In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with an Enlarged Prostate or a condition commonly referred to as Benign Prostatic Hypertrophy or Benign Prostatic Hyperplasia (BPH).

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been diagnosed with Benign Prostatic Hyperplasia?

- Why do life insurance companies care if I’ve been diagnosed with Benign Prostatic Hyperplasia?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been diagnosed with Benign Prostatic Hyperplasia (BPH)?

Yes, individuals who have been diagnosed with Benign Prostatic Hyperplasia (BPH) or an enlarged prostate can and often will be able to qualify for a traditional term or whole life insurance policy. They may even be eligible for a No Medical Exam Term Life Insurance Policy at a Preferred rate! Mainly because developing an “enlarged prostate” is a pretty common problem for a lot of men and is generally considered just one of life’s wonderful “gifts” to us as we grow older.

Basically…

What happens is that the cells within the prostate gland begin to multiply, causing the prostate gland to begin to swell. This swelling, in turns, begins to push against the urethra and begins to display symptoms that many men over the age of 50 can attest to, including:

- A frequent urge or need to urinate,

- Late-night visits to the bathroom (nocturia),

- Weak urine stream,

- Difficult time getting started when urinating,

- The inability to empty one’s bladder,

And sometimes the incontinence and/or sexual dysfunction.

The good news…

While suffering from BPH certainly isn’t an enjoyable experience, it is treatable using a variety of different prescription medications that will help one relax their bladder or shrink the prostate itself, and in cases where drugs aren’t effective, individuals may also elect to have a minimally invasive surgery performed to do the trick.

Additionally, being diagnosed with an enlarged prostate or benign prostatic hyperplasia is not the same as being diagnosed with prostatic carcinoma or prostate cancer, which may share many of the same symptoms of benign prostatic hyperplasia.

Why do life insurance companies care if I’ve been diagnosed with Benign Prostatic Hyperplasia?

The main reason why a life insurance company is going to “care” if you have been diagnosed with benign prostatic hyperplasia is that they are going to want to be sure that the reason why you are suffering from an enlarged prostate is that you’re merely suffering from what many would consider a normal part of aging and not exhibiting early signs of prostate cancer!

This is why…

Before being approved for a traditional term or whole life insurance policy, most (if not all) of the best-rated life insurance companies are going to want to ask you a series of medical questions about your enlarged prostate so that they can get a better idea about where or not it is something that they should be worried about.

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll likely be asked may include:

- When were you first diagnosed with benign prostatic hyperplasia?

- Who diagnosed your benign prostatic hyperplasia? A general practitioner or a specialist?

- What symptoms (if any) led to your diagnosis?

- Have you had a Prostatic-specific antigen (PSA) test performed? If so, what was your score?

- Have you been diagnosed with any cancer?

- Are you currently taking any prescription medications?

- Have any of your medications changed over the past 12 months?

- Has your doctor suggested that you might require some surgical procedure to treat your enlarged prostate?

- Have you used any tobacco or nicotine products in the past 12 months?

- What is your current height and weight?

- Are you currently working now?

- In the past 12 months, have you applied for or received any disability benefits?

Now, at this point, we usually like to take a moment and remind folks that nobody here at IBUSA has any “official” medical training, and we’re certainly not doctors. All we are is a bunch of life insurance agents who are really good at helping folks with pre-existing medical conditions like this one find and qualify for the life insurance coverage they are looking for.

But…

It’s it’s not so great if you’re seeking answers to specific medical questions. In such cases, we recommend contacting an actual medical professional with the training to help. For everyone else, you’re in luck because now we’re going to get into some of the “nitty-gritty” about what you may or may not be able to qualify for.

What rate (or price) can I qualify for?

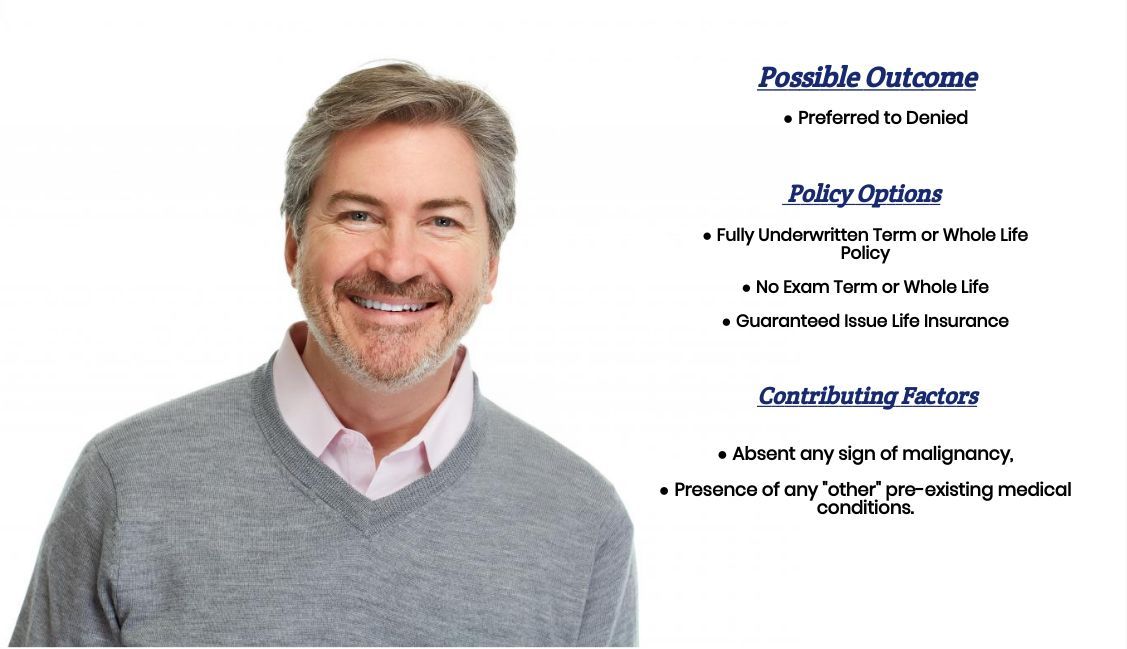

Generally speaking, once a life insurance company has had enough time to determine that you have not been diagnosed with prostate cancer and that you don’t have an increased risk for developing prostate cancer, your enlarged prostate diagnosis shouldn’t have an effect on the outcome of your life insurance application.

Or, in other words…

Whatever “rate” you would have been able to qualify for before being diagnosed with an enlarged prostate gland should be the same “rate” that you should be able to qualify for AFTER having been diagnosed with an enlarged prostate!

“Which is great!”

Now, you ought to be able to “widen” your search when determining which life insurance company to choose, including those that might not only specialize in helping individuals diagnosed with certain pre-existing medical conditions.

The good news is…

Regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to see the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

Seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is precisely what you’ll find here at IBUSA!

Now, can we help out everyone who has been previously diagnosed with an Enlarged Prostate?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many Final Expense Insurance Companies so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to explore your options, call us!