In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after having suffered from non-cardiac Chest Pain.

- Can I qualify for life insurance if I having suffered from non-cardiac Chest Pain?

- Why do life insurance companies care if I have suffered from non-cardiac Chest Pain?

- What kind of information will the insurance companies ask me or be interested in?

- What “rate” can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have suffered from non-cardiac Chest Pain?

Yes, individuals can and often will be able to qualify for a traditional term or whole life insurance policy after they have been diagnosed with Non-Cardiac Chest Pain or Chest Pain that is not directly related to any “issues” having to do with your heart! In fact, many may even be able to qualify for a no-medical exam life insurance policy at a Preferred rate!

Why do life insurance companies care if I have suffered from non-cardiac Chest Pain?

It’s pretty safe to say that any time an individual claims that they are suffering from “chest pain” most (if not all) of the best life insurance companies (in our opinion) are going to be pretty interested in learning more. After all, while there are many different “kinds” of pre-existing cardiovascular medical conditions that one can be suffering from and still be able to qualify for a traditional life insurance policy, it’s not like a life insurance company is going to want to approve of someone’s application if they are currently suffering from symptoms related to myocardial infarction (heart attack)!

This is why…

It’s important to understand that there are a lot of reasons why someone might suffer from “Chest Pain” that have nothing to do with their heart!

Reasons such as:

- Gastroesophageal Reflux Disease or GERD,

- Certain lung conditions/diseases,

- Stress,

- Anxiety,

- Depression,

- Gastrointestinal issues,

- Etc…

It’s also why…

Prior to being approved for a traditional term or whole life insurance policy, most (if not all) life insurance companies will want to ask you a series of medical questions about “why” you have been diagnosed with Chest Pain and fully understand what the underlying pre-existing medical condition is that is causing you to suffer from this condition.

“Which brings us to an important point that we think we ought to mention.”

First…

If you think you have a medical issue, don’t use the internet to try and diagnose yourself. After all, if you do and you’re correct, you’re still going to need to see the doctor, and if you’re wrong, the time you spend being you’re on doctor could really cause great harm to yourself!

Second…

Nobody here at IBUSA is medically trained and we’re certainly not doctors. All we are is a bunch of life insurance agents who just happened to be really good at helping individual find and qualify for the life insurance that they’re looking for. So please don’t mistake any of the medical information that we talk about as medical advice because it’s not!

We’re just…

Trying to “prep” you for what it might be like to apply for a life insurance policy after you have been diagnosed with non-cardiac Chest Pain… that’s it! This brings us to our next topic, which is…

What kind of information will the insurance companies ask me or be interested in?

Common questions you might be asked may include:

- When were you first diagnosed with non-cardiac chest pain?

- How frequently do you suffer from non-cardiac chest pain?

- Who has diagnosed the cause of your non-cardiac chest pain? A general practitioner or a cardiologist?

- Has the underlying cause of your chest pain been determined? If so, what is the cause?

- Have you ever been diagnosed with heart disease, diabetes, or cancer?

- Have you ever suffered from a heart attack or stroke?

- Have any of your immediate family members (mother, father, brother, or sister) ever been diagnosed with heart disease or suffered from a heart attack or stroke?

- Are you currently taking any prescription medications?

- Has your primary care physician recommended that you receive any kind of surgical procedures in the near future?

- In the past 2 years, have you been admitted to a hospital for any reason?

- In the past 12 months, have you used any tobacco or nicotine products?

- What is your current height and weight?

- Have you ever had an EKG performed or a cardiac stress test?

- Are you currently working?

- In the past 12 months, have you applied for or received any form or disability benefits?

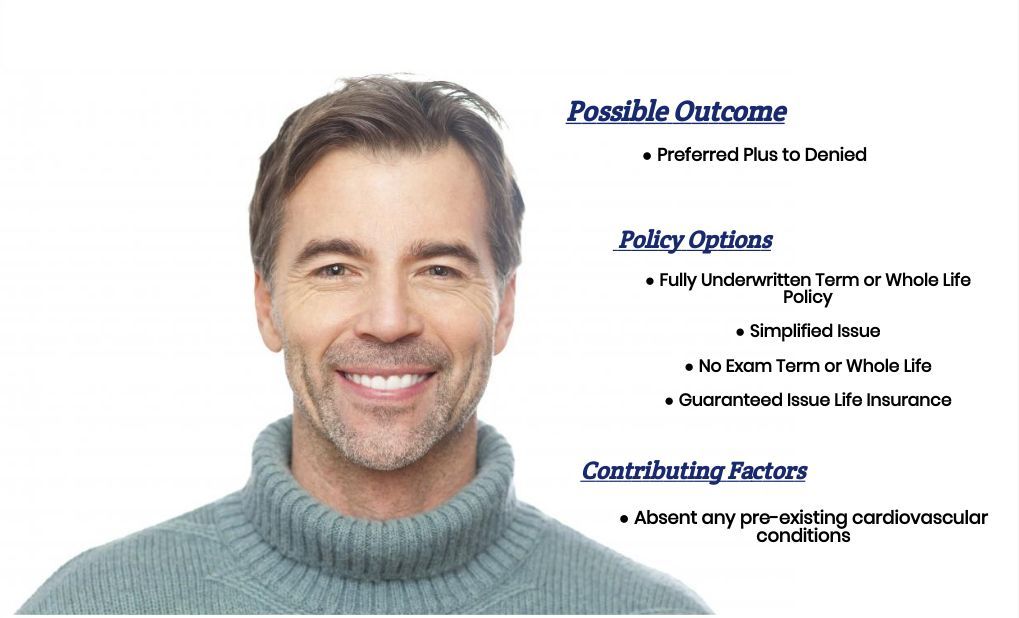

What “rate” can I qualify for?

As you can see, when it comes time to understand what kind of “rate” an individual can qualify for after having been diagnosed with non-cardiac chest pain, what you’re generally going to find is that “condition” is going to be treated more as a “symptom” of some other condition rather than as an “actual” pre-existing medical condition on its own.

Which means that…

What’s going to matter the most is “why” are you suffering from non-cardiac chest pain, and “how” is that underlying pre-existing medical condition treated by most life insurance companies? Fortunately, we here at IBUSA have a ton of experience working with folks with a wide variety of pre-existing medical conditions and have taken it upon ourselves to write articles about many of them, which you can find by visiting our PRE-EXISTING MEDICAL CONDITIONS page.

There you will find…

This article provides much more specific information focusing on the “actual cause” of your chest pain, which will ultimately determine the outcome of your life insurance application. This just leaves us with the last topic that we wanted to discuss here, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance professional who will work as an advocate for them.

Such an agent…

Will not only help guide you through the application process but also be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because, after all, it really doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly…

You’ll want to make sure that you’re completely honest with your life insurance agent prior to applying for coverage. By doing so, you will be helping him or her narrow down what options might be the “best”

Now, will we be able to help out everyone who has been previously diagnosed with “chest pain”?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Burial Life Insurance Companies as well so that in the event that someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to explore your options, just give us a call!