Life Insurance for Lotrel users.

In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Lotrel or its generic form Amlodipine/Benazeprilat to help treat high blood pressure (hypertension).

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Lotrel?

- Why do life insurance companies care if I’ve been prescribed Lotrel?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been prescribed Lotrel?

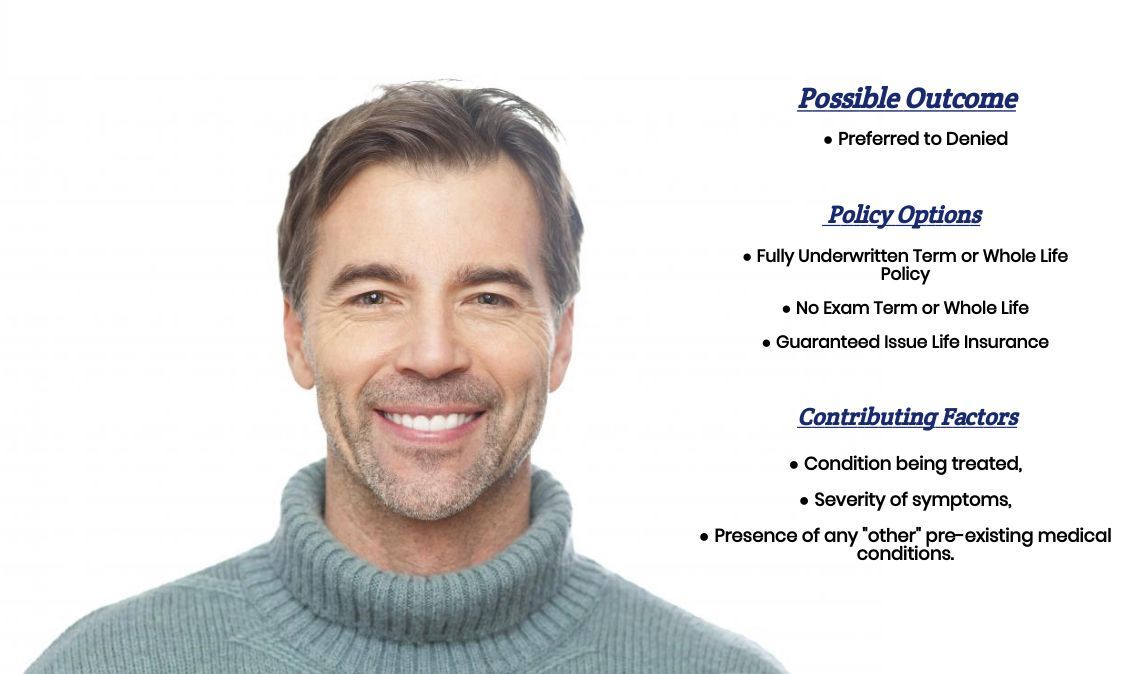

Yes, individuals who have been prescribed Lotrel can and often will be able to qualify for a traditional term or whole life insurance policy. Some, many of them may even be able to qualify for a Preferred rating!

Why do life insurance companies care if I’ve been prescribed Lotrel?

Most of the best life insurance companies don’t particularly “care” all that much with the fact that you may have been prescribed Lotrel in the past.

Sure…

They will want to know how well it is helping you to maintain a healthy blood pressure level. The good news is that, unlike many other medications that effectively does the same thing, Lotrel isn’t one of “those” medications that frequently prescribed to individuals suffering from more serious cardiovascular diseases.

And while…

Most (if not all) life insurance companies are going to want to make sure that you aren’t a potential risk for one day developing more serious cardiovascular disease or other health issues, your Lotrel prescription isn’t going to lead them to view your application with more “suspicion”.

What kind of information will the insurance companies ask me or be interested in?

The types of questions you’ll likely be asked by a life insurance underwriter before getting approved for a life insurance policy will likely look very similar to a typical applicant with maybe one or two exceptions. Common questions will likely look something like this:

- When were your first prescribed Lotrel?

- Who prescribed your Lotrel? A general practitioner or a cardiologist?

- Have you ever been diagnosed with heart disease or suffered from a heart attack or stroke?

- Have any of your immediate family members (mother, father, brother, or sister) ever been diagnosed with heart disease or suffered from a heart attack or stroke?

- Is Lotrel the only prescription medication that you’re currently taking?

- Have any of your prescription medications changed in any way over the past year?

- How well is your helping you to maintain your blood pressure levels?

- What is your current height and weight?

- In the past 12 months, have you used any tobacco or nicotine products?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

Here at IBUSA, we have found that generally, most life insurance companies will still consider an individual who is taking a medication to help control his or her blood pressure but is still “potentially” eligible for a Preferred rating.

This is why…

When we start the quoting process here at IBUSA, we like to assume that everyone taking a medical like Lotrel will be eligible for a Preferred rate and then work our way down from there. In some cases, a Preferred rate quote may make complete sense; however, when we start adding things like:

- An unbalanced height to weight ratio,

- Additional medications to treat things like:

- High cholesterol,

- High blood sugar levels (diabetes),

- Or mild depression,

We’ll then start adjusting our quote appropriately. All the while, of course, simultaneously considering what kind of simplified issue life insurance products (no medical exam life insurance) might also be available to you as well.

The hard part…

Comes when there are several factors at play and the fact that you’ve been prescribed a medication like Lotrel to keep your hypertension in check, which makes “guessing” what kind of rate you might be eligible for without speaking to you directly impossible.

The good news is…

That regardless of how few or how many factors may be in play in determining what kind of “rate,” you might be able to qualify for, here at IBUSA, we ready for it! This brings us to the last topic that we wanted to take a moment to discuss with you…

What can I do to help ensure that I get the “best life insurance” for me?

Because life insurance companies tend to use a lot of “random” factors in determining who the will and won’t insure, and at what price, we here at IBUSA have found that the “best” way for us to be able to ensure that our clients can find the “best” life insurance policy that they can qualify for is to be sure to know our STUFF and offer a TON of options.

You see…

By only employing true life insurance professionals who have tons of experience helping folks with all sorts of pre-existing medical conditions and then providing them with tons of options to offer their clients, we here at IBUSA truly do offer a one-stop-shop for folks looking to protect their family.

Now, will we be able to help out everyone who has been prescribed Lotrel?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well.

This way…

If someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available to you, just give us a call!