In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after having been diagnosed with Hypothyroidism.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Hypothyroidism?

- Why do life insurance companies care if I have been diagnosed with Hypothyroidism?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with functional Hypothyroidism?

Yes, individuals who have been diagnosed with Hypothyroidism can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, many may even be able to qualify for a Preferred Plus rate.

The only problem is…

Hypothyroidism is generally a manageable disease to treat when left unmanaged, and it has the potential to cause some pretty severe complications! This is why, before being approved for a traditional life insurance policy, most (if not all) life insurance companies will want to ask you a series of medical questions about your disease to ensure they don’t have anything they need to worry about.

Why do life insurance companies care if I have been diagnosed with Hypothyroidism?

In general, most life insurance companies are going to spend a whole lot of time worrying about the fact that you have been diagnosed with Hypothyroidism. Instead, they’re just going to ask some basic questions to make sure that you’re correctly treating your Hypothyroidism and rule out the possibility that you may one day become a “risk” to them later on.

This is why…

We wanted to take a moment and discuss what Hypothyroidism is as well as highlight some of the most common symptoms and complications that can arise due to this condition so that we can have a better understanding of what a life insurance underwriter will be looking for when making their decision about your application.

Hypothyroidism Defined:

Hypothyroidism is when the thyroid gland, a small butterfly-shaped gland located in the neck, is not producing enough thyroid hormone. The thyroid gland produces hormones that regulate the body’s metabolism, which is how the body converts food into energy. When the thyroid gland is not functioning correctly, the body’s metabolism can slow down, leading to a wide range of symptoms.

Symptoms of Hypothyroidism can include fatigue, weight gain, cold intolerance, constipation, dry skin, and thinning hair. In some cases, there may be no apparent symptoms at all.

Serious complications may include:

- Elevated cholesterol levels,

- Heart disease,

- Infertility,

- Premature death.

Hypothyroidism is typically diagnosed through a blood test that measures the level of thyroid hormone and thyroid-stimulating hormone (TSH) in the body and is usually treated with a daily dose of thyroid hormone replacement medication. This treatment is generally effective in relieving symptoms and normalizing thyroid hormone levels.

What kind of information will the insurance companies ask me or be interested in?

Insurance companies may ask you a variety of questions about your Hypothyroidism when you apply for coverage or when you are making a claim. Here are some examples of the types of information that insurance companies may be interested in:

- Your medical history: The insurance company may ask about your past and current medical conditions, including any previous diagnoses or treatments for Hypothyroidism.

- Your medications: The insurance company may ask about the medicines you are taking to treat your Hypothyroidism, including the dosage and frequency of use.

- Your symptoms: The insurance company may ask about the symptoms you are experiencing due to your Hypothyroidism and how these symptoms affect your daily life.

- Your healthcare provider: The insurance company may ask about the healthcare provider(s) you see for your Hypothyroidism, including their name, specialty, and contact information.

It is important to be honest and forthcoming when answering these questions, as providing accurate and complete information can help the insurance company make an informed decision about your coverage or claim.

What rate (or price) can I qualify for?

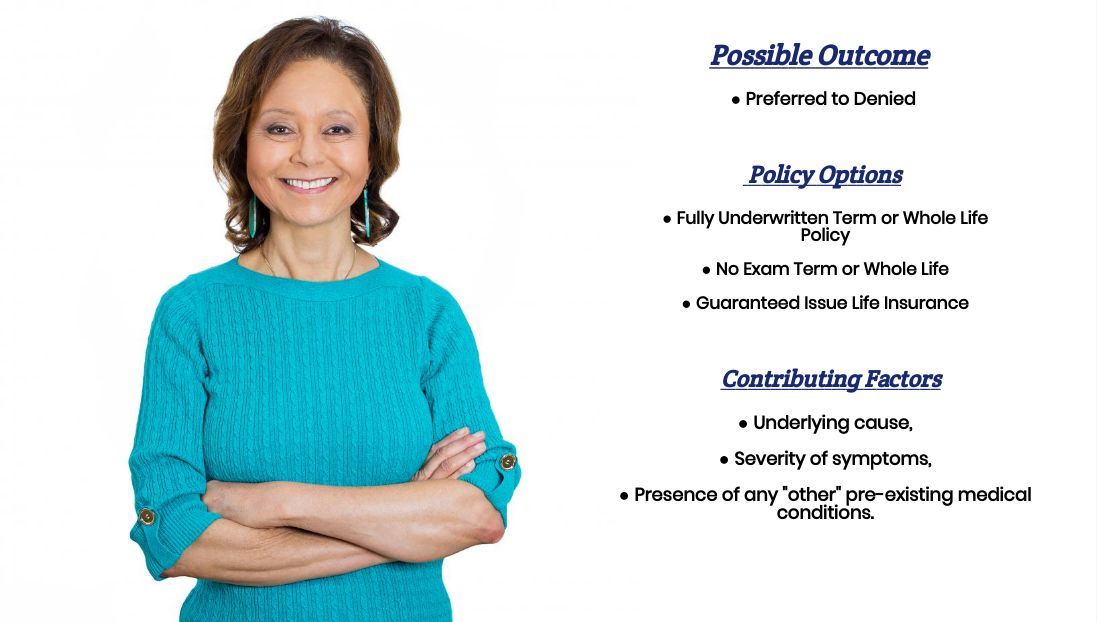

Usually, what we have found here at IBUSA is that provided that you are “treating” your Hypothyroidism, which usually means that you’re taking some synthetic thyroid hormone such as Levothyroxine or Synthroid, most life insurance companies aren’t really going to discriminate, against you, when applying for a traditional life insurance policy.

Which is why…

Individuals who have been diagnosed with Hypothyroidism and are in perfect shape will be able to qualify for a Preferred Plus rate, while those who have been diagnosed with Hypothyroidism and aren’t in ideal shape won’t. So, the rate isn’t determined by the fact that you have been diagnosed with Hypothyroidism; instead, it will be based on other factors such as:

- Your height and weight.

- Your family’s medical history.

- Your driving record.

- Previous felonies or misdemeanors?

- Participation in any dangerous hobbies or activities?

- A passion for traveling to dangerous locations?

- Etc…

For this reason, it’s pretty much impossible to know what kind of “rate” you might be able to qualify for without first speaking with you directly. The good news is that regardless of your situation, here at IBUSA, we can help, which brings us to the last topic we wanted to discuss with you in this article…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance professional who will work as an advocate for you. Such an agent who can help guide you through the application process and be perfectly “frank” with you about what options may or may not be possible.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because, after all, it doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly, you’ll want to ensure you’re completely honest with your life insurance agent before applying for coverage. By doing so, you will be helping them narrow down what options might be the “best.”

So, what are you waiting for? Give us a call today and see what we can do for you!