In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after having been diagnosed with Ankylosing Spondylitis or Bechterew’s disease.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Ankylosing Spondylitis?

- Why do life insurance companies care if I have been diagnosed with Ankylosing Spondylitis?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Ankylosing Spondylitis?

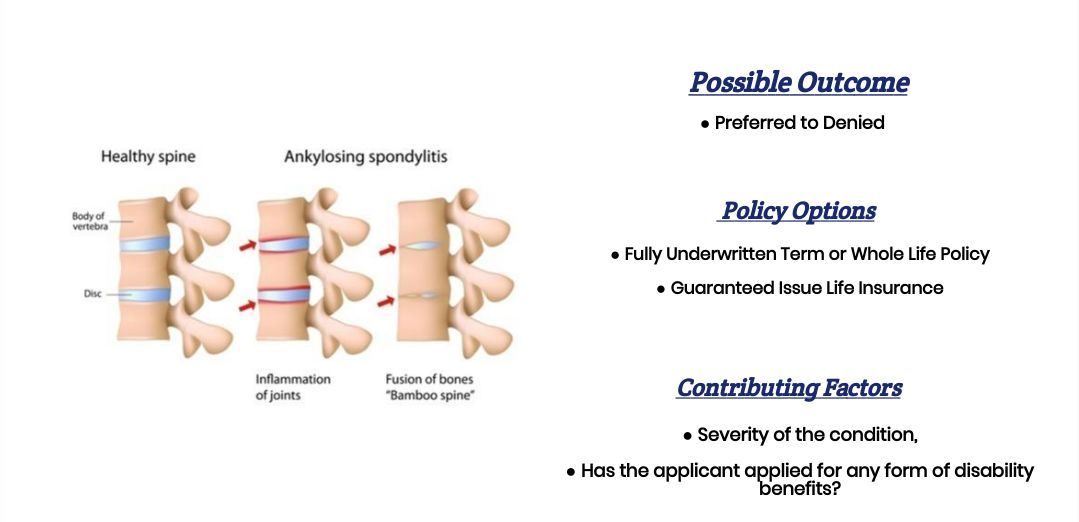

Yes, individuals who have been diagnosed with Ankylosing Spondylitis can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, you may even be eligible for a No Exam Term Life Insurance Policy at a Preferred rate in some situations.

Why do life insurance companies care if I have been diagnosed with Ankylosing Spondylitis?

There are two reasons why a life insurance company will “care” if an individual has been diagnosed with Ankylosing Spondylitis. The first reason is that, in some cases, it can become a debilitating medical condition that can become so severe that an individual isn’t able to live what one might consider a “normal” life.

The second reason why…

A life insurance company might “care” if an individual has been diagnosed with Ankylosing Spondylitis because it is a condition that can cause one to suffer from pain. And, any time you have an individual diagnosed with a chronic disease known to cause pain, life insurance underwriters will become nervous about any potential pain (narcotic) medications that might be used/abused.

This is why…

Before being approved for a traditional term or whole life insurance policy, most (if not all) of the best life insurance companies are going to want to ask you a series of medical questions about your Ankylosing Spondylitis so that they can have a better idea about how “serious” your condition is and how “concerned” they should be about taking you on as a new client.

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll likely be asked may include:

- When were you first diagnosed with Ankylosing Spondylitis?

- Who diagnosed your Ankylosing Spondylitis? A general practitioner or a specialist?

- What symptoms led up to your diagnosis?

- What treatment options are you currently pursuing?

- What medications (if any) have you been prescribed?

- Are you presently taking any prescription pain medications?

- Have any of your medications changed over the past 12 months?

- Do you have any “issues” with your driving record? Issues such as multiple moving violations, a DUI, or a suspended license?

- Have you ever been convicted of a felony or misdemeanor?

- Do you suffer from any history of drug or alcohol abuse?

- Are you currently working?

- In the past 12 months, have you applied for or received any form of disability benefit?

Now, at this point in our discussion, we usually remind folks that nobody here at IBUSA is a medical professional, and we’re certainly not doctors. All we are is a bunch of life insurance agents passionate about helping people find and qualify for the “type” of life insurance policy they are looking for.

Which means that…

If you have any specific medical questions or are looking for medical advice, we’ve got to warn you that you won’t get that from us. But if you’re trying to find the “best” life insurance policy you can qualify for, you’re in luck because that’s exactly what we’re trained to do!

Now, let’s dive in and start discussing what rates you might qualify for.

What rate (or price) can I qualify for?

As you can see, many factors can come into play when it comes time to determine what kind of “rate” an individual diagnosed with Ankylosing Spondylitis can qualify for. This is why it’s pretty much impossible to know for sure what kind of “rate” you might be able to qualify for without first speaking with you for a few minutes.

That said, however…

We can tell you that Ankylosing Spondylitis is a pre-existing medical condition that is NOT always discriminated against. In other words, simply having been diagnosed with Ankylosing Spondylitis doesn’t AUTOMATICALLY cause you to be considered a “high-risk” applicant.

Instead, should you choose to apply with the “right” life insurance company that will tend to be more lenient towards those previously diagnosed with Ankylosing Spondylitis. What you’re likely to find is that they will be more interested in “how” your diagnosis is affecting your quality of life rather than just the fact that you have been diagnosed with this somewhat common disorder.

Which means that…

If you have been diagnosed with Ankylosing Spondylitis and its effects haven’t kept you from being able to live a “normal” life. It hasn’t prevented you from being able to work or carry on a healthy and active lifestyle; there is a good chance that you ought to be able to qualify for a traditional term or whole life insurance policy. There is a good chance that you may be eligible for a Standard or better rate!

But if your condition is preventing you from working or being able to live a “normal” life. In that case, chances are you will have a more difficult time qualifying for a traditional term or whole life insurance policy. You may still be able to qualify for coverage, but now you’re going to want to be more selective with which life insurance company you choose to apply with.

This brings us to the last topic that we wanted to take a moment and discuss here in this article, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

Seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is precisely what you’ll find here at IBUSA!

Now, can we help out everyone previously diagnosed with Ankylosing Spondylitis?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available, call us!