In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Lamictal or its generic form, Lamotrigine, to help treat folks suffering from epilepsy or some other “type” of seizure disorder

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Lamictal?

- Why do life insurance companies care if I’ve been prescribed Lamictal?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been prescribed Lamictal?

Short answer: Yes.

Long answer: It depends.

You see, unlike some medications used to treat more life-threatening diseases, having been prescribed Lamictal will not automatically cause one to be denied life insurance coverage. But that doesn’t mean that it “couldn’t” cause one to be denied coverage or that it “couldn’t” cause one to have to pay more for their insurance than someone who has never been prescribed Lamictal. This leads us to ask our next question…

Why do life insurance companies care if I’ve been prescribed Lamictal?

Most (if not all) life insurance underwriters aren’t worried that you’ve been prescribed Lamictal. After all, it’s not like Lamictal is considered a “hazardous” medication with life-threatening side effects. It’s also not a medication that one might be inclined to abuse. And while some of the common side effects such as:

- Backaches,

- Blurred vision,

- Chest pain,

- Drowsiness,

- Dizziness,

- Etc…

They may cause quite a bit of discomfort, but they’re not necessarily something a life insurance underwriter would concern themself about. Instead, they’re going to be much more focused on the underlying pre-existing medical condition that caused you to be prescribed Lamictal in the first place… mainly what’s causing you to suffer from seizures and how severe they are when they occur.

Which is why…

You’ll generally find that before any life insurance underwriter decides about your life insurance application, they will want to learn more about your medical history to better gauge what kind of “risk” you may pose as a potential client.

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll likely ask about your condition will include:

- At what age did you first suffer from a seizure?

- What type of seizures do you suffer from?

- Have you been diagnosed with a specific seizure disorder?

- When was the last time that you suffered from a seizure?

- In the past 12 months, how many seizures have you experienced?

- Have you ever been hospitalized due to a seizure?

- Is Lamictal the only prescription medication that you use to control your seizures?

- In the past 12 months, has your Lamictal prescription changed at all?

- Do you currently hold a valid driver’s license?

- Has your doctor told you that you shouldn’t drive?

- Are you currently working now?

- In the past 12 months, have you applied for or received any disability benefits?

What rate (or price) can I qualify for?

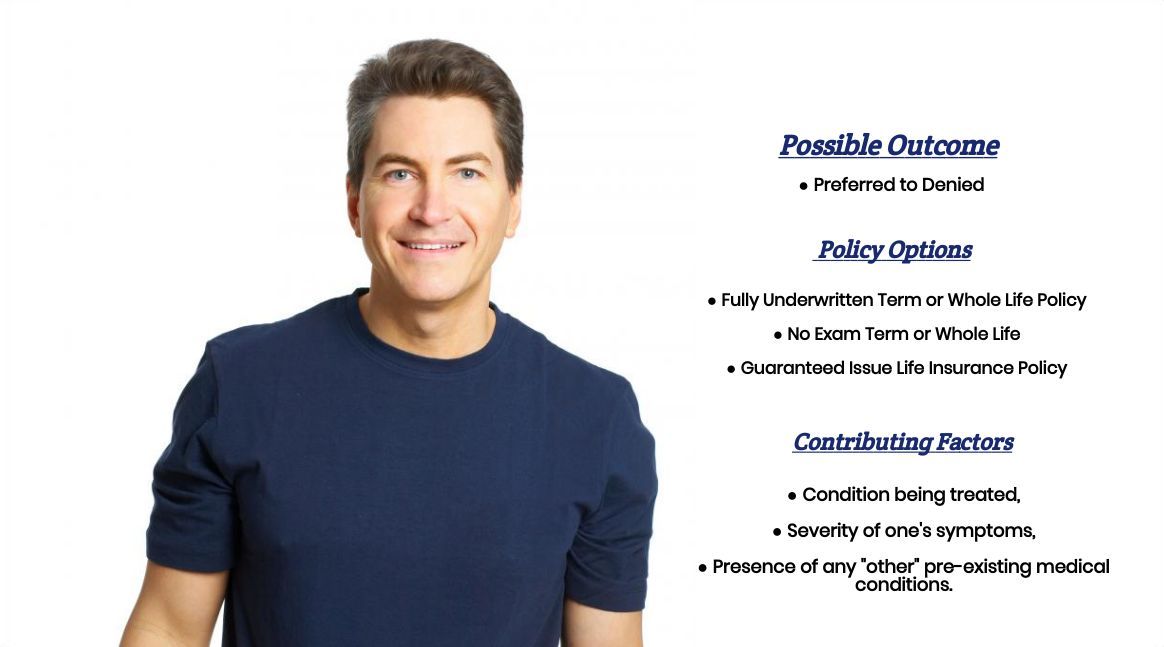

As we stated, assuming you’re otherwise healthy and haven’t suffered from a seizure within the past 12 months, you should be eligible for a Preferred rate. This is fantastic because it means that if you haven’t suffered from a seizure within the past 12 months, most insurance companies will consider you an “average risk.” ”

Now, will you be able to qualify for a Preferred rate? Who knows? After all, many factors will come into play when determining what “rate” you might qualify for. That being said, however, just knowing that you “could be” considered a Preferred applicant is good to know.

The problem is…

Not all Lamictal users are going to be able to claim that they have been seizure-free for at least one year. This means that they’re most likely not going to be able to qualify for a Preferred rate. But don’t fret; simply because you can’t qualify for a Preferred rate does not mean that you won’t be able to qualify for coverage entirely, and let’s face it, the vast majority of life insurance applicants (even those who haven’t been diagnosed with a pre-existing medical condition like seizures) won’t be able to qualify for a Preferred rate.

Which means…

We will then want to look for an insurance company that may approve your application at a Standard or Standard Plus rate and compare rates for clients in this category. We should also point out that some folks may not be able to qualify for a traditional term or whole life insurance policy due to their pre-existing seizure disorder.

These folks, will likely suffer from seizures that are so severe that they aren’t allowed to drive, and they are most likely unable to maintain steady or full-time employment. These folks may also receive some disability benefits, which will likely cause them to be ineligible for traditional life insurance coverage. Here at IBUSA, we always exhaust all standard options with these “types” of clients before suggesting any “alternative” products, such as a guaranteed issue life insurance policy or an accidental death policy.

How can I help ensure I get the “best life insurance”?

Ultimately, we have found that adhering to three rules seems to give folks the best chance at finding the “best” life insurance policy for them:

Rule #1. Be sure you’re working with a life insurance professional, not someone who processes orders all day in a call center.

Rule #2. Ensure that the professional you choose has access to dozens of different life insurance companies so that you don’t have to rely on the decision-making process of just one or two companies.

Rule #3. Don’t be afraid to be completely honest with your life insurance agent. You can find the “right” life insurance company for you by being completely honest. And by “right,” we, me, a company, are giving you the greatest opportunity for success.

So, if you’re ready to see what you might be able to qualify for, why not give us a call and see what we can do for you?