Banner Life Insurance Company is one of the leading life insurance providers in the United States, offering coverage to over a million people across the country. In this review, we will examine the various advantages and disadvantages of choosing Banner Life, as well as provide some background information on what makes this company an excellent choice for so many individuals.

Compare over 50 top life insurance companies instantly.

|

About Banner Life

Banner Life is a part of the company, Legal and General America. Banner Life was formed about 70 years ago, but Legal and General has been in the life insurance industry for more than 175 years.

Banner Life Insurance Company

3275 Bennett Creek Avenue

Frederick, Maryland 21704

Banner Life is available in 49 states plus the District of Columbia (D.C.). However, in New York, the company sells life insurance under William Penn Life Insurance Company of New York.

The company boasts over $5 billion in assets and has over 1.3 million U.S. customers, with Legal and General serving over 10 million customers worldwide. Source.

Over the past 10 years, Banner Life has consistently offered some of the best term life insurance rates in the country, and is known as a low priced leader in the term life space.

Products Offered by Banner Life:

- Term Life Insurance

- Universal Life Insurance

- Annuities

- Retirement Planning

Pros of Banner Life Insurance

Banner Life has earned a spot on our top ten list due to several factors, including its excellent underwriting process that provides everyday individuals with competitive rates on life insurance policies.

Unlike many other life insurance companies whose underwriting can be harsh on those with common health conditions such as sleep apnea or diabetes, Banner Life is much more “health problem” friendly. This means they can still offer affordable rates on life insurance policies even to those with minor health problems.

Banner Life excels in underwriting for several health conditions, including but not limited to: asthma, atrial fibrillation, bladder cancer, breast cancer, cerebrovascular disease, coronary artery disease, adult-onset diabetes mellitus, elevated liver function tests, hepatitis C, mood disorders, prostate cancer, and thyroid cancers.

Banner Life’s Financial Ratings

Banner Life has been rated by three of the top life insurance rating agencies: A. M. Best, Fitch, and Standard & Poor’s. The following Banner Life Insurance ratings are current as of September 2020.

- A.M. Best rating: A+

- S&P rating: AA-

- Moody’s rating: N/A

- Fitch rating: AA-

- Comdex ranking: 94

These are very strong ratings, and make Banner one of the highest rated life insurance companies in the U.S.

Banner Life’s solid scores for financial strength and stability suggest that policyholders face little risk of the company failing to meet policy obligations in the foreseeable future. This is doubly true considering that L&G America, which boasts over $5 billion in assets, stands behind Banner policies. According to L&G, the company employs a conservative investment philosophy, emphasizing investment grade bonds and high liquidity.

BBB

Banner Life is not accredited with the Better Business Bureau but scores an of A+ rating from BBB. In general, the A+ BBB rating indicates that Banner is usually prompt and attentive to policyholder complaints—at least, complaints lodged with BBB.

NAIC

Banner also draws, on average, much fewer consumer complaints than most life insurers its size, according to the National Association of Insurance Commissioners, with a NAIC complaint index of 0.05% on a scale where 1.00 is considered average. Source.

APPCelerate by Banner Life

Banner life offers innovative accelerated underwriting, i.e. no exam life insurance for qualifying applicants.

APPcelerate is available for qualifying applicants ages 20-50 for face amounts up to $2,000,000 in coverage, and up to $500,000 for ages 51-60.

Another benefit of Banner Life is that the company is one of a handful of companies currently offering 35 and 40 year term life insurance.

Banner Life Underwriting Strengths

Some of Banner Life’s Underwriting Strengths Include:

Potential Preferred Plus for:

- cigarette smokers 3 years out

- treated high cholesterol

- treated high blood pressure

- total cholesterol under 300

- family history of cancer

- scuba up to 100 feet

Potential Preferred for:

- Well controlled Asthma

- Well controlled Depression/Anxiety

- Mild Sleep Apnea

Potential Standard Plus for:

- Controlled Type II Diabetes

- Severe Sleep Apnea with Documented Compliance

- Personal History of Cancer (based on date of onset and last treatment)

Where Banner Life Does Not Make the Grade

Marijuana Users – Getting life insurance with marijuana is easier today than it has ever been. However, Banner Life will only offer standard tobacco rates. There are better options available for marijuana users.

Banner Life Insurance Policies

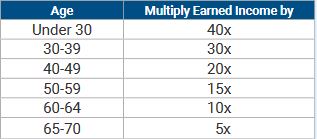

No matter which of the different types of life insurance policies you choose, how much life insurance you can get is typically determined by your age and income. You can look at the following Banner Life Multiple of Income Chart to determine how much coverage you may be eligible for.

OPTerm: Term Life Insurance Policy

Banner Life offers a guaranteed level premium term life policy that also includes a conversion option so you can convert the policy to permanent coverage if needed. The conversion option must be exercised by the end of the term or age 70, whichever comes first.

The term policy is level benefit coverage renewable to age 95, which is one of the longest guaranteed renewable term life policies available.

You can choose from the following terms:

OPTerm 10. OptTerm15. OPTerm 20. OPTerm 25. OPTerm 30. OPTerm 35. OPTerm 40

Banner Life is one of only a few life insurance companies to offer up to 35 or 40 year term life insurance.

Life Step UL: Guaranteed Universal Life Policy

Banner Life offers a Guaranteed Universal Life policy known as Life Step UL.

How a guaranteed universal life insurance policy works is, the carrier determines the premium amount you need to pay in order to keep your policy in force, no matter future economic conditions. That way, as long as you pay your premium, you are guaranteed to have your death benefit until the day you die.

$50,000

One additional benefit is that Banner Life offers their UL policy with as low as $50,000 in coverage. While the majority of life insurance companies only offer GUL policies that offer coverage of $100,000 or more, you also have to remember that you pay for that extra coverage.

Short Pay Guarantee

Banner Life’s Life Step UL policy also has a short pay guarantee. Similar to limited pay life insurance, you can design your payment over a number of years, rather than pay on the policy for the rest of your life.

So, if you choose to design the policy to be paid by the time you reach retirement, you can tailor the premium to make this happen.

Final Expense Insurance

And if you don’t qualify for a standard life insurance policy, you might want to consider final expense insurance.

Banner Life offers a final expense insurance policy for ages 50-80. It is a guaranteed issue life insurance policy, which means there is no medical exam or health questions.

It is a small whole life policy, that is paid up at age 95. Like all whole life, it accrues cash value and the premium and death benefit is fixed.

Available Life Insurance Riders

Terminal Illness Rider: This rider allows acceleration of up to 75% of a policy’s death benefit (or $500,000, whichever is less) if the insured is diagnosed with less than 12 months to live.

Children’s Rider: Banner’s Children’s Rider provides $5,000 or $10,000 in coverage for an insured’s children until they reach age 25.

Waiver of Premium (Disability): If the insured becomes totally disabled prior to reaching age 65 and the disability lasts for at least six months, premium obligations are waived while the insured remains disabled.

Term Rider: If purchased, this rider provides a supplemental death benefit for a defined period— ten or fifteen years, for example.

Accidental Death Rider: This rider provides supplemental coverage—up to 100% of the policy’s cash value—if the insured’s death results from a qualifying accident.

Potential Cons of Banner Life

As promised, this Banner Life review does include some negative aspects.

Actual age vs. Nearest Age

If you have just had a birthday when applying for life insurance, then you may find a cheaper life insurance policy with a company like Prudential.

Why?

Because Banner Life determines the premium price based on nearest age whereas some others like Prudential look at actual age.

Final thoughts…

While Banner Life Insurance Company may be an excellent choice for many individuals, it’s important to note that finding the best life insurance policy for your unique needs and circumstances requires exploring all available options.

While Banner Life may offer competitive rates and comprehensive coverage, other insurance providers may have policies that better suit your specific requirements. Additionally, each life insurance company has its own underwriting guidelines, meaning that the premiums offered by one provider may differ significantly from those of another for the same individual.

Therefore, to ensure that you’re getting the best coverage at the most affordable rate, it’s crucial to shop around and compare quotes from multiple life insurance companies. By doing so, you can make an informed decision that provides peace of mind and protection for you and your loved ones.