In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after having been diagnosed with Lupus Erythematosus (SLE).

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Lupus Erythematosus (SLE)?

- Why do life insurance companies care if I have been diagnosed with Lupus Erythematosus (SLE)?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with Lupus Erythematosus (SLE)?

Yes, individuals who have been diagnosed with Lupus Erythematosus (SLE) can and often will be able to qualify for a traditional term or whole life insurance policy. They said, however, that Lupus Erythematosus is one of those “types” of pre-existing medical conditions that can make qualifying for a traditional life insurance policy much more difficult.

This is why, before being approved for a traditional life insurance policy, one should expect to be asked a series of medical questions about their Lupus Erythematosus. You may also be required to submit copies of their medical records along with their life insurance application.”

It’s also why you may want to avoid applying for a no-medical exam term life insurance policy, seeing how these policies tend to be more challenging to qualify for after someone is diagnosed with a pre-existing medical condition like SLE.

Why do life insurance companies care if I have been diagnosed with Lupus Erythematosus (SLE)?

Life insurance companies care about your medical history, including any lupus erythematosus (SLE) diagnoses, because they want to assess the risk associated with insuring you. Life insurance is designed to provide financial protection for your loved ones in the event of your death, and the insurance company wants to understand the likelihood of your death occurring to set premiums and determine your eligibility for coverage.

Now if you have been…

Diagnosed with lupus erythematosus (SLE), the insurance company will consider your condition’s severity, treatment history, and prognosis when evaluating your application. In general, people with lupus erythematosus (SLE) who have a mild or well-controlled form of the disease may qualify for life insurance at standard or slightly higher premiums, depending on the specifics of their case. People with more severe forms of lupus erythematosus (SLE) or those who have not been successfully treated may have more difficulty qualifying for life insurance or may only be able to qualify for coverage at significantly higher premiums.

Lupus Erythematosus (SLE) Defined.

Lupus erythematosus (SLE) is a chronic autoimmune disease in which the immune system attacks the body’s tissues and organs. It can affect many body parts, including the skin, joints, blood vessels, heart, lungs, kidneys, and brain.

SLE is an autoimmune disease, which means the immune system mistakenly attacks healthy cells and tissues in the body, causing inflammation and damage. The cause of SLE is not fully understood, but it is believed to be a combination of genetic, environmental, and hormonal factors.

Symptoms of SLE can vary widely and may include:

- Rash, especially on the face or upper body

- Joint pain and swelling

- Fatigue

- Fever

- Chest pain

- Dry mouth and eyes

- Hair loss

- Anemia

SLE is typically diagnosed based on specific signs and symptoms, as well as laboratory tests that can detect antibodies often present in people with SLE. The severity of SLE can vary widely.

Fortunately…

While there isn’t a cure for Lupus Erythematosus, there are a variety of different treatments that have been found to help improve the quality of life of those suffering from (SLE) as well as minimize some of the most harmful symptoms of this disease. Treatment options may include specialized diets and the use of anti-inflammatory medications, as well as steroids.

But…

Before anyone gets upset or complains due to the simplicity of the definitions we’re using here, it’s important to understand that we here at IBUSA aren’t medical experts or doctors. All we are is a bunch of life insurance agents who are really good at helping folks with pre-existing medical conditions like the ones described above find and qualify for coverage.

What kind of information will the insurance companies ask me or be interested in?

When applying for life insurance, you will typically be asked to provide detailed information about your medical history, including any lupus erythematosus (SLE) diagnoses. The insurance company may ask you to provide the following information:

- Date of diagnosis: The insurance company will want to know when you were diagnosed with lupus erythematosus (SLE), as this will help them understand the duration and severity of your condition.

- Symptoms: The insurance company will want to know your symptoms due to lupus erythematosus (SLE), including any rash, joint pain, fatigue, fever, or other symptoms.

- Treatment history: The insurance company will want to know what treatments you have received for your lupus erythematosus (SLE), including medications and other therapies. They will also want to know the dates of your treatments and the outcomes of those treatments.

- Prognosis: The insurance company will want to know the prognosis for your lupus erythematosus (SLE), which predicts the likely course of the disease and your chances of recovery. Your prognosis will be based on the severity of your condition, your treatment history, and other factors such as your age, overall health, and lifestyle.

It’s important to be honest and transparent when providing this information to the insurance company, as providing false or misleading information on your application could result in your policy being denied or terminated.

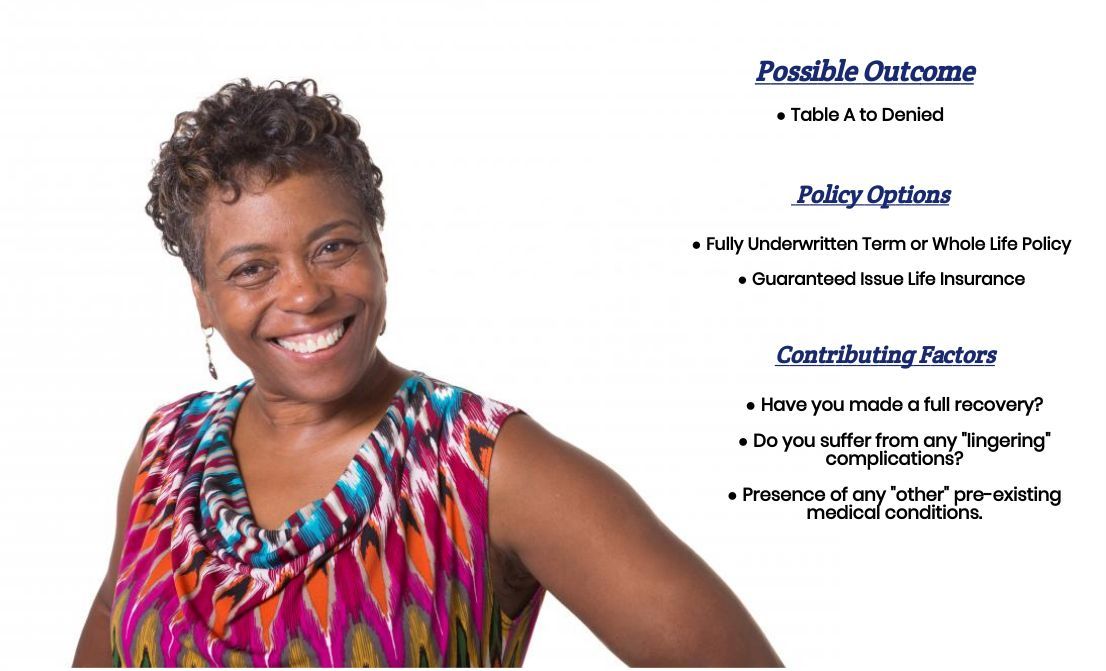

What rate (or price) can I qualify for?

When it comes time to helping those who have been diagnosed with Lupus Erythematosus, what you’re generally going to find is most life insurance companies will generally like to follow a rule stating that you will need to have been “symptom-free” for a minimum of two years before you will be able to qualify for a Standard or “Sub-standard” rate.

Which means that…

Suppose you are experiencing symptoms related to your Lupus Erythematosus or have experienced symptoms within the past two years. In that case, you will want to be very “selective” with which life insurance companies you choose to apply with. This is because there is a perfect chance that you will be denied coverage if you choose the “wrong” company for you.

The good news is…

Regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy they can qualify for.

How can I help ensure I get the “best life insurance” for me?

If you have been diagnosed with Lupus Erythematosus and are looking to obtain the best life insurance coverage, here are some tips to help you:

- Disclose your medical condition truthfully: When applying for life insurance, being honest and upfront about your medical history, including your Lupus diagnosis, is important. This ensures that you get an accurate quote and that your coverage is not denied later due to non-disclosure.

- Shop around: Different insurance companies have different underwriting policies, so it’s important to shop around to find the best policy for you. An independent insurance agent can help you compare company policies.

- Consider term life insurance: Term life insurance policies offer coverage for a set period, such as 10, 20, or 30 years. These policies tend to be more affordable than whole life insurance policies and may be a good option if you need coverage for a specific period.

- Look for guaranteed issue policies: Some insurance companies offer guaranteed issue policies, meaning you are guaranteed coverage regardless of your medical history. These policies tend to be more expensive than traditional life insurance policies but may be a good option if you have a pre-existing medical condition like Lupus.

- Work with a financial advisor: A financial advisor can help you understand your insurance needs and guide you toward the best policy for your situation.

Remember that the best life insurance policy for you will depend on your individual needs, so it’s essential to research and compare different options before making a decision.

Now, can we help out everyone previously diagnosed with an SLE?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available, call us!