When someone is diagnosed with lung cancer, it can be a devastating and overwhelming experience. Not only is the person facing a serious illness, but they are also likely to be dealing with a lot of uncertainty and fear about the future. One of the things that may be on their mind is how their diagnosis will impact their ability to get life insurance.

The good news is that it is possible to get life insurance after being diagnosed with lung cancer, but the process can be challenging and there are certain things to keep in mind. This article will provide an overview of the challenges of applying for life insurance after a lung cancer diagnosis, and offer some tips and guidance to help make the process as smooth as possible.

Overview of lung cancer

Lung cancer is a type of cancer that starts in the lungs and can spread to other parts of the body. It is caused by abnormal cell growth in the lung tissue. There are two main types of lung cancer: non-small cell lung cancer and small cell lung cancer.

Types of lung cancer:

- Small Cell Lung Cancer: This type of lung cancer is also known as oat cell cancer and is usually found in the central part of the lungs. It is a fast-growing cancer that tends to spread quickly to other parts of the body.

- Non-Small Cell Lung Cancer: This is the most common type of lung cancer and includes adenocarcinoma, squamous cell carcinoma, and large cell carcinoma. These types of lung cancer tend to grow and spread more slowly than small cell lung cancer.

- Adenocarcinoma: This type of lung cancer starts in the cells that line the air passages and is most commonly found in people who have never smoked or only smoked a little.

- Squamous Cell Carcinoma: This type of lung cancer starts in the cells that line the air passages and is more commonly found in people who have a history of smoking.

- Large Cell Carcinoma: This type of lung cancer is a catch-all category for cancers that don’t fit into the other categories and can occur in any part of the lung.

Most common causes of lung cancer:

There are several potential causes of lung cancer, including smoking, exposure to radon gas, exposure to certain chemicals and pollutants, and a family history of the disease. Smoking is the leading cause of lung cancer, accounting for around 80-90% of all cases. Exposure to radon gas, which is a naturally occurring radioactive gas that can seep into homes and buildings, is the second leading cause of lung cancer. Other potential causes include exposure to certain chemicals and pollutants, such as asbestos, air pollution, and secondhand smoke, as well as having a family history of the disease. In some cases, the cause of lung cancer may be unknown.

Stages of lung cancer:

Lung cancer is typically classified into four stages, depending on the size of the tumor and whether it has spread to nearby lymph nodes or other parts of the body.

- Stage 1: The cancer is small and limited to the lung.

- Stage 2: The cancer has grown larger and may have spread to nearby lymph nodes.

- Stage 3: The cancer has spread to other parts of the lung or nearby structures.

- Stage 4: The cancer has spread to distant parts of the body, such as the bones, brain, or other organs.

Symptoms of lung cancer:

Lung cancer symptoms can vary depending on the type and stage of the cancer. Some common symptoms include:

- Persistent cough or cough that worsens over time

- Chest pain

- Shortness of breath

- Hoarseness

- Fatigue

- Unexpected weight loss

- Recurrent lung infections, such as pneumonia or bronchitis

- Wheezing

- Coughing up blood

- Lumps in the neck or collarbone It’s important to note that many of these symptoms can also be caused by other conditions, so it’s important to see a doctor if you’re experiencing any of them. Early detection and diagnosis are key to improving the chances of survival for lung cancer patients.

Treatment options:

Treatment options for lung cancer can vary depending on the stage and type of cancer, as well as the overall health of the patient. Some common treatment options include surgery, radiation therapy, chemotherapy, targeted therapy, and immunotherapy. In some cases, a combination of treatments may be recommended. Surgery is often used for early stage lung cancer, while radiation and chemotherapy may be used for more advanced stages. Targeted therapy and immunotherapy are newer treatments that target specific genetic changes in the cancer cells.

These treatments are often used in combination with other treatments or for patients who are not candidates for surgery. It is important to consult with a medical professional to determine the best course of treatment for an individual’s specific case of lung cancer.

Impact of lung cancer on a life insurance application

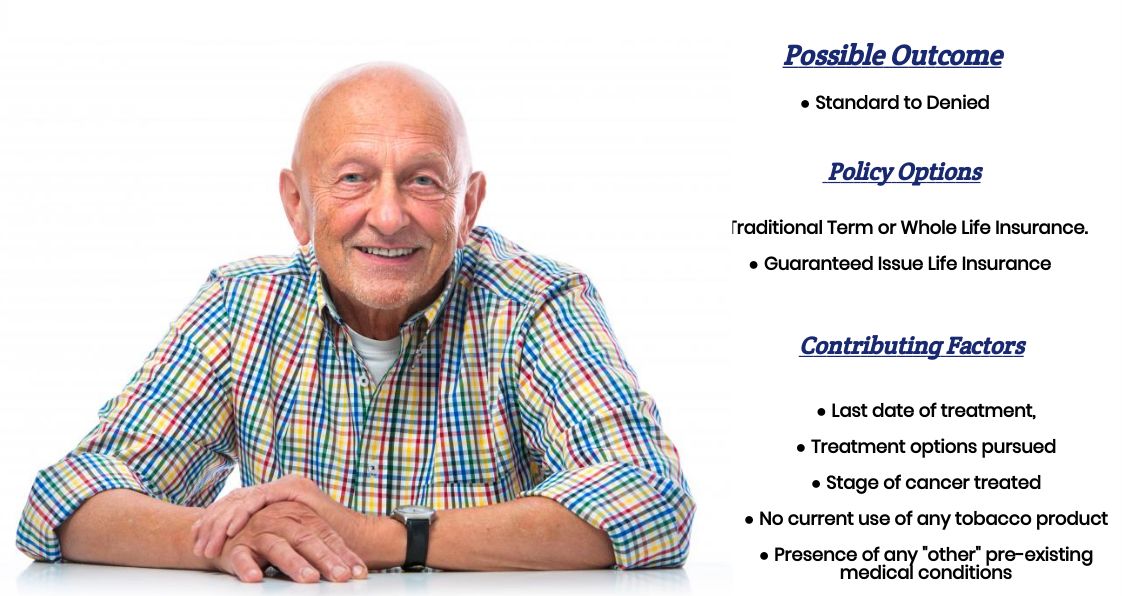

The impact of lung cancer on a life insurance application can vary depending on the stage and treatment of the disease, as well as the insurance company’s underwriting guidelines.

In general, a diagnosis of lung cancer may result in higher rates or a denial on a life insurance policy, as it is considered a high-risk condition. One thing for certain is that the insurance company is going to require additional information and documentation about the lung cancer diagnosis, such as medical records and treatment plans before they would be willing to approve an applicant who has previously been diagnosed with lung cancer.

Additionally, it’s safe to say that if you are currently receiving treatment for lung cancer, you will not be able to qualify for coverage regardless of what stage it has been diagnosed at.

What kind of information will the insurance companies be interested in regarding my lung cancer?

When applying for life insurance after being diagnosed with lung cancer, insurance companies will typically want to know details about your diagnosis, such as the type and stage of your cancer, as well as information about your treatment and prognosis. They may also ask about your smoking history and other risk factors for lung cancer

Specific questions may include:

- How old where you when were first diagnosed with Lung Cancer?

- Are you currently treating your cancer? If not, what was your last date of treatment?

- How often do you see your oncologist for checkups?

- What treatment options did you receive:

- Surgery,

- Radiation therapy,

- Chemotherapy,

- Etc…

- What “stage” of Lung Cancer were you diagnosed with?

- Stage 1: the cancer was confined to the lung itself.

- Stage 2: the cancer remained small and was confined to the chest area.

- Stage 3: the cancer tumors were larger in size while still remaining confined to the chest area.

- Stage 4: the cancer has spread (metastasized) to other parts of the body.

- How large was your tumor(s)?

- Was a “potential” cause of your lung cancer determined?

- In the past 12 months, have you used any form of tobacco or nicotine products?

- Do you suffer from any other pre-existing medical conditions?

- Are you currently taking any prescription medications?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

The insurance company will use this information to determine the level of risk you pose and to set the premium rates for your policy should they wish to extend you an offer of coverage.

What if I can’t qualify for a traditional life insurance policy due to my lung cancer diagnosis?

If your lung cancer diagnosis is preventing you from being able to qualify for a traditional life insurance policy, there are still options available. One option is to consider a guaranteed issue life insurance policy, also known as final expense insurance or burial insurance. These policies do not require a medical exam or health questions and typically have a lower coverage amount. Unfortunately, they also contain a graded death benefit which means that you would need to own your policy for a minimum of 2-3 years before it would provide a death benefit should the insured die from natural causes.

Finding the Right Insurance Company and Policy

When searching for the right insurance company and policy after being diagnosed with lung cancer, it’s important to do your research and compare different options. Here are a few steps you can take to find the right policy for you:

- Look for companies that specialize in insuring individuals with pre-existing conditions. Some insurance companies have a better track record of approving policies for individuals with lung cancer.

- Compare rates and coverage options from multiple companies. This will help you find the best policy at the best price.

- Read reviews of different insurance companies to get a sense of their customer service and claims process.

- Consult with an insurance agent or broker who is experienced in working with individuals with lung cancer. They can help guide you through the process and find the best policy for your specific needs.

Application process

The application process itself will involve providing detailed information about your cancer diagnosis, including the type of cancer, the stage, and the treatment plan. You may also need to provide medical records and other documentation, such as pathology reports. It’s important to be completely honest and upfront about your cancer diagnosis during the application process, as any misrepresentation of information could result in the denial of coverage.

Overall, applying for life insurance after being diagnosed with lung cancer can be a daunting task, but with the right approach, you can still find coverage that meets your needs. It’s important to be informed about your options, be honest about your cancer diagnosis, and work with an experienced insurance agent who can guide you through the process.

The good news is, we can help! All you need to do is give us a call.

Frequently asked questions

Can someone who has been treated for lung cancer still qualify for a traditional life insurance policy?

Yes, someone who has been treated for lung cancer may still be able to qualify for a traditional life insurance policy. However, the rate and coverage options may vary depending on the severity of the cancer, the stage at which it was diagnosed, and the individual’s current health status.

How does a lung cancer diagnosis impact my ability to get life insurance?

A lung cancer diagnosis can make it more difficult to qualify for traditional life insurance policies, as insurance companies may see you as a higher risk. However, there are still options available such as a guaranteed issue life insurance policy or an accidental death policy.

What kind of information will the insurance company want to know about my lung cancer diagnosis?

The insurance company will likely want to know details about your diagnosis, such as the type of lung cancer, the stage of the cancer, and your treatment plan. They may also want to know your prognosis and any additional health conditions you have.

Can I still get life insurance if my lung cancer is advanced or terminal?

It may be more difficult to qualify for traditional life insurance policies if your lung cancer is advanced or terminal, but there are still options such as accidental death policies that may be available to you.

How can I find the right insurance company and policy for me after a lung cancer diagnosis?

It’s important to do research and compare different insurance companies and policies. It may also be helpful to work with a financial advisor or insurance agent who can guide you through the process and help you find the best option for your individual needs.