In this article, we wanted to take a moment to answer some of the most common questions we receive from individuals who are looking to apply for a life insurance policy after they have been convicted of a felony or a misdemeanor.

But before we…

Get ahead of ourselves; the first thing that we want to let you, the reader, know is that we here at InsuranceBrokersUSA have a ton of experience helping people with a criminal background qualify for life insurance and understand that one’s questionable actions in the past do not define who one is today!

Which is why…

Unlike many other insurance brokerages who will immediately try to sell an accidental death policy or a small guaranteed issue life insurance policy to someone who has been convicted of a felony in the past, we here at IBUSA will take the time it takes to see whether or not there may be a better option for you and your family. That way, you’ll know that when presented with your options, you get from us, not the default answer so many other insurance brokerages like to use for simplicity’s sake.

Questions that will be addressed in this article will include:

- Can I qualify for life insurance if I’ve been convicted of a Felony or Misdemeanor?

- Why do life insurance companies care if I’ve been convicted of a Felony or Misdemeanor?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance”?

So, without further ado, let’s dive right in!

Compare over 50 top life insurance companies instantly.

|

Can I qualify for life insurance if I’ve been convicted of a Felony or Misdemeanor?

Yes, it is possible to qualify for life insurance even if you have been convicted of a felony or misdemeanor. However, your criminal record may affect the terms of the policy and the premium you will be required to pay.

Life insurance companies consider various factors when determining whether to offer a policy and at what cost. These factors include age, gender, health, occupation, lifestyle, and criminal history. A criminal record may be viewed as a risk factor by some insurance companies, and as a result, you may be charged a higher premium or be offered a policy with more limited coverage.

Disclosing your criminal history wholly and accurately when applying for life insurance is important. Failure to do so could result in your policy being canceled or your claims being denied. Suppose you are concerned about how your criminal record may affect your ability to get life insurance. In that case, you should speak with a licensed insurance agent or broker who can help you understand your options and find a policy that meets your needs.

The good news is that some people with a criminal record may even qualify for a no medical exam life insurance policy at a Preferred rate!

This is because…

Not all felonies or misdemeanors will be considered the same among most life insurance companies. For this reason, individuals who may have had a “previous history” with the law will want to be careful about which life insurance companies they choose to apply with until they fully understand how their previous “encounters” with the law will be viewed.

Why do life insurance companies care if I’ve been convicted of a previous Felony or Misdemeanor?

Insurance companies use actuarial tables and statistical data to assess the risks of insuring an individual. They consider various factors, including age, gender, health history, occupation, and lifestyle. A criminal record may be viewed as a risk factor because it indicates a higher likelihood of risky behaviors.

And since…

Life insurance companies are in the business of predicting and managing risk. If an applicant has a criminal record, the insurance company may view them as a higher risk, charge higher premiums, or decline to offer coverage. The company is trying to balance the risk of insuring an individual with the potential return on the premiums paid.

It’s worth noting that each of the best life insurance companies will tend to have its own underwriting guidelines and policies, and the impact of a criminal record on an applicant’s ability to get coverage can vary depending on the specifics of the case and the company’s risk tolerance.

The good news is that…

Not all life insurance companies are going to use the same rules and guidelines when determining who they will and won’t insure.

The bad news is that the underwriting guidelines for individuals who have been convicted of a felony are not regularly promoted or advertised by individual life insurance companies.

After all…

Even though many insurance companies will choose to be “lenient” when it comes to insuring specific individuals who have been convicted of a felony or misdemeanor, the last thing that these individual companies want to do is become branded as the “go-to” life insurance company for convicted felons.

We should also mention that…

Some life insurance companies that promote themselves as the “convenience carrier” that only asks 4 or 5 different questions during their application process frequently fail to mention that there will also be a thorough background check, including a:

- Prescription medication database check,

- A DMV report,

- A credit check,

And you guessed it…

A criminal background check!

This is why…

It’s important to understand that even though you may not be asked about any previous convictions during your initial application, the insurance company that you are thinking about applying with will research this possibility during the underwriting process.

For this reason…

We at IBUSA like to ask many of the same questions the most life insurance carriers ask so that we can better understand your situation and help guide you towards the carrier that will give you the best opportunity for success.

What kind of information about my criminal record will the insurance companies ask me or be interested in?

Insurance companies may ask about your criminal record when you apply for an insurance policy because they use various factors to assess the risk of insuring you and to determine your premium.

When you apply for an insurance policy, you may be asked to disclose information about your criminal history on the application form. This may include questions about any arrests, convictions, or pending charges. The insurance company may also ask for specific details about the offense, such as the type of crime and when it occurred.

Insurance companies may use this information to assess the risk of insuring you and to determine your premium. Insurance companies consider criminal convictions to indicate increased risk and may charge higher premiums for individuals with a criminal record.

However, the specific impact of a criminal record on your insurance premium will depend on the type of insurance you are applying for, the nature and severity of the offense, and the length of time since the violation occurred.

It is essential to be honest and accurate when disclosing information about your criminal record to an insurance company. Failing to disclose relevant information or providing false information on an insurance application could result in the insurance company denying your application or canceling your policy.

Additionally, we should note that…

Some life insurance companies may only be concerned about recent felonies; most (if not all) life insurance companies will retain the right to permanently deny any applicant who has been convicted of a “serious” felony such as rape, murder, child molestation, etc…

Some additional questions you can expect include:

- Are you currently on parole or awaiting charges?

- Do you have any history of drug or alcohol abuse?

- Do you have any issues with your driving record?

- In the past two years, have you been hospitalized for any reason?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

How Much is life insurance with a misdemeanor or felony?

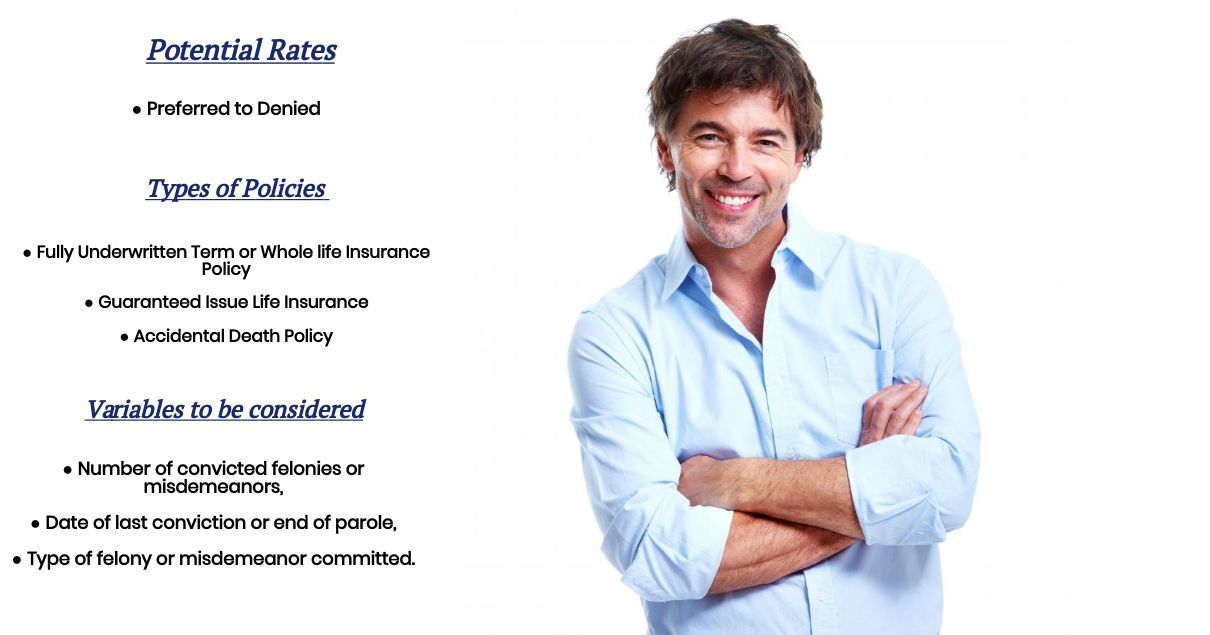

Many variables can come into play when determining what kind of life insurance rates an individual might qualify for after being convicted of a felony or misdemeanor. Your life insurance premium will be determined by what life insurance rating you qualify for.

And it’s pretty much impossible to know what kind of rating you might be able to qualify for without first speaking with you directly.

That said…

Most individuals convicted of a felony or misdemeanor will usually fall into one of three categories that we can make some “assumptions” about that will generally hold true.

3 Primary Categories for Misdemeanors and Felonies

Category #1.

The first group of folks will be those who have recently been convicted of a felony or are awaiting their day in court.

In cases like these, you’ll typically find that most (if not all) life insurance companies will want to wait until you have either been declared innocent or convicted, served your time, and are no longer on parole.

The reason for this…

Most (if not all) life insurance companies aren’t willing to insure anyone who has the potential to go to jail very soon.

Category #2.

The second group of folks that we’ll commonly encounter will be those who have been convicted of a felony or misdemeanor over five years ago and were not convicted of a “major” felony, such as:

- Murder,

- Rape,

- Drug manufacturing/trafficking (some exceptions may apply),

- Or terrorism.

In cases like these, you’ll generally find that you may qualify for a traditional term or whole life insurance policy, provided that you choose to apply with the “right” company.

It’s also safe…

To assume that your chances of being able to qualify for coverage and the rate that you may be able to qualify for will improve with the more time that lapses between when your prison sentence or parole ended and when you first applied for life insurance.

In fact…

Usually, these “types” of applicants will have the best opportunity to qualify for a Standard or better rate.

Category #3.

The last group of folks we’ll commonly encounter will be those who have served their time. However, they were convicted of some pretty serious crimes.

In cases like these, we have found that most of the time, we will have to turn to carriers who don’t look at one’s criminal background as a determinant of whether or not they will qualify for coverage.

The only problem in this situation is that this will usually mean that individuals in this situation will only be able to qualify for a small final expense insurance policy or an accidental death policy.

This brings us to the last topic that we wanted to take a moment to discuss with you here today…

How can I help ensure I get the “best life insurance”?

In our experience at IBUSA, we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

- And seek out those life insurance agents who know how to deal with complicated matters, such as life insurance with a felony.

You see…

It’s important your agent not only has experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also has access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is precisely what you’ll find here at IBSA!

Now, will we be able to help out everyone who has been convicted of a Felony?

No, probably not.

But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available, call us!

Felony in 2002. Sex offense. Not on probation or parole. No other violations of the law since then. I would like a 10 yr. term policy so I can ride my motorcycle this summer. I lost my life insurance when I was furloughed from my job (that I’ve held for the last five years with the same company).

Michael,

Given the fact that your last felony was so long ago, it sounds like we may have several term life insurance policy options for you to consider.

So, our advice would be to just give us a call at 888-271-9173 when you have a chance, and we’d be more than happy to try and help you out.

Thanks,

IBUSA.

conspiracy to commit bank, wire and mail fraud conviction. Probation ended in Aug 2019, Perfect health, no other offenses. I’d like a term policy for my 3 children 100k ea. Is this possible?

Treshell,

Before we could know for sure, we’d first need to understand whether you were convicted of a single felony or where you were convicted of several felonies?

If convicted of just one felony, there is a chance that you may be able to qualify for a traditional term life insurance policy. The only problem is that you would probably have to pay an increased premium for your coverage since you just recently got off probation.

Now, if you were convicted of multiple felonies, in that case, you’d probably have to wait another four years before you would be considered eligible for coverage by most (if not all) traditional life insurance companies.

For more information, feel free to give us a call and we’d be happy to discuss your options in greater detail.

Thanks,

InsuranceBrokersUSA.

I have had drug issues in past and 2 minor felony 5 drug possession convictions, as well aggravated menacing misdemeanor,

Felony Theft 5 years back, dozen minor charges not felony 10 or more years ago. Currently sober, healthy, own a business, and trouble free for 2 years. What’s my probability of securing a whole term policy within next 5 years for me and 2 kids for million each her coach.

Dougie,

It’s difficult to say for sure whether or not you would be able to qualify for a million dollar life insurance policy. Your best bet would be to give us a call so that we can find out a few more details this way we can know for sure.

Thanks,

InsuranceBrokersUSA

Im shopping around for life insurance for myself and my son (21 yrs old) wants to purchase coverage for himself also. Now the issue is My son was accidentally shot in the back 6 years ago. He has made a complete recovery has no ongoing medical issues…. however will this cause him to be denied for coverage

Ashley,

We’d love to have an opportunity to help you and your son find the insurance that you’re looking for. So, please give us a call so we can get a better idea about what kind of insurance each of you might be able to qualify for.

Thanks,

InsuranceBrokersUSA.

Trafficking felony in May 2011 – Served 2.5 years out of 3 (early release for good behavior), Released in November 2013, no probation, no other convictions. Steady employment since release. Would like to know what options I have

Flute,

We’ll have an agent reach out to you via email so that we can discuss what options might be available to you.

Thanks,

InsuranceBrokersUSA.

This is really disheartening to hear. I’m a recent graduate with a Bachelors Degree in Criminal Justice. I’m also a convicted felon with an armed robbery on my record. As a formerly incarcerated person who will one day work towards changing some of these laws that label and stagnant formerly incarcerated people, it makes me feel so sad to read things like this. There’s already a stigma that comes with being incarcerated and there’s already obstacles placed against us from the moment we’re released. Whether it’s not being able to receive financial aid to further our education, find housing, or obtain employment. And now to hear that an formerly incarcerated person’s life holds less value than someone who hasn’t been convicted of a crime is absolutely infuriating.

I can’t wait to be apart of the changes in laws in the near future. This is horrible. Absolutely HORRIBLE.

Tonya,

We share your frustrations which is why we try and do everything possible to help all of our clients find and qualify for the coverage they are looking for.

Thanks,

InsuranceBrokersUSA.

My husband was convicted on a murder charge 27 years ago. He Is also currently on parole and will be for the remainder of his life. I have had zero luck finding a term life policy for him. He has been home for 2 years and has had no other criminal history other than the one. Please point me in the right direction. He was 19 years old at the time of conviction, certainly isnt that child anymore.

Lynette,

We’ll be sure to have an agent reach out to you via email so that can determine whether or not we might have a solution for you.

Thanks,

InsuranceBrokersUSA

I only been in trouble one time in my life I only served 4 months it was for elderly fraud I am not in probation anymore I cleared that and did good I always had good life insurance until this one mistake of not filing documents while I was a care provider I worked all my life pay taxes now I am looking up life insurance for felony.

Hi Ruby,

Please be in touch and we will do our best to help you get covered.

Thanks,

InsuranceBrokersUSA

Hello. I 44 years old… is it possible to get life insurance? Also have high blood pressure. If so for how long and how much would I be able to get?

Thank you for your time

We would be happy to try and help you find coverage. Please give us a call at your earliest convenience, M-F. Thank you

Ex-felon off parole been out of prison since 12/5/2017 served 30 years for murder

I work full time for a 501c non profit as a corrections & community coordinator & certified life coach. Seeking information on how to obtain a whole or mutual life policy

Richard,

We’d love to try and help you accomplish your goals, please give us a call when you are available.

Thanks,

InsuranceBrokersUSA

Felon on parole. Still have a substantial amount of time on parole. Just want to get term life insurance to cover my final expenses and help my family. What can be done?

Shannon,

Many term life insurance carriers will require an applicant to be off parole before they will be willing to offer coverage. That said, depending on how much coverage you’re looking for, we may still have a few options for you to consider. Just give us a call when you have a few minutes.

Thanks,

InsuranceBrokersUSA