In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance with Pancreatitis.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Pancreatitis?

- Why do life insurance companies care if I’ve been diagnosed with Pancreatitis?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance”?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I’ve been diagnosed with Pancreatitis?

Yes, individuals who have been previously diagnosed with Pancreatitis can and often will be able to qualify for a traditional term or whole life insurance policy. Some may even be eligible for some of the best no-medical-exam life insurance companies at a Preferred rate!

The only problem is…

An individual can suffer from two “types” of Pancreatitis. This is why most (if not all) of the best-term life insurance companies will want to know more about what “kind” of Pancreatitis you were diagnosed with. And whether or not you have entirely recovered before making any decisions about your life insurance application.

Why do life insurance companies care if I’ve been diagnosed with Pancreatitis?

There are two main reasons a life insurance company will “care” if you have been diagnosed with Pancreatitis. The first reason is that Pancreatitis is a severe infection that, in some cases, may lead one to develop severe, but not life-threatening, complications.

The second main reason a life insurance company will “care” if you have been diagnosed with Pancreatitis is because one can be diagnosed with two “types” of Pancreatitis.

- One that won’t cause any long-term or permanent damage to one’s pancreas

- And another “type” that can cause permanent fibrosis and calcification of the pancreas!

This is why we wanted to take a moment to discuss what Pancreatitis is and highlight some of the most common symptoms/complications of this disease so that we’ll have a better idea of what a life insurance underwriter will look for when deciding about your life insurance application.

Pancreatitis Defined:

Pancreatitis is a term used to describe a disease whereby one’s pancreas becomes inflamed. This “inflammation” can occur in either an isolated episode, as seen in those suffering from Acute Pancreatitis in which little or no permanent damage to the pancreas occurs, or some individuals may develop Chronic Pancreatitis in which after the initial “flare-up” occurs, permanent damage in the form of fibrosis, calcification, and ductal inflammation remains.

Common symptoms may include:

- Upper abdominal pain,

- Back pain,

- Flu-like symptoms, including fever,

- Rapid pulse rate,

- Nausea and/or vomiting,

- Etc…

Serious complications may include:

- Increased risk of infections,

- Kidney failure,

- Diabetes,

- Increased risk of pancreatic cancer,

- Malnutrition,

- Development of pseudocysts with the pancreas.

Potential causes of Pancreatitis may include:

- Autoimmune diseases,

- Excessive use of alcohol,

- Surgery,

- Trauma,

- Metabolic disorders,

- Gallstones,

- Infections,

- Etc…

Fortunately, Pancreatitis is a treatable condition. However, treatment will most likely include a hospital stay whereby one can receive plenty of intravenous fluids and antibiotics to ensure the underlying infection is treated correctly.

This brings us to an essential point that we should mention.”

First…

If you think you have a medical issue, don’t use the internet to try and diagnose yourself. After all, if you do and you’re correct, you’re still going to need to see the doctor, and if you’re wrong, the time you spend being your doctor could harm yourself!

Second…

Nobody here at IBUSA is medically trained; we’re certainly not doctors. All we are is a bunch of life insurance agents who just happened to be good at helping individuals find and qualify for the life insurance they’re looking for.

So please don’t mistake any of the medical information we discuss as medical advice because it’s not!

We’re just trying to “prep” you for what it might be like to apply for a life insurance policy after you have been diagnosed with Pancreatitis… that’s it! This brings us to our next topic, which is…

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll likely be asked may include:

- When were you first diagnosed with Pancreatitis?

- Who diagnosed your Pancreatitis? A general practitioner or a specialist?

- What symptoms led to your diagnosis?

- What “type” of Pancreatitis were you diagnosed with? Acute or Chronic?

- How was your Pancreatitis treated?

- Did your treatment require a hospital stay? If so, how long were you in the hospital?

- Do you know “why” you developed Pancreatitis?

- Have you been diagnosed with any other pre-existing medical condition?

- Are you currently taking any prescription medications?

- Do you have any history of drug or alcohol abuse?

- Do you have any issues with your driving record? Issues such as multiple moving violations, a DUI, or a suspended license?

- In the past two years, have you been hospitalized for any reason?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

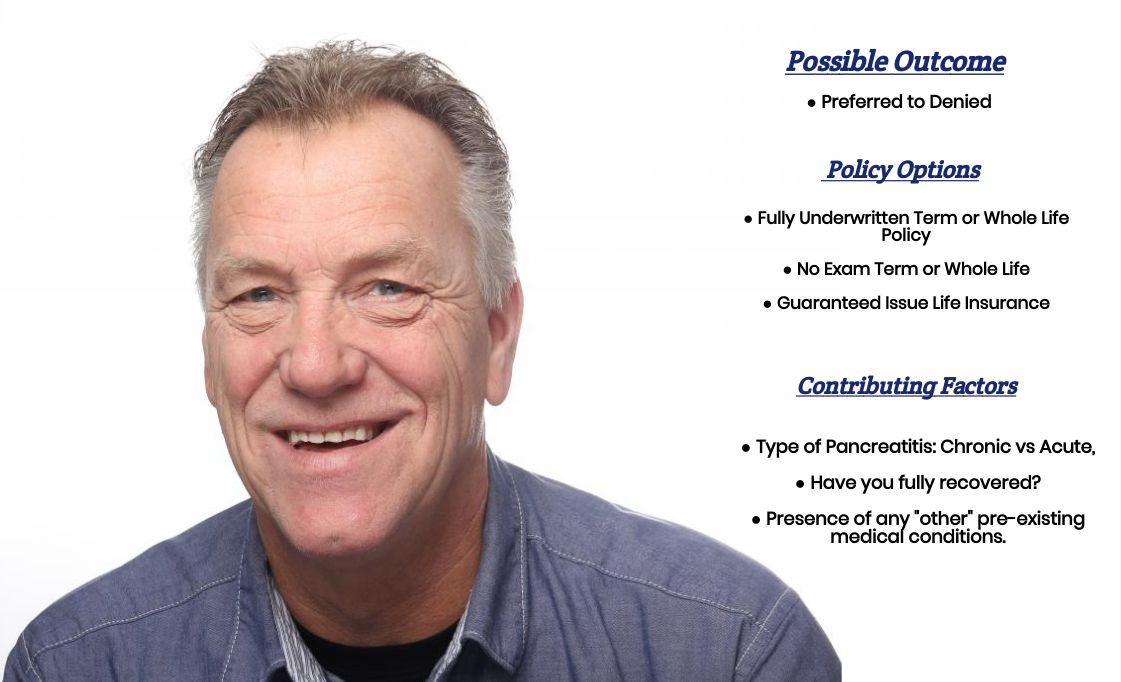

As you can see, many variables can come into play when determining what kind of “rate” an individual is diagnosed with Pancreatitis. This is why knowing what kind of “rate” you might qualify for is almost impossible without first speaking with you directly. That said, however, most individuals diagnosed with Pancreatitis usually fall into one of four categories that we can make some “assumptions” about that will generally hold true.

Category #1.

The first group we’ll start with will either be currently treating their Pancreatitis or have recently recovered from it (and by recently recovered, we mean less than two years ago).

In cases like these…

What you’re most likely going to find is that most (if not all) life insurance companies are going to want to make sure that you first make a full recovery and then maintain your good health for a minimum of two years before they will be willing to consider you eligible for a traditional life insurance policies. Individuals in this situation may consider purchasing a Guaranteed Issue Life Insurance policy or an Accidental Death Policy until they qualify for a traditional life insurance policy option.

Category #2.

Individuals who will fall into this category will be those who have been diagnosed with Chronic Pancreatitis. Most (if not all) life insurance companies consider this pre-existing medical condition to be “un-insurable” for a traditional term or whole life insurance policy.

Individuals in this situation may wish to consider purchasing a Guaranteed Issue Life Insurance policy should they still want to obtain some life insurance coverage.

Category #3.

Applicants in the category will be those who have been diagnosed with a case of Acute Pancreatitis; however, in their situation, their Pancreatitis is a symptom of another pre-existing medical condition such as an:

- Autoimmune disease,

- Metabolic disorder,

- Alcoholism,

- Etc…

In this case, the underlying cause of one’s Acute Pancreatitis will become the ultimate factor in determining what kind of “rate” an individual might qualify for. In situations like these, we encourage you to look at our Pre-existing Medical Conditions page for more information about the root cause of your Pancreatitis.

Category #4.

Finally, we’ll have those folks who developed a case of Acute Pancreatitis due to some “temporary” condition, which has subsequently passed. These individuals will have suffered from their Pancreatitis over two years ago and have been healthy ever since. Individuals like these can potentially qualify for a Preferred rate provided they don’t suffer from any lingering effects of their Pancreatitis and can meet all the other requirements to earn such a rate.

The good news is that regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with pre-existing medical conditions like yours. We are committed to helping all our clients find the “best” life insurance policy they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to see the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

Seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is precisely what you’ll find here at IBUSA!