In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with Biliary Cirrhosis, Primary Biliary Cirrhosis (PBC), or Primary Biliary Cholangitis.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been diagnosed with Biliary Cirrhosis?

- Why do life insurance companies care if I’ve been diagnosed with Biliary Cirrhosis?

- What kind of information will the insurance companies ask me or be interested in?

- What “kind” of life insurance can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been diagnosed with Biliary Cirrhosis?

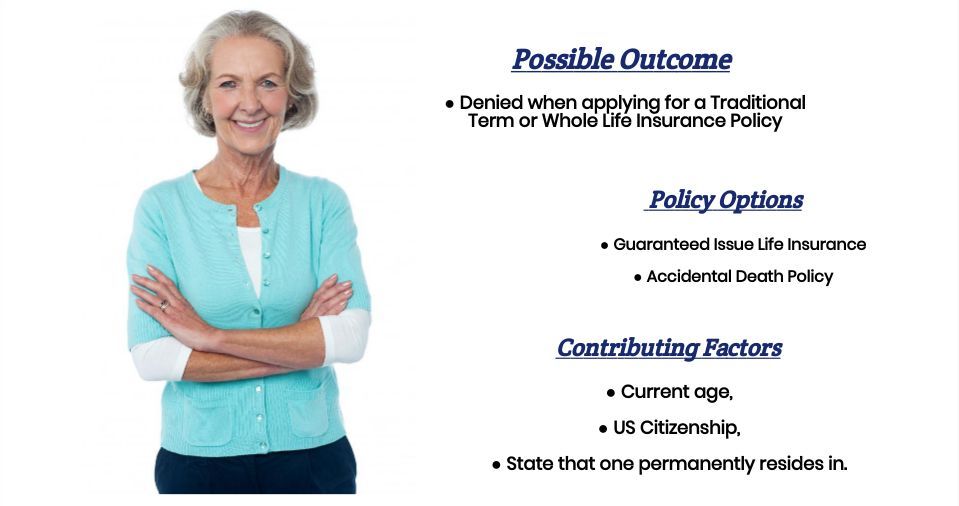

Unfortunately, being diagnosed with Biliary Cirrhosis typically means that an individual will automatically be declined for any “traditional” term or whole life insurance policy. This would also include any term life insurance policy without a medical exam.

This means that if an individual is determined to find some way to purchase insurance coverage, they will need to seek out some “alternative” product, which won’t require them to have to “medically” qualify.

Why do life insurance companies care if I’ve been diagnosed with Biliary Cirrhosis?

To understand why a life insurance company will if an individual has been diagnosed with Biliary Cirrhosis, it makes sense first to look atiliary Cirrhosis and understand what will likely be diagnosed with it!

Biliary Cirrhosis Defined:

Biliary Cirrhosis or Primary Biliary Cirrhosis (PBC) is a chronic liver disease caused by bile buildup within the liver (cholestasis). This “bile,” used to aid digestion and help get rid of cholesterol and worn-out red blood cells, is essential to normal liver function; however, too much stored up in the liver can lead to permanent scarring and, ultimately, Cirrhosis.

Symptoms may include:

- Jaundice or yellowing of one’s skin,

- Fatigue,

- And sometimes itching

The problem is that a lot of folks who suffer from this condition won’t know that they have it until significant damage has occurred. This is why the typical survival rate once an individual has been diagnosed is only about ten years. The good news is that while this pre-existing medical condition isn’t curable yet, the damage caused by this disease can be slowed with the proper medical treatment. This is a good thing, but not good enough for most (if not all) life insurance companies to want to take the risk of actually approving an individual with PBC for a traditional term or whole life insurance policy.

What kind of information will the insurance companies ask me or be interested in?

Since being diagnosed with Biliary Cirrhosis will cause most (if not all) life insurance companies to automatically deny your “traditional” term or whole life insurance application, there aren’t many questions they’ll need to ask other than…

“Have you ever been diagnosed with Biliary Cirrhosis?”

Then, once you answer…

“Yes, I have!”

That will pretty much end your application process with that particular life insurance company. You won’t be asked any more questions. But that’s not really how it works here at IBUSA. We understand that not everyone will qualify for a traditional term or whole life insurance policy, but that doesn’t mean they might not be eligible for some other “kind” of life insurance policy.

While some of these “alternative” products might not be the “Greatest” options out there, having something that they might be able to qualify for can be a good thing for those who aren’t able to qualify for a “traditional” option.

For this reason…

We wanted to take a moment to discuss some of these “alternative” options that might be available to you and encourage you to call or visit one of our other articles that discusses these options in greater detail should you have any questions. This leads us to our next topic, which is…

What “kind” of insurance can I qualify for?

Because most (if not all) best-rated life insurance companies are going to “automatically” decline someone who has been diagnosed with Biliary Cirrhosis, individuals with this pre-existing medical condition are going to need to seek out “alternative” products should they still want to be able to purchase some protection for their family.

These “alternative” products will not allow an applicant to have r any medical questions or take a medical exam. In other words, “they are willing you to be able to “medically” qualify.

This good news is…

There are two such products out there. The bad news is that neither one is perfect. This is why we want to take a moment and briefly discuss both options with you.

Options that may be available to those who have been diagnosed with Primary Biliary Cirrhosis:

Options #1. A Guaranteed Issue Life Insurance Policy.

Guaranteed-issue life insurance policies can be an excellent option for someone simply looking to purchase a relatively small amount of life insurance coverage (think $25,000 or less) because they will not require someone to be able to “medically” qualify for coverage.

In fact…

There are only three requirements one must meet to be able to qualify for a guaranteed issue life insurance policy, which is:

- One must be a US citizen.

- One must reside in a state where these “types” of life insurance policies are offered.

- One must meet the minimum age requirements, which usually means an applicant must be at least 50 (sometimes younger) and not older than 85.

“Which is great!”

But before you get too excited, we should point out that these “types” of life insurance policies have some significant disadvantages. First, they will only provide around $25,000 in coverage, so if you’re looking for more than that, this might not be the right fit for you.

The second major disadvantage…

With guaranteed-issue life insurance policies, these “types” of life insurance policies will contain a Graded Death Benefit. The problem is that a Graded Death Benefit is a “clause” written into the life insurance policy that states that it will not provide true life insurance coverage to an individual until a certain “waiting period” has expired.

The problem is…

This “waiting period” usually lasts 2 or 3 years, which can be a pretty long time for someone who is suffering from a severe illness. Now, during this time, the guaranteed issue life insurance policy will provide coverage to someone who may die from an “accidental” cause of death like a:

- Motor vehicle accident,

- Slip and fall accident,

- Natural disaster,

- Victim of crime,

- Etc…

But it will not provide coverage for a “natural” cause of death like the one which might be associated with having Biliary Cirrhosis! Now, at this point, you may be thinking…

“What a ripoff!”

But you need to remember that because the life insurance company didn’t require you to answer any medical questions and didn’t require you to take a medical exam, this is the only way they can protect themselves from insuring someone who may be really, really sick and just hours away from dying!

The last issue…

We should mention that guaranteed issue life insurance policies are the price. With this “disadvantage,” we don’t want to give you the impression that guaranteed issue life insurance policies are super expensive. It’s just that “dollar for dollar,” these life insurance policies tend to cost more than a traditional term or whole life insurance policy.

Options #1. An Accidental Death Policy.

Accidental death policies can also be a potential way for an individual to provide some coverage for their family; however, it’s essential to understand that these “types” of policies are NOT true life insurance policies. They are only “accident policies,” which means that they will never provide coverage if you die from a natural cause of death!

Now, the good news is that these “types” of policies will allow you to purchase more than 25,000 dollars in coverage, and they are relatively inexpensive; however, if you die from (a):

Or some symptom related to your Biliary Cirrhosis, these “types” of policies are not going to provide you with any death benefit. This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance” for me?

Probably the “best” thing that an individual can do to help ensure that they find the “best life insurance” for them is to take their time when initially shopping for insurance and to be completely honest with their life insurance agent right from the beginning!

This means that…

You should fully understand your needs before applying for a life insurance policy. It would be best if you also had a good idea about the options available. It would help if you were sure that your agent is not only experienced with helping folks with a pre-existing medical condition like yours find coverage but also has access to a wide variety of life insurance products so that they aren’t forced to apply for a…

“one size fits all approach”.

To your needs. So, if you’re ready to see what you might be able to qualify for, give us a call!