According to “Project Know, Understanding Addiction,” it is estimated that nearly one out of every 13 Americans suffers from a problem with alcohol. And while we would love to believe that each one of these 1 in 13 individuals fully recognizes the problem and is fully committed to treating their condition, the truth is, far fewer than 1 in 13 are going to be willing to “acknowledge” that they have an issue.

And this disconnect…

Between those who have a problem with alcohol and those who understand and “admit” that they have a problem with alcohol, it can often come to a “head” when applying for life insurance, even if you are choosing to apply for a Life Insurance Policy without a Medical Exam.

This is why, in this article, we’re going to discuss how alcohol use can affect the outcome of one’s life insurance application, as well as address some of the most common questions we receive from our clients who do have a history of alcohol abuse.

Topics that will be addressed in this article will include:

- Factors that affect life insurance eligibility.

- Alcoholism and life insurance.

- Ways life insurance companies can learn about one’s alcohol use.

- Four “groups” of applicants with a history of alcohol abuse

- Qualifying for coverage with a history of alcohol abuse.

Now, without further ado, let’s dive right in.

Factors that Affect Life Insurance Eligibility

Life insurance is a crucial investment that provides financial security to loved ones in the event of an unexpected death. However, obtaining life insurance can be challenging, as many factors affect your eligibility and coverage—factors such as age, gender, personal and family history, occupation, and lifestyle choices.

For our purposes here today, we’ll consider alcohol use as a “lifestyle choice” along the same lines as participating in a dangerous hobby or driving too fast.

Alcoholism and life insurance.

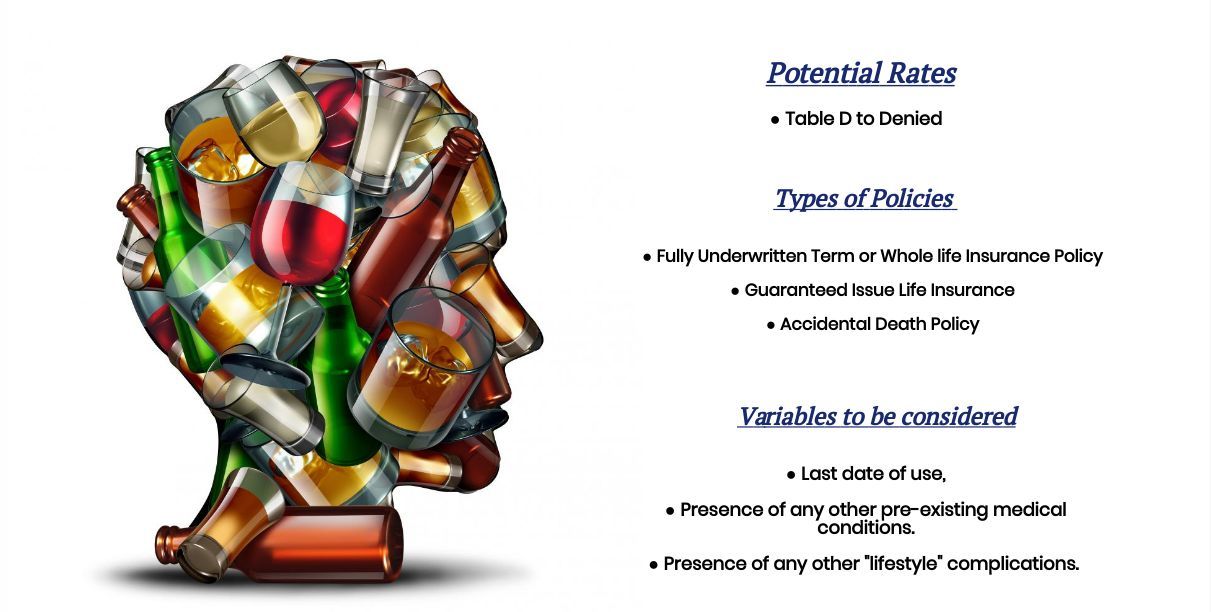

Life insurance companies view applicants with a history of alcohol abuse as high-risk individuals. Being considered high risk when applying for life insurance means that the insurance company views you as more likely to die prematurely than the average person. Insurance companies use medical underwriting to assess the risk of insuring an individual and determine the premiums and coverage amounts they offer.

If an applicant is considered high-risk due to their history of alcohol abuse, it can impact their eligibility for coverage and the cost of their premiums. Insurance companies may charge higher premiums or limit coverage amounts for high-risk individuals to offset the increased risk they pose. In some cases, insurers may also require the applicant to undergo medical exams or provide additional information about their alcohol consumption habits before deciding whether to offer coverage.

However, not all life insurance companies view applicants with a history of alcohol abuse in the same way. Some insurers may be more lenient in their underwriting criteria and offer coverage to individuals with a history of alcohol abuse at more affordable rates. Additionally, applicants who have successfully overcome their alcohol abuse or who have demonstrated a commitment to managing their alcohol consumption may be viewed more favorably by insurers.

Ways life insurance companies can learn about one’s alcohol use.

Life insurance companies have a variety of different methods they can use to determine whether an individual has a current problem with alcohol or has abused it in the past. The most common methods are as follows:

The life insurance application questionnaire:

As part of the application process, life insurance companies ask questions about an applicant’s alcohol consumption habits. The questions may vary, but they typically include how often the applicant consumes alcohol, the number of drinks they usually have on a given occasion, the types of alcohol they drink, and whether they have received treatment for alcohol abuse or addiction. It’s crucial to answer these questions honestly and accurately, as the information will be used to determine eligibility for a life insurance policy and the premiums to be paid. Failure to disclose alcohol usage could affect the policy’s coverage or payout.

The life insurance medical exam:

During a medical exam, life insurance companies screen applicants for signs of alcoholism. The exam typically includes screening for alcohol levels within the blood sample and elevated protein levels or abnormalities in the platelet shapes within the blood sample, which could indicate excessive alcohol use. The exam may also involve a physical examination and questions about the applicant’s medical history and lifestyle habits, including alcohol consumption.

Your driving record:

An applicant’s driving record may be reviewed as part of the underwriting process to identify potential risks that may affect eligibility for coverage or premiums. While a driving record is not a direct measure of alcohol consumption, certain types of traffic violations or accidents may be indicative of alcohol or substance abuse, such as driving under the influence (DUI) or driving while intoxicated (DWI).

Medical records:

Life insurance companies may review an applicant’s medical records to identify potential health risks affecting coverage eligibility or premiums. While medical records are not a direct measure of alcohol consumption, certain medical conditions or treatments may be indicative of alcohol abuse or addiction, such as a diagnosis of alcohol abuse or addiction, treatment for alcohol withdrawal or detox, liver disease, pancreatitis, and certain types of cancer.

Medical Information Bureau (MIB) report:

A MIB report is a database containing information about an individual’s medical history, including diagnoses, treatments, and prescription medications. Life insurance companies may use an MIB report to identify potential health risks affecting coverage eligibility or premiums. A MIB report that includes a diagnosis of alcohol abuse or addiction or treatment for alcohol withdrawal or detox may be considered a red flag for alcohol abuse or addiction.

Four “groups” of applicants with a history of alcohol abuse

Three Types of Life Insurance Applications for Individuals with a History of Alcoholism

When assisting individuals with a history of alcoholism, it’s crucial to understand that there are generally four categories of “alcoholics” for life insurance purposes: those who are in denial, those who are currently abusing alcohol, those with less than two years of sobriety, and those sober for over two years.

Let’s examine each category and explore the available options.

Those in denial.

The first group will be those who don’t believe they have a problem, yet there is something about their application leading a life insurance company to believe that they might. It could be a pre-existing medical condition likely caused by heavy alcohol use, a notation in a doctor’s medical records, a single (or multiple) DUI, or any number of things. The critical takeaway is that just because the applicant doesn’t feel they have a problem doesn’t mean the insurance company will feel the same way.

Those currently abusing alcohol.

Individuals with a history of alcohol abuse who are currently drinking will generally not be eligible for traditional term or whole life insurance coverage. Applicants in this situation will have two options: quit drinking and apply when eligible (usually after two years of sobriety), or apply for a guaranteed issue life insurance policy, which won’t ask about your drinking but will only provide up to $25,000 in coverage and will contain a graded death benefit.

“Alcoholic” applicants who have recently quit drinking.

Congratulations on quitting! This is great news. However, insurance companies understand that sobriety requires an ongoing effort, and the risk of relapse is significant, particularly in the first year. For this reason, most life insurance companies typically require a minimum of two years of sobriety before considering traditional life insurance policies. During the waiting period, individuals in recovery are often treated like those currently using but can qualify for traditional policies once they reach their two-year milestone.

Sober for over two years!

Congratulations on achieving this milestone! Some (but not all) life insurance companies may now consider you eligible for traditional coverage. To determine your best options and rates, insurers will need information about your health and lifestyle factors, such as age, height, weight, pre-existing medical conditions, prescribed medications, driving record, criminal record, and travel plans. We’ll analyze this information to find your best policy and insurer.

Qualifying for coverage with a history of alcohol abuse.

OK, now let’s quickly summarize what we’ve learned so far.

- Qualifying for life insurance with a history of alcohol abuse can make it more challenging to be eligible for traditional coverage.

- Insurance companies have a variety of methods to determine whether or not someone may have a drinking problem, which will not solely rely on an applicant declaring their condition on their life insurance application.

- Active alcoholics will likely not be able to qualify for traditional life insurance.

- Most life insurance companies will require applicants to be sober for at least two years before considering them eligible for traditional coverage.

Let’s focus on applying for life insurance after two years of sobriety.

Applying for life insurance can seem daunting, but taking specific steps can increase your chances of finding the best policy for your needs. Here are some critical steps to consider:

- Assess your coverage needs: Before you begin shopping for insurance, it’s important to determine your coverage needs. Consider factors such as your age, health, financial obligations, and any dependents you have to determine how much coverage you need and what type of policy would be best for you.

- Research insurance providers: Look for insurance companies that specialize in providing coverage for individuals with a history of alcohol abuse. Check their ratings and reviews to ensure they have a good reputation and are financially stable.

- Be honest in your application: When filling out your application, be completely honest about your history of alcohol abuse and your current state of sobriety. Lying or omitting information could lead to denial of coverage or reduced benefits.

- Complete the underwriting process: The insurance company will likely require you to undergo a medical exam and provide detailed information about your health and lifestyle. Be sure to provide all requested information and follow through with necessary tests.

- Consider the cost: Premiums for life insurance policies can vary widely depending on age, health status, and the coverage amount. Shop around for the best rates and compare policy terms carefully.

- Please read the policy thoroughly. Once you receive an offer, please review the policy documents carefully to ensure they accurately reflect the coverage you need and understand the policy terms.

After achieving two years of sobriety, you can find the best life insurance policy to meet your needs. It’s important to work with a reputable insurance provider and be transparent about your history of alcohol abuse to ensure that you get the coverage you need at a fair price. The good news is that we here at IBUSA can help; all you need to do is call and let us show you what we can do for you!

My mom died and it was from Alcoholic Liver Disease from drinking. But in her mind, she wasn’t a drinker, didn’t have a problem and she didn’t have any mental health issues. She was so delusional she wrote on the insurance papers she never had an issue with alcohol because in her mind, she didn’t. Even though to us we all knew she did have a problem…but again, when you are an alcoholic like her, you truly do not think you have a problem. In her mind she was answering the questions truthfully. But the insurance company is most likely going to deny it because she lied. How is it fair that someone who truly didn’t think they had a problem gets penalized and now her 4 young children are not going to get any money. Our dad passed away years ago and we are left with no one. And now we don’t even get the insurance money. I don’t know what to do at this point. I’m the executor to my mothers estate and I’m only 23 and still in university. Is there anything we can do to get the insurance money?

Madisyn,

Without knowing more about your situation, we here at InsuranceBrokersUSA wouldn’t be in a position to really offer much advice with regards to your mothers life insurance policy.

What we can say is that like any other legal document, it is the responsibility of both parties to be completely honest and truthful so that each party is aware of their risks and obligations prior to entering into any kind of legal contract.

Now as one can imagine, situations like these can and often will arise. This is why there are several different rules and regulations that will come into play with regards to whether or not your mothers life insurance policy will be considered valid.

Most of these rules and regulations will center around the “type” of life insurance policy that was purchased and how long that policy was inforce.

This is why our recommendation would be to first wait and see what your mothers life insurance company decides to do about your situation. From there, if the policy is not “honored” ask for as much documentation as they are willing to provide you justifying their decision. This way, if you don’t feel that you are being treated fairly, you will have plenty of information to then present to your local state insurance department for further assistance.

Sorry we couldn’t be more helpful,

InsuranceBrokersUSA.

I have been sober non drinker for more than two years and still am turned down for life insurance how long do I have to wait to get more than a token policy

Keith,

We’re sorry to hear that you’re having a difficult time finding coverage even after being sober for over two years. Our advice would to you would be to give us a call here at InsuranceBrokersUSA, because there are a lot of reasons that could account for this difficulty (number one being that you keep choosing the WRONG companies to apply with).

Thanks,

InsuranceBrokersUSA.

I was born in 1957 (65 years old). I had a DUI in 1975 at the age of 18. I went through an outpatient treatment program for alcholol abuse in 1983 (age 25). I last drank an alcholic beverage in 1985 (38 years ago). Will these events in my history affect my term life insurance application?

Thank you,

Steven Miller

Steven,

Congratulations on your 38 years of sobriety! Rest assured that your commitment to your health will be appreciated by the insurance industry. Any previous “difficulties” with alcohol should no longer be a factor when determining whether or not you’ll qualify for coverage.

For more information, please don’t hesitate to give us a call at your earliest convenience.

Sincerely,

InsuranceBrokersUSA