In this article, we wanted to take a moment to answer some of the most common questions we hear from individuals looking to apply for life insurance while currently receiving Dialysis (whether it be Hemodialysis or Peritoneal Dialysis) to treat a variety of different conditions, including:

- Haemodialysis,

- Hemodialysis,

- Kidney failure,

- Renal failure,

Questions that will be directly addressed will include:

- Can I qualify for life insurance while currently on Dialysis?

- Why do life insurance companies care if I’m on Dialysis?

- What information will the insurance companies ask me about my Dialysis treatment?

- What options might be available to me?

- How can I help ensure I get the “best life insurance”?

So, without further ado, let’s dive right in!

Can I qualify for life insurance while currently on Dialysis?

It is possible to qualify for life insurance while currently on Dialysis, but the terms of the policy and the premiums you will be required to pay may be affected by your condition. The terms of a life insurance policy will depend on the insurer and the specific details of your situation, including the severity of your condition, your age, and any other underlying health conditions you may have.

This is why…

It’s so important to be honest and forthcoming about your medical history when applying for life insurance with a pre-existing condition like being on Dialysis because many insurers will likely ask for medical records and other information about your condition as part of the application process. If there are any discrepancies, this could affect your changes of being approved for coverage.

It’s also worth noting that life insurance policies for individuals with pre-existing conditions may have exclusions or limitations on coverage, and the premiums may be higher than those for individuals without pre-existing conditions. For this reason, it’s important to carefully review the terms of any policy before you agree to it to ensure that you understand any exclusions or limitations and are comfortable with the premiums and other words of the policy.

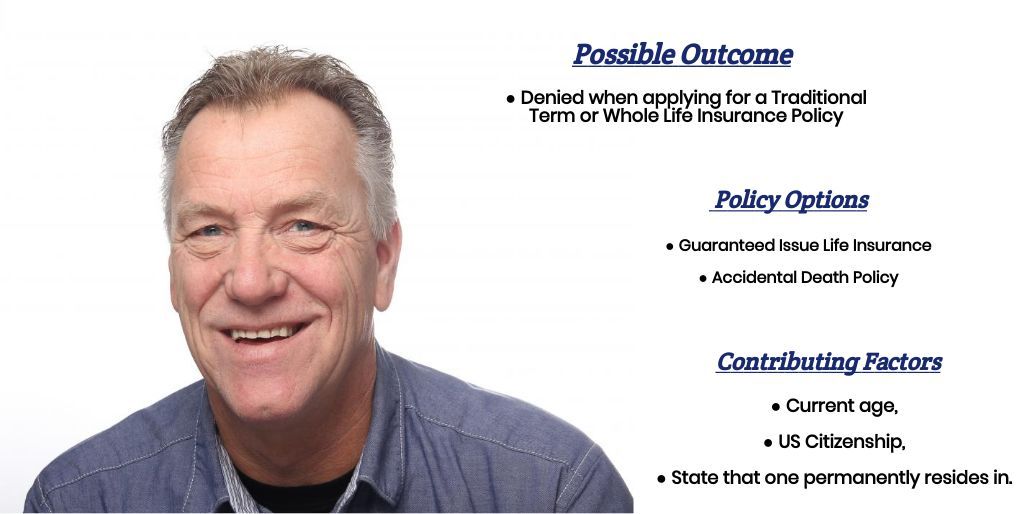

That said, it’s safe to say that individuals who are currently receiving Dialysis or have been diagnosed with End-Stage Kidney Failure or End-Stage Renal Failure will not be able to qualify for a traditional life insurance policy or any no-medical exam term life insurance policy either.

In cases like these, where an individual might not be able to qualify for a traditional term or whole life insurance policy, seeking out an alternative product such as a guaranteed issue life insurance policy (AKA Final Expense Insurance) or an accidental death policy (which would not provide a death benefit if the insured died due to a medical issue stemming from their kidney failure) may be a good option.

Why do life insurance companies care if I’m on Dialysis?

Life insurance companies are in the business of assessing and managing risk. When they issue a life insurance policy, they agree to pay out a benefit to the beneficiary in the event of the insured person’s death. The premiums that policyholders pay cover the costs of administering the policy and build a reserve to pay out claims when they are made.

When a life insurance company evaluates an applicant for a policy, it considers various factors to determine the risk associated with insuring that person. This includes the applicant’s age, gender, overall health, and pre-existing medical conditions or risk factors. Being on Dialysis may be considered a risk factor because it is a treatment for a severe medical condition, such as kidney failure. The severity of the situation, the disease’s stage, and any other underlying health conditions may also be considered.

Life insurance companies use this information to determine the likelihood that the insured person will die during the policy term and to set the premiums accordingly. If an insurer believes that an applicant on Dialysis is at an increased risk of death, it may charge higher premiums to compensate for that increased risk. In some cases, an insurer may decline to offer coverage altogether.

This is particularly true when the underlying cause could be due to a significant pre-existing medical condition such as:

- Heart attack or heart disease,

- Illicit drug use/abuse,

- Poor blood flow to the kidneys,

- Kidney infections,

- And/or trauma.

What kind of information will the insurance companies ask me or be interested in?

When you apply for life insurance and disclose that you are currently on Dialysis, the insurer may ask for detailed information about your medical history and current condition. This may include:

- The specific type of Dialysis you are receiving, such as hemodialysis or peritoneal Dialysis

- The frequency and duration of your dialysis treatments

- Any underlying medical conditions that are causing your need for Dialysis, such as kidney failure

- The results of any medical exams or tests that you have undergone, such as blood work or imaging studies

- Information about your diet and lifestyle, including whether you smoke and your level of physical activity

- Any medications you are taking to manage your condition or treat any underlying medical conditions

The specific information an insurer will request will depend on the policy and the insurer’s requirements. Some insurers may ask for additional details or require you to undergo a medical exam as part of the application process. It is essential to be honest and accurate when providing this information, as any false or misleading information could result in a denial of coverage or a dispute over a claim.

Fortunately…

Here at IBUSA, we do offer a wide variety of these “types” of products, which is why once we learn that an applicant is currently receiving Dialysis, we like to ask three critical questions:

#1. Are you a US Citizen?

#2. Are you between the ages of 40 and 85?

#3. What state do you live in?

This is because…

You might be able to qualify for a guaranteed issue life insurance policy or purchase an accidental death policy.

What options might be available to me?

Now, before anyone gets too excited about the fact that there may be a few options available to you even though you’ve been diagnosed with end-stage kidney failure and are currently receiving Dialysis, we want to make it clear that there are some very real disadvantages to some of the products that we’re about to discuss.

Which is why…

After reading what we’re about to discuss, we would invite you to give us a call or visit one of our other articles that will go into greater detail about these “alternative products” so that you’ll know precisely what you are “getting” should you decide to purchase one of these “types” of products ultimately.

Accidental Death and Guaranteed Issue Life Insurance Policies Defined

Accidental Death Policies

First, we want to start by describing an Accidental Death Policy because of the two options that might be available to you; these are the easier ones to understand and, ironically, the ones that people most often get confused about!

So…

We will attempt to describe these “kinds” of products in the worst and least flattering way so that there shouldn’t be any “misunderstanding” about what these types of policies will and won’t cover. For starters, accidental death policies are NOT TRUE LIFE INSURANCE POLICIES. This is why you don’t need to be a licensed life insurance agent to sell them and why they aren’t going to provide you with any coverage if you die of a “natural” cause of death.

And by…

Natural cause of death: we’re referring to an “illness-based” death like you would experience as a result of:

Or from some complications that one might experience as a result of kidney failure!

These types of products…

You are only going to provide a death benefit to your family if you die from an accidental cause or any cause of death that isn’t “illness-based.” Examples that would typically qualify would include:

- A motor vehicle accident,

- A slip-and-fall accident

- A natural disaster,

- Victim of crime,

- Etc…

Which is nice…

But typically, it isn’t what someone is looking for after they have been diagnosed with end-stage kidney failure. On the plus side, these “types” of products are generally pretty affordable. They will allow someone to purchase a large amount of ACCIDENT insurance for a relatively small amount.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance policies, on the other hand, ARE TRUE LIFE INSURANCE PRODUCTS. This means you need to be a licensed life insurance agent to sell them, and “ultimately,” they will provide an individual true-life insurance coverage.

But there’s a catch…

In our experience here at IBUSA, we’ve found that the best way to discuss these types of life insurance policies is by analyzing the three significant disadvantages that these “types” of life insurance policies have aside from the fact that you generally have to be over the age of 50 and live in a state where these “types” of life insurance policies are available.

So, let’s dive right in…

Problem #1.

Guaranteed-issue life insurance policies will only provide a limited amount of life insurance coverage and will usually “cap out” right around 25,000 dollars in coverage. This means that if you need more than 25,000 dollars in coverage, a guaranteed issue life insurance policy might not be suitable for you!

(Yes, individuals can purchase several different guaranteed issue life insurance policies from several companies, but as we will now discuss, this can get expensive).

Problem #2.

Dollar-for-dollar, guaranteed-issue life insurance policies tend to cost more than other “traditional” life insurance policy options.

Now, we don’t want to imply that these “types” of life insurance policies are going to cost a fortune; it’s just that if you can qualify for another “kind” of life insurance policy, that coverage will usually cost less dollar for dollar than a guaranteed issue life insurance policy will.

Problem #3.

Guaranteed issue life insurance policies contain a clause known as a Graded Death Benefit.

Graded Death Benefit Defined:

Graded Death Benefits are “clauses” written into most (if not all) guaranteed issue life insurance policies, which state that a guaranteed issue life insurance policy won’t begin to cover an individual from “natural causes” of death until a certain waiting period has elapsed. This “waiting period” will usually last 2 to 3 years and is designed to ensure that someone who knows they are very close to death can use these “types” of life insurance policies.

And while…

This may seem incredibly unfair. It’s important to remember that a guaranteed life insurance policy doesn’t require you to take a medical exam or answer any health-related questions. So, it’s only this “clause” that’s going to allow the insurance companies to protect themselves from unnecessary risk.

The excellent news is…

While you may have to wait 2 to 3 years for one a Guaranteed Issue Life Insurance policy to provide you true life insurance protection, these “types” of life insurance policies will provide immediate coverage for any “accidental causes” of death. They may also offer some “return of premium” to the beneficiaries of the insured who do end up dying from natural causes before their Graded Death Benefit expires.

So, have we confused you yet?

If so, don’t fret. The purpose of this article wasn’t to try to make you an insurance expert; it was to give you an idea of what questions you’ll want to pursue before making any decisions.

This brings us to the last topic we wanted to discuss here in this article, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the disease is often “subjective” is for the applicant to make sure that they first find a true-life insurance professional who will work as an advocate for you.

Such an agent…

It will help guide you through the application process and be perfectly “frank” with you about what options may or may not be possible.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because, after all, it doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly…

Before applying for coverage, you’ll want to be completely honest with your life insurance agent. By doing so, you will be helping them narrow down what options might be the “best.”

So, what are you waiting for? Give us a call today and see what we can do for you!

My son is dyaliis patient. 30 yrs old.

Criselda,

We’re sorry to hear about your son, but we are happy to let you know that he may still be able to qualify for a guaranteed issue life insurance policy provided he lives in a state where one is offered at his age. Please call us at your earliest convenience so that we can go over what options may be available to him.

Thanks,

InsuranceBrokersUSA

So if I read this right, my wife that is getting kidney dialysis for end stage kidney disease can get a guaranteed issue life insurance policy. If she should die because of the kidney failure the beneficiary would NOT get paid, only for accidental death like traffic accident. My wife lives in New Mexico with me and my oldest son. She has had a total of 6 heart stents, TTP(remission) and is on oxygen. That is the tip of the iceberg though. Currently she had been the best health since 2014 when she had TTP among other serious medical conditions. She is 63 years old. All I would like is a policy that would pay for the funeral. Seems futile though… Jim S. I suppose this inquiry just means more spam emails…

Jim,

You are correct with your assessment of how guaranteed issue life insurance policies work. However, if the insured lives beyond what is commonly referred to as the graded death benefit which usually lasts 2-3 years (depending on the carrier) the policy would then provide complete coverage for natural causes of death including kidney failure.

Additionally, many guaranteed issue life insurance policies offer a full refund the the insureds beneficiary for all premiums paid to the insurance company if an insured dies from natural causes before the graded death benefit is over (plus interest in some cases). Which in our opinion, significantly reduces any risks to the insured even if they don’t believe will live beyond the graded death benefit period.

Thanks,

InsuranceBrokersUSA

Helping my son 43 yrs old kidney dialysis patient obtain life insurance.

Odell,

It sounds like your son may be able to qualify for a guaranteed issue life insurance policy provided he lives in a state where they are available. Our suggest would be to give us a call so that we can discuss what options may be available to you.

Thanks,

InsuranceBrokersUSA

I’ve had life insurance long before I was diagnosed with kidney failure. I am now retired. If I decided to stop dialysis treatments and die would my insurance pay?

Sylvester,

Without being able to review your policy we wouldn’t be able to advise you on your policy, however choosing to discontinue your dialysis treatments doesn’t sound like a good idea. We wish you the best and recommend that you speak with your doctor about any changes you may be considering making with regard to your current treatment.

Thanks,

InsuranceBrokersUSA

I am end stage kidney patient requiring hemo dialysis 3 times a week

Also I am Type 2 diabetic requiring insulin

I am 57 years old and live in Ohio

Beverly,

It sounds like you may be able to qualify for a guaranteed issue life insurance policy which would provide up to $25,000 in coverage. If you believe this is something you would like to learn more about, please call us at your earliest convenience.

Thanks,

IBUSA