In this article, we wanted to take a moment and try to answer some of the most common questions we get from folks applying for life insurance after having a Nephrectomy (benign).

Questions that will be addressed will include:

- Can I qualify for life insurance if I’ve had a Nephrectomy?

- Why do life insurance companies care if I’ve had a Nephrectomy?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I’ve had a Nephrectomy?

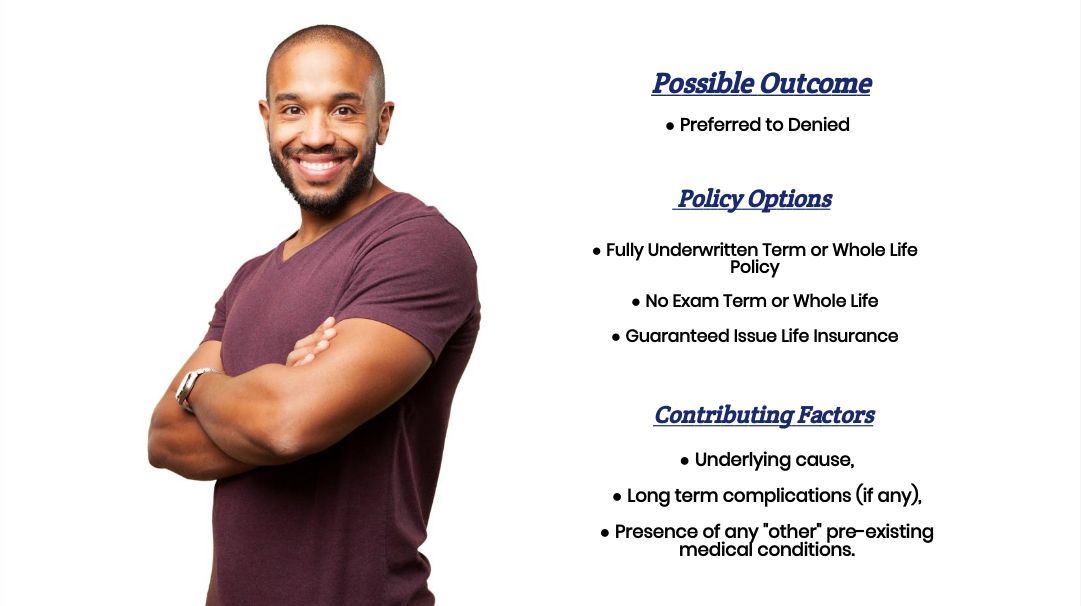

Yes, individuals who have had a Nephrectomy performed on them can and often will be able to qualify for a traditional term or whole life insurance policy. They may even be able to qualify for a Preferred rate.

The problem is…

Before any life insurance company is going to be willing to approve someone who has had a Nephrectomy performed on them for coverage, they’re going to want to make sure they fully understand “why” an individual had to have a kidney removed. They also want to ensure the applicant fully recovers from this procedure.

It’s also why…

You may want to consider avoiding applying for a no-medical exam term life insurance policy and seeing how these policies tend to be more challenging to qualify for after someone has been diagnosed with a medical condition that may have required them to receive a Nephrectomy.

Why do life insurance companies care if I’ve had a Nephrectomy?

The main reason why a life insurance company is going to “care” if someone has had a Nephrectomy performed is that having your kidney removed isn’t a popular type of “elective” surgery that someone might want to have performed on themselves.

Instead…

Nephrectomies are generally only performed when someone has something seriously wrong with one of their kidneys, which is why they want (need) to have it removed before it can cause any additional damage or harm. This is why we wanted to take a moment and discuss what a Nephrectomy is and some of the most common reasons why someone might have one performed on them.

This way…

We can better understand what a life insurance underwriter will be looking for when deciding about your life insurance application.

Nephrectomy Defined:

A Nephrectomy is a term used to describe the surgical removal of a kidney. Common reasons why someone might require to have a Nephrectomy may include:

- Kidney cancer,

- Kidney damage due to physical injury,

- Kidney damage due to infections (pyelonephritis),

- Polycystic Kidney disease,

- Kidney damage due to severe hypertension caused by renal artery stenosis.

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll likely be asked may include:

- When did you receive a Nephrectomy?

- Why did you need to receive a Nephrectomy?

- Have you been diagnosed with any other previous pre-existing medical condition?

- Are you currently taking any prescription medications?

- Has your Nephrectomy “cured” the underlying pre-existing medical condition that caused you to need to have a Nephrectomy performed?

- In the past two years, have you been admitted to a hospital for any reason?

- Are you currently working?

- In the past 12 months, have you applied for or received any form of disability benefits?

Now, at this point…

We usually like to take a moment and remind folks that nobody here at IBUSA has any “official” medical training, and we’re certainly not doctors. All we are is a bunch of life insurance agents who are good at helping folks with pre-existing medical conditions like this one find and qualify for the life insurance coverage they are looking for.

But…

It’s not so great if you’re seeking answers to specific medical questions. In such cases, we recommend contacting an actual medical professional with the training to help. For everyone else, you’re in luck because now we’re going to get into some of the “nitty-gritty” about what you may or may not be able to qualify for.

What rate (or price) can I qualify for?

Generally, you’re going to find that when it comes time to help an individual who has received a Nephrectomy in the past, most individuals will fall into one of two different groups. There will be those who have had a Nephrectomy performed to treat a condition for which a Nephrectomy would be considered a “cure.”

And…

There will be those who have had a Nephrectomy performed, which would be considered more of a “treatment” for a chronic medical condition. This latter group would consist of individuals who have received a Nephrectomy to treat:

- A malignant cancer,

- Damage due to chronic infections,

- Etc…

In cases like these, you’ll typically find that the underlying pre-existing medical condition that causes one to need to have a Nephrectomy will ultimately determine what kind of “rate” you might qualify for.

As for the rest…

Who has been “cured” by their Nephrectomy? What you’re most likely going to find is that most life insurance companies aren’t going to consider your need to have a Nephrectomy as a reason to discriminate against you when applying for a traditional life insurance policy. This means that whatever “rate” you could qualify for before requiring a Nephrectomy should be the same “rate” you could qualify for AFTER a Nephrectomy is performed.

The good news is…

Regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with pre-existing medical conditions like yours. We are committed to helping all our clients find the “best” life insurance policy they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to see the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

Seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is precisely what you’ll find here at IBUSA!

Now, can we help out everyone who has previously received a Nephrectomy?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available, call us!