In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with Narcolepsy.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Narcolepsy?

- Why do life insurance companies care if I have been diagnosed with Narcolepsy?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Narcolepsy?

Yes, individuals who have been diagnosed with Narcolepsy can and often will be able to qualify for a traditional term or whole life insurance policy. The only problem is that even though Narcolepsy isn’t a pre-existing medical condition that one might consider “life-threatening,” because of the nature of the disease and some of the treatment options that may be pursued, most (if not all) of the top-rated life insurance companies are going to consider those diagnosed with Narcolepsy as “high risk.”

It’s also why, you may want to consider avoiding applying for a no medical exam term life insurance policy as well, seeing how these policies tend to be more challenging to qualify for after someone has been diagnosed with a pre-existing medical condition like Narcolepsy.

Why do life insurance companies care if I have been diagnosed with Narcolepsy?

The main reason why a life insurance company is likely to “care” if an individual has been diagnosed with Narcolepsy is that it is a severe case; not only may it increase one’s chances of suffering from an accident, but it may warrant some of the prescriptions of certain medications that may be prone to be abused. For this reason, we wanted to take a moment to discuss what narcotics are and highlight some of the most common symptoms of this disease so that we can better understand exactly what a life insurance underwriter will be looking for when deciding on your application.

Narcolepsy Defined:

Narcolepsy is a chronic sleep disorder characterized by an overwhelming tendency to fall asleep whenever in a relaxing situation.

Common symptoms may include:

- Excessive daytime sleepiness,

- Sleep paralysis,

- Difficulty sleeping at night,

- Hallucinations,

- Memory problems,

- Cataplexy, or a sudden loss of muscle tone.

Unfortunately, there isn’t a “cure” for Narcolepsy. That said, some folks may find relief from their symptoms by using various medications, including:

- Simulants,

- Selective serotonin reuptake inhibitors (SSRIs),

- Serotonin and Norepinephrine reuptake inhibitors (SNRIs),

- Tricyclic antidepressants,

- And sodium oxybate.

“This brings us to an important point we think we ought to mention.”

First…

If you have a medical issue, don’t use the internet to diagnose yourself. After all, if you do and you’re correct, you’ll still need to see the doctor, and if you’re wrong, the time you spend being your own doctor could harm you!

Second…

Nobody here at IBUSA is medically trained; we’re certainly not doctors. All we are is a bunch of life insurance agents who just happened to be really good at helping individuals find and qualify for the life insurance they’re looking for.

So please don’t mistake any of the medical information we discuss as medical advice because it’s not! We’re just trying to “prep” you for what it might be like to apply for a life insurance policy after you have been diagnosed with Narcolepsy… that’s it! This brings us to our next topic, which is…

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll likely be asked may include:

- When were you first diagnosed with Narcolepsy?

- Who diagnosed your Narcolepsy? A general practitioner? A specialist? Or yourself?

- How would you classify your Narcolepsy? Mild, moderate, or severe?

- Have you been diagnosed with any other pre-existing medical conditions?

- Are you currently taking any prescription medications?

- Do you have any history of drug or alcohol abuse?

- Have you ever been convicted of a felony or misdemeanor?

- Do you have an active driver’s license?

- In the past two years, have you been admitted to a hospital for any reason?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

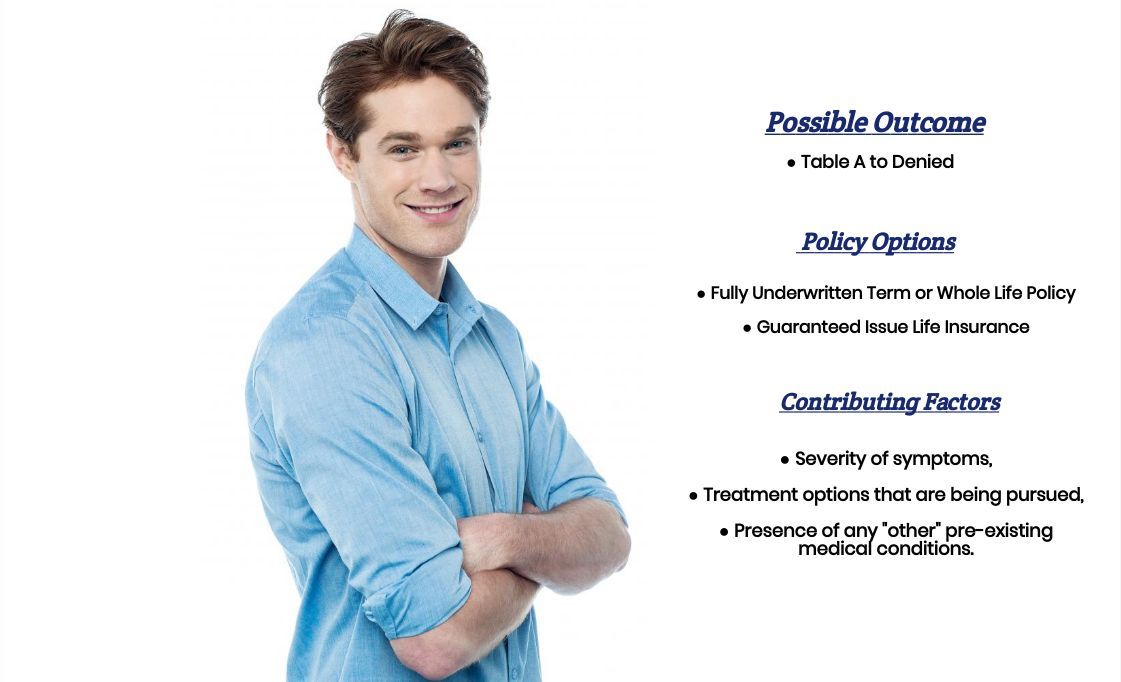

Generally, what you’re going to find is that most life insurance companies are going to “automatically” place someone who has been diagnosed with Narcolepsy into a “high-risk” category. From there, the individual life insurance underwriters will look for “clues” to inform them that an individual’s Narcolepsy may be too severe for the insurance company to approve.

Clues may include:

- Loss of a driver’s license,

- Extensive use (or possible abuse) of a prescription stimulant.

- Possibly indicated by:

-

- Multiple prescriptions from several doctors,

- Criminal charges,

- DUI’s

- Etc…

- A poor employment history or current recipient of some disability benefit.

-

In cases like these…

It’s entirely possible that the individual in question might not be able to qualify for a traditional term or whole life insurance policy. The truth is that anyone with these types of “additional” issues wouldn’t be able to qualify for a traditional life insurance policy even if they haven’t been diagnosed with Narcolepsy.

The good news is that regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is precisely what you’ll find here at IBUSA!

Now, will we be able to help out everyone who has been previously diagnosed with Narcolepsy?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available, call us!