In this article, we aim to answer some of the most common questions we receive from individuals who have been diagnosed with Addison’s disease, Adrenal Insufficiency, or Hypocortisolism and are applying for life insurance.

The questions we will address include:

- Can I qualify for life insurance if I have been diagnosed with Addison’s disease?

- Why do life insurance companies care if I have been diagnosed with Addison’s disease?

- What kind of information will insurance companies ask for or be interested in?

- What rate or price can I qualify for?

- What can I do to ensure I get the best life insurance policy?

Without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Addison’s disease?

Yes, individuals who have been diagnosed with Addison’s disease can generally qualify for life insurance. However, the qualification process and the rate you are offered will depend on factors such as the severity of your condition, how well it is managed, and other health factors. In some cases, it may also be possible to qualify for a no-medical-exam life insurance policy.

Why do life insurance companies care if I have been diagnosed with Addison’s disease?

Life insurance companies are interested in knowing about any medical conditions you may have, including Addison’s disease, because they use this information to assess the risk of insuring you.

Now, in the case of Addison’s disease, it’s important to understand that if not appropriately managed, Addison’s disease can lead to serious health complications such as low blood pressure, dehydration, and even coma. In extreme cases, some individuals may even suffer from a condition referred to as “Addisonian crisis,” which is caused by dangerously low blood pressure.

Now, is this likely to happen to someone who is appropriately treating Addison’s disease?

No, probably not; this is why many of the best life insurance companies (in our opinion) will be willing to approve an individual diagnosed with Addison’s disease at a Preferred rate.

But…

just because you may be able to qualify for a Preferred rate doesn’t mean that most life insurance companies don’t want to ensure that you are properly treating your condition before they will be willing to make that determination.

What kind of information will the insurance companies ask me or be interested in?

When applying for life insurance with Addison’s disease, insurance companies typically ask for information about your medical history, current health status, and treatment regimen. Here are some of the types of information that they may ask for:

- Medical records: You may be asked to provide copies of medical records related to your Addison’s disease, including diagnoses, treatments, and any hospitalizations.

- Medications: Insurers will want to know what medications you take to manage your condition, including dosages and how frequently you take them.

- Symptoms: You may be asked to describe any symptoms you experience due to your Addison’s disease, such as fatigue, muscle weakness, or weight loss.

- Tests and lab results: Insurance companies may request the results of any blood tests or other diagnostic tests you have undergone related to your Addison’s disease.

- Doctor’s notes: Your doctor may be asked to provide additional information about your condition, such as how well it is managed and whether you have any other underlying health issues.

They may also ask you specific questions such as:

- What medications are you currently taking to help treat your condition?

- Have you been prescribed any other medications?

- Have you been diagnosed with any other pre-existing medical conditions?

- Have any of your medications changed within the past two years?

- Have you been hospitalized for any reason within the past two years?

- Have you used any tobacco or nicotine products within the past two years?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

By providing this information, insurance companies can better understand your health status and determine the appropriate rate to offer you.

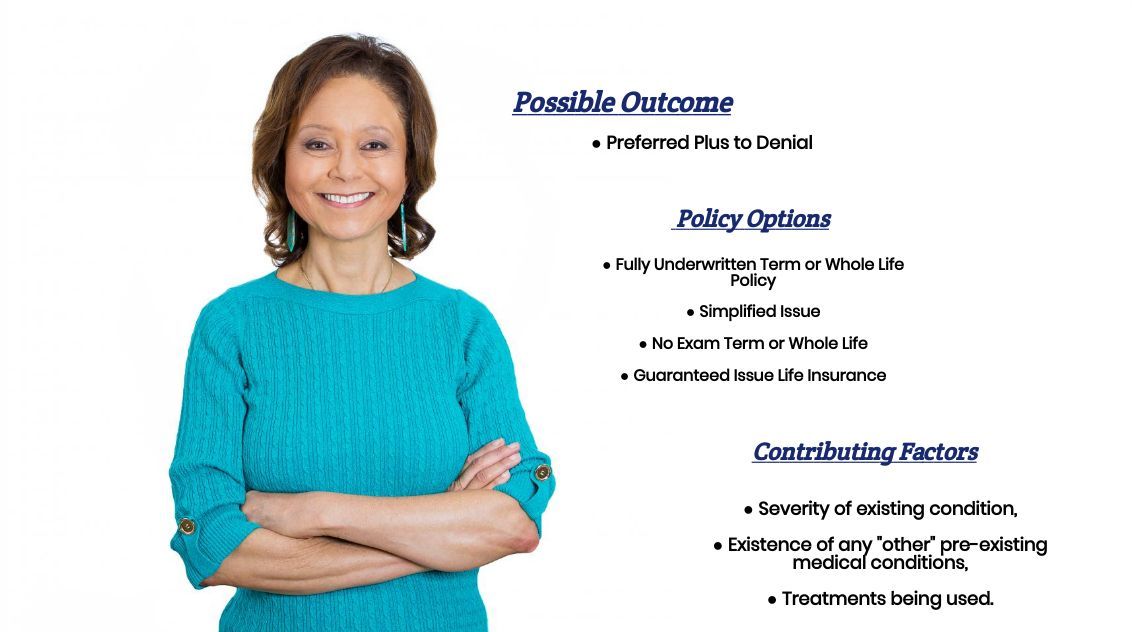

What rate (or price) can I qualify for with Addison’s Disease?

Now, as you can see, there are a lot of factors that can come into play when trying to determine what kind of rates someone who has been diagnosed with Addison’s disease might be able to qualify for. This is why it’s pretty much impossible to know what kind of “rate” you might be able to qualify for without first having had the opportunity to speak with you for a few minutes.

That said, however…

What we can tell you is that if it appears that your Addison’s disease isn’t preventing you from living a “normal” life, and if you’ve never experienced an Addisonian Crisis, then there is a pretty good chance that you might still be considered eligible for a Preferred rate despite your previous diagnosis.

But remember…

You may not qualify for a Preferred rate due to some “other” factor unrelated to your Addison’s disease, which would prevent you from qualifying for such a rate. Or it could be because you may be experiencing one of the many symptoms commonly associated with having Addison’s disease that while “it” may not be serious enough to prevent you from being able to qualify for coverage, it could be used as a reason to “knock” you down from a Preferred rate to a Standard or Standard Plus rate.

Symptoms that could…

Cause one not to be able to qualify for a Preferred rate might include:

- An absence of menstruation,

- Significant darkening of the skin,

- Unexplained weight loss,

- Excessive fatigue,

- Fainting spells and/or dizziness,

- etc.…

The good news is, here at IBUSA, we have plenty of experience helping folks like yourself find and qualify for the life insurance you’re looking for.

This brings us to the last topic that we wanted to take a moment to discuss with you:

How can I help ensure I get the “best life insurance” for me?

Here are some steps you can take to increase your chances of getting the best life insurance policy if you have been diagnosed with Addison’s disease:

- Shop around: Do your research and compare quotes from multiple insurance companies. Each company has its underwriting guidelines and may offer different rates for individuals with Addison’s disease.

- Work with an experienced agent: An experienced insurance agent familiar with Addison’s disease and the insurance industry can help you navigate the application process, understand the policies available, and find the best coverage for your situation.

- Keep your condition under control: Work closely with your doctor to effectively manage your Addison’s disease. Follow your treatment plan, take your medications as prescribed, and keep up with your regular check-ups and blood tests. Demonstrating that you are managing your condition can help reassure insurers and may lead to more favorable rates.

- Be honest: Always be honest and transparent when applying for life insurance. Disclose all relevant information about your medical history and Addison’s disease, as withholding information could lead to your policy being canceled or denied.

Now, will some have been diagnosed with Addison’s Disease who won’t be able to qualify for a traditional life insurance policy?

Sure, that’s likely to happen. But that’s why we at IBUSA work hard to establish and maintain relationships with many of the Best Final Expense Insurance Companies. If someone can’t qualify for a traditional life insurance policy, there may be some other “type” of product they CAN qualify for.

So, if you’re ready to explore your options, call us!