In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance with Osteoporosis.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Osteoporosis?

- Why do life insurance companies care if I’ve been diagnosed with Osteoporosis?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I’ve been diagnosed with Osteoporosis?

Yes, individuals who have been diagnosed with Osteoporosis can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, some may even be able to qualify for some of the best no medical exam life insurance companies at a Preferred rate!

The problem is…

That in many cases, an individual who is suffering from Osteoporosis won’t know that they are until they suffer from some type of bone fracture.

Which means that…

In some cases, this disease can do significant damage to one’s bones before being diagnosed, which is why a life insurance company is going to want to learn more about an individuals Osteoporosis diagnosis prior to making any decision about his or her life insurance application.

Why do life insurance companies care if I’ve been diagnosed with Osteoporosis?

The main reason why most of the best life insurance companies are going to “care” if someone has been diagnosed with Osteoporosis is that when left untreated or diagnosed late in the progression of this disease, some people can suffer from some pretty significant complications as a result of suffering from Osteoporosis.

For this reason…

We wanted to take a moment and discuss exactly what Osteoporosis is as well as highlight some of the most common symptoms/complications that can occur as a reslut of this disease. This way we might gain a better understanding of what a life insurance underwriter will be looking for when making his or her decision about your life insurance application.

Osteoporosis Definition:

Osteoporosis is a medical condition in which the bones become weak and brittle, increasing the risk of fractures. It is more common in older people, and is more prevalent in women than in men. Osteoporosis is caused by a decrease in bone density, which occurs when the body does not produce enough new bone to replace old bone as it is broken down. This can lead to bones becoming thin and fragile, increasing the risk of fractures.

Risk factors for osteoporosis include:

- Advanced age

- Female gender

- Family history of osteoporosis

- Thin or small body frame

- Lack of physical activity

- Low calcium intake

- Certain medications, such as corticosteroids and certain cancer drugs

Symptoms of osteoporosis may include:

- Fractures that occur with minimal trauma or injury

- Back pain

- Loss of height

- A hunched or stooped posture

Serious complications may include:

- Limited mobility leading to hospitalizations and or assisted living requirements,

- Depression,

- Debilitating pain.

Osteoporosis is typically diagnosed through a bone density test, which measures the density of your bones. Treatment may include medications to increase bone density, lifestyle changes such as increasing calcium and vitamin D intake, and weight-bearing exercise to strengthen bones.

Fortunately…

Because Osteoporosis is a very common disease, most general practitioners will advise their “aging” clients to be on the lookout for it. This combined with the fact that prevention and minimization of many of Osteoporosis’ most harmful effects often coincide with a healthy lifestyle many individuals can slow down the natural progress of this disease utilizing a combination of:

- Certain medications,

- A healthy diet,

- And plenty of exercise.

Which is why, it’s not all that uncommon to see that many individuals who have been diagnosed with Osteoporosis will still be able to qualify for a Preferred rate.

What kind of information will the insurance companies ask me or be interested in?

When applying for life insurance, you will typically be asked to provide detailed information about your medical history, including any diagnoses of osteoporosis. The insurance company may ask you to provide the following information:

- Date of diagnosis: The insurance company will want to know when you were diagnosed with osteoporosis, as this will help them to understand the duration and severity of your condition.

- Symptoms: The insurance company may ask if you have experienced any symptoms as a result of your osteoporosis, such as fractures or back pain.

- Risk factors: The insurance company may ask about risk factors for osteoporosis, such as your age, gender, family medical history, and lifestyle.

- Treatment history: The insurance company will want to know what treatments you have received for your osteoporosis, including medications and other therapies. They will also want to know the dates of your treatments and the outcomes of those treatments.

- Prognosis: The insurance company will want to know the prognosis for your osteoporosis, which is a prediction of the likely course of the disease and your chances of recovery. Your prognosis will be based on the severity of your condition, your treatment history, and other factors such as your age, overall health, and lifestyle.

It’s important to be honest and transparent when providing this information to the insurance company, as providing false or misleading information on your application could result in your policy being denied or terminated.

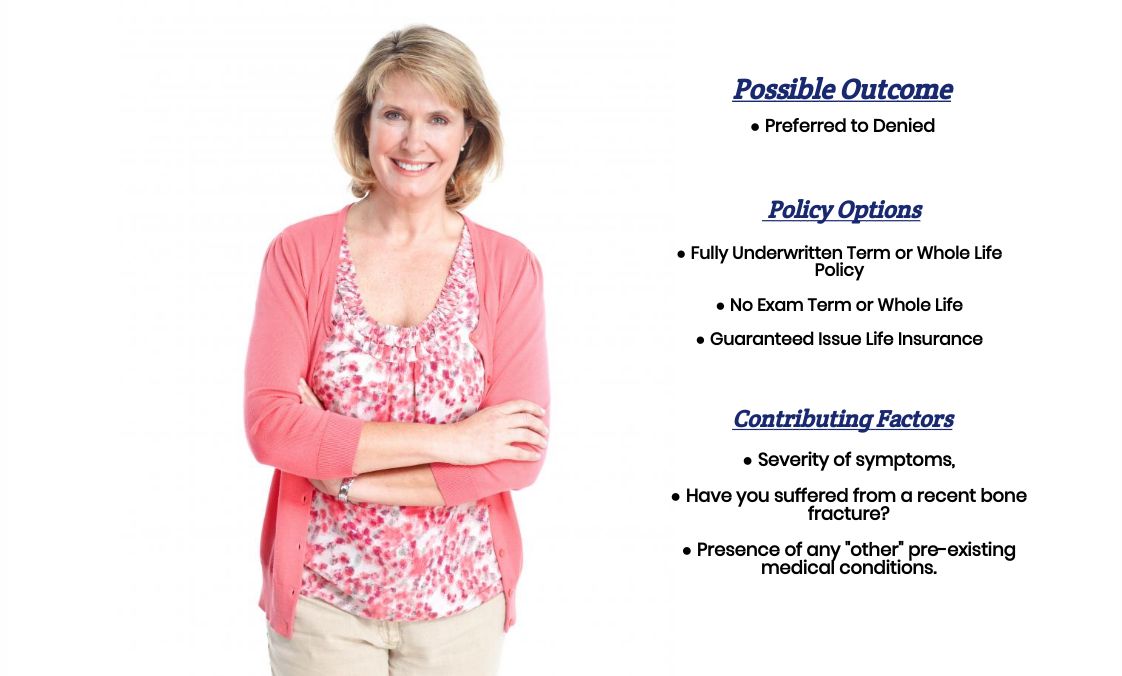

What rate (or price) can I qualify for?

As you can see, there are many variables that can come into play when trying to determine what kind of “rate” an individual diagnosed with Osteoporosis. This is why it’s almost impossible to know what kind of “rate” you might qualify for without first speaking with you directly.

That said however…

Most individuals who have been diagnosed with Osteoporosis will usually fall into one of three different categories that we can make some “assumptions” about that will generally hold true.

Category #1.

Those who have been diagnosed with Osteoporosis early on by their general practitioner prior to bone fractures.

Individuals in this category generally won’t have any “symptoms” of their disease and won’t usually be discriminated against due to this “proactive” diagnosis made by their primary care physician. In cases like these, what we usually find is that whatever rate these “types” of individuals would have been able to qualify for PRIOR to their Osteoporosis diagnosis ought to be the same “rate” that they will be able to qualify for AFTER having been diagnosed with Osteoporosis.

Category #2.

The second “type” of applicant that we’ll commonly see with Osteoporosis is those that may have suffered from a bone fracture or two but are now treating their condition and are generally still in good health. These “types” of individuals will still be able to live a “normal” life; they’re just going to need to be a bit more careful.

Typically, what we’ll…

Find is with these “types” of applicants is that they may still be able to qualify for a Preferred rating, however, they may be more likely to only be able to qualify for a Standard depending on the type of bone that was fractured and the degree of the fracture as well.

Category #3.

Lastly, we’ll often encounter some clients who seem to be suffering many of the more “severe” symptoms of Osteoporosis, including severe pain and loss of mobility. In cases like these, we’ll often find that most life insurance companies are going to automatically consider them “high risk” or “sub-standard” applicants which will make it more difficult for them to qualify for a traditional term or whole life insurance policy particularly if they have also been diagnosed with some other “type” of pre-existing medical condition as well.

The good news is…

That regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy that they can qualify for.

Which brings us to the last topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to helping a more “challenging” case, they don’t have to rely on a…

“One size fits all approach

The good news is that this is exactly what you’re going to find here at IBUSA!

Now, will we be able to help out everyone who has been previously diagnosed with Osteoporosis?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well so that in the event that someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available to you, just give us a call!