When finding the right life insurance coverage, the options can feel overwhelming. With so many companies vying for your attention, it can be challenging to determine which one will offer you the best protection for you and your loved ones. We understand that making this decision is an important one.

After all, we know that you want to choose a life insurance policy you can trust to provide financial security for your family in the event of your passing. That’s why we’ve carefully evaluated each company based on their reputation, financial stability, and customer satisfaction, among other factors, to bring you a comprehensive list of the best life insurance companies available.

To achieve a spot on this list, each company must have received high marks from at least two of the industry’s most reputable 3rd party rating agencies: A.M. Best, S&P, Moody’s, and Fitch.

So, sit back, relax, and let us help you find the life insurance coverage that will give you peace of mind, knowing that your loved ones will be cared for no matter what.

Top Rated Life Insurance Companies

| Company | A.M. Best | S&P | Moody's | Fitch |

|---|---|---|---|---|

| Northwestern Mutual | A++ | AA+ | Aaa | AAA |

| New York Life | A++ | AA+ | Aaa | AAA |

| Thrivent Financial | A++ | n/a | n/a | AA+ |

| Guardian Life | A++ | AA+ | Aa2 | AA+ |

| USAA Life | A++ | AA+ | Aa1 | n/a |

| Massachusetts Mutual | A++ | AA+ | Aa3 | AA+ |

| State Farm | A++ | AA | Aa1 | n/a |

| Minnesota Life | A+ | AA- | Aa3 | AA |

| Western & Southern Life | A+ | AA- | Aa3 | AA |

| Securian Life | A+ | AA- | Aa3 | AA |

| Metropolitan Life (MetLife) | A+ | AA- | Aa3 | AA- |

| Prudential (Pruco) Life | A+ | AA- | Aa3 | AA- |

| American United Life | A+ | AA- | n/a | n/a |

| State Life | A+ | AA- | n/a | n/a |

| Lafayette Life | A+ | AA- | n/a | AA |

| Banner Life | A+ | AA- | n/a | AA- |

| John Hancock | A+ | AA- | A1 | AA- |

| Pacific Life | A+ | AA- | A1 | |

| Lincoln National | A+ | AA- | A1 | A+ |

| Principal Life | A+ | A+ | A1 | AA- |

| Protective Life | A+ | AA- | A1 | A+ |

Why Does A Company’s Financial Rating Matter?

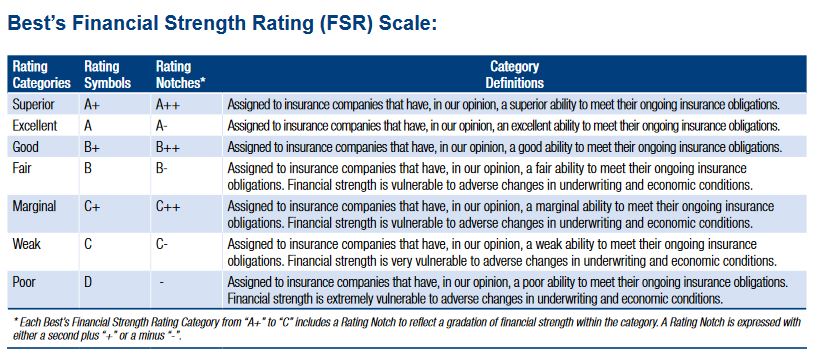

A life insurance company’s financial rating is important because it provides information on the company’s ability to meet its financial obligations and pay claims to policyholders. Higher-rated companies are considered more creditworthy and financially stable, meaning they have a stronger ability to pay out on life insurance claims.

This is important because choosing a life insurance policy is a long-term commitment, and policyholders want to know that their beneficiaries will receive the death benefit if they pass away. Financial ratings from top rating agencies, such as A.M. Best, S&P, Moody’s, and Fitch, provide an independent evaluation of a company’s financial strength and stability, making it easier for policyholders to make informed decisions about their life insurance coverage.

AM Best Financial Strength Rating Scale

Common types of life insurance

Life insurance comes in all shapes and sizes, each designed to fit your unique needs and goals. But if you’re feeling overwhelmed by the sheer number of options, don’t worry. Here are the most common types of life insurance to help you get started on your search for the perfect coverage:

- Term Life Insurance: As its name suggests, term life insurance covers a set period, typically 10, 20, or 30 years. It’s the most straightforward and affordable option, making it popular for those seeking coverage to secure their family’s future.

- Whole Life Insurance: Unlike term life insurance, whole life insurance covers your entire life. It also includes a savings component that builds cash value over time, allowing you to access these funds in the future if needed.

- Universal Life Insurance: This type of life insurance combines whole life insurance coverage with the flexibility of term life insurance. You can adjust your coverage amount and premium payments, making it easier to adapt to changes in your life.

- Variable Life Insurance: Similar to universal life insurance, variable life insurance allows you to allocate your premiums towards various investment options. This type of life insurance is more complex and may be a good choice for those with a background in investing.

No matter which type of life insurance you choose, it’s essential to research and find a company that aligns with your needs and goals. Happy hunting!

How much life insurance do I need?

Determining how much life insurance you need can feel like a daunting task. However, it’s important to take the time to figure it out because it will ensure that your loved ones are taken care of financially should anything happen to you. When calculating your life insurance needs, there are several factors to consider. The most important things to consider include your current and future expenses, debts, and income. It’s also a good idea to factor in any major upcoming expenses, such as a child’s college education or the costs associated with a wedding.

It can be helpful to sit down with a financial advisor to better understand how much life insurance you need. They can help you consider all your expenses, debts, and other financial obligations and estimate how much coverage you need. Another option is to use a life insurance calculator, which you can easily find online. Input your information, and the calculator will provide you with an estimate of how much life insurance you need.

Ultimately, the best way to determine how much life insurance you need is to take the time to assess your financial situation and future goals. This will give you a better understanding of what coverage you need to ensure your loved ones are financially protected.

What’s the best way to determine which life insurance company is right for me?

The best way to determine which life insurance company is right for you is to consider your needs and financial situation. So first, start by evaluating the amount of coverage you need, your budget, and the length of time you want the coverage to last. Then, research different life insurance companies and compare their products, financial stability, and customer service ratings.

It’s also important to consider any additional benefits or riders that may be available, such as accidental death coverage or living benefits. Finally, consider working with an independent insurance agent or financial advisor who can help you compare different options and help you make an informed decision on which life insurance company will have the best underwriting criteria to meet your needs.

After all, life insurance is something that you’re going to need to qualify for. This is why the best life insurance company for your neighbor might not be the “best” life insurance policy for you!

Factors considered when applying for life insurance.

When applying for life insurance, several factors are considered to determine the coverage amount and premium rate. These factors include:

- Age: Younger individuals are typically considered lower risk and thus receive lower premiums.

- Health: An individual’s current health and medical history play a significant role in determining the premium rate.

- Lifestyle: Habits such as smoking, excessive alcohol consumption, and high-risk hobbies can impact the premium rate.

- Occupation: Certain occupations are considered riskier and may result in higher premiums.

- Coverage amount: The amount of coverage requested will impact the premium rate.

- Term length: The length of the policy term will also impact the premium rate.

- Family history: An individual’s family history may also be considered.

- Previous felonies or misdemeanors can affect the outcome of one’s life insurance application.

- Driving record. Multiple speeding tickets, moving violations, and/or dui’s will be considered.

- Travel history. Insurance companies will discriminate against those who have travel plans to dangerous locations.

- Etc.

Pros and cons of owning a life insurance policy

Life insurance is an important financial product that provides peace of mind and financial protection to the policyholder and their family in case of their death. But, like any financial product, there are pros and cons before purchasing a life insurance policy.

Pros of Purchasing Life Insurance:

- Financial Protection: Life insurance provides a financial safety net for your loved ones in case of death. This can help cover funeral costs and outstanding debts and provide ongoing financial support for your family.

- Peace of Mind: Knowing that your loved ones will be taken care of in case of your death provides peace of mind, which can help you sleep better at night and reduce stress.

- Estate Planning: Life insurance can help pay off any estate taxes and probate costs, which can help ensure that your estate is distributed according to your wishes.

- Flexibility: Life insurance policies offer a wide range of coverage options, from term life insurance to whole life insurance, and can be tailored to your needs.

Cons of Purchasing Life Insurance:

- Cost: Life insurance policies can be expensive, especially for those older or in poor health. The cost of life insurance can make it difficult for some people to afford, especially if they are already on a tight budget.

- Complexity: Life insurance policies can be complicated and confusing, and it can be difficult to understand all the terms and conditions. This can make it a challenging decision when choosing a policy.

- Required to Keep Policy Active: To keep a life insurance policy in force, you must continue paying the premiums. If you stop paying, your coverage will end, and you will not receive any benefits.

- Limited Use: Life insurance benefits are only paid out if the policyholder dies. If the policyholder does not die, the policy will not provide any financial benefits, and the premiums paid will be lost.

Ultimately, purchasing a life insurance policy is a personal decision that should be carefully considered based on your needs and circumstances. It’s essential to weigh the pros and cons, understand your options, and choose a policy that meets your needs. Ultimately, life insurance can provide peace of mind and financial protection, but it’s important to understand the costs and limitations before purchasing.