In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after they have been diagnosed with Epilepsy or suffer from convulsions or seizures. But before we get started, we need to clarify that we here at IBUSA are not medical professionals and are certainly not doctors.

This is why…

Even though Epilepsy and any one of the many pre-existing medical conditions that could cause one to suffer from a seizure or a convulsion are (and should be considered) totally separate and unique medical conditions by medical professionals, we here at IBUSA don’t have to view them this way.

Because, in the “eyes” of the life insurance industry, Epilepsy and many of the other different pre-existing medical conditions that may cause someone to suffer from a convulsion or seizure will usually be treated the same! This allows us to “lump” these pre-existing medical conditions together and discuss them in this article.

Questions that will be directly answered will include the following:

- Can I qualify for life insurance if I have been diagnosed with Epilepsy (Seizures or Convulsions)?

- What kind of information will the insurance companies ask me or be interested in?

- What “rate” can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Epilepsy (Seizures or Convulsions)?

Yes, individuals can and often will be able to qualify for a traditional term or whole life insurance policy after they have been diagnosed with Epilepsy or after they have suffered from a seizure or a convulsion. The only problem is that is because Epilepsy and many of the conditions that might cause an individual to suffer from a seizure or convulsion can vary significantly from one patient to the next.

Simply “knowing” one’s “medical diagnosis” isn’t enough information for most top-rated life insurance companies to make definitive decisions about one’s life insurance application. This is why once a life insurance company learns that you’ve been diagnosed with Epilepsy or that you’ve suffered from a previous seizure and/or convulsion, they’re typically going to want to ask you a series of medical questions, all designed to learn more about your situation and try to ascertain exactly what kind of “risk” you would pose to them should they decide to approve your life insurance application.

It’s also why…

You may want to consider avoiding applying for a no medical exam term life insurance policy as well, seeing how these policies tend to be more challenging to qualify for after someone has been diagnosed with a pre-existing medical condition like Epilepsy.

Medical terms are defined for the purposes of this article.

As we’ve already stated before, it’s important to understand that we here at IBUSA are not medical professionals. We’ve certainly never attended medical school, which is why the following definitions we will provide for a few terms that we will use throughout the rest of this article will most likely be woefully inadequate for a wide variety of reasons.

The good news is…

We’re not trying to cure any disease here in this article; we’re simply trying to give our readers a realistic idea of what it will be like to apply for a traditional term or whole life insurance policy after being diagnosed with a pre-existing medical condition like Epilepsy.

So, please forgive us in advance and humor us as we go through the following paces so that we’re all on the same page as we begin to discuss how a life insurance company is likely to “view” your application during the underwriting process.

Epilepsy Defined:

Epilepsy is a neurological disorder that causes recurrent seizures. Seizures are caused by abnormal electrical activity in the brain. Various factors, including genetics, head injury, and brain infections, can cause Epilepsy.

There are many different types of Epilepsy, and they are generally classified based on the type of seizure that the person experiences and the part of the brain that is affected. Some common types of Epilepsy include:

- Generalized Epilepsy: This type of Epilepsy involves seizures that affect both sides of the brain.

- Focal Epilepsy: This type of Epilepsy involves seizures that start in a specific area of the brain.

- Absence epilepsy: This type of Epilepsy, also known as petit mal epilepsy, involves brief lapses in consciousness.

- Myoclonic Epilepsy: This type of Epilepsy involves sudden, brief muscle jerks or spasms.

- Clonic Epilepsy: This type of Epilepsy involves repeated, rhythmic muscle jerks or spasms.

- Tonic Epilepsy: This type of Epilepsy involves sustained muscle contractions or stiffness.

- Tonic-clonic Epilepsy: This type of Epilepsy, also known as grand mal epilepsy, involves both tonic and clonic seizures.

Symptoms may include:

- Temporary confusion,

- “Zoning-out” or just staring off into space,

- Uncontrollable jerking movements,

- Loss of consciousness or awareness,

- Psychotic symptoms such as unjustified anxiety, fear, or déjà vu.

Epilepsy vs. Seizure.

When an individual suffers from a “seizure” rather than Epilepsy, this diagnosis is usually derived because an individual has only suffered from one “attack,” and the “attack” does not seem to be linked to some “neurological” condition.

Common causes that might provoke one into suffering from a seizure may include:

- Abnormal levels of sodium or glucose in the blood.

- Infections within the brain.

- A traumatic brain injury.

- Congenital brain defects.

- Brain tumors.

- Etc…

Common conditions which may be misdiagnosed as Epilepsy may include:

- Fainting,

- Narcolepsy,

- Cataplexy,

- Certain sleep disorders,

- Panic attacks,

As well as a host of other rare psychiatric disorders that can often mimic many of the common symptoms of Epilepsy as well.

Treatment of Epilepsy:

The treatment of Epilepsy typically involves the use of medications to control seizures. The goal of treatment is to achieve seizure freedom or at least a significant reduction in seizure frequency.

Several different types of medications can be used to treat Epilepsy, and the choice of medication will depend on the individual’s specific type of Epilepsy and their overall health. In some cases, surgery or other treatments may be necessary if medications are not effective at controlling seizures.

Other treatments that may be used to manage Epilepsy include dietary changes (such as following the ketogenic diet) and devices such as vagus nerve stimulators. People with Epilepsy need to work closely with their healthcare team to determine the best treatment plan for their individual needs.

What kind of information will the insurance companies ask me or be interested in?

Insurance companies will typically ask for detailed information about your Epilepsy to determine your coverage eligibility and assess the risk associated with insuring you. This may include information about your medical history, including any diagnoses you have received, the type of seizures you experience, and the treatments you have received.

The insurance company may also ask about your lifestyle and daily routine, including whether you are employed and whether you have any restrictions on your activities due to your Epilepsy.

Specific questions you’ll likely be asked may include:

- How old were you when you first suffered from a seizure or convulsion?

- Have you been given a specific diagnosis?

- Have you been diagnosed with Epilepsy?

- If so, what “kind” of seizures do you suffer from?

-

- Petit mal or absence seizures?

- Grand mal or tonic-clonic (convulsive seizures)?

- Atonic seizures or drop attack seizures,

- Clonic seizures,

- Tonic seizures,

- Myoclonic seizures?

- Do you know what causes you to suffer from a seizure or convulsion?

- When was the last time that you suffered from a seizure or convulsion?

- In the past 12 months, how many seizures or convulsions have you suffered from?

- What treatment options are you currently pursuing?

- What medications have you been prescribed?

- Have you undergone any surgical procedures to help treat your condition, or has your doctor recommended any surgical procedures you should consider in the future?

- In the past two years, have you been hospitalized for any reason?

- Do you currently hold a valid driver’s license?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

-

What “rate” can I qualify for?

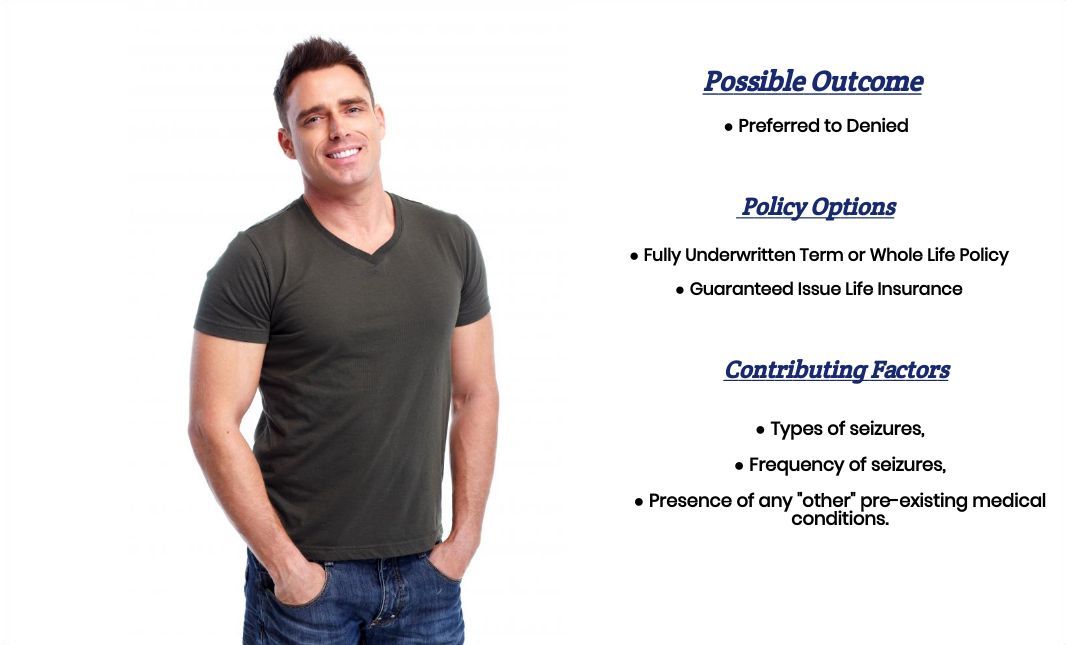

Now, as one can see, there are a lot of factors that can come into play when trying to determine what kind of “rate” an individual might be able to qualify for after having been diagnosed with Epilepsy or after suffering from a seizure or convulsion.

For this reason, it’s almost impossible to know for sure what kind of “rate” you might qualify for without first speaking with you. That said, however, we can make a few “assumptions” that will generally hold true and hopefully can provide you with a general idea of what rate you might qualify for.

For example…

Suppose you are someone diagnosed with Epilepsy or has suffered from a previous seizure or convulsion but currently seems to have these “conditions” under control. In that case, you may qualify for a Standard or possibly an even better health rate, which means you may even be eligible for a Preferred rate.

The big problem is…

Defining how “well” an individual has their condition under control will be a highly “subjective” determination made solely by the life insurance underwriter assigned to your application. This is where having an experienced life insurance agent like those working here at IBUSA can make a huge difference in the outcome of your life insurance application.

This brings us to the last topic that we wanted to take a moment and discuss with you, which is…

How can I help ensure I get the “best life insurance” for me?

There are a few steps you can take to help ensure that you get the best life insurance policy for your Epilepsy:

- Work with a life insurance agent specializing in high-risk cases: An experienced agent can help you navigate the underwriting process and find the right insurance carrier for your situation.

- Be honest about your medical history: Be upfront about your epilepsy diagnosis, including any medication you take and how frequently you experience seizures. Being open and transparent will help ensure that the underwriting process goes smoothly.

- Prepare for a medical exam: Most life insurance policies require a medical exam, which will likely include questions about your epilepsy diagnosis and medication. Be prepared to answer these questions and provide any additional information that may be requested.

- Consider a guaranteed-issue life insurance policy: If you have difficulty obtaining traditional life insurance coverage due to your Epilepsy, you may want to consider a guaranteed-issue policy. These policies do not require a medical exam and are designed for people with pre-existing medical conditions.

- Compare multiple policies and carriers: Shopping around and comparing multiple life insurance policies and carriers is important to ensure you get the best coverage at the best price.

So, what are you waiting for? Give us a call today and see what we can do for you!

Now, can we help out everyone previously diagnosed with Epilepsy?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Burial Life Insurance Companies so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that they CAN qualify for.

So, if you’re ready to explore your options, call us!

Can it be paid with a money order

William,

Yes, it is possible to pay with a money order in many situations. However, it’s important to note that acceptance of money orders as a form of payment depends on the specific policies being purchased and the individual preferences of the insurance carrier.

Some insurance carriers may accept money orders, while others may not. It’s always a good idea to check with the carrier beforehand to ensure that they will accept a money order as payment.

Thanks,

InsuranceBrokersUSA