In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with Kyphosis.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Kyphosis?

- Why do life insurance companies care if I have been diagnosed with Kyphosis?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Kyphosis?

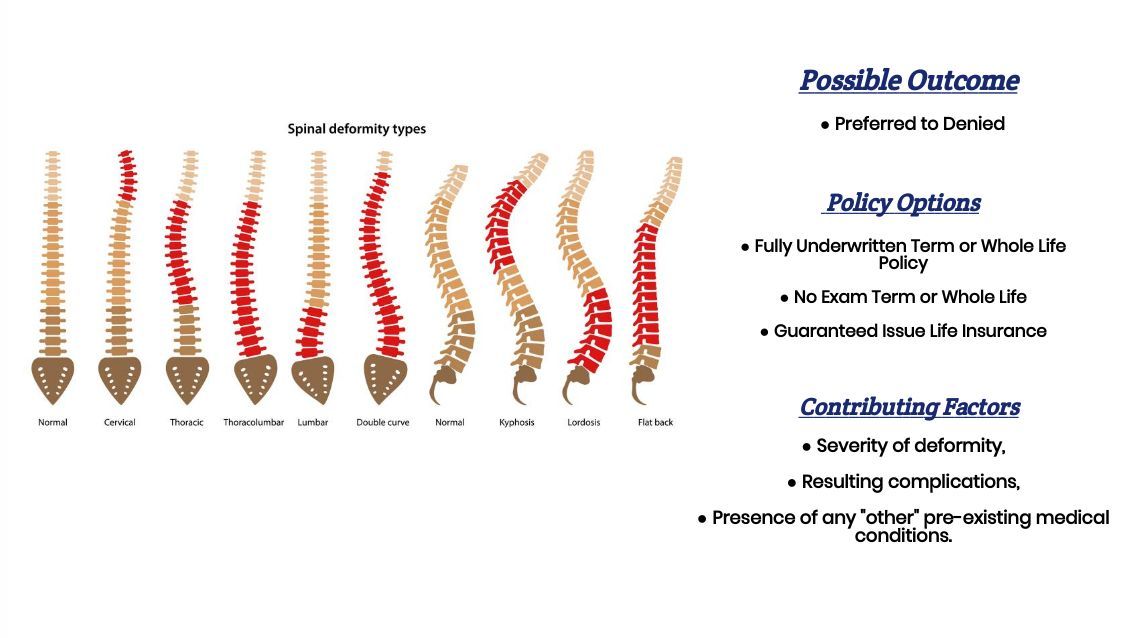

Yes, individuals who have been diagnosed with Kyphosis can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, they may even be able to qualify for some of the best no medical term life insurance policies at a Preferred rate!

The only problem is…

Like many pre-existing medical conditions, extreme cases can cause some individuals to suffer from symptoms that may make some life insurance companies a bit “nervous” which is why it’s not all that uncommon for some life insurance companies to want to know more about your Kyphosis before them deciding the outcome of your life insurance application.

Why do life insurance companies care if I have been diagnosed with Kyphosis?

Because Kyphosis isn’t considered a “life-threatening” medical condition, it’s fair to say that most of the best life insurance companies are going to spend an enormous amount of time focusing on the fact that you have been diagnosed with Kyphosis.

Other than to…

Simply rule out whether your particular situation is a rare one, which could potentially affect your life insurance application.

For this reason…

We wanted to take a moment and briefly describe what Kyphosis is and highlight some of the most common symptoms/complications of this disease so that we would have a better idea of exactly what a life insurance underwriter will be looking for when making their decision about your application.

Kyphosis Defined:

Kyphosis is a very common spinal disorder that causes patients to suffer from an excessive outward curve of the spine. As a result, individuals who suffer from this condition will begin exhibiting an abnormal “rounding” of the upper back, which is why this disease is commonly referred to as “hunchback” or “roundback”.

Possible causes may include:

- Growing older,

- Scheuermann’s disease,

- Arthritis or Osteoporosis,

- Spine injury due to trauma,

- Slipped disc.

Common symptoms may include:

- Poor posture, with a “hump” or “bump” appearance,

- Back pain,

- Back muscle fatigue and/or stiffness.

Serious complications may include:

- Chronic pain that can only be treated with pain medications,

- Breathing difficulties due to airways and lungs being compressed by the spine.

Fortunately…

Even though Kyphosis is a somewhat common disorder, only a small percentage of those suffering from this condition will ever experience any “serious” complications as a result of this disease and even those who begin to develop more serious complications, the are a variety of different therapeutic techniques one can try to help minimize the severity of their condition.

Therapeutic techniques such as:

- Physical therapy,

- Certain strength-building exercises,

- As well as pain medication.

“Which brings us to an important point that we think we ought to mention.”

First…

If you think you have a medical issue, don’t use the internet to try and diagnose yourself. After all, if you do and you’re correct, you’re still going to need to see the doctor, and if you’re wrong, the time you spend being your own doctor could really harm yourself!

Second…

Nobody here at IBUSA is medically trained, and we’re certainly not doctors. All we ware is a bunch of life insurance agents who just happened to be really good at helping individuals find and qualify for the life insurance that they’re looking for. So please don’t mistake any of the medical information that we talk about as medical advice because it’s not!

We’re just…

Trying to “prep” you for what it might be like to apply for a life insurance policy after you have been diagnosed with Kyphosis… that’s it! This brings us to our next topic, which is…

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked may include:

- When were you first diagnosed with Kyphosis?

- How has your disease been progressing?

- Do you know “why” you may be suffering from this condition?

- Growing older?

- Scheuermann’s disease?

- Arthritis or Osteoporosis?

- Spine injury due to trauma?

- Slipped disc?

- Are you currently taking any prescription medications?

- Have you been diagnosed with any other pre-existing medical conditions?

- In the past two years, have you been hospitalized for any reason?

- Do you have any issues with your driving record? Issues such as multiple moving violations, a DUI, or a suspended license?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

When it comes to helping someone who has been diagnosed with Kyphosis qualify for a traditional term or whole life insurance policy, what you’re generally going to find is that provided your Kyphosis isn’t preventing you from being able to live a “normal life” (whatever that may be), most life insurance companies aren’t going to use your Kyphosis diagnosis as a reason to discriminate against you.

That said, however…

If your Kyphosis is preventing you from being able to live a normal life or if your Kyphosis is forcing you to use a powerful pain narcotic cause a life insurance underwriter become a “bit” nervous, you may find that you may not be able to qualify for a Standard or better rate, and in some cases, you may even be told that you can’t qualify for coverage at all (typically only when extensive pain meds are being used).

The good news is…

That regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy that they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to helping a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is exactly what you’re going to find here at IBUSA!

Now, will we be able to help out everyone who has been previously diagnosed with Kyphosis?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well so that in the event that someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.