In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance with Peripheral Vascular Disease (PVD).

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Peripheral Vascular Disease?

- Why do life insurance companies care if I’ve been diagnosed with Peripheral Vascular Disease?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I’ve been diagnosed with Peripheral Vascular Disease?

Yes, individuals who have been diagnose with Peripheral Vascular Disease can and often will be able to qualify for a traditional term or whole life insurance policy.

The only problem is…

That symptoms of this disease can vary significantly from one patient to the next which is why just “knowing” that someone has been diagnosed with PVD isn’t going to be enough information to know whether or not someone will be able to qualify for a traditional life insurance policy.

It’s also why…

You may want to consider avoiding applying for a no medical exam term life insurance policy as well seeing how these policies tend to be more difficult to qualify for after someone has been diagnosed with a pre-existing medical condition like Peripheral Vascular Disease.

Why do life insurance companies care if I’ve been diagnosed with Peripheral Vascular Disease?

The main reason why most of the best life insurance companies (in our humble opinion) is going to “care” if an individual has been diagnosed with Peripheral Vascular Disease is because at the end of the day, Peripheral Vascular Disease is cause by peripheral artery disease which is caused by atherosclerosis.

For this reason…

We wanted to take a moment and just briefly discuss exactly what Peripheral Vascular Disease is as well as highlight some of the most common symptoms/complications so that we can gain a better understanding of what a life insurance underwriter will be looking for when making his or her decision about your life insurance application.

Peripheral Vascular Disease Defined:

Peripheral vascular disease (PVD) is a condition that occurs when there is a reduced blood flow to the extremities, such as the legs, arms, and feet. This can be caused by a narrowing or blockage of the blood vessels, which can be due to a variety of factors, including plaque build-up, blood clots, and inflammation.

The most common cause…

Of Peripheral Vascular Disease is due to atherosclerosis which is a separate disease that is characterized by the deposition of fatty plaques along the inner walls of one’s arteries. Complications associated with atherosclerosis may include an increased risk of:

- Aneurysms,

- Angina,

- Kidney disease,

- Heart disease,

- Stroke,

- Heart attack and/or heart failure.

Common symptoms of Peripheral Vascular Disease may include:

- Symptoms of PVD can include pain or cramping in the legs, feet, or toes, especially when walking or exercising; numbness or weakness in the legs, feet, or toes; coldness in the lower legs or feet; and changes in the color or texture of the skin on the legs, feet, or toes. PVD can be diagnosed through a physical examination and various tests, such as an angiogram or an ultrasound. Treatment for PVD may include medications, lifestyle changes, and in severe cases, surgery to restore blood flow.

Serious complications of Peripheral Vascular Disease may include:

- Severe pain,

- Wounds that won’t heal,

- Increased risk of infections,

- Tissue death, potentially requiring limb amputation,

- Impotence.

Treatment for peripheral vascular disease (PVD):

May include a combination of medications, lifestyle changes, and in severe cases, surgery. The specific treatment plan will depend on the underlying cause of the PVD, the severity of the condition, and the presence of any other medical conditions.

Medications:

- Antiplatelet drugs: These medications help prevent blood clots from forming in the blood vessels.

- Cholesterol-lowering medications: These drugs can help reduce plaque build-up in the blood vessels.

- Blood pressure medications: These medications can help lower blood pressure, which can help reduce the risk of PVD.

Lifestyle changes:

- Exercise: Regular physical activity can help improve blood flow and reduce the risk of PVD.

- Smoking cessation: Quitting smoking can help improve blood flow and reduce the risk of PVD.

- Diet: A healthy diet low in saturated fat, cholesterol, and salt can help reduce plaque build-up in the blood vessels and lower the risk of PVD.

Surgery:

- Angioplasty: This procedure involves inserting a small balloon into the blocked blood vessel and inflating it to widen the vessel.

- Atherectomy: This procedure involves using a catheter with a tiny blade or laser to remove plaque from the blood vessel.

- Bypass surgery: This surgery involves creating a new path for blood to flow around the blocked artery.

What kind of information will the insurance companies ask me or be interested in?

When applying for life insurance and disclosing a history of peripheral vascular disease (PVD), you can expect the insurance company to ask you a variety of questions to assess your risk. This may include questions about your medical history, including the severity of your PVD, any treatment you have received or are currently receiving, and any other medical conditions you have.

The insurance company may also ask about your lifestyle habits, such as whether you smoke or have a history of smoking, and whether you engage in regular physical activity. They may also ask about your family medical history, as PVD can sometimes have a genetic component.

Specific questions may include:

- When were you diagnosed with Peripheral Vascular Disease?

- Who diagnosed your Peripheral Vascular Disease? A general practitioner or a specialist?

- What symptoms (if any) led to your diagnosis?

- Have you been diagnosed with any other pre-existing medical conditions?

- Have you been diagnosed with heart disease or diabetes?

- Have you ever suffered from a heart attack or a stroke?

- What is your current height and weight?

- Are you currently taking any prescription medications right now?

- In the past 12 months, have you used any tobacco or nicotine products?

- In the past 2 years, have you been admitted into a hospital for any reason?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

As you can see, there are a lot of variables that can come into play when trying to determine what kind of “rate” an individual who has been diagnosed with Peripheral Vascular Disease. This is why it’s pretty much impossible to know what kind of “rate” you might be able to qualify for without first speaking with you directly.

That said however…

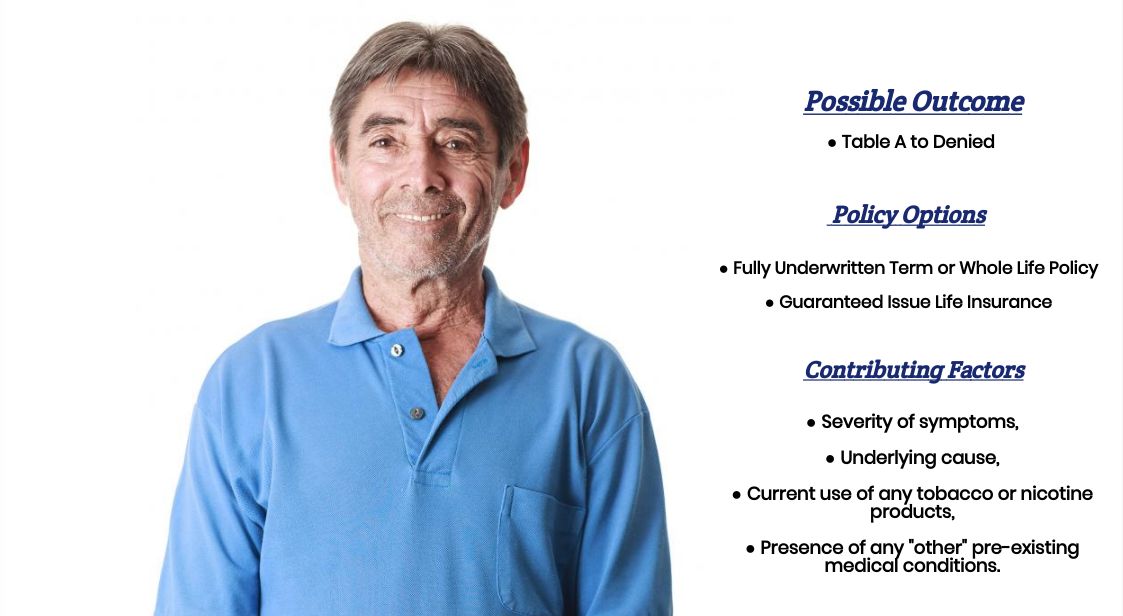

Most individuals who have been diagnosed with Peripheral Vascular Disease will usually fall into one of four different categories that we can make some “assumptions” about that will generally hold true.

Category #1.

Individuals in this first category that we want to discuss will be those who have been diagnosed with Peripheral Vascular Disease absent any other “serious” pre-existing medical conditions. Individuals that fall into this category will still be considered a “high risk” but will usually be able to qualify for a traditional term or whole life insurance policy usually at a Table A to D rate.

Category #2.

Individuals in this category will be those who have been diagnosed with Peripheral Vascular disease along with some other “kind” of serious pre-existing medical condition. In most cases like these, what you’re generally going to find is that most life insurance companies are going to treat one’s PVD as a symptom of this other disorder which will ultimately be the determinate regarding what “kind” of life insurance policy an individual will be able to qualify for.

The next two categories…

Will be reserved for those who are currently using some form of tobacco or nicotine or have quite some form of tobacco or nicotine less than 1 year ago.

Category #3.

Will be reserved for those who have been diagnosed with Peripheral Vascular Disease absent any “other” pre-existing medical condition while currently using some “type” of tobacco or nicotine products. These “types” of individuals will theoretically still be eligible for a traditional term or whole life insurance policy like their “non-smoking” equivalents only in their case they will most likely need to pay 3 to 4 times more for their coverage!

Category #4.

The last group of individuals that we’ll encounter will be those who have been diagnosed with Peripheral Vascular Disease, in addition to some other “type” of pre-existing medical condition, while simultaneously using some form of tobacco or nicotine. In cases like these, what you’re likely going to fine is that if an individual is able to qualify for a traditional term or whole life insurance policy, chances are it’s going to be VERY expensive.

For this reason…

So, folks may elect to pursue a Guaranteed Issue Life Insurance policy instead or wait until they have been tobacco free for a minimum of one year so that they can qualify for a lower rate. The danger there is that during this time they won’t have any insurance in place (assuming that they don’t have any life insurance in place elsewhere).

The good news is…

That regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy that they can qualify for. Which brings us to the last topic that we wanted to take a moment and discuss which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that usually the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions, but also have access to dozens of different life insurance companies so that when it comes time to helping a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is exactly what you’re going to find here at IBUSA. So, what are you waiting for; give us a call today to experience the IBUSA difference!

i am a 69 year old male, a smoker, retired and living in Vung Tau, vietnam, i have a slight blood pressure problem that is being treated. i have no other health problems

Dudley,

It sounds like you would be able to qualify for a life insurance policy only here at InsuranceBrokersUSA, we are only able (and licensed) to work with individuals currently living in within the United States, or at the very least intend to be staying within the United States throughout the entire application process.

Our suggestion would be to see if some of same companies that we represent here in the United State also write insurance policies within Vietnam.

Thanks,

InsuranceBrokersUSA