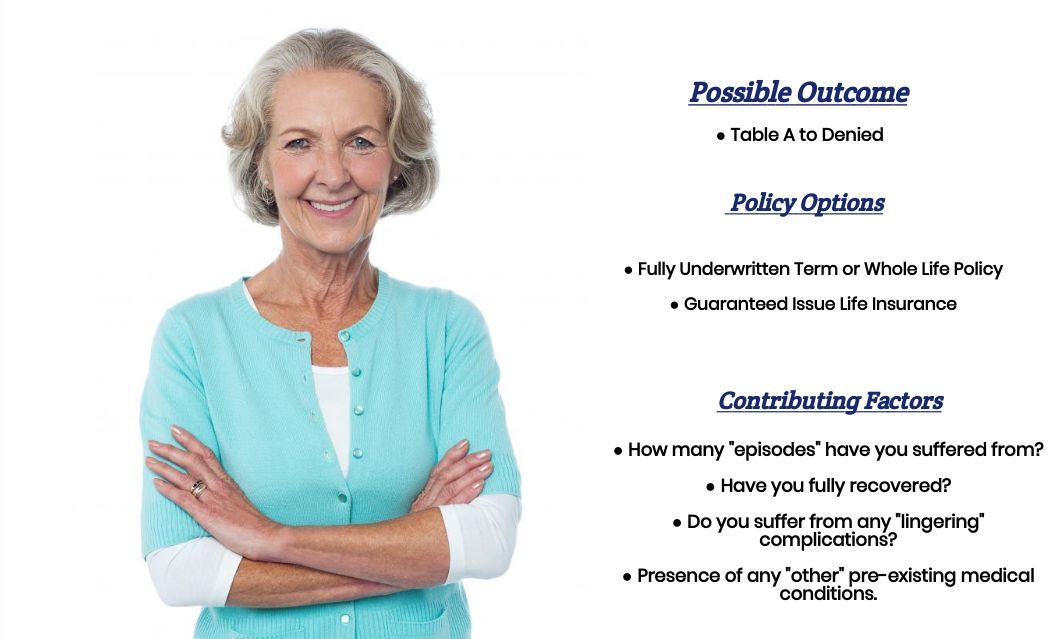

What rate class can I qualify for?

As you can see, there are many factors that can come into play when trying to determine what kind of “rate” an individual might qualify for once it has been determined that an applicant has suffered from a previous stroke.

This is why it’s almost impossible to know what kind of “rate” you might qualify for without first speaking with you for a minute or two.

That said, however…

There are a few “assumptions” that one can make that will generally hold true once it has been determined that an individual has been diagnosed with a previous cerebral thrombosis.

For example…

If it has been determined that you have actually suffered from multiple Cerebrovascular Accidents and are currently suffering from a variety of complications as a result of these “attacks,” it’s pretty safe to say that most life insurance companies aren’t going to be willing to approve your application.

In cases like these…

An individual will typically need to seek out an “alternative” product, such as a guaranteed issue life insurance policy or an accidental death policy should they still wish to purchase some “kind” of protection for their families.

As for those…

Who may have only suffered from a single Cerebrovascular accident and aren’t currently suffering from any “significant” complications from this single attack, you may be able to qualify for a traditional life insurance policy. However, it’s safe to say that you probably won’t be able to qualify for a Standard or Better rate.

The good news is…

That regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy that they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

If you have suffered from a stroke and are looking to get the best life insurance policy for your needs, here are some tips:

- Be honest and upfront about your medical history: Provide accurate and detailed information about your stroke, including the date, type, severity, and any ongoing treatment or medication. This will help the insurance company assess your risk level and determine the appropriate rate class.

- Consider a guaranteed issue policy: If you are having difficulty qualifying for traditional life insurance due to your stroke history, you may consider a guaranteed issue policy, which does not require a medical exam and may be easier to qualify for.

- Work with an experienced agent or broker: An experienced insurance agent or broker can help you navigate the application process and find the best coverage options for your needs. They can also help you understand the underwriting guidelines of different insurance companies and determine the best approach to applying for coverage.

- Improve your overall health: Making lifestyle changes such as eating a healthy diet, getting regular exercise, and quitting smoking can help improve your overall health and potentially qualify you for better rates.

- Compare rates and policies: Shop around and compare policies from different insurance companies to find the best coverage and rates for your needs.

- Read and understand the policy: Make sure you understand the policy’s terms and conditions, including any exclusions or limitations related to your stroke history.

- Follow up: Stay in touch with your insurance agent or broker to review your coverage periodically and make any necessary changes as your needs and circumstances change.