In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after they have been diagnosed with a urinary tract infection (UTI), bladder infection, or cystic fibrosis.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been diagnosed with an Urinary Tract Infection?

- Why do life insurance companies care if I’ve been diagnosed with an Urinary Tract Infection?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been diagnosed with an Urinary Tract Infection?

Individuals can and often will qualify for a traditional term or whole life insurance policy. They may even be eligible for a Preferred Plus rate when applying for a no-medical-exam life insurance policy!

The only problem is that when not treated quickly and correctly, these infections can “morph” into a kidney infection (pyelonephritis), which, over time, can cause some pretty significant health issues.

Why do life insurance companies care if I’ve been diagnosed with an Urinary Tract Infection?

What you’re typically going to find is that most (if not all) of the best life insurance companies (in our humble opinion) aren’t going to be all that worried about the fact that an individual has been diagnosed with a UTI or Bladder Infection provided that the infection didn’t spread to one’s kidney’s or cause any long term damage.

For this reason…

Unless you seem to have a “propensity” for developing a UTI or you have suffered from several kidney infections before, most of the time, individual life insurance applicants aren’t going to be asked about their previous UTIs during a life insurance application.

That said, however, it’s crucial to understand what precisely a Bladder Infection is and what some of the symptoms of this “disease/condition” are so that if asked, you’ll have a better understanding of “why” a life insurance underwriter might be interested in the fact that you have been diagnosed with a UTI and not get too worried about their “inquiries. “.

Cystitis, Bladder Infection, and Urinary Tract Infection (UTI) Defined:

Cystitis, Bladder Infection, and Urinary Tract Infection are three different terms often used interchangeably to describe a condition whereby one’s bladder and/or urethra become inflamed.

Symptoms may include:

- A strong and persistent urge to urinate,

- A burning sensation when urinating,

- Difficulty passing urine,

- Hematuria or blood in the urine,

- Cloudy urine,

- Strong-smelling urine,

- Fever,

- Etc…

Fortunately, Urinary Tract Infections are typically relatively easy to treat with antibiotics. They won’t usually progress into more complicated infections involving one’s kidneys (pyelonephritis), so most life insurance companies aren’t too concerned about individuals diagnosed with a UTI or multiple UTIs over time.

Now, at this point…

We usually like to take a moment and remind folks that nobody here at IBUSA has any “official” medical training, and we’re certainly not doctors. All we are is a bunch of life insurance agents who are good at helping folks with pre-existing medical conditions like this one find and qualify for the life insurance coverage they are looking for.

But…

It’s not so great if you’re seeking answers to specific medical questions. In such cases, we recommend contacting an actual medical professional with the training to help. For everyone else, you’re in luck because now we’re going to get into some of the “nitty-gritty” about what you may or may not be able to qualify for.

What kind of information will the insurance companies ask me or be interested in?

Typical questions you may be asked may include:

- When did you suffer from your first UTI?

- How often do you experience a UTI?

- Have any of your UTI infections spread to a kidney?

- Are you currently suffering from a UTI right now?

- Are you presently taking any prescription medications right now?

From there, you’ll typically be asked a few questions to ensure they’re not missing anything they should know about. These questions will be asked of all applicants applying for a traditional life insurance policy. Don’t let these questions scare you or make you wonder if having been diagnosed with a UTI is more severe than you initially thought!

- Have you been diagnosed with any other pre-existing medical conditions?

- In the past two years, have you been admitted to a hospital for any reason?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

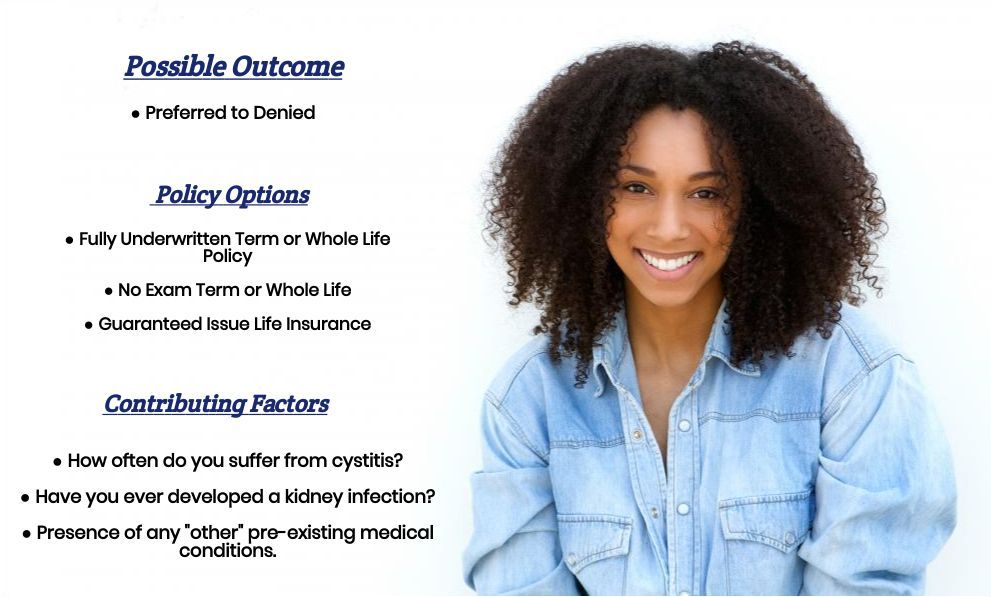

What rate (or price) can I qualify for?

When it comes time to determine what kind of “rate” an individual can qualify for after having been diagnosed with Cystitis or a UTI, what you’re generally going to find is that if you’ve never had a UTI affect one of your kidneys, or if you’ve never really suffered from any “serious” consequences as a direct result from a UTI most life insurance companies aren’t going to use this as a factor in determining what kind of “rate” that you’ll be able to qualify for.

Or, in other words…

What you’re most likely going to find is that whatever “rate” you would have been able to qualify for before your UTI should be the same “rate” you would be able to get after your UTI diagnosis.

“Which is great!”

But unfortunately, not everyone is so lucky. This means that some may have had a UTI infection spread to one of their Kidneys or occur so frequently that some life insurance companies may consider these a potential “risk” that could prevent an applicant from qualifying for a Preferred rate.

The good news is…

Regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to see the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

Seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is precisely what you’ll find here at IBUSA!