In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Bupropion or one of the many brand names it is sold under, including

- Aplenzin,

- Budeprion Sr

- Budeprion XL,

- Forfivo XL,

- Wellbutrin Sr,

Wellbutrin XR can help treat one’s depression or be used as an aid to help individuals quit smoking. It can also be used to help treat seasonal affective disorder (SAD) as well.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Bupropion?

- Why do life insurance companies care if I’ve been prescribed Bupropion?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been prescribed Bupropion?

Yes, individuals who have been prescribed Bupropion can and often will be able to qualify for a traditional term or whole life insurance policy. The only problem is that Bupropion is a medication that can be used to treat various medical conditions, some of which could make it impossible to qualify for a traditional term or whole life insurance policy.

This is why in this article, we’re going to “shift gears” a little bit; instead of talking primarily about Bupropion, we will focus a bit more on what “conditions” Bupropion can be used to treat and how those conditions can potentially affect the outcome of one’s life insurance application.

Why do life insurance companies care if I’ve been prescribed Bupropion?

You’ll generally find that most top-rated life insurance companies “care” if an individual has been prescribed Bupropion in the past because its use can tell a life insurance underwriter a lot about an applicant and let them know what “kind” of questions they will want to know the answers to before making a final decision about your life insurance application.

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll likely be asked will typically look something like this:

- Why were you first prescribed Bupropion?

- Who prescribed your Bupropion? A general practitioner or a psychiatrist?

- Have you been diagnosed with depression?

- If so:

-

- What “kind” of depression have you been diagnosed with?

- Do you suffer from Seasonal Affect Disorder (SAD)?

- Is Bupropion the only prescription medication that you’re taking to treat your depression?

- Have you ever been hospitalized as a result of your depression?

- Have you ever attempted or thought about attempting suicide?

- In the past 12 months, have any of the medications that you’re taking to treat your depression changed in any way?

- Were you prescribed Bupropion to help you quit smoking?

- In the past 12 months, have you used any tobacco or nicotine products?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

-

What rate (or price) can I qualify for?

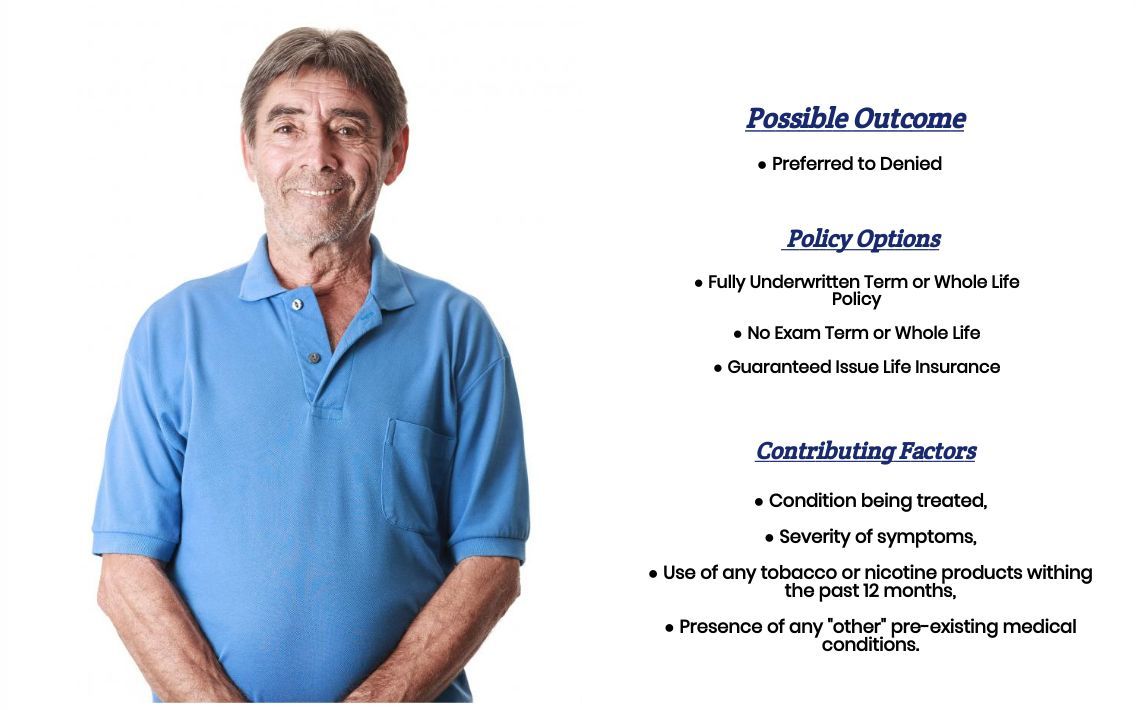

Now, when it comes time to determine what “kind” of rate you’ll be eligible for, it’s important first to separate those who are using Bupropion to help them quit smoking from those who are using it to help them manage and/or treat symptoms of depression. Now for those using Bupropion to help them quit smoking, what you’re going to find is that having been prescribed Bupropion, for this reason, shouldn’t affect the outcome of your life insurance application other than the fact that you will probably be labeled a “smoker” even though you aren’t currently using any tobacco today.

This is because…

Most life insurance companies will not consider someone a “non-smoker” until they have remained entirely “tobacco-free” for an entire year. And by “tobacco-free, ” we mean completely tobacco-free. So even if you only smoked one cigarette ten months ago, insurance companies will want to know about it, and in their eyes, you would still be considered a smoker. This is also why having been prescribed Bupropion 8 months ago to help you quit smoking can and will usually be a way that an insurance company can determine when, in fact, an individual did ultimately quit smoking for a life insurance application.

As for those who…

Have been prescribed Bupropion to help them deal with their depression, it should be noted that if you simply suffer from a “mild” case of depression or you suffer from Season Affect Disorder (SAD) and aren’t experiencing any “serious” symptoms, you should theoretically still be considered eligible for a Preferred rate.

The only problem in making this determination is that an insurance underwriter is going to have a lot of “discretion” when determining what constitutes a “mild” case of depression and what constitutes a “moderate” or “severe” case. This is why spending time and “shopping” around is important before applying for coverage. This way, you can get a “feel” for how an insurance underwriter might view your case before you’ve submitted your application. This brings us to the last topic we wanted to discuss, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, what works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true life insurance professional who will work as an advocate for them. Such an agent who can help guide you through the application process and be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because after all, it doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly, before applying for coverage, you should be completely honest with your life insurance agent. By doing so, you will help them narrow down what options might be the “best. “

Now, can we help out everyone who has been prescribed Bupropion?

No, probably not. But we can tell you that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies. This way if someone can’t qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to explore your options, call us!