Unfortunately, people often make jokes about their arthritis as they age, or use it as an excuse for not performing as well as they used to in certain sports or activities. This can lead to forgetting or under-appreciating the actual severity of some cases of arthritis.

As a result, many applicants may be surprised by the interest some life insurance companies show once they learn that an applicant has arthritis or has been prescribed medications to treat it.

Therefore, we wanted to take a moment to answer some of the most common questions we receive from applicants who have been diagnosed with arthritis and are applying for life insurance. We will discuss how different types of arthritis, including osteoarthritis and rheumatoid arthritis, are treated differently.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with either Osteoarthritis or Rheumatoid Arthritis?

- Why do life insurance companies care if I have been diagnosed with Osteoarthritis or Rheumatoid Arthritis?

- What kind of information will the insurance companies ask me or be interested in?

- What “rate” can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Osteoarthritis or Rheumatoid Arthritis?

Individuals diagnosed with arthritis can often qualify for traditional term or whole life insurance policies. In fact, some may even qualify for a top-rated no medical exam life insurance policy at a preferred rate.

However, in the world of life insurance, there isn’t a pre-existing medical condition called arthritis. Instead, the best life insurance companies view arthritis as either osteoarthritis or rheumatoid arthritis.

If you have been diagnosed with osteoarthritis, most life insurance companies won’t spend a lot of time questioning you. However, if you have been diagnosed with rheumatoid arthritis, it may be much more difficult (if not impossible) to qualify for a traditional term or whole life insurance policy.

Why do life insurance companies care if I have been diagnosed with Osteoarthritis or Rheumatoid Arthritis?

The primary reason why a life insurance company is interested in an individual’s arthritis diagnosis is that the term “arthritis” does not provide enough information for them to evaluate the risk. What they want to know is if the individual has been diagnosed with Rheumatoid Arthritis, which is a more serious condition.

Although life insurance companies typically want to know about any pre-existing medical conditions that an individual has, they are primarily interested in the serious ones. Therefore, while Osteoarthritis may be a common diagnosis, it is not generally considered a serious condition by most insurance companies, so it is unlikely to affect an individual’s ability to qualify for coverage.

However, Rheumatoid Arthritis is a more serious condition that can make it more difficult for an individual to obtain traditional life insurance coverage. Therefore, it is important to understand the differences between the two types of arthritis and how they are viewed by insurance companies.

Osteoarthritis Defined.

Osteoarthritis, also known as “OA”, is a degenerative joint disease that occurs when the flexible tissue at the ends of bones wears down. This type of arthritis is quite common, with nearly 3 million new cases in the United States alone. In fact, many people consider osteoarthritis a normal part of aging rather than a disease or pre-existing medical condition.

Symptoms of Osteoarthritis may include:

- Aching pain in one’s joints, including: hands, knee’s hips, lower back, and neck.

- Swelling of the joints.

- Joint deformity.

As well as a sensitivity to weather changes…

“My left knee always likes to let me know when it’s about to rain!”

Unfortunately…

There isn’t any kind of “cure” for Osteoarthritis, however many folks can benefit by losing weight, staying active, and utilizing a variety of different physical therapy techniques designed to allow one to maintain range of motion and flexibility. Anti-inflammatory and pain medications can also be useful when administered by a physician. The good news is that only on rare occasions will one’s Osteoarthritis cause one to become “disabled”, in which case having been diagnosed with Osteoarthritis could play a significant role in the outcome of one’s life insurance applicant.

Rheumatoid Arthritis Defined.

Rheumatoid Arthritis (RA) is a pre-existing medical condition defined as a chronic inflammatory disorder whereby one’s own immune system actively attacks one’s own tissues. In most cases, this damage will be confined to one’s joints, causing swelling, bone erosion, and joint deformity. In extreme cases, some individuals may even suffer from internal organ damage, which is another reason why life insurance companies will tend to be quite nervous about insuring those who have been diagnosed with this “type” of Arthritis.

Symptoms of Rheumatoid Arthritis may include:

- Pain and swelling in one’s joints, back, and muscle tissue.

- Overall stiffness, fatigue and/or malaise,

As well as physical deformities caused by the actual swelling of one’s joints or due to the physical “toll” taken out on its patients.

Unfortunately…

Similar to Osteoarthritis, there is no known cure for Rheumatoid Arthritis, so treatment options aim to reduce disease progression and alleviate pain. However, it is important to note that Rheumatoid Arthritis has been shown to decrease an individual’s life expectancy by up to 10-15 years. This is why most life insurance companies will ask a variety of questions about an individual’s case before making any decisions regarding their life insurance application.

What kind of information will the insurance companies ask me or be interested in?

If you’ve been diagnosed with osteoarthritis or rheumatoid arthritis, the life insurance company may ask you a range of questions to better understand your health status and any potential risks.

Some of the information they may ask about includes:

- Date of diagnosis: The life insurance company may ask when you were diagnosed with osteoarthritis or rheumatoid arthritis and how severe your symptoms were at the time.

- Treatment: The life insurance company may ask about any treatments you have received for your arthritis, such as medication, physical therapy, or surgery. They may also ask about the effectiveness of these treatments and whether you have experienced any side effects or complications as a result of the condition.

- Current health status: The life insurance company may ask about your current health status, including any ongoing medical conditions, medications you are currently taking, and any other health issues you have experienced.

- Lifestyle: The life insurance company may ask about your lifestyle habits, such as your diet, exercise routine, and use of tobacco or alcohol, as these can all potentially impact your health.

It’s important to be as honest and accurate as possible when answering these questions, as any discrepancies or omissions could affect the coverage provided by the policy.

Now at this point…

We usually like to take a moment and remind folks that nobody here at IBUSA has any kind of medical training, and we’re certainly not doctors.

All we are is a bunch of life insurance agents who just happen to be really good at helping folks with pre-existing medical conditions like Arthritis, find and qualify for the life insurance coverage that they are looking for.

So, let’s take a look at what kind of rates an individual who has been diagnosed with Arthritis might be able to qualify for!

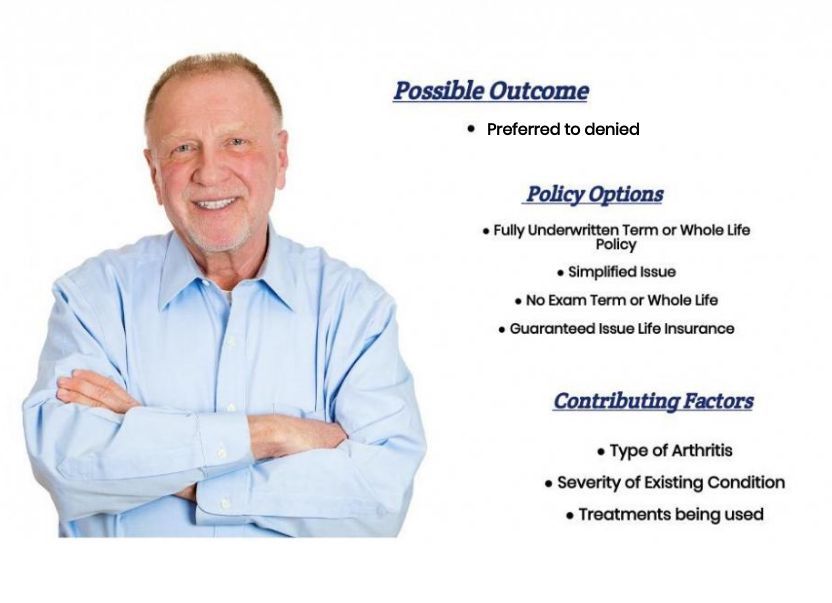

What “rate” can I qualify for?

If you have been diagnosed with Osteoarthritis, most life insurance companies will likely ask you a few questions about it during the underwriting process. However, unless your Osteoarthritis causes significant pain and prevents you from living a normal life, you can expect to qualify for the same rate you would have prior to the diagnosis. In fact, some individuals with Osteoarthritis may even qualify for a Preferred Plus rate.

On the other hand, if you have been diagnosed with Rheumatoid Arthritis, you may still be eligible for a traditional term or whole life insurance policy. However, your Arthritis is unlikely to be viewed as a normal part of aging, so most (if not all) life insurance companies will likely rate you as a high-risk applicant. They will closely examine your medications and the progression of your condition to determine its severity. In such cases, life insurance companies typically order medical records for review before making any decisions about your application.

Therefore, it’s impossible to know what kind of rate you may qualify for without first speaking with you. However, the good news is that IBUSA can help regardless of your situation, as we have extensive experience assisting people with pre-existing medical conditions like yours.

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions. But we also have access to dozens of different life insurance companies so that when it comes time to helping a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is exactly what you’re going to find here at IBUSA!

Now, will we be able to help out everyone who has been previously diagnosed with Arthritis?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Burial Life Insurance Companies as well so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available to you, just give us a call!