In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with Bell’s Palsy.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been diagnosed with Bell’s Palsy?

- Why do life insurance companies care if I’ve been diagnosed with a Bell’s Palsy?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been diagnosed with Bell’s Palsy?

Yes, individuals can and often will be able to qualify for a traditional term or whole life insurance policy after having been diagnosed with Bell’s Palsy. In fact, they may even be able to qualify for a Life Insurance Policy without a Medical exam at a Preferred Plus rate in some cases.

Why do life insurance companies care if I’ve been diagnosed with a Bell’s Palsy?

It is probably the best way to understand why a life insurance company is going to “care” if an individual has been diagnosed with Bell’s Palsy to first look at what Bell’s Palsy is and examine what many medical researchers believe may cause it to occur in the first place.

Bell’s Palsy Defined.

Bell’s Palsy is a pre-existing medical condition whereby the seventh cranial never suddenly become swollen or compressed, causing the affected patient to experience facial weakness or paralysis on one side of the face or the other.

The exact cause…

Of this condition remains unknown, but it is believed that I may be triggered by some “viral” infection and may perhaps be linked to the herpes zoster virus, which is known to cause chickenpox and shingles in people.

The good news is…

In most cases, the damage done during one of these “viral” attacks will usually resolve within six months or so. The bad news is that most of the best life insurance companies that we’re all familiar with will want to wait until an applicant has fully healed form their “attack” before approving them for a traditional term or whole life insurance policy.

Insurance companies…

May also be interested in any factors that may have contributed to or made one more likely to be susceptible to such a viral outbreak.

They may also want to ask you a few questions about whether or not you suffer from any other pre-existing medical conditions, which may have contributed to your falling victim to this disease (even if only temporarily).

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll like be asked may include:

- When were you first diagnosed with Bell’s Palsy?

- Who diagnosed your condition? A general practitioner or a specialist?

- What symptoms led to your diagnosis?

- Facial spasm?

- Facial paralysis?

- Sagging eyelid?

- Drooping mouth?

- Drooling?

- Dry or excessive tearing?

- Sensitivity to sound?

- Decreased sense of taste?

- Do you still experience any of these symptoms?

- Did your doctor recommend any kind of treatment options?

- If healed, how long did it take to recover fully?

- Are you currently taking any prescription medications?

- Have you been diagnosed with any other pre-existing medical conditions?

- Do you suffer from any condition that might be causing your immune system to be depressed?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

Now before we…

Start discussing what kind of “rates” you might be able to qualify for after having been diagnosed with Belly’s Palsy. We do want to make it clear that we here at IBUSA are not medical professions, and we’re certainly not doctors! For this reason, we would encourage anyone who has any medical questions about their condition to seek out advice from a true medical professional.

Because…

All we are is a bunch of life insurance agents who happen to be good at helping folks with a wide variety of pre-existing medical conditions find and qualify for the type of life insurance that they’re looking for. Now, if this sounds like you, well good news because you’ve come to the right place!

What rate (or price) can I qualify for?

Now we know that we’ve covered a lot of information so far in this article and we’ll acknowledge that in our section:

“What kind of information will the insurance companies ask me or be interested in?”

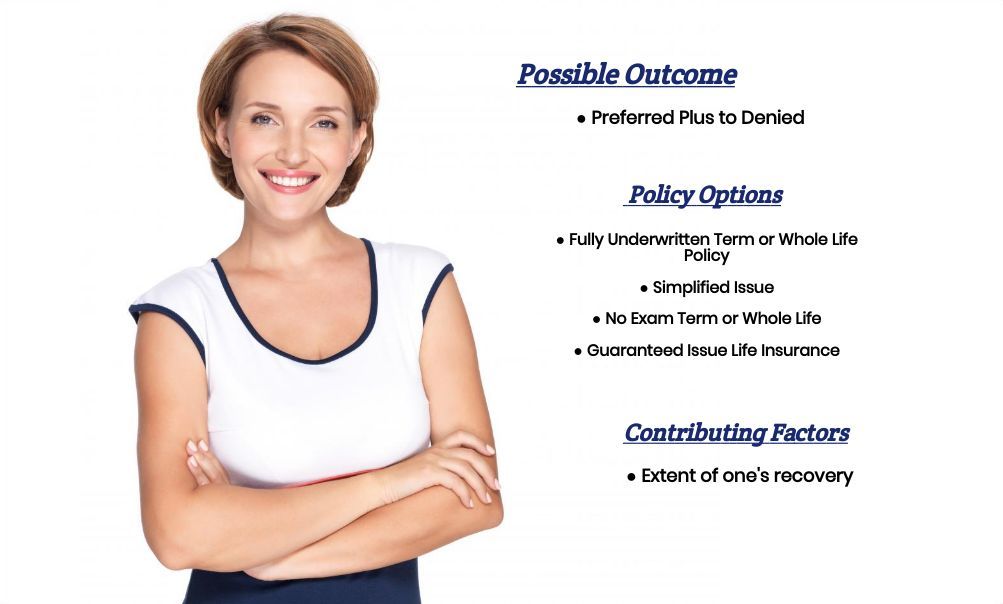

And while it’s likely that most (if not all) life insurance companies are going to ask most of these questions at some point during your application when it comes down to it, the most important factors regarding a previous Bell’s Palsy diagnosis will be:

Have you recovered from your condition?

And if so…

Do you suffer from any lingering effects from your Bell’s Palsy attack?

And if the answers to these questions are:

“Yes, I have recovered, and no, I don’t suffer from any linger effects!”

Chances are your previous Bell’s Palsy diagnosis isn’t going to affect the outcome of your life insurance application, which means that “theoretically” you still ought to be able to qualify for a Preferred Plus rate assuming that you would otherwise be eligible.

Now if…

It turns out that you still haven’t recovered from your Bell’s Palsy attack or you still have some lingering effects; it’s possible that you may still be eligible for coverage however it’s more likely that a life insurance company will want to “postpone” your life insurance application until which point you have completely healed.

The good news is…

That regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy that they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to helping a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is exactly what you’re going to find here at IBUSA!

Now, will we be able to help out everyone who has been previously diagnosed with Bell’s Palsy?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Burial Life Insurance Companies as well so that in the event that someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available to you, just give us a call!