In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with Kidney Cancer.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Kidney Cancer?

- Why do life insurance companies care if I’ve been diagnosed with Kidney Cancer?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Kidney Cancer?

Yes, some individuals diagnosed with Kidney or Renal Cancer can sometimes be able to qualify for a traditional life insurance policy. The only problem is that most top-rated life insurance companies will first want to ensure you are no longer being treated for Kidney Cancer before possibly approving your application.

Why do life insurance companies care if I’ve been diagnosed with Kidney Cancer?

It’s pretty safe to say that any time an individual has been diagnosed with cancer, that diagnosis will be something that a life insurance company is going to “care” about. This is particularly true with Kidney Cancer, where the 5-year survival rate can vary significantly based on the “cell type” of Kidney Cancer an individual has been diagnosed with and the “stage” that it was first diagnosed.

This is why, most life insurance companies will want to ask you a series of questions about your Kidney Cancer before considering your application so that they can get a better idea about what “kind” of risk you may pose to them should they decide to order a medical exam and/or your medical records from your primary care physician.

What kind of information will the insurance companies ask me or be interested in?

Typical questions the insurance companies likely ask you will include:

- When were you first diagnosed with Kidney Cancer?

- How was your Kidney Cancer diagnosed?

- Were you diagnosed by your primary care physician or an oncologist?

- What led up to your diagnosis? Were you suffering from any symptoms?

- What “kind” of Kidney Cancer were you diagnosed with?

- Renal cell carcinoma?

- Urothelial cell carcinoma or transitional cell carcinoma?

- Sarcoma?

- Wilms tumor?

- Lymphoma?

- What “stage” did your Kidney Cancer grow to?

- Stage 1: Tumor contained within the kidney and is less than 7 cm.

- Stage 2: Tumor is greater than 7 cm but is still within the kidney.

- Stage 3: Tumor has expanded outside of the kidney and may also be affecting one’s adrenal glands or other nearby tissues or organs. Lymph node involvement may or may not exist.

- Stage 4: Cancer has now spread beyond the kidney and has likely spread to other parts of the body, including one’s lymph nodes and/or other distant organs, including one’s liver, lungs, or bladder.

- How was your Kidney Cancer treated?

- Surgically, with a partial nephrectomy or with a radical nephrectomy?

- Immunotherapy?

- Radiation or chemotherapy?

- Are you currently cancer-free today? And if so, when was your last date of treatment?

- Do you suffer from any lingering effects of your Kidney Cancer?

- Are you currently taking any prescription medications?

- Have you been diagnosed with any other pre-existing medical conditions?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

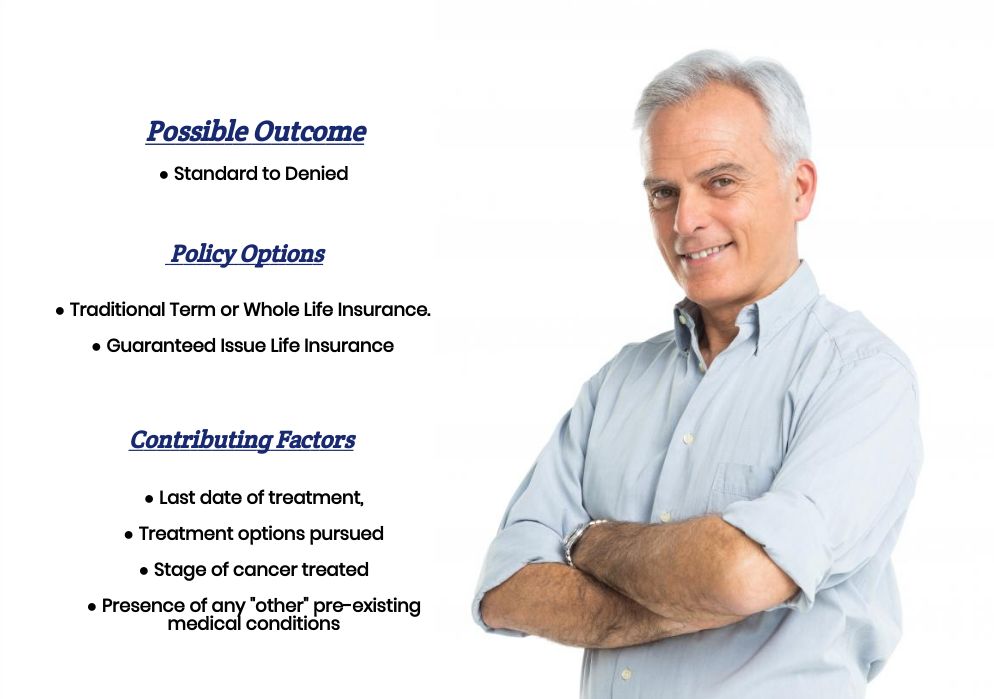

As one can see from these questions, it’s safe to say that no two Kidney Cancer cases will ever look the same. Variations in one’s tumor type, size, and spread will all play a role in determining who will and won’t qualify for coverage, not to mention what “price” they may end up having to pay.

That said, however, we can make a few “assumptions” that will generally hold true and provide one with a “general” idea of what they may or may not be able to qualify for. For example, it’s pretty safe to say that if you are currently treating your Kidney Cancer today or you have only recently entered into remission (two years or less), chances are most life insurance companies are going to choose to either DENY your application today or POSTPONE your application until you have been ultimately cancer free for a minimum of two years.

In cases like these…

You may want to seek out an alternative product like an Accidental Death Policy (which is not considered a life insurance product) or a Burial Life Insurance Policy, which won’t discriminate against you for having been diagnosed with Kidney Cancer. We’ll commonly recommend that an individual use one of these “types” products as a “bridge” until they qualify for a traditional term or whole life insurance policy.

No, for those who have been in remission for at least two years, most life insurance companies will generally divide people into two groups. Some may qualify for a Standard rate, and some won’t.

Individuals able to qualify for a Standard rate will typically be those who were usually diagnosed over the age of 40, only suffered from a small tumor that remained contained within a single kidney, and likely didn’t need to receive a radical nephrectomy. As for everyone else, there is still a chance that you, too, may be able to qualify for coverage. You will most likely need to settle on a “substandard” rate now.

Which when you…

Really think about it isn’t so bad that you may have to pay more for your coverage. You’ll want to be more “selective” with which life insurance company you choose because prices vary more significantly from one insurance company to another regarding ” substandard ” rates. This means that when you are “shopping” for coverage, you’ll probably want to limit your search to only companies that specifically try to compete in “high-risk” niches.

How can I help ensure I get the “best life insurance” for me?

In our experiences here at IBUSA, we’ve found that usually, the “best” approach in helping someone find the “best” life insurance policy for them is to first:

- Fully understand what an individual is trying to achieve by purchasing their life insurance policy.

- Are you looking to:

- Cover the cost of a mortgage?

- Replace lost wages?

- Protect a child or spouse?

- Or cover one’s final expenses?

- Are you looking to:

- Then, provide plenty of options so that one is not limited to one or two different options.

This is why, we at IBUSA choose to work with so many different life insurance companies that when it comes time to help you decide “which” company will be the best for you, we don’t have to apply a…

“One Size Fits All”

Approach. Instead, we can make dozens of life insurance companies compete for your business.

So, what are you waiting for? Give us a call today and experience the IBUSA difference.