In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with a Peptic Ulcer.

Questions that will be directly addressed will include:

- Can I qualify for life insurance if I have been diagnosed with a Peptic Ulcer?

- Why do life insurance companies care if I’ve been diagnosed with a Peptic Ulcer?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I have been diagnosed with a Peptic Ulcer?

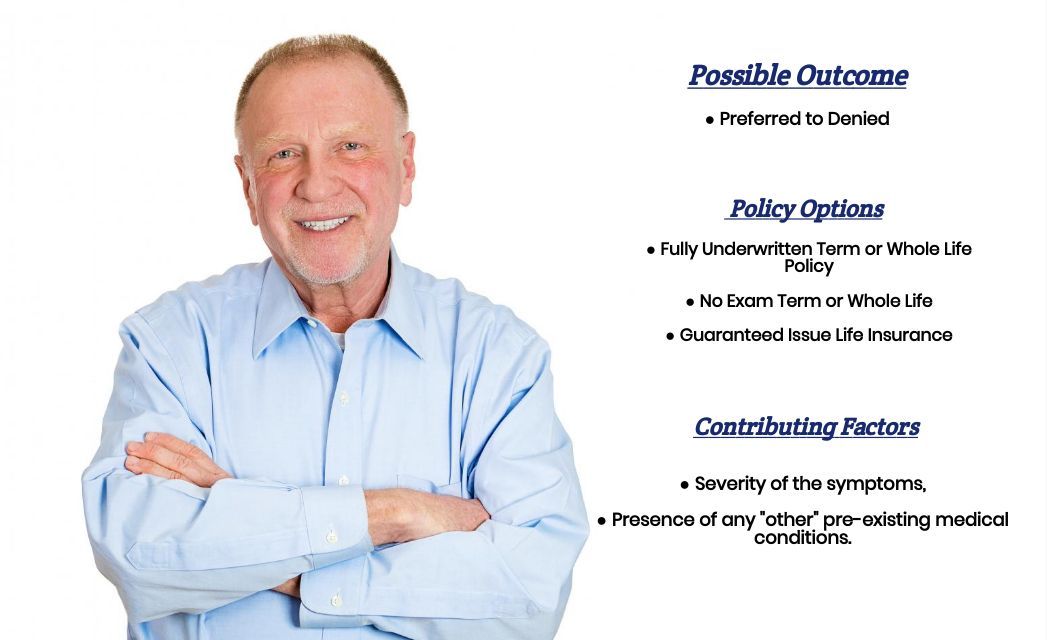

Yes, individuals who have been diagnosed with either a Peptic Ulcer can and often will be able to qualify for a traditional term or whole life insurance policy. They may even be eligible for a no-exam life insurance policy at a Preferred rate.

Why do life insurance companies care if I’ve been diagnosed with a Peptic Ulcer?

The main reason a life insurance company is going to “care” if you have been diagnosed with an Ulcer is that there are a variety of reasons “why” an individual might develop an Ulcer, some of which may affect the outcome of one’s life insurance application.

Additionally, not all individuals will experience the same symptoms due to the Ulcer (s) they are suffering from. For this reason, most (if not all) of the best life insurance companies (in our opinion) will want to ask a series of medical questions about an individual’s “ulcer” before making any definitive decisions about the outcome of one’s life insurance application.

Fortunately…

Most life insurance companies treat all three of these “types” of Ulcers the same during the underwriting process, which makes discussing all three types in this article much more manageable. However, just so that we’re all on the same page when discussing these different kinds of pre-existing medical conditions, we did want to take a moment and briefly define each of these “types” of Ulcers so that there won’t be any misunderstanding of what we’re discussing.

Peptic Ulcer Defined:

Peptic ulcers are open sores that develop along the inside lining of one’s stomach or small intestine.

Types of Peptic Ulcers:

- Gastric Ulcer: A peptic ulcer located in the stomach.

- Duodenal Ulcer: A peptic ulcer in the duodenum (small intestine).

- Esophageal Ulcer: A peptic ulcer in the lower part of one’s esophagus.

Common causes:

The most common causes of Peptic ulcers are infections caused by the bacterium Helicobacter pylori (H. pylori) or prolonged exposure to aspirin and nonsteroidal anti-inflammatory drugs (NSAIDs). It should be noted that the long-held belief that “Ulcers” are commonly caused by stress or spicy food isn’t true.

Symptoms may include:

- Dull pain at the location of the Ulcer,

- Weight loss,

- Avoidance of eating due to pain,

- Acid reflux,

- Heartburn,

- Nausea,

- Vomiting,

- Etc…

The good news…

That is because most ulcers are caused by an infection caused by the H. pylori bacteria or exposure to certain medications. Ulcers can usually be treated by administering antibiotics to kill the H. pylori bacteria causing the infection or by adjusting the medicines used.

Now…

Before anyone gets upset or complains about the simplicity of the definitions we’re using here, it’s important to understand that we here at IBUSA aren’t medical experts or doctors. All we are is a bunch of life insurance agents who are really good at helping folks with pre-existing medical conditions like the ones described above find and qualify for coverage.

This means that because we won’t be the ones “diagnosing” your condition, all we need to do is understand the differences between these different pre-existing medical conditions. Those differences will affect how a life insurance underwriter will consider you a potential “risk. “The good news is that despite how simple our definitions of these diseases may be, we have this down pat!

Which is why…

When we are approached by an individual diagnosed with any of these “kinds” of conditions, we’ll know right away what questions a life insurance underwriter will want to know the answers to before deciding about the outcome of your life insurance application.

What kind of information will the insurance companies ask me or be interested in?

Typical questions you’ll likely be asked may include:

- When were you first diagnosed with an Ulcer?

- What “kind” of Ulcer have you been diagnosed with?

- Gastric?

- Duodenal?

- Esophageal?

- Who diagnosed your Ulcer? A general practitioner or a specialist?

- What symptoms (if any) led to your diagnosis?

- Do you know what has caused you to develop an Ulcer?

- Have you been diagnosed with any other pre-existing medical conditions?

- What treatment options are you pursuing?

- Are you currently taking any prescription medications?

- What are your current height and weight?

- In the past two years, have you been admitted to the hospital for any reason?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

When it comes time to help someone diagnosed with an Ulcer qualify for a traditional term or whole life insurance policy, folks typically fall into one of two categories. First, some have developed their Ulcer due to suffering from an H. pylori infection. Then, some have developed their Ulcer due to prolonged exposure to aspirin and nonsteroidal anti-inflammatory drugs (NSAIDs).

For those…

Who can attribute their Ulcers to an H. pylori infection? Most life insurance companies aren’t too concerned about your condition, provided you have taken care of it responsibly!

Meaning that…

Once you began feeling symptoms, you went to your primary care physician, had your condition properly treated immediately, and didn’t allow significant damage to occur. Individuals like these will likely find that their previous Ulcer diagnosis will not play an important role in the outcome of their life insurance application, so folks like these will generally still be eligible for a Preferred rate provided that they would otherwise be able to qualify.

As for the rest…

Those who have developed their ulcers as a result of prolonged exposure to aspirin and nonsteroidal anti-inflammatory drugs (NSAIDs) medications will generally find that the underlying pre-existing medical condition that warranted the use of these medications will be the primary factor determining the outcome of their life insurance application, not the Ulcers that have developed as a result of these treatments.

In cases like these, we recommend that you check out our Pre-Existing Medical Conditions page and see if we have an article focusing on the “other” pre-existing medical condition causing the development of your Ulcers.

The good news is…

Regardless of your situation, we at IBUSA can help because we have extensive experience helping people with pre-existing medical conditions like yours. We are committed to helping all our clients find the “best” life insurance policy they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance”?

In our experience here at IBUSA, we have found that usually, the folks who seem to see the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

Seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is precisely what you’ll find here at IBUSA!

Now, can we help out everyone who has been previously diagnosed with an Ulcer?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Burial Life Insurance Companies so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that they CAN qualify for.