In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with Prostate Cancer.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Prostate Cancer?

- Why do life insurance companies care if I’ve been diagnosed with Prostate Cancer?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Prostate Cancer?

Yes, some men who have been previously diagnosed with Prostate Cancer will be able to qualify for a traditional term or whole life insurance policy. The only problem is that because Prostate Cancer can often become a complicated illness that can be treated in a variety of different ways (or left untreated entirely), most of the best life insurance companies are going to want to know a lot more about your Prostate Cancer diagnosis before they will make any decisions about your application.

Why do life insurance companies care if I’ve been diagnosed with Prostate Cancer?

Life insurance companies assess risk. When you apply for a life insurance policy, the company considers various factors to determine how likely you are to be covered by the policy terms. The insurance company may consider your overall health, including any pre-existing medical conditions you have. If you have been diagnosed with prostate cancer, the insurance company may view you as a higher risk because cancer is a severe illness that can affect your lifespan.

That being said, it is important to note that not all prostate cancers are the same, and the severity and prognosis of your cancer will be taken into consideration when evaluating your application. In some cases, you may still qualify for a policy, but the terms of the policy may differ from those of someone with no pre-existing medical condition.

Prostate Cancer Defined:

Prostate cancer is a type of cancer that develops in the prostate, a small gland in the male reproductive system. The prostate gland is located below the bladder and in front of the rectum. It is responsible for producing some of the fluid that makes up semen.

Prostate cancer is the most common cancer in men, and it is typically a slow-growing cancer. In many cases, prostate cancer does not cause any symptoms in its early stages, and it may not require treatment. However, if left untreated, prostate cancer can spread to other parts of the body, such as the bones or lymph nodes, and it can become more aggressive and potentially life-threatening.

Symptoms of prostate cancer may include:

- Difficulty urinating

- Weak or interrupted urine flow

- Frequent urination, especially at night

- Pain or burning during urination

- Blood in the urine or semen

- Pain in the lower back, hips, or upper thighs

Stages of Prostate Cancer:

Prostate cancer is typically classified into four stages, with stage I being the least advanced and stage IV being the most advanced. The stages of prostate cancer are determined by the size and extent of the cancer, as well as whether it has spread beyond the prostate gland.

Here is a brief overview of the stages of prostate cancer:

- Stage I: The cancer is found only in the prostate gland, is small, and has not spread.

- Stage II: The cancer is larger or has grown outside of the prostate gland, but it has not spread to other parts of the body.

- Stage III: The cancer has spread to nearby lymph nodes, but it has not spread to other parts of the body.

- Stage IV: The cancer has spread to other organs or parts of the body, such as the bones or lungs.

It is important to note that these stages are just general guidelines, and the specific characteristics and prognosis of a person’s prostate cancer may be different.

Prostate Cancer Treatment:

The treatment for prostate cancer will depend on a variety of factors, including the stage and grade of the cancer, your overall health, and your personal preferences.

Some standard treatment options for prostate cancer include:

- Active surveillance: This is a watch-and-wait approach where the cancer is monitored closely, but no treatment is given unless the cancer begins to grow or spread. Active surveillance is often recommended for men with early-stage, low-grade prostate cancer that is not causing any symptoms.

- Surgery: Surgery to remove the prostate gland (prostatectomy) is a standard treatment for prostate cancer. There are several types of prostatectomy, including open surgery, laparoscopic surgery, and robotic-assisted surgery. The type of surgery recommended will depend on the stage and grade of the cancer and the patient’s overall health.

- Radiotherapy uses high-energy beams, such as X-rays or protons, to kill cancer cells. Radiotherapy can be given externally, using a machine to deliver the radiation, or internally, using radioactive seeds implanted in the prostate gland.

- Hormonal therapy: This treatment works by blocking the production or action of hormones, such as testosterone, which can fuel the growth of prostate cancer cells. Hormonal therapy is often used in combination with other treatments, such as surgery or radiotherapy.

- Chemotherapy: This treatment uses medications to kill or stop cancer cells from growing. Chemotherapy is typically reserved for men with advanced prostate cancer that has spread to other parts of the body.

What kind of information will the insurance companies ask me or be interested in?

When you apply for life insurance and disclose that you have been diagnosed with prostate cancer, the insurance company will likely ask you for more information about your cancer. They may ask you the following questions:

- When were you first diagnosed with Prostate Cancer?

- What led to your Prostate Cancer diagnosis? Were you experiencing any symptoms of your disease?

- How was your Prostate Cancer diagnosed?

- What stage was your Prostate Cancer at when it was diagnosed?

- Stage 1: Prostate cells begin to look “suspect.” Some doctors may recommend treatment at this stage, while others may monitor your situation more closely. All suspected cancer cells remain contained within the prostate itself.

- Stage 2: PSA scores may be slightly elevated; more active monitoring may be recommended, or in some cases, radiation therapy or surgery may be performed. All suspected cancer cells remain contained within the prostate itself.

- Stage 3: Suspect cancerous cells have begun to spread outside of the prostate but have not spread to one’s lymph nodes or other parts of the body. Active treatment is usually warranted in this situation and may include radiation therapy, hormonal therapy, and surgery.

- Stage 4: Cancer cells in this stage have spread throughout the body, including organs such as the bladder, rectum, lymphatic system, and, in some cases, bones. Treatment options at this stage usually focus on improving one’s quality of life rather than eliminating one’s cancer.

- Are you currently treating your Prostate Cancer? If not, when was your last date of treatment?

- What treatment options did you receive?

- Radiation therapy,

- Hormonal therapy,

- Chemotherapy,

- Surgery?

- Etc…

- When was the last time you had a PSA test performed? What was its score?

- Have you been diagnosed with any other pre-existing medical conditions?

- Are you currently working now?

- In the past 12 months, have you applied for any disability benefits?

With this information in hand, most life insurance companies (and us as well) will have a pretty good idea about what “type” of life insurance policy you may be able to qualify for, as well as what “kind” of rate you might be expected to pay.

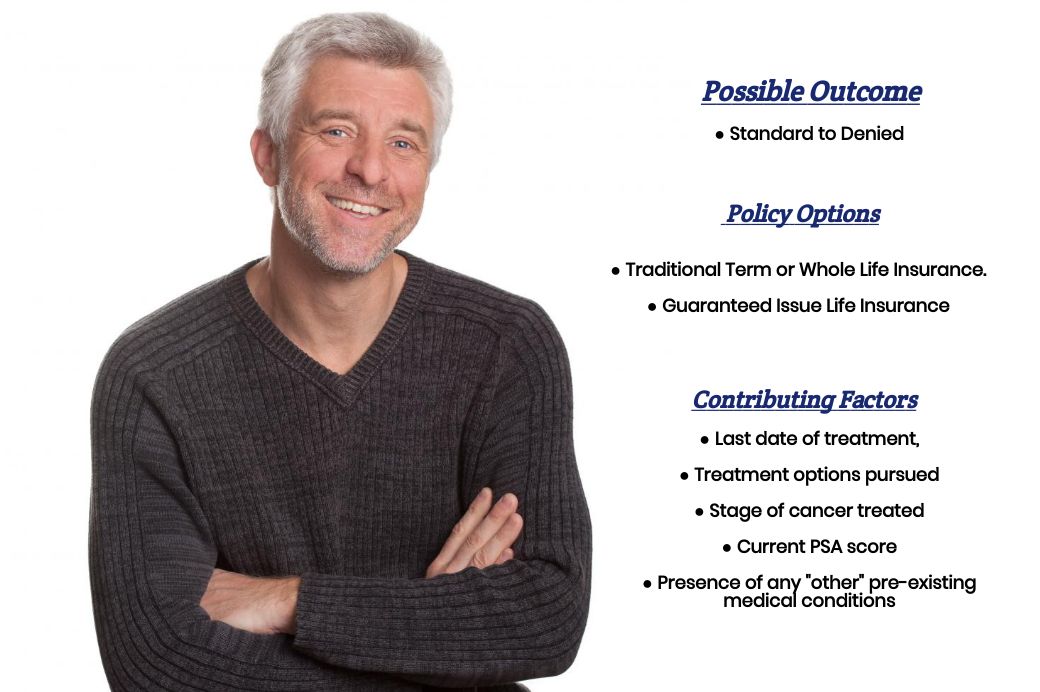

What rate (or price) can I qualify for?

Unlike many other “types” of cancer where it can be difficult for an insurance company to get an accurate idea about how “serious” one’s condition is, Doctors and Insurance companies alike have found that performing a PSA Test or Prostate-Specific Antigen Test to determine how “active” one’s cancer is can be pretty helpful.

This is why…

Insurance companies will rely heavily on this exam and typically use your PSA score to guide them on how they will and won’t underwrite your life insurance policy. For this reason, it’s essential to know what a “normal” PSA score should look like before you apply for coverage to avoid any unnecessary DENIALS. You should also reach out to different insurance companies before you use to see if they will be willing to make any exceptions for you if you do not meet these “ideal” scores.

Normal PSA by age:

40-49: 0 to 2.5 ng/ml

50-59: 0 to 3.5 ng/ml

60-69: 0 to 4.5 ng/ml

70-79: 0 to 6.5 ng/ml

*We should note that researchers have found that PSA levels can vary amongst different racial groups. While these PSA levels represent “normal” levels, many life insurance companies will be more “lenient” when making their underwriting decisions.

That said, however…

It’s fair to say that if you currently have a PSA level well above 7.0, chances are you won’t qualify for a traditional term or whole life insurance policy. In such cases, you may need to either postpone applying for coverage immediately or purchase an “alternative” product like an Accidental Death Policy or Final Expense Insurance policy, which does not consider one’s PSA score.

Now if…

If you have been diagnosed with Prostate Cancer, your current PSA levels are below 7.0, and you have either been treated and/or cured of your disease, there is a perfect chance that you may be able to qualify for coverage. You may even qualify for a Standard rate, which is pretty impressive considering a Standard rate is considered “normal.”

The only trick is…

You’ll need to be much more careful about which life insurance company you choose to apply with because not all life insurance companies are going to be super “lenient” with those who have been previously diagnosed with Prostate Cancer, no matter how low your PSA score is. This brings us to the next topic we wanted to take a moment to discuss, which is…

How can I help ensure I get the “best life insurance” for me?

In our experiences here at IBUSA, we’ve found that usually, the “best” approach in helping someone find the “best” life insurance policy for them is to first:

- Fully understand what an individual is trying to achieve by purchasing their life insurance policy.

- Are you looking to:

- Cover the cost of a mortgage?

- Replace lost wages?

- Protect a child or spouse?

- Or cover one’s final expenses?

- Are you looking to:

- Then, provide plenty of options so one is not limited to just one or two.

This is why…

We at IBUSA choose to work with so many different life insurance companies that when it comes time to help you decide “which” company will be the best for you, we don’t have to apply a…

“One Size Fits All”

Approach. Instead, we can make dozens of life insurance companies compete for your business. So, what are you waiting for? Give us a call today and experience the IBUSA difference.

Dear sir/madam,

I spoke with a representative several weeks ago. I believe his name was Mark. He was checking into different providers for me. Do you have any record or where he left off? I think he found one or two that would be a good fit.

Thank you,

Adam

PS: you may have a different email address on file for me… horns4him@gmail.com

Adam,

Thanks for reaching back out to us; we’ll be sure to have the agent working with you to give you a follow-up call ASAP!

Yours truly,

InsuranceBrokersUSA.