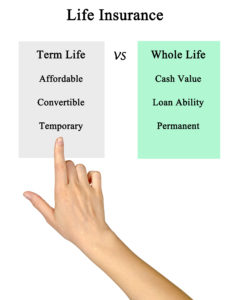

Life insurance is a crucial aspect of financial planning, providing peace of mind and security for you and your loved ones. But with so many options available, it can be overwhelming to choose the right one. Should you opt for the low-cost term life insurance or the long-term protection offered by whole life insurance?

To make this important decision, it’s important to weigh the pros and cons of each. In this article, we’ll dive into the world of life insurance and explore the differences between term life and whole life insurance, helping you make an informed choice for your future.

So grab a cup of coffee, sit back, and let’s get started!

First things first, what is life insurance?

Life insurance is a binding legal contract between you and an insurance company. In it, you pay regular premiums in exchange for a financial benefit paid to your designated beneficiaries in the event of your death.

Life insurance aims to provide financial protection for your loved ones in the event of your unexpected passing, ensuring that they are taken care of and can maintain their standard of living. With life insurance, you can rest easy knowing that your family will be protected, even if you’re no longer there. It is a means of securing their future and providing peace of mind, making it an important component of any comprehensive financial plan.

So, when we compare term vs. whole life insurance, we’re really comparing which binding contract you want to hold the insurance company to. Do you want that contract limited to a certain period of time, or do you want to hold the insurance company accountable for your entire life?

How does one qualify for life insurance?

To qualify for life insurance, individuals typically go through an underwriting process that involves providing personal and health information to the insurance company. The insurance company then uses this information to assess the individual’s risk and determine their eligibility for coverage and the premium rate. The following factors typically play a role in determining eligibility for life insurance:

- Age: Life insurance companies typically set minimum and maximum age requirements for coverage.

- Health: Individuals who have pre-existing medical conditions or engage in risky behavior, such as smoking, may be subject to higher premiums or declined coverage.

- Lifestyle: Life insurance companies may consider factors such as occupation, hobbies, and travel when determining eligibility and premium rates.

- Medical history: Life insurance companies typically review an individual’s medical history, including any chronic conditions or major illnesses, to determine their risk.

- Family medical history: Life insurance companies may consider an individual’s family medical history when determining their risk.

- Life expectancy: Life insurance companies may use life expectancy tables and other data to determine an individual’s expected lifespan and potential for risk.

Once an individual is eligible for coverage, the same factors will be used to calculate the premium for their life insurance policy.

Term life insurance

Term life insurance is a type of life insurance that provides coverage for a specified period of time, usually ranging from 10 to 30 years. It is the most straightforward and affordable form of life insurance, offering a death benefit to the policyholder’s beneficiaries in the event of their death during the coverage period.

Unlike whole life insurance, term life insurance does not accumulate cash value and is typically only in force for a set term. This makes it a good choice for individuals who want to provide temporary financial protection for their loved ones. The cost of term life insurance is determined by various factors, including the policyholder’s age, health, lifestyle choices, and the amount and length of coverage.

Types of term life insurance policies

Term life insurance comes in two main forms: level term and decreasing term.

Level-term life insurance offers a set amount of coverage for a specified term, typically 10, 20, or 30 years, with premiums that remain the same throughout the term. This stability can make budgeting easier and provide a death benefit for loved ones. However, premiums may increase if the policyholder renews the term at the end of the original term, and coverage may end before the policyholder dies if the term expires.

Decreasing term life insurance, on the other hand, provides a decreasing amount of coverage over the term of the policy, with premiums that remain the same. This type of policy can be a more affordable option, but the death benefit decreases over time, which may not provide enough coverage for final expenses or other needs. It is important to weigh the pros and cons of each type of term life insurance policy and choose the one that best fits your individual needs and circumstances.

We should note that…

Level-term life insurance is generally more popular than decreasing-term life insurance for several reasons:

- Stable coverage: Level-term life insurance offers stable coverage for the entire term, providing peace of mind for policyholders and their loved ones.

- Predictable premiums: With level-term life insurance, the premiums remain the same throughout the term, making budgeting easier.

- Flexibility: Level-term life insurance policies can be tailored to meet specific needs, with options for varying terms and coverage amounts.

- No decreasing benefit: Unlike decreasing term life insurance, level term life insurance provides a consistent death benefit, which can help ensure financial security for loved ones.

- Cost-effective: While level term life insurance may have a higher premium than decreasing term life insurance, it can provide more coverage over time and can be a more cost-effective option in the long run.

Ultimately, the popularity of level-term life insurance can be attributed to its stability, flexibility, and cost-effectiveness, which make it a popular choice for many policyholders.

Common term lengths

The most common term length for term life insurance policies is typically 10, 20, or 30 years. These terms are popular because they provide coverage for a significant portion of a policyholder’s life while still being affordable. A 10-year term is often the shortest and most affordable option, while a 30-year term provides the longest and most comprehensive coverage.

The 20-year term is often a happy medium, offering a balance between cost and coverage. Policyholders can choose the term length that best fits their needs, budget, and long-term goals. However, while longer terms provide more coverage, they also come with higher premiums.

Features available with some term life insurance policies

Renewable term life insurance is a type of term life insurance policy that can be renewed at the end of its term, typically without the need for further medical underwriting. This means that the policyholder can continue their coverage, even if their health has changed, by renewing the policy for another term. The new term will typically have to be renewed each year and will likely have a higher premium than the original policy (in some cases significantly higher), but it provides continued coverage for the policyholder.

Renewable term life insurance offers the benefit of flexibility and security for policyholders who want to continue their coverage but may not be able to afford or qualify for a new term life insurance policy.

Convertible term life insurance

Convertible term life insurance is a type of term life insurance policy that can be converted into a permanent life insurance policy, such as whole life insurance, without the need for further medical underwriting. This means that the policyholder can change the type of coverage they have, even if their health has changed or they have reached an age where they may not be eligible for new coverage. The conversion option is typically available during the policy term or within a specified period, such as the first 5 to 10 years of the policy.

Convertible term life insurance offers flexibility and security for policyholders who want the option to change their coverage in the future. This can be especially useful for young policyholders who may not be able to afford the higher premiums of a permanent life insurance policy but want the option to have permanent coverage in the future. It is important to review the terms and conditions of a convertible term life insurance policy and the cost of converting the policy to determine if this type of coverage is right for you.

Term life insurance riders

A life insurance rider is an optional add-on to a life insurance policy that provides additional coverage and benefits to the policyholder. Riders are typically purchased in addition to the main life insurance policy and provide additional coverage in specific circumstances, such as accidental death and dismemberment, critical illness, or long-term care.

Life insurance riders can be tailored to meet the policyholder’s specific needs and can provide additional financial security and peace of mind in the event of a covered loss. Some common life insurance riders include accidental death and dismemberment coverage, which provides additional benefits in the event of accidental death or injury, and critical illness coverage, which provides a lump sum payment in the event of a specified critical illness.

It is important to carefully review the terms and conditions of any life insurance rider before purchasing to ensure that it meets your needs and provides the coverage you are looking for. You should also consider the rider’s cost and how it may impact the overall cost of your life insurance policy.

These riders are only attached to the term life insurance policy and will terminate when the primary coverage ends.

Summary of term life insurance benefits

A term life insurance policy offers several benefits to policyholders, including:

- Affordability: Term life insurance is typically more affordable than permanent life insurance, making it a cost-effective option for many people.

- Coverage period: Term life insurance provides coverage for a specific period, usually 10 to 30 years. Policyholders can choose a term that aligns with their financial needs and goals.

- Protection for loved ones: Term life insurance provides financial protection for the policyholder’s loved ones in the event of their death. The death benefit can be used to pay off debts, cover living expenses, or provide for their children’s education.

- Coverage flexibility: Term life insurance policies can often be converted to a permanent policy, such as whole life insurance if the policyholder’s needs change. This allows for more coverage options as the policyholder’s life evolves.

- Estate planning: Term life insurance can be used as part of an overall estate planning strategy to help minimize the tax implications of passing on wealth to beneficiaries.

Overall, term life insurance provides peace of mind and financial protection for the policyholder and their loved ones, making it an important part of any comprehensive financial plan.

Potential cons of a term life insurance policy

While term life insurance offers several benefits, it also has some drawbacks, including:

- Limited coverage period: Term life insurance only provides coverage for a specific period of time. If the policyholder does not die during that term, the policy will simply expire, and the premiums paid will not be returned.

- No cash value: Unlike permanent life insurance policies, term life insurance does not accumulate cash value over time. This means that if the policyholder does not die during the term, the premiums paid will not be returned.

- Renewal costs: At the end of the term, policyholders will typically be required to renew their coverage, which can result in higher premiums. In some cases, renewing the coverage may not be possible if the policyholder’s health has declined or if they are no longer eligible for coverage.

- Lack of customization: Term life insurance policies are typically standardized, with limited customization options (compared to whole life insurance). This can make finding a policy that meets the policyholder’s specific needs difficult.

- Inadequate coverage: The coverage amount provided by a term life insurance policy may be insufficient for some policyholders, particularly if their needs change over time. In these cases, the policyholder may need to purchase additional coverage to provide the protection they need.

While term life insurance has some drawbacks, it is still a popular and effective way to provide financial protection for loved ones in the event of the policyholder’s death. When choosing a life insurance policy, policyholders should carefully consider their specific needs and goals.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, is a type of life insurance policy that provides coverage for the policyholder’s entire lifetime as long as premiums are paid. Unlike term life insurance, which provides coverage for a specific period of time, whole life insurance does not expire as long as the policyholder continues to pay premiums.

In addition to providing coverage for the policyholder’s entire lifetime, whole-life insurance policies also accumulate cash value over time, which can be used to provide a source of savings or investment income.

This makes whole life insurance a popular choice for those who want to provide long-term financial protection for their loved ones while also building financial security for themselves.

Types of whole life insurance

There are several different types of whole life insurance, each with its own unique features and benefits:

- Traditional whole life insurance: This is the most common type of whole life insurance, and provides a guaranteed death benefit, as well as a cash value component that grows over time.

- Universal life insurance: Universal life insurance provides flexible premium payment options, and the death benefit and cash value components can be adjusted over time to meet the policyholder’s changing needs.

- Variable life insurance: Variable life insurance allows policyholders to invest their cash value in a range of investment options, such as stocks, bonds, and mutual funds. This type of whole life insurance offers the potential for higher returns but also carries a higher level of risk.

- Indexed universal life insurance: This type of whole life insurance combines features of both universal life insurance and variable life insurance, linking the cash value component to the performance of a stock market index, such as the S&P 500.

- Guaranteed acceptance life insurance: This type of whole life insurance is designed for individuals who have health conditions that make it difficult to obtain traditional life insurance coverage. It typically requires no medical exam and offers guaranteed acceptance but comes with higher premiums and lower death benefits. Guaranteed acceptance policies will also include a graded death benefit limiting when full coverage begins.

Features available with some whole life insurance policies

Since convertibility and renewability don’t apply to whole life insurance policies, we list some of the most common riders one might choose to purchase with a whole life insurance policy. Riders such as:

- Accelerated death benefit: This rider allows policyholders to access a portion of the death benefit while they are still alive in the event of a terminal illness or chronic condition.

- Guaranteed insurability: This rider allows policyholders to purchase additional life insurance coverage in the future without undergoing a medical exam or providing evidence of insurability.

- Waiver of premium: This rider waives the policyholder’s premium payments if they become disabled, allowing them to keep their life insurance coverage in place without incurring additional costs.

- Long-term care rider: This rider provides policyholders with coverage for long-term care expenses, such as assisted living or nursing home costs.

Benefits of whole life insurance

Unfortunately, fully articulating many of the benefits that can be derived by owning a whole life insurance policy goes beyond the scope of this article. However, we did want to list a few of the major benefits so that you might better understand why many people choose to purchase a whole life insurance policy despite the fact that it will typically cost significantly more than a term life insurance policy.

Key benefits will include:

- Guaranteed death benefit: The death benefit provided by a permanent life insurance policy is guaranteed for the policyholder’s entire life, regardless of how long they live.

- Cash value component: Unlike term life insurance, which provides coverage only for a specified period, permanent life insurance has a cash value component that grows over time, offering the potential for a source of savings or investment.

- Premium stability: Permanent life insurance premiums are typically higher than those for term life insurance, but once set, they do not increase over time, providing policyholders with stability and predictability.

- Estate planning: Permanent life insurance can be an important tool for estate planning, providing a source of tax-free funds to help pay estate taxes and other expenses when a policyholder passes away.

- Living benefits: Some permanent life insurance policies provide living benefits, such as the ability to access a portion of the policy’s death benefit while the policyholder is still alive. This can be useful in the event of a serious illness or injury, when funds may be needed to pay for medical expenses or other costs.

- Flexibility: Many permanent life insurance policies allow policyholders to change their coverage over time, such as adjusting the death benefit or premium payments, providing greater flexibility to meet their evolving needs and goals.

Potential cons of owning a whole life insurance policy

While whole life insurance has several significant benefits, we would be remiss if we didn’t mention some of their potential drawbacks. Drawbacks such as:

- Cost: Whole life insurance is generally more expensive than term life insurance, as the premiums are designed to cover the policyholder for their entire life.

- Complexity: Whole life insurance can be more complex than term life insurance, as it involves elements such as cash value, dividends, and premium payments. This can make it harder for some policyholders to understand the details of their policy and how it works.

- Reduced Liquidity: Whole life insurance policies generally have limited flexibility, as the policyholder may not be able to withdraw or surrender the policy for its cash value unless they meet certain conditions, such as reaching a certain age or the policy has been in force for a minimum number of years.

- Potential for a Reduced Death Benefit: If the policyholder takes a loan against the cash value of their whole life insurance policy and fails to repay it, the death benefit paid to their beneficiaries may be reduced.

- Limited Market Participation: Whole life insurance policies are not tied to the performance of the stock market, which means that the policyholder does not have the opportunity to benefit from market gains.

- Potential for Lower Returns: Whole life insurance policies may not provide the same level of returns as other investment options, such as stocks or mutual funds.

This is why it’s always important to consider the pros and cons of whole life insurance carefully and to consult with a financial professional if you have any questions or concerns. Your financial goals, needs, and risk tolerance should be taken into account when deciding if a whole life insurance policy is right for you.

Bullet point comparison:

Term Life Insurance:

- Coverage is only provided for a specific term, typically 10, 20, or 30 years

- Lower premium costs compared to whole life insurance

- No cash value component

- The death benefit is only paid if the policyholder dies during the term of the policy

Whole Life Insurance:

- Coverage is provided for the policyholder’s entire life as long as the premium is paid

- Higher premium costs compared to term life insurance

- Includes a cash value component that grows over time and can be borrowed against or used to pay premiums

- Guaranteed death benefit, paid out tax-free to the named beneficiaries, regardless of when the policyholder dies

- It can be used to utilize different estate planning strategies not available with term life insurance policies

In conclusion, it’s fair to say that both term life insurance and whole life insurance have benefits and drawbacks, and the best choice will ultimately depend on the policyholder’s individual needs, goals, and financial situation.

The good news is that we here at IBUSA have plenty of experience helping clients qualify for both term and whole-life products. Once you’ve determined what’s best for you and your family, we should have a variety of different policies for you to choose from. All you need to do is give us a call, and let us show you what we can do for you!