In this article, we wanted to take a moment and answer some of the most common questions we get from folks applying for life insurance after having been diagnosed with a Bundle Branch Block, whether that be a Right Bundle Branch Block or a Left Bundle Branch Block.

- Can I qualify for life insurance if diagnosed with a Bundle Branch Block?

- Why do life insurance companies care if I have been diagnosed with a Bundle Branch Block?

- What kind of information will the insurance companies ask me or be interested in?

- What “rate” can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if diagnosed with a Bundle Branch Block?

Yes, individuals who have been diagnosed with a “Bundle Branch Block” can and often will be able to qualify for a traditional term or whole life insurance policy. The only problem is that “bundle branch block” often describes or ” encompasses ” different pre-existing medical conditions. This is why it’s important to fully understand what condition you have been diagnosed with so that we can better understand” a life insurance company is willie” your application.

Why do life insurance companies care if I have been diagnosed with a Bundle Branch Block?

It’s a pretty safe bet that any time an individual has been diagnosed with a pre-existing medical condition related to one’s heart, most (if not all) of the best-rated life insurance companies that most folks are familiar with is going to be pretty interested in learning more about the “condition. “

This is especially true…

When we’re dealing with a condition such as a “Bundle Branch Block,” this “term” can often be used to describe a:

- Left Anterior Fascicular Block is also known as a left anterior hemiblock.

- Left Bundle Branch Block,

And/or a Right Bundle Branch Block.

And here lies the major problem that most (if not all) life insurance companies face. Will treat each of these three medical conditions differently. This is why before we can know how a life insurance company is going to “view” our life insurance application, we’re first going to need to know what “kind” of Bundle Branch Block you’ve been diagnosed with as well as how “serious” your condition is.

For this reason…

We want to briefly describe each of these different medical conditions and highlight some of the most common symptoms/complications that can arise, which most (if not all) life insurance underwriters will be looking for.

Left Anterior Fascicular Block or Left Anterior Hemiblock Defined:

The left anterior fascicular block (LAFB) is a type of heart block that affects the electrical signals that control the contraction of the heart’s left ventricle. This condition occurs when there is a delay or blockage in the electrical signals that travel through the left anterior fascicle, a bundle of fibers that carries electrical impulses from the sinoatrial (SA) node to the left ventricle.

LAFB can cause abnormal heart rhythms and may increase the risk of certain cardiac complications, such as heart failure or atrial fibrillation. It is usually diagnosed using an electrocardiogram (ECG) or other diagnostic tests.

Left anterior hemiblock (LAHB) is a similar condition that occurs when there is a blockage in the electrical signals that travel through the left posterior fascicle, a bundle of fibers that carries electrical impulses from the SA node to the left ventricle. Like LAFB, LAHB can cause abnormal heart rhythms and may increase the risk of certain cardiac complications. It is also usually diagnosed using an ECG or other diagnostic tests.

Both LAFB and LAHB are typically treated with medications or other therapies to manage abnormal heart rhythms and reduce the risk of complications. Sometimes, a pacemaker may be necessary to help regulate the heart’s electrical activity.

For this reason…

Individuals who have been diagnosed with a Left Fascicular Block or Left Anterior Hemiblock will usually be “viewed” more favorably by most (if not all) life insurance underwriters during a “typical” life insurance application.

Left Bundle Branch Block Defined:

The left bundle branch block (LBBB) is a type of heart block that affects the electrical signals that control the contraction of the heart’s left ventricle. This condition occurs when there is a delay or blockage in the electrical signals that travel through the left bundle branch, a bundle of fibers that carries electrical impulses from the sinoatrial (SA) node to the left ventricle.

LBBB can cause abnormal heart rhythms and may increase the risk of certain cardiac complications, such as heart failure or atrial fibrillation. It is usually diagnosed using an electrocardiogram (ECG) or other diagnostic tests.

LBBB is typically treated with medications or other therapies to manage the abnormal heart rhythms and reduce the risk of complications. Sometimes, a pacemaker may be necessary to help regulate the heart’s electrical activity.

It is also essential for individuals with LBBB to manage any underlying conditions that may be contributing to the condition, such as high blood pressure or diabetes, and to follow a healthy lifestyle, including eating a balanced diet, getting regular exercise, and avoiding tobacco and alcohol.

Right Bundle Branch Block Defined:

Right bundle branch block (RBBB) is a type of heart block that affects the electrical signals that control the contraction of the heart’s right ventricle. This condition occurs when there is a delay or blockage in the electrical signals that travel through the right bundle branch, a bundle of fibers that carries electrical impulses from the sinoatrial (SA) node to the right ventricle.

RBBB can cause abnormal heart rhythms and may increase the risk of certain cardiac complications, such as heart failure or atrial fibrillation. It is usually diagnosed using an electrocardiogram (ECG) or other diagnostic tests.

RBBB is typically treated with medications or other therapies to manage the abnormal heart rhythms and reduce the risk of complications. Sometimes, a pacemaker may be necessary to help regulate the heart’s electrical activity.

It is also essential for individuals with RBBB to manage any underlying conditions that may be contributing to the condition, such as high blood pressure or diabetes, and to follow a healthy lifestyle, including eating a balanced diet, getting regular exercise, and avoiding tobacco and alcohol.

Now, before you get too upset…

Given the simplicity of our definitions, it’s essential to understand that we at IBUSA aren’t medical experts or doctors. We are a bunch of life insurance agents who are good at helping folks with pre-existing medical conditions like the ones described above find and qualify for coverage.

Which means that…

Because we won’t be the ones “diagnosing” your condition, all we need to do is understand the differences between these different pre-existing medical conditions. Those differences will affect how a life insurance underwriter will consider you a potential “risk.” The good news is that despite how simple our definitions of these diseases may be, we have this down pat!

Which is why…

When we are approached by an individual diagnosed with these “kinds” of conditions, we’ll know right away what questions a life insurance underwriter will want to know the answers to before they make any about the outcome of your life insurance application.

What kind of information will the insurance companies ask me or be interested in?

If you’ve been diagnosed with a bundle branch block, such as left bundle branch block (LBBB), right bundle branch block (RBBB), left anterior fascicular block (LAFB), or left anterior hemiblock (LAHB), the life insurance company may ask you a range of questions better to understand your health status and any potential risks. Some of the information they may ask about includes:

- The life insurance company may ask when you were diagnosed with the bundle branch block and how severe your symptoms were.

- Type of bundle branch block: The life insurance company may ask about your specific bundle branch block type, as different types can impact your health differently.

- Treatment: The life insurance company may ask about any treatments you have received for your bundle branch block, such as medication or a pacemaker. They may also ask about the effectiveness of these treatments and whether you have experienced any side effects or complications resulting from the condition.

- Current health status: The life insurance company may ask about your current health status, including any ongoing medical conditions, medications, and other health issues you have experienced.

- Lifestyle: The life insurance company may ask about your lifestyle habits, such as your diet, exercise routine, and use of tobacco or alcohol, as these can all potentially impact your health.

It’s essential to be as honest and accurate as possible when answering these questions, as any discrepancies or omissions could affect the coverage provided by the policy.

What “rate” can I qualify for?

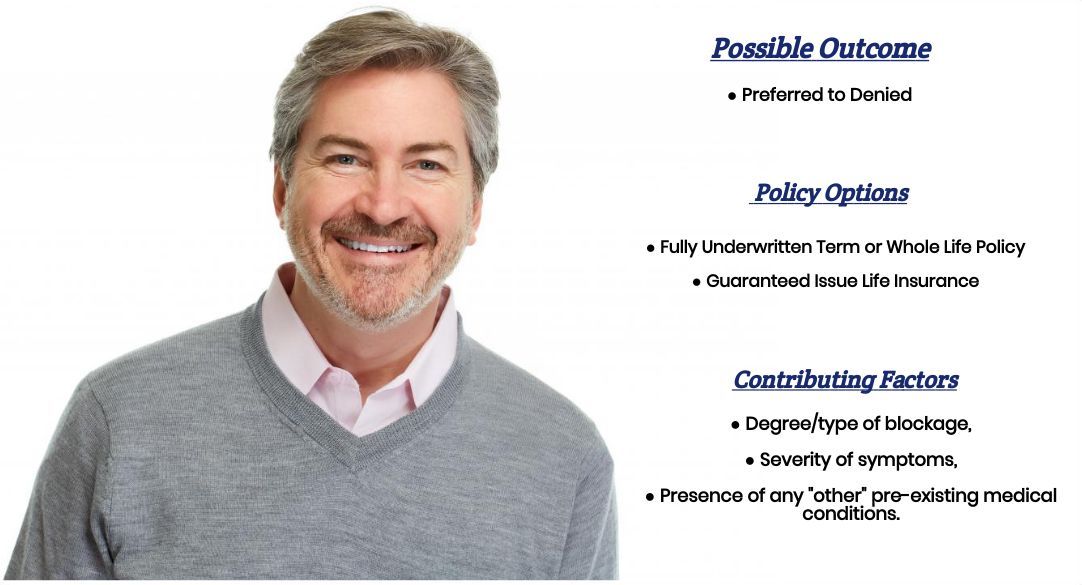

As you can see, there are many variables when determining what kind of “rate” an individual might qualify for after being diagnosed with Branch Block. This is why it’s pretty much impossible to know for sure what kind of “rate” you might be able to qualify for without first speaking with you directly.

That said, however, we can make a few “assumptions” that will generally hold so that you can at least get a general idea about what kind of rate you “might” qualify for after having been diagnosed with a bundle branch blockage.

For example,

It’s generally safe to say that those who have been diagnosed:

- With either a Hemiblock or a right bundle branch block, you will usually have an “easier” time qualifying for a traditional term or whole life insurance policy than a person diagnosed with a Left Bundle Branch Block.

- Those who have been diagnosed with a Hemiblock will usually have an “easier” time qualifying for a traditional term or whole life insurance policy than someone who has been diagnosed with a Right Bundle Branch Block.

Additionally…

For those who have been diagnosed with either a hemoblock or a Right Bundle Branch Block and don’t seem to be suffering from any “serious” symptoms due to their condition, they may be able to qualify for a Standard or Standard Plus rate.

Underwriting guidelines even state that they may also be able to qualify for a Preferred rate; however, in our experiences here at IBUSA, this will only happen in sporadic cases, which is why we don’t like quoting these rates to folks simply because we don’t want to “overpromise and under deliver”!

Now, as for those…

You have been diagnosed with a Left Bundle Branch Block; it still may be possible to qualify for a traditional life insurance policy; only now will you undoubtedly be considered a “high-risk” applicant. This is why it would be best to be careful about “which” life insurance company you apply to so you don’t overpay for your coverage.

The good news is…

Regardless of your situation, we at IBUSA can help because we have extensive experience helping folks with pre-existing medical conditions like yours. We are committed to helping all our clients find the “best” life insurance policy they can qualify for.

This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to see the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

Seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is precisely what you’ll find here at IBUSA!

Now, can we help out everyone who has been previously diagnosed with a Bundle Branch Block?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that they CAN qualify for.

So, if you’re ready to explore your options, call us!