Receiving an aneurysm diagnosis fundamentally changes your relationship with life insurance, transforming what might have been a straightforward application into a complex navigation of medical underwriting, policy limitations, and often, initial rejections from traditional insurers. Worry meets frustration as conflicting online information suggests coverage could be possible, but maybe not, leaving families uncertain about protecting their financial future.

Our comprehensive analysis examines the complete landscape of life insurance options for individuals with aneurysms, from traditional fully-underwritten policies for stable cases to guaranteed issue alternatives for those facing immediate health concerns. It is our hope that this guide will increase your understanding and thus increase your chances of qualifying for a policy that meets your needs.

Important Medical Disclaimer

This article provides information about insurance options and should not be considered medical advice. Always consult with qualified healthcare professionals about your aneurysm diagnosis, treatment options, and health management. If you are experiencing symptoms that could indicate aneurysm complications, seek immediate medical attention.

How Do Insurance Companies View Aneurysms?

Insurance companies approach aneurysm cases with careful risk assessment that varies dramatically based on specific medical factors rather than applying blanket approval or denial policies. Understanding how underwriters evaluate aneurysm cases helps applicants prepare realistic expectations and choose appropriate coverage strategies.

Key insight: Modern insurance underwriting recognizes significant differences between aneurysm types, locations, and treatment outcomes. A small, stable cerebral aneurysm under regular monitoring receives vastly different consideration than a large, untreated abdominal aortic aneurysm, requiring individualized assessment approaches.

Primary Underwriting Considerations:

- Aneurysm Type and Location: Cerebral (brain) aneurysms, abdominal aortic aneurysms, and thoracic aneurysms each carry different risk profiles, with location significantly impacting mortality statistics that drive underwriting decisions.

- Size and Growth Rate: Smaller aneurysms (under 7mm for cerebral, under 5cm for abdominal) with stable sizing over time demonstrate lower risk than larger or growing aneurysms requiring immediate intervention.

- Treatment Status: Successfully treated aneurysms with good recovery outcomes often qualify for coverage, while untreated cases face more restrictive underwriting regardless of current stability.

- Time Since Diagnosis: Recent diagnoses typically result in postponed decisions pending treatment and recovery, while longer-term stable cases demonstrate improved insurability over time.

“Insurance underwriting for aneurysms has evolved significantly as medical outcomes have improved. Companies now differentiate between high-risk and manageable cases rather than implementing universal restrictions, creating opportunities for appropriate candidates.”

– InsuranceBrokers USA – Management Team

Aneurysm Risk Classification by Insurers

| Risk Category | Typical Scenarios | Coverage Likelihood |

| Lower Risk | Small, stable, treated, 2+ years | Standard to mild substandard |

| Moderate Risk | Medium size, monitored, 1-2 years | Substandard to table ratings |

| Higher Risk | Large, untreated, recent diagnosis | Postponed or declined |

| Immediate Risk | Requiring surgery, complications | Declined for traditional coverage |

Bottom Line

Insurance companies evaluate aneurysm cases individually based on specific medical factors rather than blanket policies, creating opportunities for coverage when cases demonstrate stability and appropriate medical management.

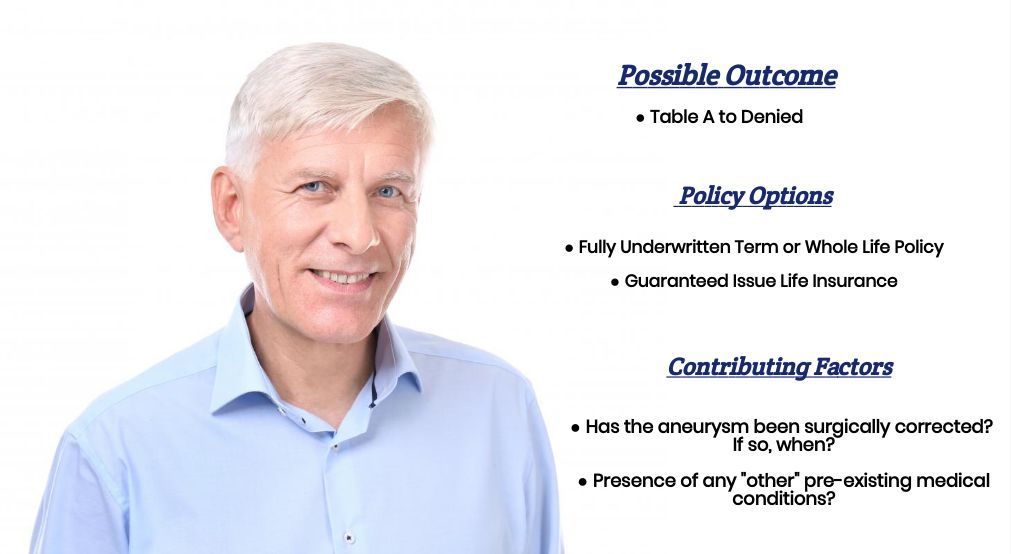

What Life Insurance Options Are Available?

Individuals with aneurysms can access multiple types of life insurance coverage, each with different underwriting requirements, approval timelines, and cost structures. Understanding the full range of options helps match coverage types to specific health profiles and coverage needs.

The key to successful coverage acquisition lies in understanding which insurance products align with your specific aneurysm situation and applying for appropriate coverage types rather than pursuing options unlikely to approve your case.

Traditional Fully-Underwritten Coverage:

- Term Life Insurance: Best option for stable, treated aneurysms with good long-term prognosis. Offers highest coverage amounts at lowest cost for qualified applicants, typically requiring 2+ years since successful treatment.

- Whole Life Insurance: Permanent coverage with cash value accumulation, suitable for stable cases needing lifelong protection. Higher premiums but provides estate planning benefits and guaranteed coverage continuation.

- Universal Life Insurance: Flexible premium permanent coverage allowing adjustments to death benefits and payment schedules, beneficial for managing changing financial circumstances during treatment periods.

Simplified Issue Coverage:

- No-Exam Life Insurance: Simplified underwriting options that rely on health questionnaires rather than medical examinations, often more accessible for minor aneurysms or well-managed cases.

- Accelerated Underwriting: Fast-track approval processes using medical databases and algorithms, potentially avoiding detailed aneurysm disclosure requirements for smaller coverage amounts.

“The simplified issue market has expanded significantly, creating new opportunities for individuals with controlled health conditions who might face challenges with traditional underwriting. These products often provide middle-ground solutions between standard coverage and guaranteed issue policies.”

– InsuranceBrokers USA – Management Team

Guaranteed Issue and Final Expense Options:

- Guaranteed Issue Life Insurance: Accepts all applicants within age ranges (typically 45-85) without health questions, though coverage amounts are limited and waiting periods apply for natural death benefits.

- Final Expense Insurance: Burial insurance specifically designed for end-of-life costs, often more accessible than traditional coverage with simplified health questions focused on immediate health concerns.

- Group Life Insurance: Employer-sponsored coverage that typically provides guaranteed acceptance up to certain amounts, valuable as base coverage while pursuing additional individual policies.

Specialized High-Risk Coverage:

- Substandard Life Insurance: Coverage specifically designed for higher-risk applicants, often available through specialized insurers at higher premiums but with more flexible underwriting standards.

- Graded Benefit Policies: Policies with reduced death benefits in early years, gradually increasing to full coverage over 2-3 years, designed for applicants with significant health concerns.

Key Takeaways

- Multiple coverage options exist beyond traditional fully-underwritten policies

- Simplified issue products provide middle-ground solutions for controlled aneurysms

- Guaranteed issue coverage ensures some protection regardless of health status

- Matching coverage type to aneurysm severity improves approval success rates

What Factors Affect Coverage Approval?

Insurance underwriters evaluate aneurysm cases using specific medical and demographic factors that significantly influence approval decisions and premium rates. Understanding these factors helps applicants present their cases effectively and set realistic expectations for coverage outcomes.

Key insight: Successful aneurysm life insurance applications depend heavily on demonstrating medical stability, appropriate treatment compliance, and long-term management rather than simply meeting minimum time requirements since diagnosis.

Critical Medical Factors:

- Aneurysm Characteristics: Size measurements, growth rate over time, and morphology (shape and wall characteristics) directly impact risk assessment, with smaller, stable aneurysms receiving more favorable consideration.

- Location-Specific Risk Assessment: Cerebral aneurysms face different evaluation criteria than abdominal or thoracic aneurysms, reflecting varying mortality rates and treatment outcomes associated with each location.

- Treatment History and Outcomes: Successful surgical repair, endovascular treatment, or clipping procedures with good recovery demonstrate reduced ongoing risk compared to untreated cases requiring only monitoring.

- Complications and Comorbidities: Additional health conditions like hypertension, smoking history, or family history of aneurysms compound risk assessment and may limit coverage options or increase premiums.

Favorable vs. Challenging Underwriting Scenarios

| Factor | Favorable for Approval | Challenging for Approval |

| Size | Small (<7mm cerebral, <5cm abdominal) | Large (>10mm cerebral, >6cm abdominal) |

| Treatment Status | Successfully treated, good recovery | Untreated, awaiting surgery |

| Time Since Diagnosis | 2+ years, stable monitoring | Recent diagnosis (<6 months) |

| Symptoms | Asymptomatic, incidental finding | Symptomatic, ruptured history |

| Lifestyle Factors | Non-smoker, controlled BP | Smoker, uncontrolled hypertension |

Documentation Requirements:

- Medical Records: Comprehensive documentation including initial diagnosis reports, imaging studies, treatment records, and current monitoring results provide underwriters with complete risk assessment information.

- Physician Statements: Attending physician statements (APS) from treating specialists carry significant weight in underwriting decisions, particularly regarding prognosis and treatment compliance.

- Current Health Status: Recent medical examinations, blood work, and imaging studies demonstrate current stability and help underwriters assess ongoing risk factors.

“The quality and completeness of medical documentation often determines underwriting outcomes more than the aneurysm diagnosis itself. Well-documented cases with clear treatment timelines and stable follow-up results significantly improve approval chances.”

– InsuranceBrokers USA – Management Team

Lifestyle and Demographic Factors:

- Age at Application: Younger applicants with aneurysms face more scrutiny due to longer expected life spans, while older applicants may find more acceptance if aneurysms appear well-managed.

- Occupation and Hobbies: High-risk occupations or activities that could exacerbate aneurysm risks may compound underwriting concerns and limit available coverage options.

- Family History: Genetic predisposition to aneurysms or related cardiovascular conditions influences risk assessment, though personal health management often outweighs family history concerns.

Bottom Line

Coverage approval depends on demonstrating medical stability and appropriate treatment management rather than simply meeting minimum time requirements, making comprehensive documentation and specialist care crucial for success.

How Should You Apply for Coverage?

Strategic application approaches significantly influence approval success rates for aneurysm cases, requiring careful timing, appropriate product selection, and thorough preparation to maximize chances of obtaining coverage at favorable rates.

The application process for aneurysm cases differs substantially from standard life insurance applications, demanding more detailed medical disclosure, longer underwriting timelines, and often multiple iterations to find accepting insurers.

Pre-Application Preparation:

- Medical Documentation Assembly: Gather comprehensive medical records, including initial diagnosis reports, treatment summaries, current imaging results, and physician notes demonstrating stability and compliance with recommended care.

- Health Optimization: Address controllable risk factors like blood pressure management, smoking cessation, and weight control to present the strongest possible health profile during underwriting review.

- Coverage Needs Assessment: Determine appropriate coverage amounts and policy types based on realistic underwriting expectations rather than ideal scenarios, allowing for potential premium increases or coverage limitations.

- Insurer Research: Identify insurance companies with favorable aneurysm underwriting guidelines and recent approval history for similar cases, focusing application efforts on most promising prospects.

“Timing applications strategically can significantly impact outcomes. Applying too soon after diagnosis or treatment often results in postponements, while waiting too long may limit coverage options. The optimal window typically occurs 6-24 months after demonstrating stable medical management.”

– InsuranceBrokers USA – Management Team

Application Execution Strategy:

- Single Company Focus: Rather than applying simultaneously with multiple insurers, focus on one carefully selected company to avoid multiple declinations that complicate future applications.

- Complete Disclosure: Provide thorough, honest medical information from the start rather than minimal disclosure that leads to additional requests and potential trust issues with underwriters.

- Professional Advocacy: Work with experienced agents or brokers who understand aneurysm underwriting and can present cases effectively to increase approval probability.

- Flexible Coverage Acceptance: Remain open to substandard ratings, modified coverage terms, or higher premiums rather than pursuing only standard rates that may result in declination.

Common Application Mistakes to Avoid:

- Inadequate Medical Documentation: Incomplete or unclear medical records force underwriters to request additional information, delaying decisions and potentially leading to unfavorable outcomes.

- Unrealistic Coverage Expectations: Pursuing maximum coverage amounts or standard rates when medical history suggests substandard underwriting is more realistic.

- Poor Timing Decisions: Applying too soon after diagnosis, during active treatment, or without demonstrating stable medical management.

- Multiple Simultaneous Applications: Creating underwriting complications and potential declination records that harm future application prospects.

Key Takeaways

- Comprehensive preparation significantly improves approval chances and premium rates

- Strategic timing based on medical stability outweighs rushing for immediate coverage

- Professional guidance helps navigate complex underwriting requirements effectively

- Realistic expectations and flexibility improve success rates compared to pursuing ideal terms

What Alternatives Exist if Traditional Coverage is Denied?

When traditional life insurance applications result in declinations or prohibitively expensive premiums, numerous alternative coverage options ensure individuals with aneurysms can still provide meaningful financial protection for their families.

These alternatives often provide the essential financial protection families need while avoiding the comprehensive underwriting requirements that create barriers in traditional life insurance markets.

Guaranteed Issue Life Insurance:

- No Health Questions Required: Guaranteed acceptance policies eliminate medical underwriting entirely, providing coverage regardless of aneurysm status or other health conditions.

- Coverage Limitations: Typically limited to $25,000-$50,000 in death benefits with graded benefit periods requiring 2-3 years for full death benefit eligibility.

- Premium Costs: Higher than traditional coverage but provides certainty of approval for individuals unable to qualify through standard or even substandard underwriting processes.

Group Life Insurance Strategies:

- Employer Group Coverage: Maximum participation in employer group life insurance provides guaranteed issue coverage up to specific limits, often 1-3 times annual salary.

- Association Group Plans: Professional associations, alumni groups, and membership organizations sometimes offer group life insurance with simplified underwriting requirements.

- Conversion Rights: Group coverage conversion privileges allow continuation of coverage without medical underwriting when leaving employment, though at higher individual rates.

“Group life insurance often represents the most cost-effective coverage for individuals with significant health conditions. While amounts may be limited, the guaranteed issue nature and group pricing create valuable opportunities that complement other coverage strategies.”

– InsuranceBrokers USA – Management Team

Specialized High-Risk Insurance Products:

- Accidental Death Insurance: Accidental death coverage provides substantial death benefits for accident-related deaths without medical underwriting, though it excludes natural death from aneurysm complications.

- Final Expense Insurance: Burial insurance designed specifically for end-of-life costs often accepts aneurysm cases that traditional insurers decline, providing $5,000-$35,000 in coverage.

- Mortgage Protection Insurance: Specialized coverage designed to pay off mortgages upon death, sometimes available with simplified underwriting for specific lending relationships.

Self-Insurance and Investment Strategies:

- Dedicated Savings Accounts: High-yield savings accounts or money market funds designated for family protection, providing liquid assets without insurance underwriting requirements.

- Investment Portfolio Development: Building investment accounts specifically for family financial protection, offering growth potential that may exceed life insurance death benefits over time.

- Real Estate Investment: Property ownership provides family assets and potential income streams that serve protective functions similar to life insurance death benefits.

Combination Strategy Approaches:

- Multiple Small Policies: Acquiring several smaller policies from different insurers rather than one large policy, reducing individual underwriting scrutiny while building meaningful total coverage.

- Phased Coverage Acquisition: Starting with guaranteed issue or simplified coverage while working to improve health profile for future traditional insurance applications.

- Family Coverage Coordination: Emphasizing life insurance coverage on healthy family members while using alternative strategies for the individual with aneurysm diagnosis.

Key Takeaways

- Multiple alternatives ensure coverage availability regardless of traditional insurance outcomes

- Group insurance provides valuable guaranteed issue opportunities often overlooked

- Combination strategies often provide better overall protection than single coverage approaches

- Alternative coverage can serve as foundation while pursuing traditional insurance improvements

How Can You Improve Your Approval Chances?

Strategic actions taken before and during the application process significantly influence approval outcomes and premium rates for aneurysm life insurance applications, focusing on demonstrable health management and risk reduction rather than simply meeting minimum requirements.

Key insight: Insurance underwriters evaluate ongoing risk management and stability trends more favorably than static medical reports, making proactive health management and comprehensive documentation crucial for optimal outcomes.

Pre-Application Health Optimization:

- Blood Pressure Management: Demonstrate consistent blood pressure control through medication compliance and lifestyle modifications, as hypertension significantly compounds aneurysm risk assessment.

- Smoking Cessation: Complete smoking cessation for at least 12 months prior to application, as smoking dramatically increases aneurysm rupture risk and underwriting concerns.

- Weight Management: Achieve and maintain healthy BMI ranges to demonstrate overall health commitment and reduce cardiovascular risk factors that compound aneurysm concerns.

- Regular Medical Monitoring: Maintain consistent follow-up appointments with specialists and document stable imaging results over time to demonstrate appropriate medical management.

Documentation Strategy Enhancement:

- Comprehensive Medical Timeline: Prepare detailed chronological summary of aneurysm diagnosis, treatment, recovery, and ongoing monitoring to help underwriters understand complete medical picture.

- Specialist Letters: Obtain detailed letters from treating physicians explaining current status, prognosis, and treatment compliance to provide professional medical perspective on ongoing risk.

- Current Health Demonstration: Include recent imaging studies, blood work, and physical examination results showing current stability and absence of progression or complications.

- Lifestyle Documentation: Provide evidence of healthy lifestyle choices including exercise habits, dietary management, and stress reduction activities that support overall health management.

“Underwriters appreciate applicants who take active roles in health management rather than passive compliance with medical recommendations. Demonstrating lifestyle modifications and proactive monitoring significantly improves risk assessment outcomes.”

– InsuranceBrokers USA – Management Team

Application Timing Optimization:

- Stability Demonstration Period: Wait for appropriate timeframes after treatment or diagnosis to demonstrate ongoing stability rather than rushing applications during uncertain medical periods.

- Health Status Monitoring: Time applications during periods of optimal health management when blood pressure, weight, and other controllable factors are well-managed.

- Avoid Stress Periods: Submit applications during stable life periods rather than during major life changes, work stress, or other factors that might impact health assessments.

Professional Support Utilization:

- Experienced Agent Selection: Work with insurance professionals who have specific experience with aneurysm cases and understand which insurers offer most favorable underwriting for your situation.

- Medical Underwriting Consultation: Consider consulting with medical underwriting specialists who can provide pre-application assessment and strategy recommendations.

- Multiple Opinion Seeking: Obtain second opinions from multiple agents or brokers to ensure comprehensive understanding of available options and optimal application strategies.

Realistic Expectation Management:

- Coverage Amount Appropriateness: Apply for reasonable coverage amounts based on income and needs rather than maximum possible amounts that may trigger additional underwriting scrutiny.

- Premium Acceptance Flexibility: Remain open to substandard rates or premium increases rather than insisting on standard rates that may lead to application declination.

- Policy Type Adaptation: Consider term insurance rather than permanent coverage if it improves approval chances, with ability to convert or add coverage later as health demonstrates stability.

Key Takeaways

- Proactive health management significantly improves underwriting outcomes beyond minimum requirements

- Comprehensive documentation and specialist support enhance application presentation quality

- Strategic timing and realistic expectations improve approval probability and terms

- Professional guidance helps navigate complex underwriting requirements effectively

Why Work with Experienced Insurance Professionals?

Navigating life insurance applications with aneurysm diagnoses requires specialized knowledge of medical underwriting, insurer guidelines, and alternative coverage strategies that most individuals cannot effectively manage independently.

Experienced insurance professionals who specialize in high-risk medical cases provide invaluable guidance that often determines the difference between successful coverage acquisition and repeated declinations or suboptimal coverage terms.

Specialized Knowledge and Experience:

- Insurer-Specific Guidelines: Professional agents understand which insurance companies have favorable aneurysm underwriting policies and recent approval history for similar medical profiles.

- Medical Underwriting Expertise: Experienced professionals understand how to present medical information effectively and what additional documentation strengthens applications for complex health conditions.

- Alternative Product Knowledge: Access to specialized insurance products and niche insurers that focus on high-risk medical cases, often unavailable through direct consumer channels.

- Application Strategy Development: Guidance on optimal timing, coverage amounts, and policy types based on specific medical situations rather than generic application approaches.

“Insurance professionals specializing in medical impairments often achieve approval rates 2-3 times higher than direct consumer applications for complex health conditions. Their expertise in presentation, company selection, and alternative strategies provides significant value beyond simple policy placement.”

– InsuranceBrokers USA – Management Team

Application Process Advantages:

- Pre-Application Assessment: Professional evaluation of medical records and health status to determine optimal application strategies before submitting formal applications.

- Documentation Assistance: Help assembling comprehensive medical documentation and physician statements that present cases in most favorable light for underwriting review.

- Underwriter Communication: Direct communication with insurance company underwriters to clarify medical questions and advocate for favorable consideration during review process.

- Appeal and Reconsideration Support: Professional assistance with appeals processes and alternative applications when initial attempts result in declinations or unsatisfactory terms.

Long-Term Relationship Benefits:

- Ongoing Coverage Monitoring: Professional review of coverage adequacy and opportunities for improvement as health status changes or new products become available.

- Claims Assistance: Support during claims processes to ensure proper benefit payment and resolution of any complications that may arise.

- Policy Management: Assistance with policy changes, beneficiary updates, and premium optimization as circumstances change over time.

- Additional Coverage Opportunities: Ongoing assessment of opportunities for additional coverage as health improves or alternative products become available.

Selection Criteria for Insurance Professionals:

- Medical Impairment Experience: Verify specific experience with aneurysm cases and other cardiovascular conditions rather than general life insurance expertise.

- Company Relationships: Ensure access to multiple insurance companies including specialized high-risk insurers rather than limited product portfolios.

- Transparent Communication: Professionals who provide realistic expectations and comprehensive explanation of options rather than overly optimistic projections.

- Ongoing Support Commitment: Long-term service commitment beyond initial policy placement, including future coverage needs and claim support.

Bottom Line

Professional guidance from experienced insurance specialists significantly improves approval chances, coverage terms, and long-term policy management for aneurysm cases, providing value that typically far exceeds additional service costs.

Frequently Asked Questions

Can I get life insurance if I have an unruptured brain aneurysm?

Direct answer: Yes, life insurance is possible with unruptured brain aneurysms, though approval depends on size, location, treatment status, and time since diagnosis.

Small, stable aneurysms under regular monitoring may qualify for standard or mildly substandard rates, while larger or untreated aneurysms typically face higher premiums or require alternative coverage options like guaranteed issue policies.

How long should I wait to apply for life insurance after aneurysm treatment?

Direct answer: Most insurers prefer 6-24 months after successful treatment to demonstrate recovery and stability before considering standard applications.

The optimal timing depends on treatment type and recovery progress. Successful surgical repair with good recovery may qualify sooner, while conservative management requires longer stability demonstration for favorable underwriting consideration.

Will life insurance companies require medical exams for aneurysm cases?

Direct answer: Traditional policies typically require medical exams and extensive medical records review, though simplified issue options may avoid exams for smaller coverage amounts.

Medical exams help insurers assess current health status beyond aneurysm concerns. Some no-exam life insurance options exist but usually with lower coverage limits and higher premiums for aneurysm cases.

Do different types of aneurysms affect life insurance approval differently?

Direct answer: Yes, cerebral, abdominal aortic, and thoracic aneurysms receive different underwriting consideration based on location-specific risks and treatment outcomes.

Brain aneurysms often face stricter underwriting due to rupture consequences, while abdominal aortic aneurysms may receive more favorable consideration if small and stable. Location, size, and treatment success significantly influence approval outcomes.

What happens if my aneurysm grows after getting life insurance?

Direct answer: Existing life insurance policies typically continue unchanged unless you apply for additional coverage, as current policies are based on health status at application time.

Life insurance contracts generally cannot be modified or cancelled due to health changes after approval. However, applying for additional coverage would require new underwriting based on current health status including any aneurysm progression.

Are there specific insurance companies that are better for aneurysm cases?

Direct answer: Yes, certain insurers have more favorable aneurysm underwriting guidelines, though the best company varies based on specific medical details and coverage needs.

Companies specializing in medical impairments or those with experienced medical underwriting departments often provide better outcomes. Working with agents familiar with multiple insurance company guidelines helps identify optimal options for specific situations.

What if I’m declined for life insurance due to my aneurysm?

Direct answer: Declination from one company doesn’t prevent approval elsewhere, and guaranteed issue policies provide coverage regardless of health status, though with limitations.

Multiple coverage alternatives exist including guaranteed issue life insurance, group coverage through employers, and final expense insurance options that often accept cases declined by traditional insurers.

Final Recommendation: Securing Life Insurance with an Aneurysm

Life insurance approval with an aneurysm diagnosis is achievable through strategic application approaches, appropriate coverage selection, and realistic expectation management. While aneurysm cases face additional underwriting complexity, numerous coverage options ensure families can obtain meaningful financial protection regardless of health status.

Success depends heavily on demonstrating medical stability, appropriate treatment compliance, and proactive health management rather than simply meeting minimum time requirements. Well-managed aneurysm cases often surprise applicants with reasonable premium rates, while challenging cases can still access guaranteed issue coverage for essential family protection.

The key to optimal outcomes lies in working with experienced insurance professionals who understand aneurysm underwriting, comprehensive preparation of medical documentation, and flexibility in coverage terms and premium expectations. Most importantly, don’t let an aneurysm diagnosis prevent you from exploring coverage options – alternatives exist for every situation.

Bottom Line

Aneurysm diagnoses complicate but don’t eliminate life insurance opportunities. Strategic application approaches, professional guidance, and realistic expectations typically result in meaningful coverage for family financial protection.

Just diagnosed with thoracic aneurysm, having it removed.

58yrs old good health otherwise. Previous smoker 3months. Whats my quote

Stephen,

While we would love to provide you with a quote, it’s simply not possible given the little we have to work from here. For example, you haven’t even told us how much insurance you’re looking for. For this and many other reasons, it’s probably best for you to give us a call if you would like us to be able to provide you with an accurate quote.

Thanks,

InsuranceBrokersUSA