Life Insurance for Uroxatral users.

In this article, we wanted to take a moment and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Uroxatral or its generic form Alfuzosin to help treat urinary problems commonly caused by an enlarged prostate.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Uroxatral?

- Why do life insurance companies care if I’ve been prescribed Uroxatral?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been prescribed Uroxatral?

While having been prescribed Uroxatral may attract the attention of some life insurance underwriters during a traditional life insurance application process, its prescription alone should not have any effect on its outcome.

This is why…

Some may even qualify for some of the best no medical exam life insurance policy at a Preferred rate!

That said, however…

Because Uroxatral is a prescription medication designed to help folks who seem to be having difficulty urinating due to an enlarged prostate, one should not be surprised if they’re asked a series of questions about their Uroxatral prescription before being approved for coverage.

Why do life insurance companies care if I’ve been prescribed Uroxatral?

What you’re generally going to find is that most top life insurance companies aren’t all that worried about the fact that you’ve been prescribed Uroxatral. Instead, they are much more concerned with the fact that you have been diagnosed with an enlarged prostate, albeit caused by benign prostatic hyperplasia-BPH.

As a result, what you’re likely going to find is that before having your life insurance application “processed” most (if not all) life insurance companies will want to know a little bit more about your situation prior to making any definitive decisions about whether or not to offer you a life insurance policy.

What kind of information will the insurance companies ask me or be interested in?

Mainly, what insurance companies are most interested in is whether you have been diagnosed with benign prostatic hyperplasia and not actually prostate cancer.

The good news is…

That because Uroxatral is a medication that is used to simply “relax” the muscles around the prostate and bladder rather than try and treat any cancerous growth, most (if not all) life insurance underwriters aren’t going to “dwell” too long on whether or not you’ve been diagnosed with BPH vs Prostate cancer.

Nevertheless, we are dealing with individuals whose official job title is to “worry,” so we really can’t blame them for asking a few questions:

- When were you first diagnosed with benign prostatic hyperplasia-BPH?

- Who diagnosed your BPH? A general practitioner or a urologist?

- How often do you see your doctor or a checkup?

- When was the last time you had your PSA level checked?

- What was the value of your last PSA?

- Have you ever been diagnosed with prostate cancer?

- Is Uroxatral the only medication that you’re taking to treat you BPH?

What rate (or price) can I qualify for?

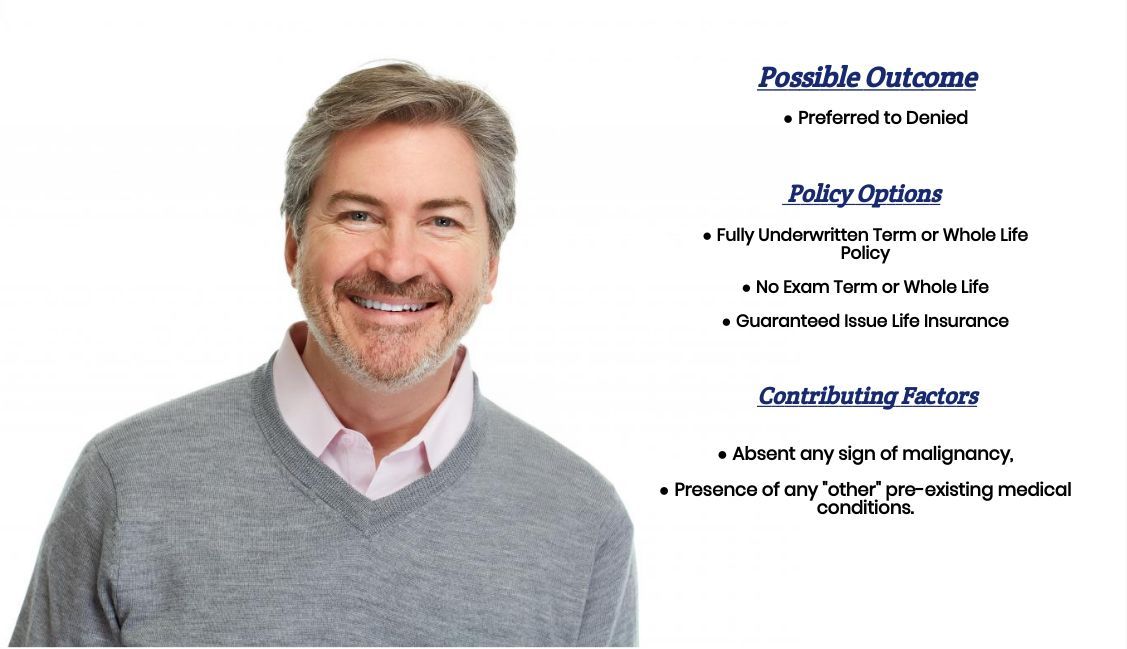

Once it has been determined that the difficulties that you’re experiencing urinating are the result of benign prostatic hyperplasia-BPH and not prostate cancer, in theory, you should still be eligible to qualify for the best possible life insurance rate available, a Preferred Plus.

Now we say…

“In theory”

Because there are many factors that will come into play when determining what kind of “rate,” you may be eligible for. Some of these factors will center around your health, but some of them will actually not be related to your health at all!

Examples being:

- Your immediate family medical history,

- Your driving record,

- Travel plans to potentially dangerous locals,

- A hazardous work environment or dangerous occupations,

- Participation in hazardous hobbies,

- Etc…

This brings us to the next topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that seems to work the “best” for helping folks find the best life insurance policy that they can qualify for is to…

First…

Fully understand what the client is hoping to achieve by purchasing their life insurance policy.

And second…

Make sure that we here at IBUSA have plenty of options for them to choose from so that neither they or we have to rely on just one or two different options.

Which is why…

Our recommendation to anyone looking to purchase a term or whole life insurance policy whether they’ve been diagnosed with a serious pre-existing medical condition or not is to first make sure that you choose to work with a life insurance agent who takes the time to understand what you’re looking to accomplish.

And then…

Make sure that this agent has dozens of different life insurance companies for you to choose from.

Now, will we be able to help out everyone who has been prescribed Uroxatral?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well.

This way…

If someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available to you, just give us a call!