In this article, we will answer some of the most common questions we receive from individuals diagnosed with aneurysm or aneurysmal dilation who are applying for life insurance. These questions will include:

- Can I qualify for life insurance if I have been diagnosed with an Aneurysm?

- Why do life insurance companies care if I have been diagnosed with an Aneurysm?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to ensure I get the best life insurance policy?

At IBUSA, we want to provide our clients with the best possible service, and we understand that navigating the life insurance application process can be confusing and overwhelming. So, let’s dive right in and address these important questions.

Can I qualify for life insurance if I have been diagnosed with Aneurysm?

Yes, it is possible to qualify for life insurance even if you have been diagnosed with an aneurysm. However, your diagnosis may affect the terms of your policy and the premiums you will have to pay.

It is worth noting that different insurance companies have different underwriting guidelines and may have varying approaches to assessing risk for individuals with an aneurysm. Therefore, shopping around and comparing quotes from multiple insurance companies to find the right policy for you may be helpful.

Why do life insurance companies care if I have been diagnosed with Aneurysm?

Life insurance companies are concerned about the potential risks associated with insuring someone who has been diagnosed with an aneurysm because, if an insured’s Aneurysm ruptures, it can become life-threatening!

That said, however…

Most insurance companies aren’t going to rule out insuring someone diagnosed with an aneurysm immediately. Instead, most insurance companies want to ensure that they provide coverage that accurately reflects the risks associated with each policyholder. When assessing the risk associated with a person diagnosed with an aneurysm, the insurer will consider several factors, including the size and location of the Aneurysm, the person’s overall health, and the treatment plan in place.

So, in summary, life insurance companies care about whether you have been diagnosed with an aneurysm because it is a medical condition that can affect your overall health and longevity and thus potentially increase the risk of a claim being made on the policy.

What kind of information will the insurance companies ask me or be interested in?

When applying for life insurance, you’ll typically need to complete an application with questions about your personal and medical history. If you’ve been diagnosed with an aneurysm, the insurance company may request additional information about your condition and its management. This could include:

- The date of your diagnosis, the location of the Aneurysm, and its size

- Details of your treatment, such as the medications you’re taking, any lifestyle changes you’ve made, and any surgical procedures you’ve undergone

- Any other medical conditions you have, as well as your family medical history

- Information about your occupation and leisure activities, particularly if they’re hazardous

- Details of your lifestyle habits, such as your diet, exercise routine, and use of tobacco or alcohol

It’s important to answer these questions honestly and accurately, as the information will be used to determine your eligibility for a life insurance policy and the premiums you’ll pay. Failing to disclose your aneurysm diagnosis could affect your coverage or the payout of your policy.

To help the insurance company better understand your condition, it’s a good idea to have a copy of your medical records and a list of the medications you’re taking when you apply for life insurance. This can help ensure that your condition is accurately represented and that you receive the right coverage.

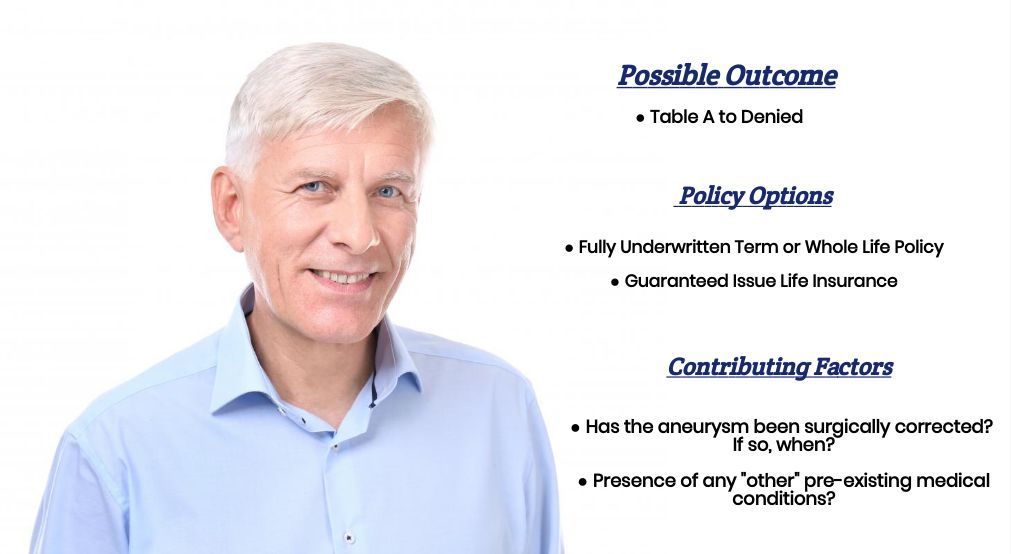

What rate can I qualify for?

As you can see, numerous variables can affect the rate an individual can qualify for when applying for life insurance. It can be challenging to predict what rate an individual might be eligible for without speaking with them first.

However, there are life insurance companies that are willing to insure individuals diagnosed with an aneurysm, regardless of whether or not they have had it treated surgically. Some of these companies may even offer a Preferred rate, depending on the type of Aneurysm and when it was diagnosed.

The challenge is…

That insurance companies can vary significantly in their underwriting decisions regarding aneurysms. Unlike some other pre-existing medical conditions, there is no set outcome for an aneurysm, nor is there a definitive test to determine its severity.

Therefore, determining whether an individual is eligible for coverage and what premium they may be required to pay is often subjective and may vary from one insurance company to another.

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, honesty and having options available are the number one factors in helping someone find the “best” life insurance policy.

This is because when a client is upfront with us about all the factors that may affect their eligibility and premiums, and we have a wide range of options to choose from, the likelihood of finding the perfect policy increases significantly.

Of course, this assumes that you apply with a life insurance brokerage like IBUSA. Our team has access to dozens of different life insurance companies. It comprises true life insurance professionals with the knowledge and expertise to help you navigate the options and find the best fit.

So why wait? Give us a call today and experience the IBUSA difference.

Just diagnosed with thoracic aneurysm, having it removed.

58yrs old good health otherwise. Previous smoker 3months. Whats my quote

Stephen,

While we would love to provide you with a quote, it’s simply not possible given the little we have to work from here. For example, you haven’t even told us how much insurance you’re looking for. For this and many other reasons, it’s probably best for you to give us a call if you would like us to be able to provide you with an accurate quote.

Thanks,

InsuranceBrokersUSA