In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after having been diagnosed with Hyperthyroidism or an Overactive Thyroid gland.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Hyperthyroidism or an Overactive Thyroid gland?

- Why do life insurance companies care if I have been diagnosed with Hyperthyroidism or an Overactive Thyroid gland?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Hyperthyroidism or an Overactive Parathyroid?

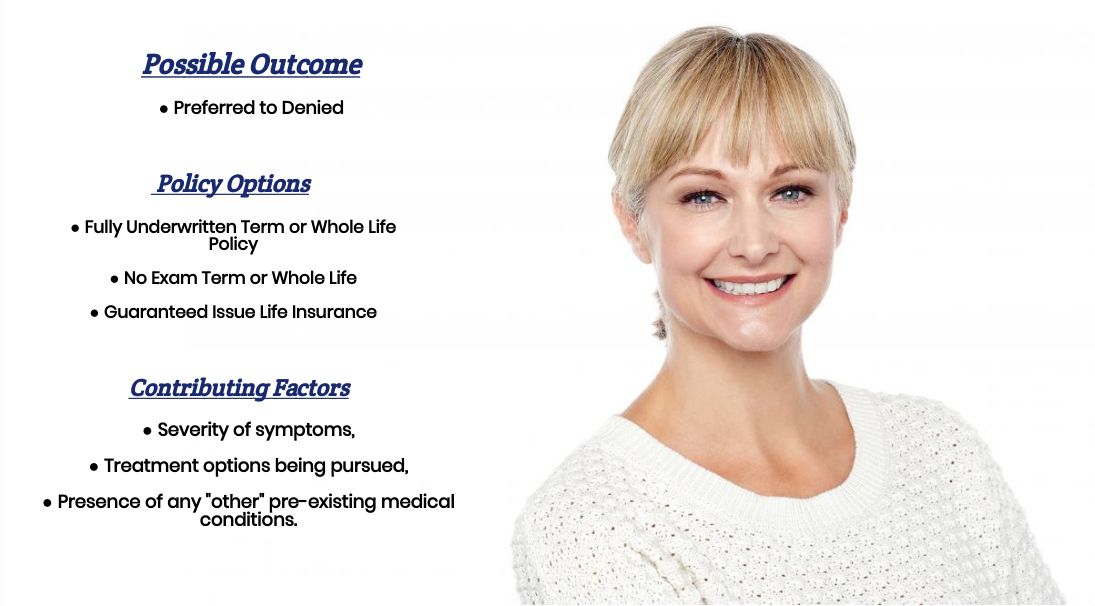

Yes, individuals who have been diagnosed with Hyperthyroidism can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, some folks may even be able to qualify for a no exam term life insurance policy at a Preferred rate!

The problem is…

That when an individual is either unable or unwilling to properly manage their Hyperthyroidism, it can, over time, cause someone to develop some pretty serious complications! This is why before being approved for a traditional term or whole life insurance, one should be prepared to answer quite a few questions about their Hyperthyroidism.

Why do life insurance companies care if I have been diagnosed with Hyperthyroidism or an Overactive Thyroid gland?

Because suffering from Hyperthyroidism is a condition that is usually easily managed, it’s fair to say that most of the best life insurance companies are less “worried” that someone might have been diagnosed with Hyperthyroidism and is more “concerned” with how well they are managing their condition. This is why individuals who have their Hyperthyroidism well under control will “potentially” still be considered eligible for a Preferred rate.

This is also why…

We wanted to take a moment and discuss what Hyperthyroidism is as well as highlight some of the most common symptoms of this disorder so that we can get a better understanding of what a life insurance underwriter will be looking for when making his or her decision about your life insurance application.

Hyperthyroidism Defined:

Hyperthyroidism is a condition in which the thyroid gland, a small butterfly-shaped gland located in the neck, produces too much thyroid hormone. The thyroid gland produces hormones that regulate the body’s metabolism, which is the process by which the body converts food into energy. When the thyroid gland produces too much hormone, it can cause the body’s metabolism to speed up, leading to a wide range of symptoms.

Symptoms of hyperthyroidism can include:

Weight loss, rapid heartbeat, sweating, and tremors. Hyperthyroidism is usually diagnosed through a blood test that measures the level of thyroid hormone and thyroid-stimulating hormone (TSH) in the body.

Serious complications of Hyperthyroidism may include:

- Cardiovascular disease,

- Osteoporosis,

- Thyrotoxic crisis.

Treatment for hyperthyroidism may include:

There are several treatment options for hyperthyroidism, depending on the specific cause and severity of the condition. Some common treatments for hyperthyroidism include:

- Medications: There are several medications that can help to control the production of thyroid hormone and reduce symptoms of hyperthyroidism. These may include beta blockers, which can help to control rapid heartbeat and tremors, and antithyroid medications, which can help to reduce the production of thyroid hormone.

- Radioiodine therapy: This treatment involves taking a small dose of radioactive iodine, which is absorbed by the thyroid gland and destroys the cells that produce thyroid hormone. This can help to bring the thyroid gland back to a normal level of hormone production.

- Surgery: In some cases, it may be necessary to remove the thyroid gland surgically. This is typically done in cases of severe hyperthyroidism or when other treatments are not effective.

What kind of information will the insurance companies ask me or be interested in?

Insurance companies may ask you a variety of questions about your hyperthyroidism when you apply for coverage or when you are making a claim. Here are some examples of the types of information that insurance companies may be interested in:

-

- Your medical history: The insurance company may ask about your past and current medical conditions, including any previous diagnoses or treatments for hyperthyroidism.

- Your medications: The insurance company may ask about the medications you are taking to treat your hyperthyroidism, including the dosage and frequency of use.

- Your symptoms: The insurance company may ask about the symptoms you are experiencing as a result of your hyperthyroidism, and how these symptoms are affecting your daily life.

- Your healthcare provider: The insurance company may ask about the healthcare provider(s) you are seeing for your hyperthyroidism, including their name, specialty, and contact information.

What rate (or price) can I qualify for?

As you can see, there are a lot of factors that can come into play when trying to determine what kind of “rate” someone who has been diagnosed with Hyperthyroidism can qualify for. This is why it’s pretty much impossible to know what kind of “rate” you might be able to qualify for without first speaking with you directly.

That said, however…

There are a few “assumptions” that we can make about those who have been diagnosed with Hyperthyroidism that are applying for a traditional term or whole life insurance policy that will “generally” hold true.

For example…

If you are able to demonstrate that your Hyperthyroidism is well under control and that you’re not currently suffering from any symptoms of your disease, it’s reasonable to assume that you would “theoretically” still be considered eligible for a Preferred rate assuming that you would otherwise be able to qualify for such a rate.

As for the rest…

Of those who may not have their Hyperthyroidism totally under control or who may still be suffering from symptoms related to their disease, not all hope is lost. It just means that you probably won’t be able to qualify for a Preferred rate. It may mean that you may only be able to qualify for a Standard or “sub-standard” rate.

The good news is…

That regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy that they can qualify for.

This brings us to the last topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that usually the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to helping a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is exactly what you’re going to find here at IBUSA!

Now, will we be able to help out everyone who has been previously diagnosed with Hyperthyroidism?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well so that in the event that someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.