In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Tussionex or its generic form, Hydrocodone-Chlorpheniramine, to treat coughs and other symptoms associated with the common cold and allergies.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Tussionex?

- Why do life insurance companies care if I’ve been prescribed Tussionex?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been prescribed Tussionex?

Yes, individuals who have been prescribed Tussionex can and often will be able to qualify for a traditional term or whole life insurance policy. Heck, they may even be able to qualify for a Preferred Plus rate! The problem is that Tussionex isn’t your average cough syrup, which is why insurance underwriters will be interested in the fact that you have been prescribed Tussionex in the past, particularly if it was prescribed to you relatively recently.

Why do life insurance companies care if I’ve been prescribed Tussionex?

Unlike many other prescription medications where the underlying pre-existing medical condition that is being treated becomes the primary concern for a life insurance company, with Tussionex, it’s actually the fact that you’ve been prescribed this medication that can often sound the alarm bells during a life insurance application process.

This is because…

Tussionex is a prescription medication that consists of a combination of two different medications, Hydrocodone and Chlorpheniramine, one of which is considered a narcotic! In fact, back in 2008, the FDA actually issued a warning of the dangers of misusing Tussionex, stating that abuse of this medication could potentially cause several dangerous side effects, including overdose and/or death!

This is why, before being approved for a traditional term or whole life insurance policy, most (if not all) life insurance companies are going to want to make sure that there is no risk that you may be abusing this medication. This is why, you may be asked a series of questions about your Tussionex prescription as well as potentially being asked to “postpone” submitting your life insurance application until which point you are no longer taking your Tussionex.

What kind of information will the insurance companies ask me or be interested in?

- When were you first prescribed Tussionex?

- Who prescribed your Tussionex? A primary care physician or a specialist?

- Why have you been prescribed Tussionex?

- In the past 2 years, have you been admitted to a hospital for any reason?

- Have you received multiple prescriptions for Tussionex from several different doctors?

- Are you currently taking Tussionex right now? If so, when do you anticipate stopping?

- Do you have any history of drug or alcohol abuse?

- Do you have any issues with your driving record? Issues such as multiple moving violations, a DUI, or a suspended license?

- Have you ever been convicted of a felony or misdemeanor?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

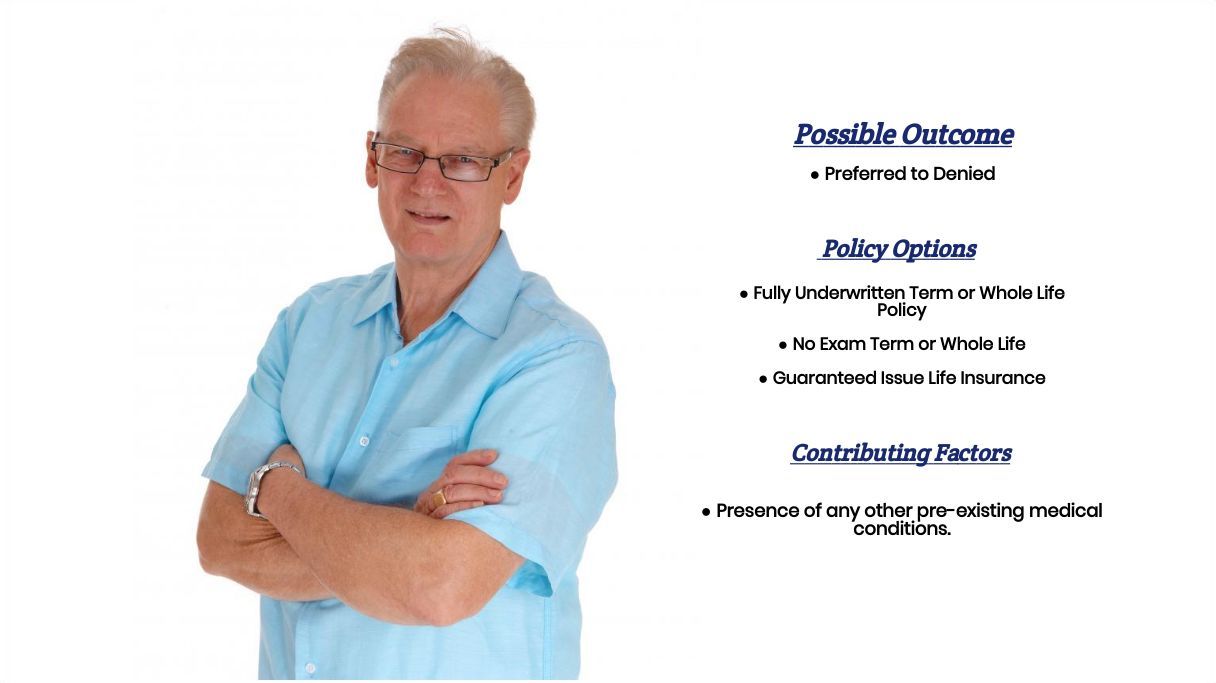

What rate (or price) can I qualify for?

Now at this point, if you’re asking yourself…

“Wow, these are some pretty crazy questions about that prescription for Tussionex that I got!”

Chances are you’re Tussionex prescription isn’t going to affect the outcome of your life insurance application one way or another. Conversely, if you just read these questions and are thinking to yourself…

“Yeah, I can see why a life insurance company might be nervous about the fact that I’ve been prescribed Tussionex in the past.”

Then, there’s probably a good chance that your Tussionex prescription may play a serious role in the outcome of your life insurance application. So seriously, it would be pretty much impossible to guess what kind of “rate” you might be able to qualify for other than simply saying that if you’re currently struggling with a dependency or addiction to this medication, seeking help for that first will be a pre-requisite for ever being able to qualify for a traditional term or whole life insurance policy.

This brings us to the last topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

Because life insurance companies tend to use a lot of “random” factors in determining who they will and won’t insure and at what price, we here at I&E have found that the “best” way for us to be able to ensure that our clients are able to find the “best” life insurance policy that they can qualify for is to be sure to know our STUFF and offer a TON of options.

You see…

By only employing true life insurance professionals who have tons of experience helping folks with all sorts of pre-existing medical conditions and then providing them with tons of options to offer their clients, we here at I&E truly do offer a one-stop shop for folks looking to protect their families.

Which is why…

Our advice to anyone looking to purchase a life insurance policy is to be sure that the insurance agent that they choose to work with is truly an expert and that he or she has dozens of options for you to consider because even if they are the greatest life insurance agent in the world if they don’t have access to the “best” life insurance policy for you what good is that going to do you?

So, what are you waiting for? Give us a call today, and let us earn the right to protect your family today!