In this article, we’ll answer some of the most common questions we receive from people who have undergone Angioplasty and are applying for life insurance. We hope this information will help you better understand the process and feel more confident in your search for the right policy.

The questions we’ll cover include:

- Can I qualify for life insurance after undergoing an Angioplasty procedure?

- Why do life insurance companies consider Angioplasty when assessing my application?

- What kind of information will the insurance companies need from me?

- What rate or price can I expect to qualify for?

- How can I increase my chances of getting the best life insurance policy for me?

Without further ado, let’s dive in!

Can I qualify for life insurance if I have undergone an Angioplasty procedure?

Yes, individuals who have undergone Angioplasty can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, some may even be able to qualify for a Standard or “normal” rate!

The only problem is, that because having to need to receive an angioplasty typically “implies” that one has been diagnosed with cardiovascular disease! Which is certainly, going to complicate one’s life insurance application.

This is why, what you’re usually going to find is that before getting approved for a traditional term or whole life insurance policy, most (if not all) of the best life insurance companies are going to want to ask you a series of medical questions all designed to learn “why” you needed to receive an angioplasty and just how “serious” your cardiovascular disease might be.

This also why, you may want to avoid applying for a No Medical Exam Term Life Insurance Policy because these “type” of life insurance policies usually won’t provide insurers with enough information for you to be able to get approved for coverage.

What kind of information will the insurance companies ask me or be interested in?

When applying for life insurance after an Angioplasty procedure, insurance companies will likely ask you a series of questions to better understand your condition and assess your risk. Some of the common questions may include:

- Reason for Angioplasty: The insurance company may want to know the reason you needed to undergo the Angioplasty procedure, such as chest pain or a heart attack.

- Number of Stents: If you received stents during your Angioplasty, the insurance company may want to know the number of stents you received and the location of the blockages.

- Complications: If you experienced any complications during or after the procedure, such as an allergic reaction or bleeding, the insurance company may want to know.

- Medications: The insurance company may want to know if you are taking any medications to manage your condition and if you have any allergies to medications.

- Lifestyle: The insurance company may also ask about your lifestyle habits, such as whether you smoke, exercise regularly, and follow a healthy diet.

- Follow-up care: The insurance company may want to know about any follow-up care you have received since your Angioplasty, such as any additional procedures, medications, or doctor visits.

By providing accurate and thorough answers to these questions, the insurance company can better assess your overall health and determine your eligibility for coverage and the appropriate rates. It’s essential to be honest in your responses to ensure you get accurate quotes and appropriate coverage.

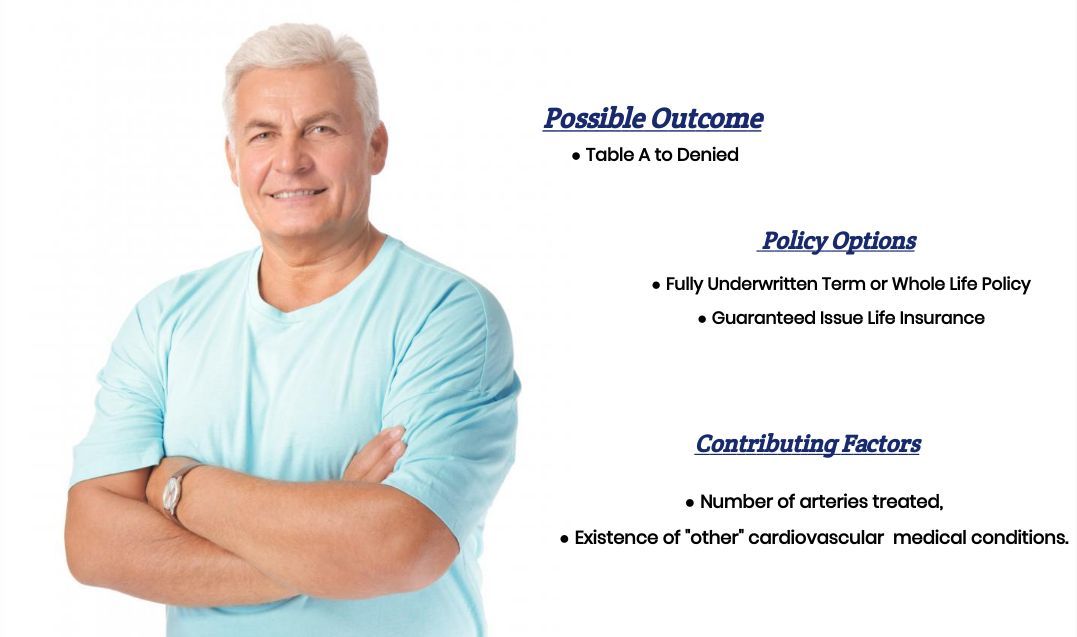

What rate (or price) can I qualify for?

The rate (or price) that an individual can qualify for life insurance after having angioplasty can vary depending on several factors, including the severity of the condition, the number of stents received, any complications experienced, and the overall health of the individual.

In general, individuals who have undergone angioplasty may be considered higher risk by insurance companies due to the underlying cardiovascular disease, which can affect the rates they qualify for. However, some individuals may still be able to qualify for standard rates, especially if they have made significant lifestyle changes and have a good overall health history.

To determine the rate for life insurance after angioplasty, the insurance company will consider the individual’s medical history, age, gender, lifestyle habits, and other factors. It’s essential to provide accurate and complete information during the application process to get an accurate quote.

It’s also worth noting that different insurance companies have different underwriting guidelines, so rates can vary between companies. It’s recommended to compare quotes from multiple companies to find the best rate for your individual situation.

That said, we have found that several life insurance companies tend to be more lenient in allowing individuals to qualify for a Standard rate assuming that aside from your procedure you are relatively healthy.

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance profession who will work as an advocate for you.

Such an agent…

Will not only help guide you through the application process but also be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because after all, it really doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly…

You’ll want to make sure that you’re completely honest with your life insurance agent prior to applying for coverage. By doing so, you will be helping him or her narrow down what options might be the “best”.

Now, will we be able to help out everyone who has been previously received an angioplasty procedure?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Life Insurance Companies as well so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available to you, just give us a call!