In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after having been diagnosed with Angioneurotic Edema.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Angioneurotic Edema?

- Why do life insurance companies care if I have been diagnosed with Angioneurotic Edema?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Angioneurotic Edema?

Yes, individuals who have been diagnosed with Angioneurotic Edema can and often will be able to qualify for a traditional term or whole life insurance policy. The problem will be that because Angioneurotic edema is a “genetically” linked form of angioedema or Quincke’s disease, at times you may find that some life insurance agents aren’t going to be totally familiar with this condition and therefore may not know how an individual life insurance company is going to “underwrite” this condition.

A situation that is only exacerbated by just how rare Angioneurotic Edema is.

Why do life insurance companies care if I have been diagnosed with Angioneurotic Edema?

At the end of the day, Angioneurotic edema is basically a medical condition that causes individuals to suffer from edema that is triggered by an allergy. An allergy that is usually linked to some kind of environment trigger such as:

- Animal dander,

- Pollen,

- Medication or drugs,

- Certain foods,

- Etc, etc…

What’s unique about…

Being diagnosed with Angioneurotic edema vs traditional Angioedema or Quincke’s disease is that the “cause” of Angioneurotic edema is directly linked to a genetic trait whereby an individual is born lacking a particular inhibitor protein (specifically the C1 esterase inhibitor) that prevents the normal activation of a wave of particular proteins that prevents the body from “over reacting” to certain stimuli.

And…

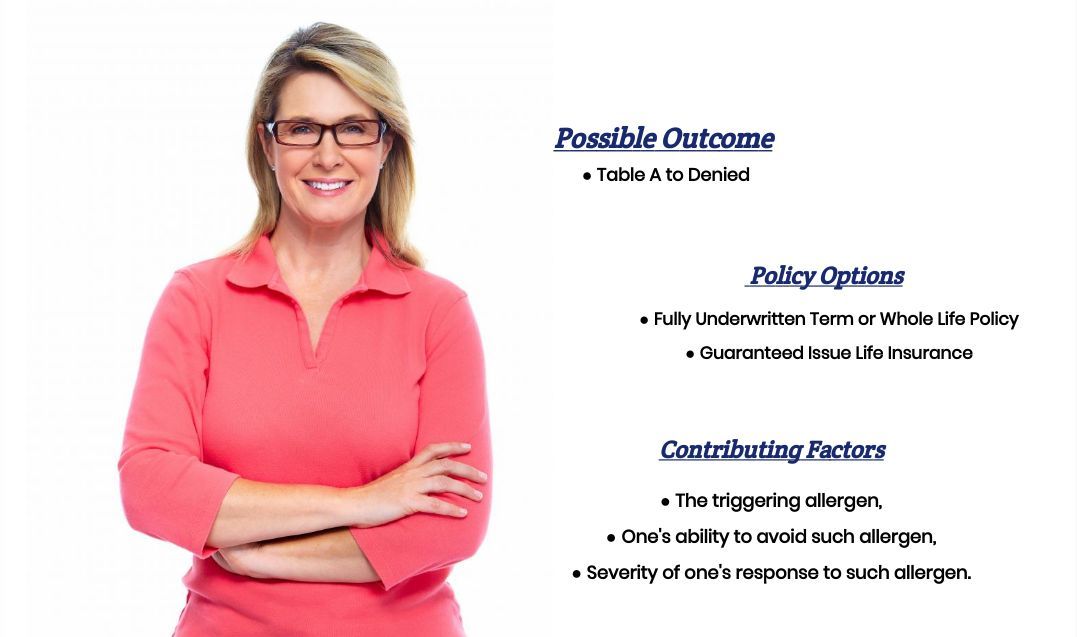

Any time you have a situation where an individual may be considered at risk of suffering from some kind of allergic reaction, what you’re going to find is that most life insurance companies are going to become interested in that fact! This is why, prior to getting approved for a traditional term or whole life insurance policy, most (if not all) life insurance companies are going to want to know more about your condition and just how “serious” it might be.

This will hold true…

Regardless of whether your angioedema is genetically linked like in the case of angioneurotic edema or just a particular “quirk” that you may have to a certain environmental factor such as traditional angioedema might be.

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked may include:

- When were originally diagnosed with angioneurotic edema?

- Who diagnosed your angioneurotic edema? A general practitioner or a specialist?

- What symptoms led to your diagnosis?

- Do you know what “triggers” your allergic reactions?

- Are you currently taking any prescription medications to help you treat/reduce your allergic reactions?

- Have you been hospitalized for any reason within the past 2 years?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

Now at this point…

It’s probably a good time to remind folks that we here at IBUSA are not medical professionals, and we’re certainly not doctors. All we are is a bunch of life insurance agents who just happen to be really good at helping folks with all sorts of pre-existing medical conditions find and qualify for life insurance.

Which means that…

If you looking for a life insurance policy, you’ve definitely come to the right place, but if you’re looking for medical advice, this would be a horrible place to seek out information and you really ought to give your current doctor a call or look for one in your community! And with that said, let’s get back to the question at hand which is…

What rate (or price) can I qualify for?

Typically, what you’re going to find is that if you have been diagnosed with Angioneurotic edema, because it is a “genetically linked” disease, most life insurance companies are going to consider you a “higher” risk applicant right from the start.

Which is basically,

Another way of saying that the “best” rate that you’re likely to be able to qualify for would be a Standard or “normal” rate but in most cases will probably only be a “sub-standard” or high risk “table rate”. From there, it’s really going to come down to “what” triggers your allergic reaction and how “serious” your reactions are.

For example…

If it turns out that you are only mildly allergic to cat dander, chances are you will be able to qualify for a pretty “high” table rate which means that you life insurance premium wouldn’t be all that expensive compared to someone who might suffer from severe reactions to “pollen” or “exhaust fumes” which would be much more difficult to avoid.

This is why…

While we may know “generally” what kind of rate that you might be able to qualify for based on your pre-existing medical condition diagnosis, without actually speaking with you directly and getting a better idea about you “specifically” it really is impossible to know for sure what you may or may not be able to qualify for. This is why, we would encourage anyone considering purchasing a life insurance policy after having been diagnosed with angioneurotic edema to give us a call prior to actually applying for a life insurance policy with another company.

Which bring us to the last topic that we wanted to take a moment and discuss with you here today which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that usually the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions, but also have access to dozens of different life insurance companies so that when it comes time to helping a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is exactly what you’re going to find here at IBUSA!