In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after having been diagnosed with functional Hypoglycemia.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with functional Hypoglycemia?

- Why do life insurance companies care if I have been diagnosed with functional Hypoglycemia?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with functional Hypoglycemia?

Yes, individuals who have been diagnosed with functional Hypoglycemia can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, they may even be able to qualify for a no exam term life insurance policy Preferred rate!

The problem is…

That before anyone with Hypoglycemia will be able to qualify for a traditional life insurance policy, most of the best term life insurance companies (if not all) will want to understand “why” an individual has been diagnosed with Hypoglycemia and make sure that the underlying cause isn’t something that they should be worried about.

Why do life insurance companies care if I have been diagnosed with functional Hypoglycemia?

The main reasons why a life insurance company is likely to “care” if an individual has been diagnosed with Hypoglycemia is because this is a pre-existing medical condition that can either be caused by not eating “regularly” enough in which case an individual will just need to monitor their food intake better or it could be caused due to a variety of other much more “serious” underlying medical causes.

This is why…

Once a life insurance company learns that you have been diagnosed with Hypoglycemia, one should expect to be asked a series of medical questions about their condition and maybe even supply medical records along with their life insurance application.

It’s also why we wanted to take a moment and describe what Hypoglycemia is as well as highlight some of the most common symptoms and complications that can arise so that we’ll have a better understanding of what it is that a life insurance underwriter will be looking for when making his or her decision about your application.

Hypoglycemia Defined:

Hypoglycemia is a medical condition that occurs when an individual has very low blood sugar in their system.

And that’s pretty much it!

Where the conversation becomes more “complicated” occurs when we begin to look at “why” someone’s blood sugar might become seriously low? Is it because they aren’t eating enough to keep up with the amount of energy their body is using? Or is it because their Hypoglycemia is the result of some other pre-existing medical condition that we need to learn about?

Common causes of Hypoglycemia:

- Diabetes,

- Excessive exercise,

- Excessive dieting and/or fasting,

- Use of certain medication,

- Excessive alcohol use,

- Kidney disease,

- Cancer,

- Etc…

Common symptoms may include:

- Dizziness,

- Fainting,

- Sweating,

- Irritability,

- Hunger,

- Headaches,

- Etc…

The good news is…

That in most cases, simply consuming a sugar-rich drink or “treat” will usually help an individual’s symptoms go away. However, one should not ignore the potential seriousness of this condition because in severe cases of Hypoglycemia that are treated properly, one can suffer from an accident (fainting, dizzy spells), injuries, coma, and may even prove fatal in the most extreme cases!

Now at this point…

We usually like to take a moment and remind folks that nobody here at IBUSA has any kind of “official” medical training, and we’re certainly not doctors. All we are is a bunch of life insurance agents who just happen to be really good at helping folks with pre-existing medical conditions like this one, find and qualify for the life insurance coverage that they are looking for.

But…

Not so great if you’re looking for answers to any specific medical questions. In cases like these, we would recommend that you contact a true medical professional who has the training to help. For everyone else, you’re in luck because now we’re going to get into some of the “nitty-gritty” about what you may or may not be able to qualify for.

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked may include:

- When were you first diagnosed with Hypoglycemia?

- Who diagnosed your Hypoglycemia? A general practitioner? A specialist? Yourself?

- What symptoms led to your diagnosis?

- How often do you suffer from Hypoglycemia?

- Do you know what causes it?

- Have you been diagnosed with any other pre-existing medical conditions?

- Have you been diagnosed with cancer, heart disease or diabetes?

- Are you currently taking any prescription medications?

- In the past 2 years, have you been admitted into a hospital for any reason?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

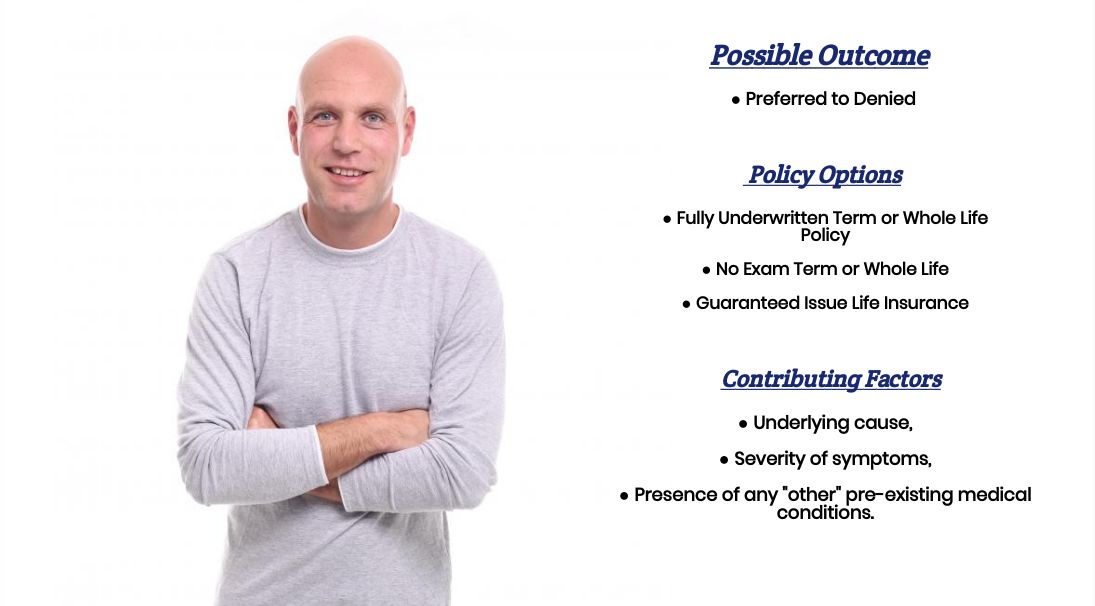

What rate (or price) can I qualify for?

When it comes time to helping someone that has been diagnosed with Hypoglycemia, what you’re generally going to find is that most folks are going to fall into one of two different “camps.” There will be those who suffer from Hypoglycemia because they just don’t eat enough to keep up with their metabolism, and there will be those who suffer from Hypoglycemia because of some kind of pre-existing medical condition.

For those who…

Suffer from some kind of pre-existing medical condition, what you’re generally going to find is that Hypoglycemia will be treated as a “symptom” of the underlying pre-existing medical condition, and probably won’t play a huge role in the outcome of your life insurance application because this “other” pre-existing medical condition which is causing you to suffer from Hypoglycemia will be the major determinant.

In cases like these, we would recommend that you take a look at our Pre-Existing Medical Conditions page and see if we haven’t already written an article focusing on the cause of your Hypoglycemia.

Now for those…

Who suffer from Hypoglycemia because they aren’t eating enough (absent any eating disorders) what you’re generally going to find is that most life insurance companies aren’t really going to discriminate against you provided that your Hypoglycemia seems to be under control and you don’t seem to be really “accident” prone!

In cases like these…

What you’re generally going to find is that whatever “rate” you would have been able to qualify for PRIOR to being diagnosed with Hypoglycemia should be the same “rate” that you would be able to qualify for AFTER being diagnosed with Hypoglycemia.

Which means that…

If you would have been able to have qualified for a Preferred Plus rate prior to being diagnosed with Hypoglycemia, chances are you’ll still be able to qualify for a Preferred Plus rate after having been diagnosed with Hypoglycemia, only now you’ll just need to make sure that the life insurance underwriter “working” your case understands that your Hypoglycemia isn’t related to some “other” pre-existing medical condition.

This brings us to the last topic that we wanted to discuss here in this article, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance professional who will work as an advocate for you.

Such an agent…

Will not only help guide you through the application process but also be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because after all, it doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly…

You’ll want to make sure that you’re completely honest with your life insurance agent prior to applying for coverage. By doing so, you will be helping him or her narrow down what options might be the “best”.

Now, will we be able to help out everyone who has been previously diagnosed with Hypoglycemia?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well so that in the event that someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.