In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been diagnosed with Depression.

But before we can do that…

We do need to point out that there are a lot of “types” of Depression that one can be diagnosed with, including:

- Major Depression Disorder (MDD)

- Persistent Depressive Disorder

- Bipolar disorder,

- Postpartum Depression

- Premenstrual Dysphoric Disorder (PMDD)

- Seasonal Affective Disorder

- Atypical Depression

Each type of these “types” of depression will usually have its own unique set of symptoms and characteristics. That’s why most life insurance companies consider each type of depression a separate pre-existing medical condition.

Fortunately, here at IBUSA, we have good news for you. Even though most top-rated life insurance companies consider each type of depression a unique condition, many of them follow similar underwriting rules and guidelines. This applies to all types of policies, including no medical exam life insurance policies.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been diagnosed with Depression?

- Why do life insurance companies care if I’ve been diagnosed with Depression?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been diagnosed with Depression?

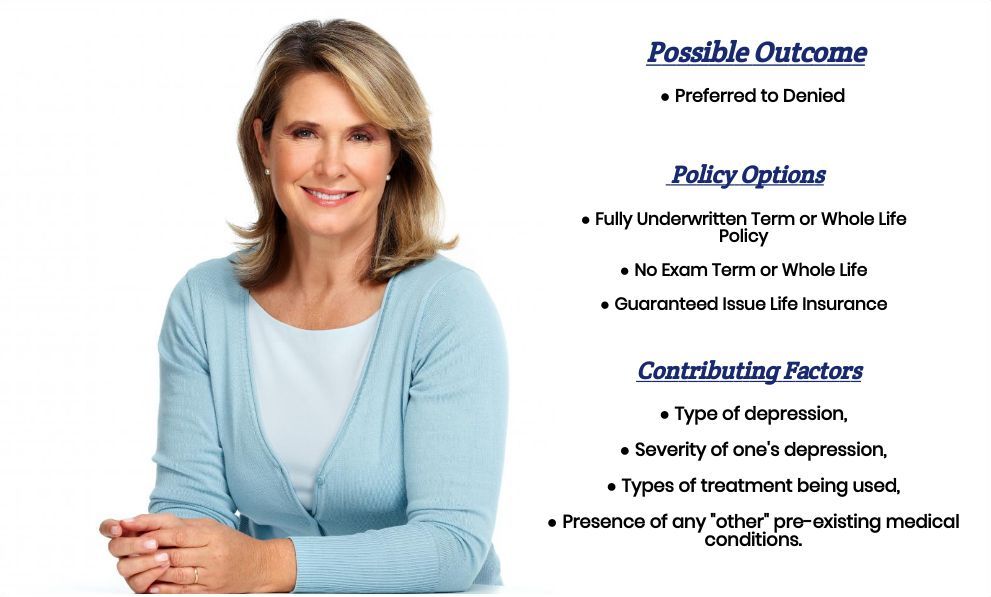

Yes, it is possible to qualify for life insurance after being diagnosed with depression, but it will depend on several factors such as the type and severity of depression, the treatment you have received, and how well you have managed your condition.

In some cases, if your depression is mild and well-controlled with medication or therapy, you may still be able to qualify for a standard life insurance policy at a reasonable rate. However, if your depression is severe or you have a history of hospitalization or suicide attempts, you may be considered a higher risk and may only qualify for a policy with higher premiums or more limited coverage.

It’s important to note that each insurance company has its own underwriting guidelines, so it’s always a good idea to shop around and compare quotes from multiple insurers to find the best coverage for your specific situation. Additionally, working with a licensed insurance agent can help you navigate the application process and find the best policy for your needs.

Why do life insurance companies care if I’ve been diagnosed with Depression?

The main reason why life insurance companies are going to “care” if you have been diagnosed with “Depression” is that, for some, Depression can be a very serious medical condition and one that people should not take lightly!

The problem is…

As of 2016, nearly one in six Americans were taking some form of psychiatric medication, with the majority being antidepressants. While some of these individuals may be suffering from serious depression, it is likely that many are taking medication to help them manage normal stressors in life.

Now…

Please don’t misunderstand us. We don’t want to imply that it’s a bad thing. All we’re trying to point out is that many people who have been diagnosed with depression and are taking medications to treat it may still be eligible for traditional life insurance, and some may even qualify for a preferred rate.

It’s important to remember that having depression and taking medication to manage it does not necessarily mean that you’re ineligible for life insurance or that you will have to pay high premiums. Life insurance companies have different underwriting guidelines, and they will consider several factors, including the type and severity of your depression, your medical history, and your overall health.

In some cases, if your depression is well-managed and under control with medication, you may still be considered a low-risk applicant by the insurance company. This could lead to more affordable premiums and better coverage options.

“Which is great!”

We just need to identifying which type of depression you have and it’s severity so that we can help you determine how an individual life insurance underwriter might view your condition and ultimately affect your premiums.

Therefore, we’d like to take a moment and briefly describe some of the most common types of depression. By understanding these diagnoses, you’ll be better prepared when discussing your condition with an underwriter.

Types of Depression Defined:

-

Major Depressive Disorder (MDD).

The term Major Depressive Disorder is one that is usually reserved for those folks who would be considered “clinically depressed” these individuals will typically experience symptoms such as:

- Lack of interest in activities that they once enjoyed,

- Unexplained weight loss,

- Changes in sleep patterns,

- Fatigue,

- Low self-esteem,

- Feelings of worthlessness,

- Suicidal ideation,

- Suicidal attempts,

- Etc…

These are the “types” of Depression that will be the biggest concern for most life insurance companies.

-

Persistent Depressive Disorder.

Persistent depressive disorder, also known as dysthymia, is a type of depression that is characterized by a low, depressed mood that persists for at least two years.

People with dysthymia may experience symptoms similar to those of major depression, but the symptoms are usually less severe and more chronic. They may also have periods of time where their symptoms improve, but the overall course of the illness is one of long-term low mood.

Dysthymia can interfere with daily functioning and can be severely disabling. Symptoms may include:

- Loss of interest in activities that they once enjoyed,

- Low self-esteem,

- Feelings of hopelessness,

- Changes in appetite,

- Difficulty concentrating,

- Sleeping too much,

- Etc…

Individuals suffering from this “type” of Depression will still typically be eligible for a traditional term or whole life insurance policy, provided that their “bouts” of Depression don’t happen so frequently that it is preventing them from being able to live a “normal” life.

-

Bipolar Disorder.

Bipolar disorder, also known as manic-depressive illness, is a mental health condition characterized by extreme mood swings. People with bipolar disorder experience periods of elevated or irritable mood, energy, and activity levels, known as manic or hypomanic episodes, as well as periods of depressed mood.

During a manic episode, a person may feel very high or euphoric, have a lot of energy, and may engage in risky or reckless behavior. During a depressed episode, a person may feel very low, have difficulty with daily activities, and may experience changes in appetite, sleep, and energy levels.

Manic symptoms may include:

- Elevated mood swings including anger, anxiety, apprehension, euphoria, guilt, etc…

- Increase risk-taking,

- Difficulty concentrating,

- False belief of superiority or invincibility,

- Etc…

Depression symptoms may include:

- Fatigue,

- Sleeping disorders,

- Low self-esteem,

- Anxiety and/or irritability,

- Difficulty concentrating,

- Etc…

Bipolar disorder can be severe which is why it’s often difficult for some individuals who have been diagnosed with bipolar disorder to qualify for coverage, particluarly if they are applying for no medical exam life insurance policy.

That said however, individual’s suffering from this “type” of Depression may still be able to qualify for coverage, provided that their “mood swings” do not happen too frequently and they haven’t engaged in any “extracurricular” activities that can often be associated with increase risk-taking that may prevent them from being able to qualify for a traditional life insurance policy.

-

Postpartum Depression.

Postpartum depression is a type of depression that can occur after giving birth. It is a serious and common condition that affects about 1 in 9 women in the United States. Symptoms of postpartum depression may include feeling overwhelmed, sad, anxious, or unable to bond with the baby. Some women may also have thoughts of hurting themselves or the baby.

Unfortuately, this type of depression is often exacerbated by the sheer amount of pressure that the mother is likely feeling in addition to complicated feelings of guilt and shame for not feeling elated about the birth or their new child.

Fortunately…

This condition has received a considerable amount of attention as of late, which has helped shed light it and make folks who do experience this condition realize that they are not alone and that there is no reason to feel guilty about having these “kinds” of feelings!

The good news…

That postpartum Depression will usually go away and will not be something that someone will need to deal with for their entire life. The bad news that nearly 50% of individuals diagnosed with postpartum Depression will still show signs of their Depression after one year and 30% even after three years.

It’s also important to point out that this is not a medical condition that one should try and treat on their own. Now, if you are experiencing symptoms of this condition, you should reach out for help right away because not only will it help you feel better, it will also probably improve your chances at being able to qualify for a better life insurance rate!

-

Seasonal Affective Disorder (SAD).

Seasonal Affective Disorder or SAD is a very real medical condition that is characterized by feeling depressed and sleepy during the winter, which is usually coupled with weight gain. Then once spring comes around, you may begin to feel completely normal.

It is believed…

That this condition is caused by a disturbance in one’s normal circadian rhythm of the body, which is known to be affected by the amount of light entering into one’s eyes. A theory supported by statistical diagnostic data shows that people living further from the equator are much more likely to develop SAD vs. those living in much warmer/sunnier climates.

The good news…

For these “kinds” of applicants is that this condition is well documented, and most life insurance companies aren’t going to discriminate against you for having been diagnosed with it provided that your “symptoms” of this disorder aren’t too severe!

-

Atypical Depression.

Is a “type” of Depression that might associate with someone who seems to be a bit of a “downer” but can snap out of it when something good happens. For example, someone like this might feel depressed but can get excited about the fact that their “home team” won a game, or that their favorite TV show is on, then once it is over, go back to feeling “down”.

Symptoms may include:

- Excessive eating or weight gain,

- Excessive sleep,

- Feelings of fatigue,

- Intense sensitivity of rejection,

- Moody,

Folks suffering form this condition may just feel like nothing works out for them or a sense that everything just seems worse than it actually is.

The good news is…

That with the proper medication, this “type” of Depression can often be easily improved and isn’t generally a disorder that causes a lot of life insurance companies to worry too much!

What kind of information will the insurance companies ask me or be interested in?

When applying for life insurance with a history of depression, the insurance company will typically ask you to provide detailed information about your condition. Some of the information that the insurance company may ask for includes:

- Type of depression: The insurer may want to know the specific type of depression you have, such as major depressive disorder or persistent depressive disorder.

- Treatment history: The insurance company may ask about the type of treatment you’ve received for your depression, such as medication or therapy.

- Severity of your condition: The insurer may ask about the severity of your depression and whether you’ve been hospitalized or had suicidal thoughts.

- Duration of your condition: The insurer may ask how long you’ve been diagnosed with depression and how long you’ve been undergoing treatment.

- Frequency of appointments: The insurer may want to know how often you see your mental health provider and whether you have regular check-ups.

- Medications: The insurer may ask about any medications you’re taking to manage your depression and any other medical conditions you have.

- Current symptoms: The insurer may ask about your current symptoms, including how often they occur and how they affect your daily life.

You may also be asked specific questions which might not seem to be related to your diagnosis. Questins such as:

- In the past two years, have you been hospitalized for any reason?

- Do you have a history of drug or alcohol abuse?

- Have you ever been convicted of a felony or misdemeanor?

- Do you have any issues with your driving record? Issues such as multiple moving violations a DUI or a suspended license?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

It’s essential to answer these questions honestly and provide accurate information to the insurer. Disclosing all relevant information upfront can help avoid any surprises or issues later in the underwriting process.

What rate (or price) can I qualify for?

Now as you can see, there are a lot of factors that can come into play when trying to determine what kind of “rate” an individual might be able to qualify for after having been diagnosed with Depression. Which is why, it’s pretty much impossible to know for sure what kind of “rate” you might be able to qualify for without first speaking with you directly.

That said, however, there are a few “assumptions” that we can make that will generally hold true that may hopefully provide you with a general idea about what kind of “rate” you might be able to expect.

For example, if you are someone who read through this list of questions and became “shocked” by what was asked, chances are your just one of the millions of individuals who, on occasion, fell a little “down”.

And as a result…

Your primary care physician prescribed you an antidepressant and “boom” all of a sudden, you have been “diagnosed” with Depression.

For folks like these, what we can tell you is that most life insurance companies are going to understand your situation and not discriminate against you too severely and still consider you potentially eligible for a Preferred rate.

Now for the rest…

Of you who read through these questions and found yourself answering “YES” to a lot of the questions, we don’t want to make you feel like there’s no hope because the truth is, while you may not be able to qualify for a Preferred rate, there’s a halfway decent chance that you may be able to qualify for a “standard” or “normal” rate which is what most people who haven’t been diagnosed with any kind of pre-existing medical condition end up qualifying for anyways!

And the good news is…

That regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy that they can qualify for. Which brings us to the last topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

Here are some steps you can take to help ensure that you get the best life insurance coverage for you after being diagnosed with depression:

- Be honest and upfront about your medical history: When applying for life insurance, be honest and transparent about your history of depression and any treatment you’ve received. Providing accurate information upfront can help ensure that you get the best possible coverage and avoid any issues down the road.

- Work with an experienced insurance agent or broker: An experienced agent or broker can help you navigate the underwriting process and find the right insurance policy for your needs. They can also help you compare rates and coverage from multiple insurers, which can save you time and money.

- Shop around: Don’t just settle for the first policy you come across. Take the time to shop around and compare rates and coverage from multiple insurance companies. This can help you find the best policy at the most affordable rate.

- Consider working with an insurer that specializes in mental health coverage: Some insurance companies specialize in providing coverage for individuals with mental health conditions, including depression. These insurers may be more likely to offer competitive rates and more comprehensive coverage than traditional insurers.

- Improve your overall health: Maintaining good overall health can help you qualify for better rates on your life insurance policy. This includes things like exercising regularly, eating a healthy diet, getting enough sleep, and avoiding smoking and excessive alcohol consumption.

By taking these steps, you can help ensure that you get the best life insurance coverage possible after being diagnosed with depression.

Now, will we be able to help out everyone who has been previously diagnosed with Depression?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many Guaranteed Issue Life Insurance Companies as well so that in the event that someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available to you, just give us a call!